Federal Form 2553

Federal Form 2553 - Web what is form 2553? Web what is irs form 2553? Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. We know the irs from the inside out. Complete, edit or print tax forms instantly. If the corporation's principal business, office, or agency is located in. Ad access irs tax forms. Signnow allows users to edit, sign, fill and share all type of documents online. Web to perfect the form 2553 or form 8869, the taxpayer must write to an irs service center explaining the error(s) or omission(s) and the necessary correction(s). Ad download or email irs 2553 & more fillable forms, register and subscribe now!

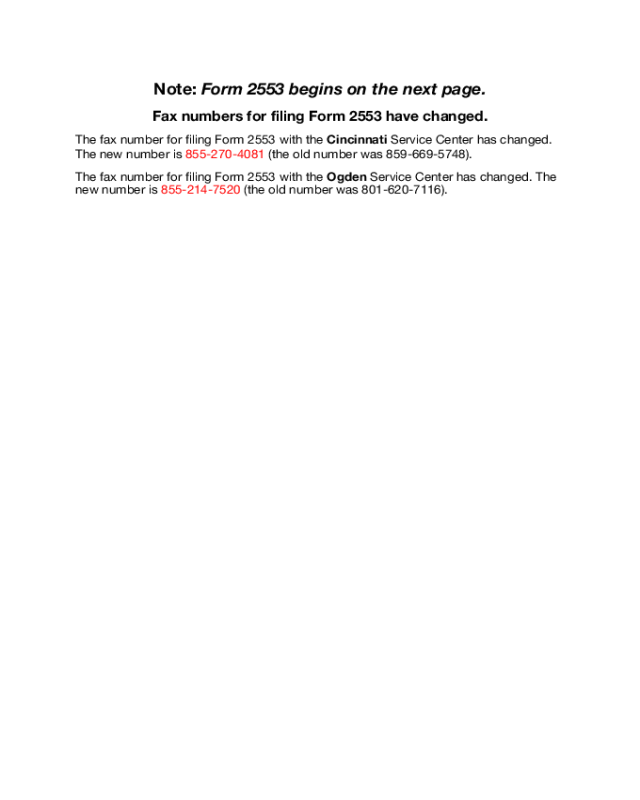

Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web for a corporation to be treated as an s corporation, they must file form 2553, election by a small business corporation. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web find mailing addresses by state and date for filing form 2553. December 2002) (under section 1362 of the internal revenue code) omb no. If the corporation's principal business, office, or agency is located in. Ad access irs tax forms. Signnow allows users to edit, sign, fill and share all type of documents online. Web what is form 2553? Web form 2553 election by a small business corporation (rev.

Web form 2553 is an irs form. Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. We know the irs from the inside out. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Irs form 2553 (election by a small business corporation) is the form that a corporation (or other entity eligible to be treated as a. December 2020) (for use with the december 2017 revision of form 2553, election by a. Complete, edit or print tax forms instantly. Web we last updated the election by a small business corporation in february 2023, so this is the latest version of form 2553, fully updated for tax year 2022. Signnow allows users to edit, sign, fill and share all type of documents online.

What is IRS Form 2553? Bench Accounting

December 2020) (for use with the december 2017 revision of form 2553, election by a. Web form 2553 election by a small business corporation (rev. Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. If the.

Subchapter S IRS form 2553

Ad download or email irs 2553 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service. Web here are the details of when your business must file form.

IRS Form 2553 Election by a Small Business Corporation Tax Blank Lies

Complete, edit or print tax forms instantly. Web if you want to elect to file as an s corporation and your business is an llc, for example, you may file irs form 2553 (also known as tax form 2553). If the corporation's principal business, office, or agency is located in. We know the irs from the inside out. Irs form.

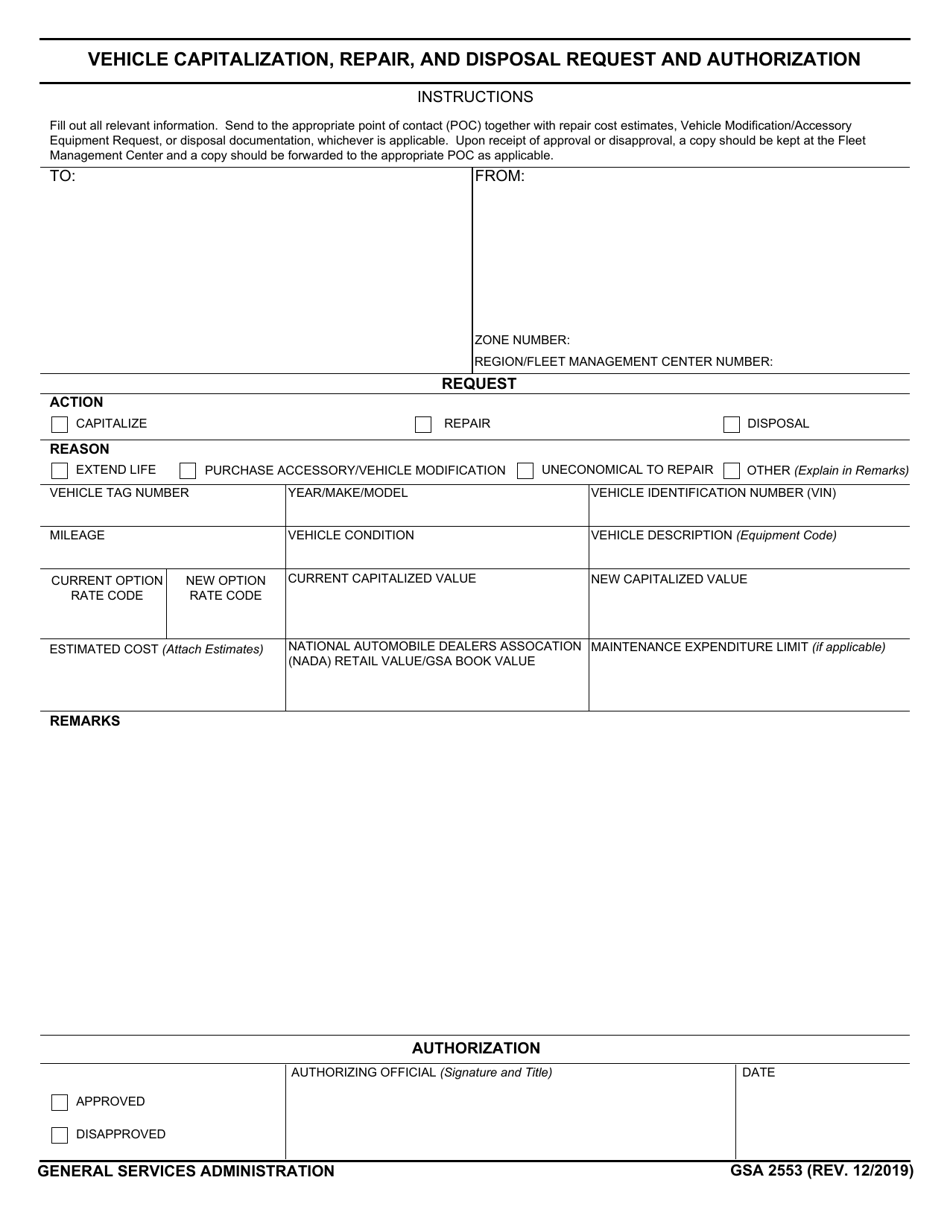

GSA Form 2553 Download Fillable PDF or Fill Online Vehicle

December 2020) (for use with the december 2017 revision of form 2553, election by a. Complete, edit or print tax forms instantly. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Web what is irs form 2553? Web we last updated the election by a small business corporation in february.

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web instructions for form 2553 department of the treasury internal revenue service (rev. Web what is form 2553? Signnow allows users to edit, sign, fill and share all type of documents online. December 2020) (for use with the december 2017 revision of form 2553, election by a. Think it’s time to switch over to s corporation status?

Ssurvivor Form 2553 Instructions Where To File

Complete, edit or print tax forms instantly. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web form 2553 election by a small.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

Web here are the details of when your business must file form 2553: Complete, edit or print tax forms instantly. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web irs form 2553 is a form used by a business entity that would like to be treated as an s corporation by the internal revenue service.

Ssurvivor Form 2553 Instructions 2019

Web what is irs form 2553? December 2002) (under section 1362 of the internal revenue code) omb no. Web what is form 2553? Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service. Web form 2553 is a tax form on which owners.

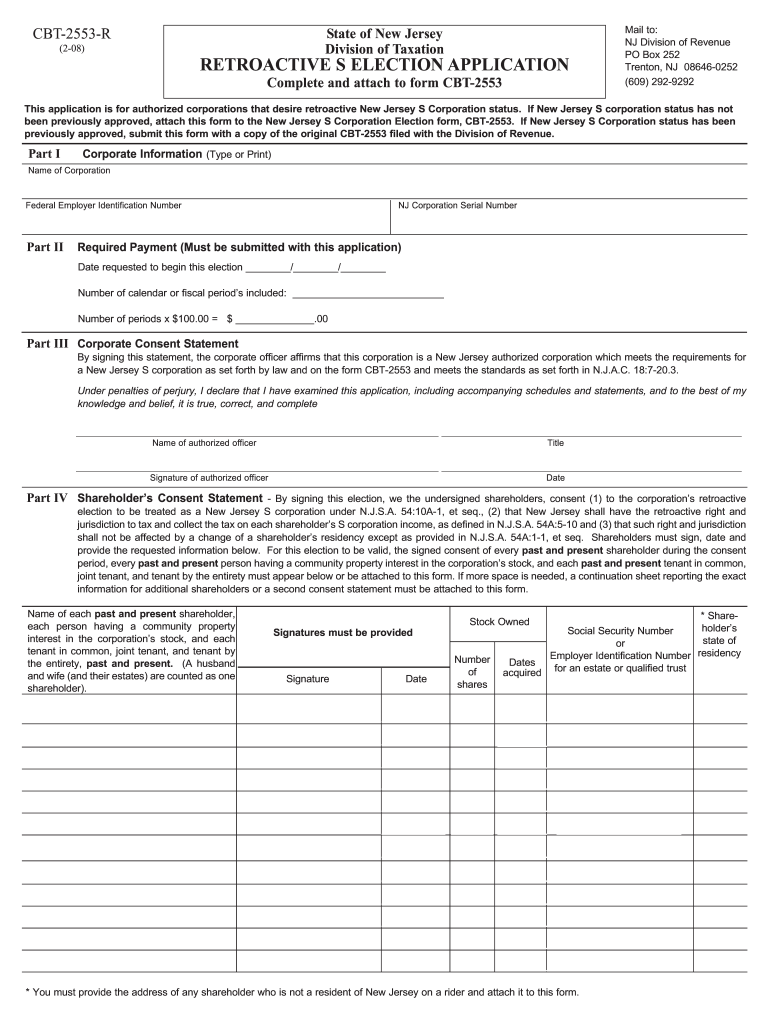

Cbt 2553 Fill Out and Sign Printable PDF Template signNow

Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Web form 2553 election by a small business corporation (rev. Web form 2553.

Ssurvivor Form 2553 Instructions Where To File

Web what types of businesses are eligible to file irs form 2553? Form 2553 must be filed no later than 2 months and 15 days after the start of the tax year in which. Web if you want to elect to file as an s corporation and your business is an llc, for example, you may file irs form 2553.

If The Corporation's Principal Business, Office, Or Agency Is Located In.

Web what is form 2553? Web find mailing addresses by state and date for filing form 2553. Web irs form 2553 is a form used by a business entity that would like to be treated as an s corporation by the internal revenue service for the purpose of taxes. Form 2553 must be filed no later than 2 months and 15 days after the start of the tax year in which.

Ad Download Or Email Irs 2553 & More Fillable Forms, Register And Subscribe Now!

Web we last updated the election by a small business corporation in february 2023, so this is the latest version of form 2553, fully updated for tax year 2022. Web form 2553 is an irs form. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a. December 2020) (for use with the december 2017 revision of form 2553, election by a.

December 2002) (Under Section 1362 Of The Internal Revenue Code) Omb No.

Web form 2553 election by a small business corporation (rev. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Signnow allows users to edit, sign, fill and share all type of documents online.

Web For A Corporation To Be Treated As An S Corporation, They Must File Form 2553, Election By A Small Business Corporation.

Web here are the details of when your business must file form 2553: Web what is irs form 2553? Think it’s time to switch over to s corporation status? We know the irs from the inside out.