Electronic 1099 Consent Form

Electronic 1099 Consent Form - Web you may withdraw your consent to paperless delivery by providing written notice either (1) by mail at the address set forth above; Web baptist sunday school committee electronic 1099 consent form. Prior to furnishing the statements electronically, the business must ask for the recipient’s consent. The form is available on any device with. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Your consent to electronic delivery will apply to all future irs form 1099s unless consent is For internal revenue service center. Gw may take up to 10 business days after receipt to process your request. The recipient must consent in the affirmative to receiving the statement electronically and not have withdrawn the. Before you can issue a form 1099 electronically, however, you must receive consent from your end user, the form 1099 recipient.

Gw may take up to 10 business days after receipt to process your request. The recipient must consent in the affirmative to receiving the statement electronically and not have withdrawn the. You may also have a filing requirement. The recipient must consent in the affirmative and have not withdrawn the consent before the statement is furnished. For internal revenue service center. See the instructions for form 8938. The form is available on any device with. The irs has approved the use of electronic 1099 statements. Instead of a paper copy, vendors must choose to receive their 1099 statement electronically. See your tax return instructions for where to report.

For internal revenue service center. If you do not consent to electronic delivery, or if we cease to offer this electronic delivery service, you will receive a paper irs form 1099 in the mail, which will be delivered to the address that we currently have on file. The advantages of this option are: Web baptist sunday school committee electronic 1099 consent form. The form is available on any device with. Before you can issue a form 1099 electronically, however, you must receive consent from your end user, the form 1099 recipient. Abound® facilitates an electronic delivery of irs forms 1099. If a furnisher does not obtain affirmative consent, they must furnish the return by paper, or they will be in violation of. Your consent to electronic delivery will apply to all future irs form 1099s unless consent is Web the irs has several requirements for furnishing form 1099 electronically.

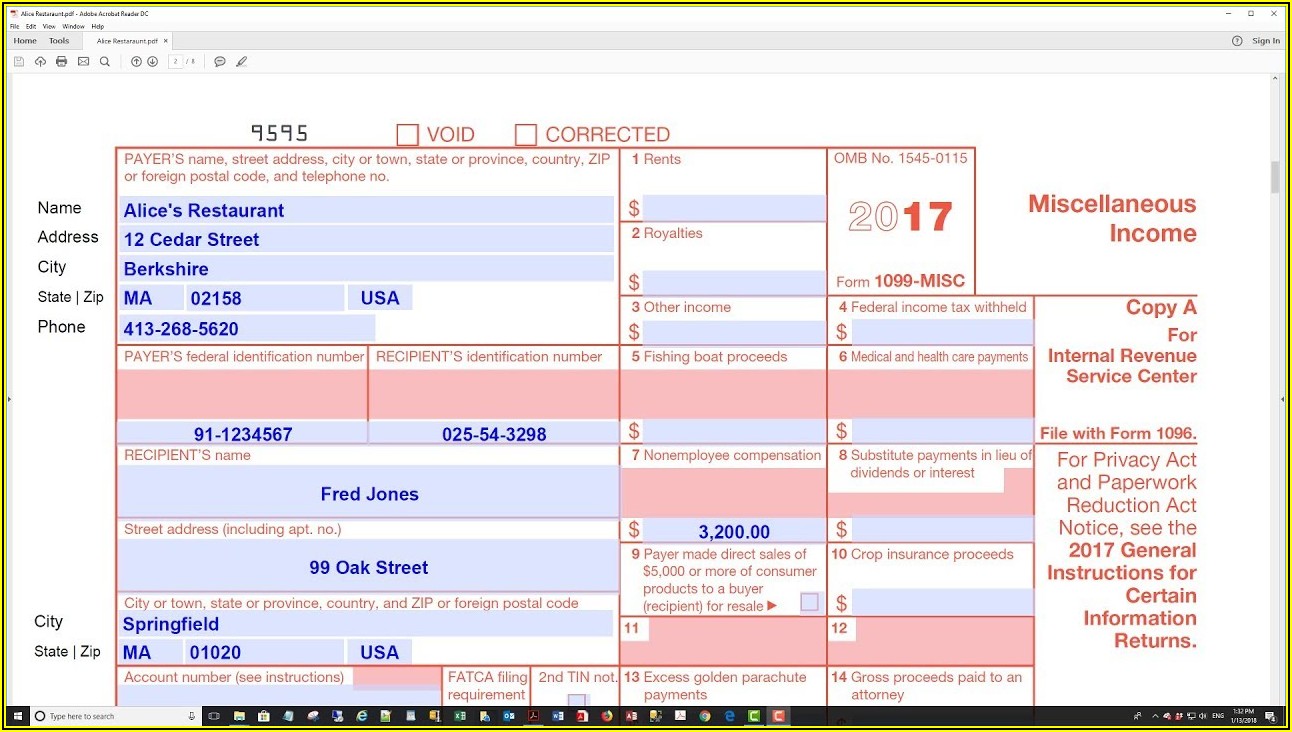

Irs Form 1099 Misc Form Resume Examples dP9l7NZW2R

Prior to furnishing the statements electronically, the business must ask for the recipient’s consent. You may also have a filing requirement. The form is available on any device with. The irs has approved the use of electronic 1099 statements. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

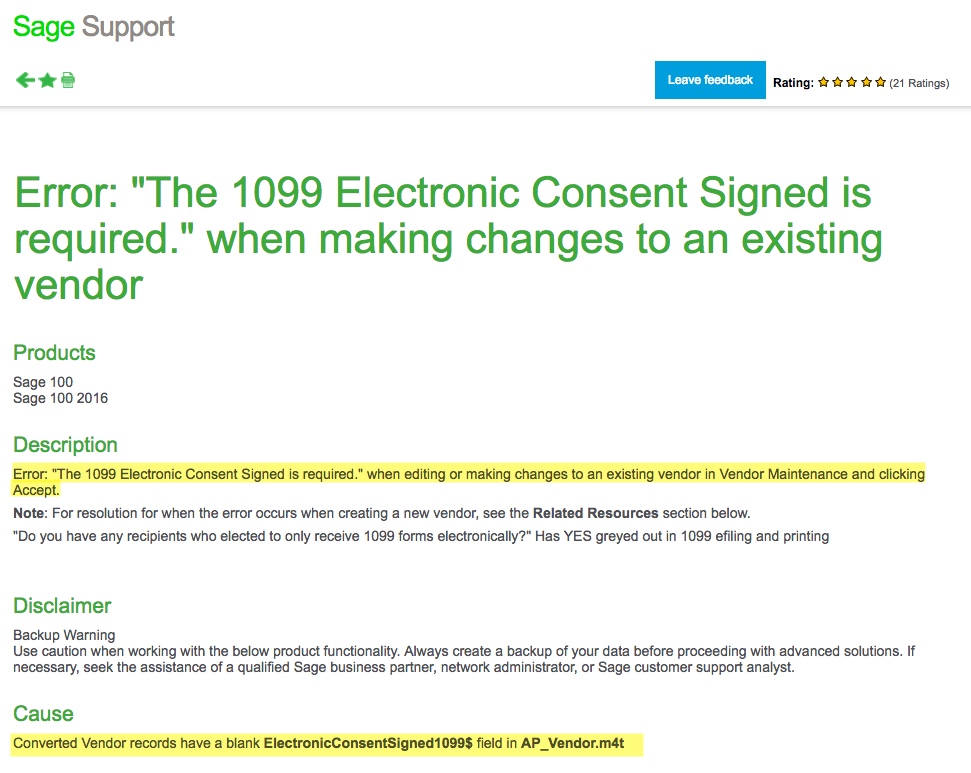

Form 1099 Electronic Filing Requirements Universal Network

Payment card and third party network transactions. For internal revenue service center. See the instructions for form 8938. Web the irs has several requirements for furnishing form 1099 electronically. You can include this information in their contract or via email.

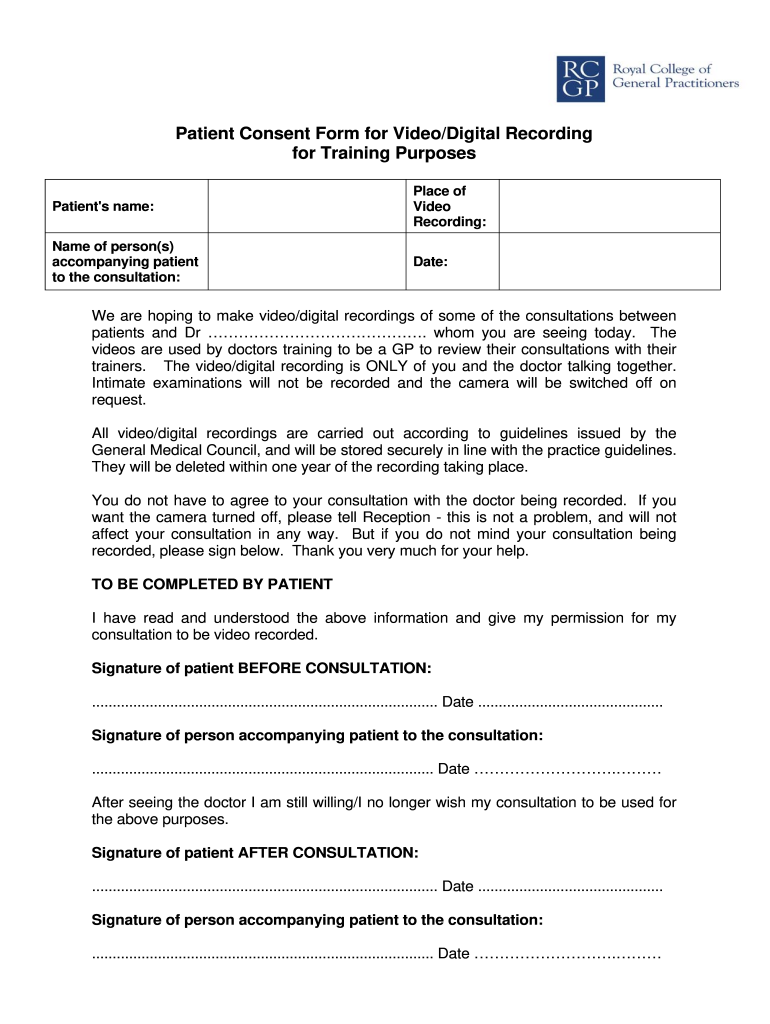

Electronic Filing W2 Consent Form (Example)

Prior to furnishing the statements electronically, the business must ask for the recipient’s consent. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See the instructions for form 8938. The recipient must consent in the.

Electronic 1099 MISC Form 2018 Irs Tax Forms Withholding Tax

Web to provide 1099 electronically, you must follow the below instructions: See your tax return instructions for where to report. Before furnishing the statements electronically, the business must ask for the recipient’s consent. Web the irs has several requirements for furnishing form 1099 electronically. You can include this information in their contract or via email.

Fixed Sage 100 Upgrade Bug The 1099 Electronic Consent Signed is

See your tax return instructions for where to report. The recipient must consent in the affirmative and have not withdrawn the consent before the statement is furnished electronically. For internal revenue service center. See the instructions for form 8938. Or (2) by email to gw_e1099@gwu.edu.

Electronic W2 Consent Form

Abound® facilitates an electronic delivery of irs forms 1099. Web the irs has several requirements for furnishing form 1099 electronically. Web baptist sunday school committee electronic 1099 consent form. Web to provide 1099 electronically, you must follow the below instructions: Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

1099 A 2021 Printable PDF Sample

But take care of it early, so you don’t miss the filing deadline. For internal revenue service center. Prior to furnishing the statements electronically, the business must ask for the recipient’s consent. You can include this information in their contract or via email. The recipient must consent in the affirmative and have not withdrawn the consent before the statement is.

Digital Consent Form Fill Online, Printable, Fillable, Blank pdfFiller

The recipient must consent in the affirmative to receiving the statement electronically and not have withdrawn the. If the recipient does not consent to receive the statement electronically, a paper copy has to be provided. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web downloaded a copy for your.

Electronic IRS Form 1099H 2018 2019 Printable PDF Sample

Prior to furnishing the statements electronically, the business must ask for the recipient’s consent. Web the irs has several requirements for furnishing form 1099 electronically. See your tax return instructions for where to report. The recipient must consent in the affirmative and have not withdrawn the consent before the statement is furnished. Web baptist sunday school committee electronic 1099 consent.

1099NEC

Taxpayer identification number (tin) matching Web the irs has several requirements for furnishing form 1099 electronically. The recipient must consent in the affirmative and have not withdrawn the consent before the statement is furnished. You may also have a filing requirement. See your tax return instructions for where to report.

Web Downloaded A Copy For Your Records.

Prior to furnishing the statements electronically, the business must ask for the recipient’s consent. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See the instructions for form 8938. The recipient must consent in the affirmative and have not withdrawn the consent before the statement is furnished electronically.

Web Baptist Sunday School Committee Electronic 1099 Consent Form.

Taxpayer identification number (tin) matching Some online services may handle this for you. Web to provide 1099 electronically, you must follow the below instructions: The form is available on any device with.

The Recipient Must Consent In The Affirmative And Have Not Withdrawn The Consent Before The Statement Is Furnished.

See your tax return instructions for where to report. The irs has approved the use of electronic 1099 statements. Before you can issue a form 1099 electronically, however, you must receive consent from your end user, the form 1099 recipient. You may also have a filing requirement.

If You Do Not Consent To Electronic Delivery, Or If We Cease To Offer This Electronic Delivery Service, You Will Receive A Paper Irs Form 1099 In The Mail, Which Will Be Delivered To The Address That We Currently Have On File.

Gw may take up to 10 business days after receipt to process your request. Before furnishing the statements electronically, the business must ask for the recipient’s consent. For internal revenue service center. But take care of it early, so you don’t miss the filing deadline.