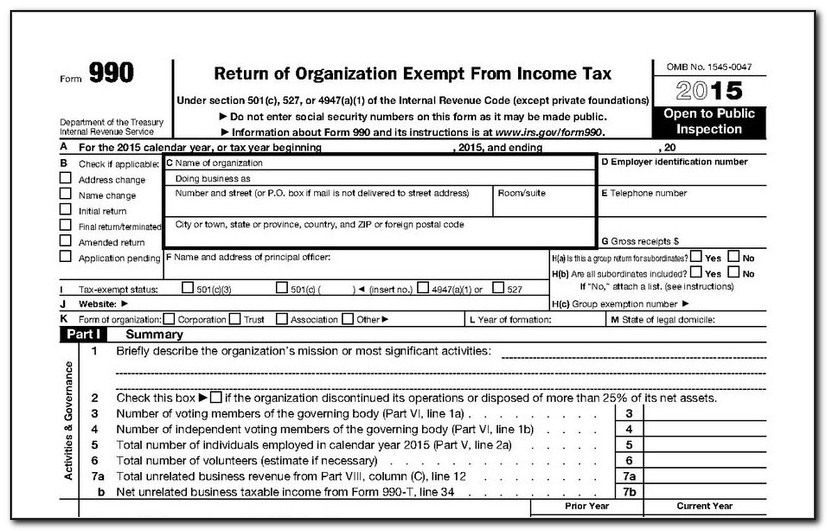

Extension Form For 990

Extension Form For 990 - To use the table, you. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web the following are the requirements for filing a form 8868 (request for extension) using the form 990 online system: Upon written request, copies available from: Web there are several ways to submit form 4868. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. The extension request must be for a form 990 or form 990. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Log into your tax990 account. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Edit, sign and save org exempt tax retn short form. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Thus, for a calendar year. To use the table, you. Web is there an extension for 990 forms? The extension request must be for a form 990 or form 990. Only submit original (no copies needed). Web here is how you can file your extension form 8868 using tax990:

Upon written request, copies available from: Thus, for a calendar year. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Web here is how you can file your extension form 8868 using tax990: Web there are several ways to submit form 4868. Log into your tax990 account. Web the following are the requirements for filing a form 8868 (request for extension) using the form 990 online system: Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code. To use the table, you. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Irs Fillable Extension Form Printable Forms Free Online

Web what does it mean to file for an extension? Thus, for a calendar year. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Taxpayers can file form 4868 by mail,.

Form 990 Filing Instructions Fill Out and Sign Printable PDF Template

Upon written request, copies available from: Web when is form 990 due? Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. Form 990 is due on the 15th day of the 5th month.

form 990 extension due date 2020 Fill Online, Printable, Fillable

Web when is form 990 due? Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. Uslegalforms allows users to edit, sign, fill & share all type of documents online. The extension request must be for a form 990 or form 990. For organizations on a calendar.

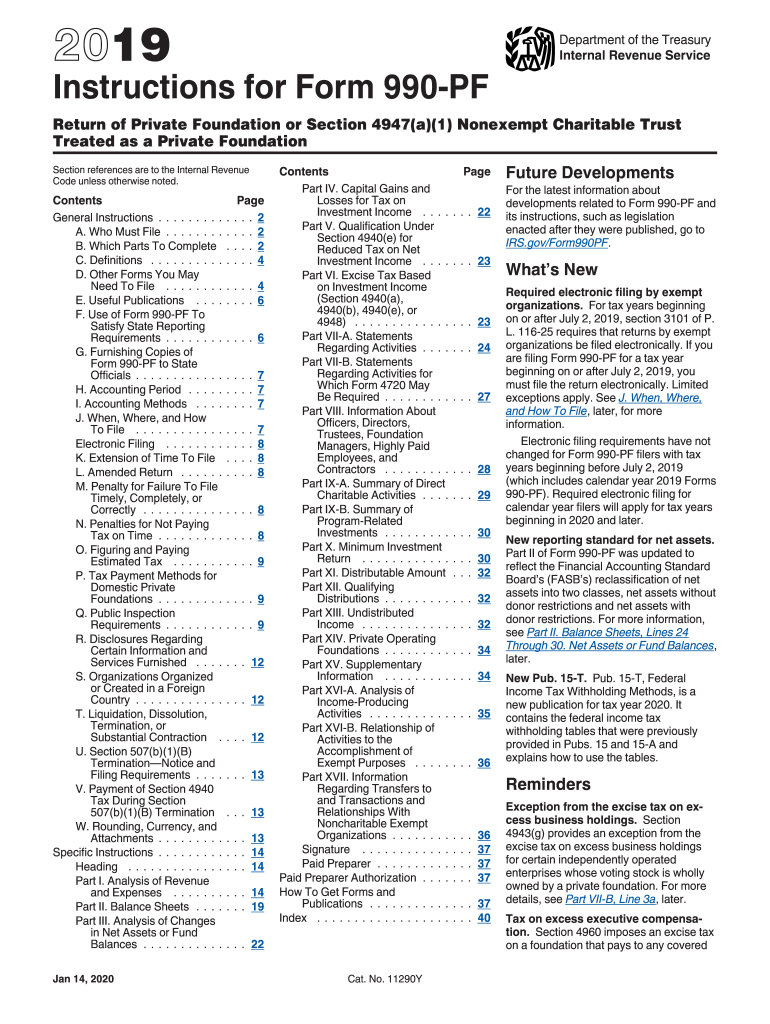

Instructions to file your Form 990PF A Complete Guide

Web the following are the requirements for filing a form 8868 (request for extension) using the form 990 online system: For organizations on a calendar. Web when is form 990 due? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web there are several ways to submit form 4868.

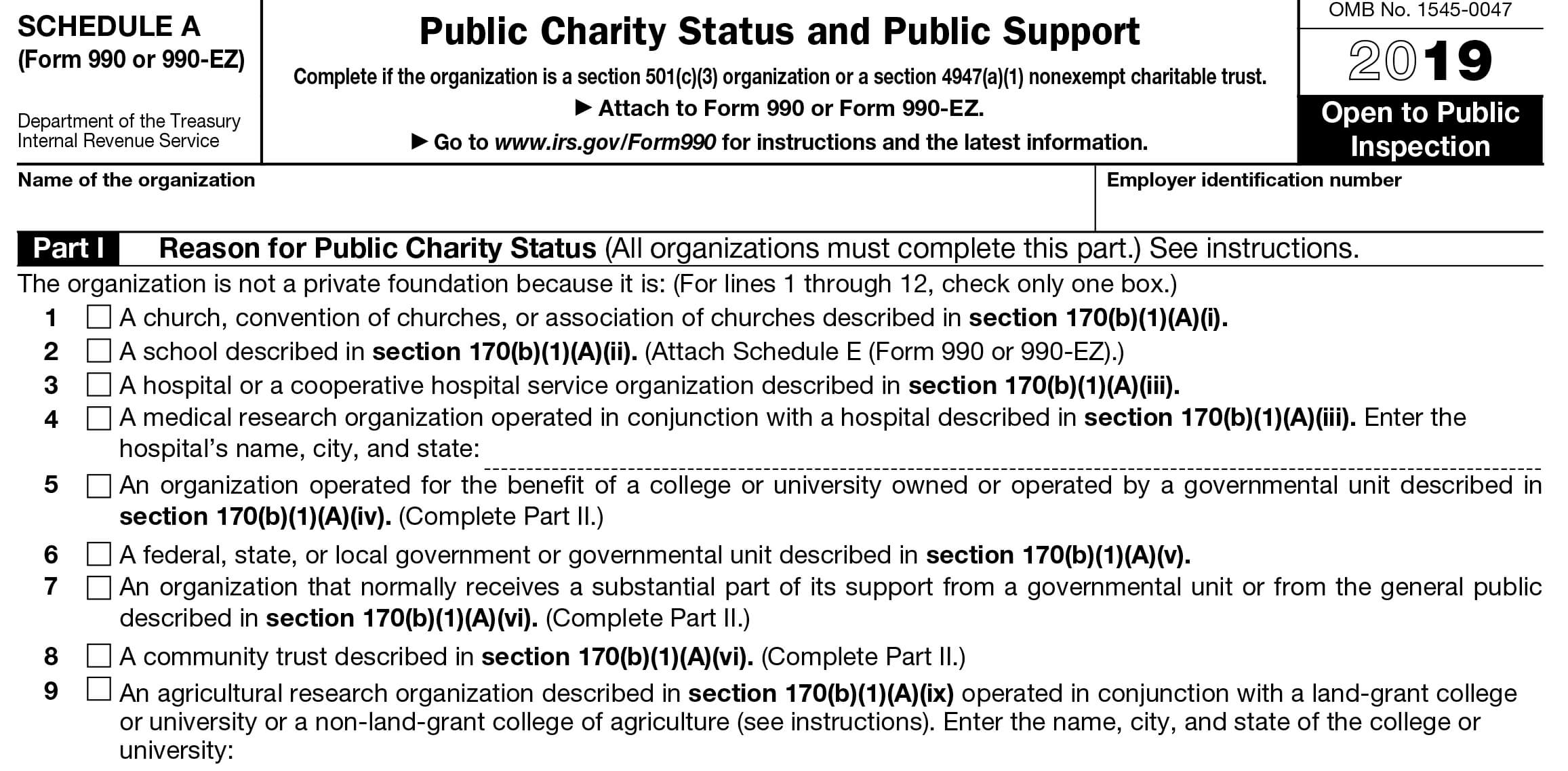

IRS Form 990 Schedules

For organizations on a calendar. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. Thus, for a calendar year. Edit, sign and save org exempt tax retn short form. Web when is form 990 due?

How to File A LastMinute 990 Extension With Form 8868

Web there are several ways to submit form 4868. Edit, sign and save org exempt tax retn short form. Web the following are the requirements for filing a form 8868 (request for extension) using the form 990 online system: Log into your tax990 account. Web when is form 990 due?

How to Keep Your TaxExempt Status by Filing IRS Form 990

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web here is how you can file your extension form 8868 using tax990: Upon written request, copies available from: For organizations on a calendar. Form 990 is due on the 15th day of the 5th month following the end of the.

Oh [Bleep]! I Need to File a Form 990 Extension! File 990

Thus, for a calendar year. To use the table, you. On the dashboard, click on the start return button. Edit, sign and save org exempt tax retn short form. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

990 Form For Non Profits Irs Universal Network

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Upon written request, copies available from: Web what does it mean to file for an extension? Web is there an extension for 990 forms? Only submit original (no copies needed).

Form 990 Filing Extension Form Resume Examples GEOG2LE5Vr

Edit, sign and save org exempt tax retn short form. Web is there an extension for 990 forms? The extension request must be for a form 990 or form 990. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web the following are the requirements for filing a form 8868.

Thus, For A Calendar Year.

Web the following are the requirements for filing a form 8868 (request for extension) using the form 990 online system: Upon written request, copies available from: Uslegalforms allows users to edit, sign, fill & share all type of documents online. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc.

Filing An Extension Only Extends The Time To File Your Return And Does Not Extend The Time To Pay Any Tax Due.

Log into your tax990 account. Web here is how you can file your extension form 8868 using tax990: On the dashboard, click on the start return button. To use the table, you.

For Organizations On A Calendar.

Web when is form 990 due? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web is there an extension for 990 forms? Edit, sign and save org exempt tax retn short form.

Web There Are Several Ways To Submit Form 4868.

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Only submit original (no copies needed). Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

![Oh [Bleep]! I Need to File a Form 990 Extension! File 990](https://www.file990.org/hubfs/Imported_Blog_Media/I-Need-to-File-a-Form-990-Extension-1.jpg)