E Filing Form 1096

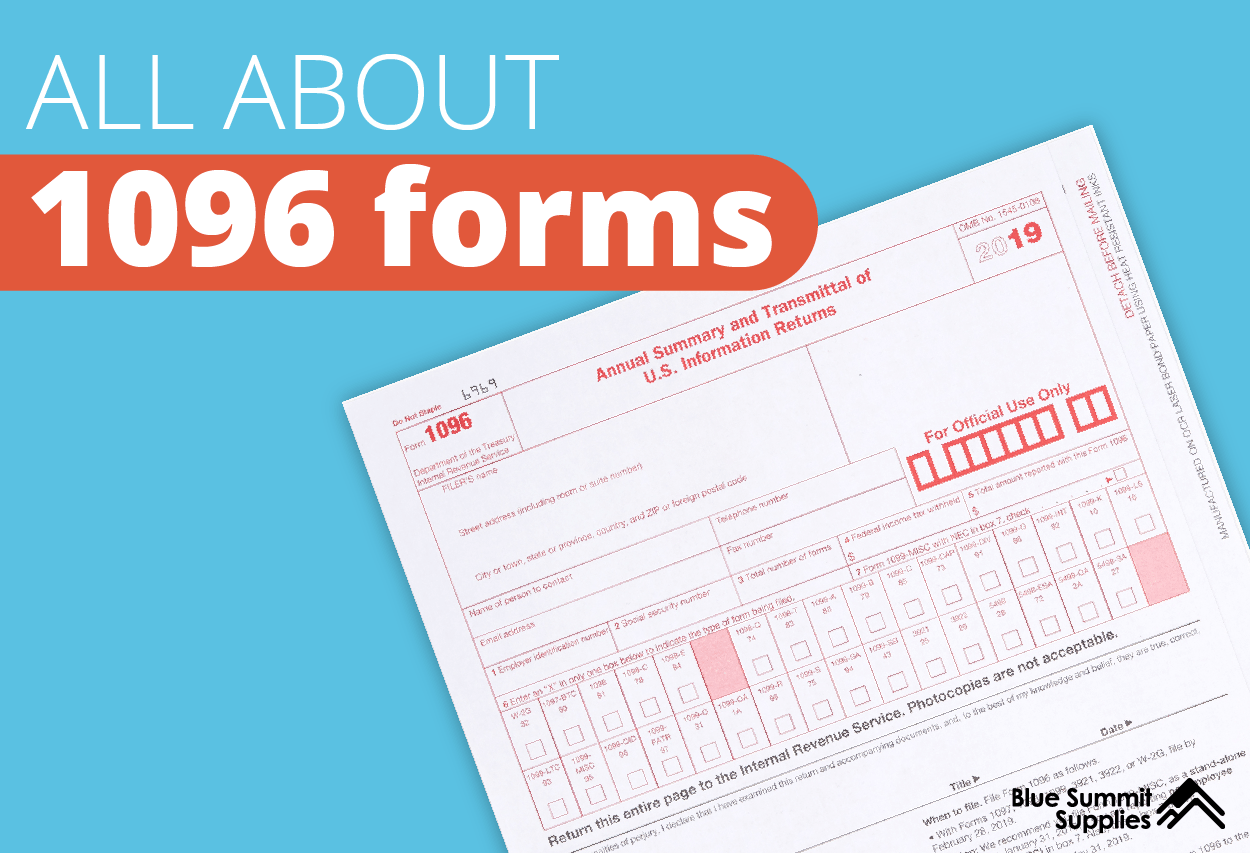

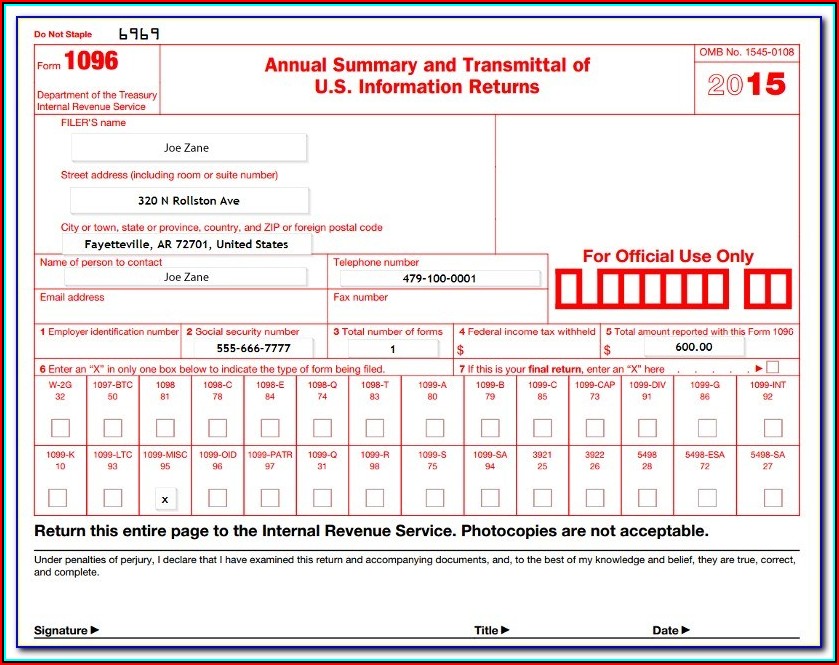

E Filing Form 1096 - Form 1096 is due by january 31. The mailing address is on the last page of the form 1096 instructions. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. For more information, go to easily e. Web each group with a separate form 1096. As a business owner or. Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. Provide the total number of information returns being filed. Do not include blank or voided forms or the form 1096 in your total. Complete, edit or print tax forms instantly.

Do not include blank or voided forms or the form 1096 in your total. At an office supply store; Web form 1096 summarizes all of your 1099 forms and is filed with the irs. Complete, edit or print tax forms instantly. Enter the number of correctly completed forms, not the number of pages, being transmitted. Web each group with a separate form 1096. Form 1096 is due by january 31. Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. From an account, bookkeeper, or payroll service; The mailing address is on the last page of the form 1096 instructions.

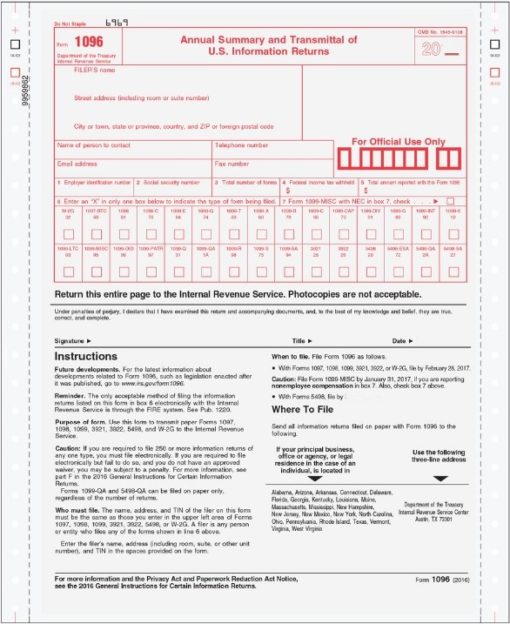

Form 1096 is due by january 31. The mailing address is on the last page of the form 1096 instructions. Enter the number of correctly completed forms, not the number of pages, being transmitted. If you need 1096 forms, you can get them: Do not use form 1096 to transmit electronically. Enter your name, address, and identification numbers in the designated spaces. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. As a business owner or. For example, if you must file both forms 1098 and.

Downloadable Irs Form 1096 Form Resume Examples N8VZj7DVwe

At an office supply store; Do not include blank or voided forms or the form 1096 in your total. From an account, bookkeeper, or payroll service; As a business owner or. Enter your name, address, and identification numbers in the designated spaces.

Filing Form 1096 and Form W3 with TaxBandits Blog TaxBandits

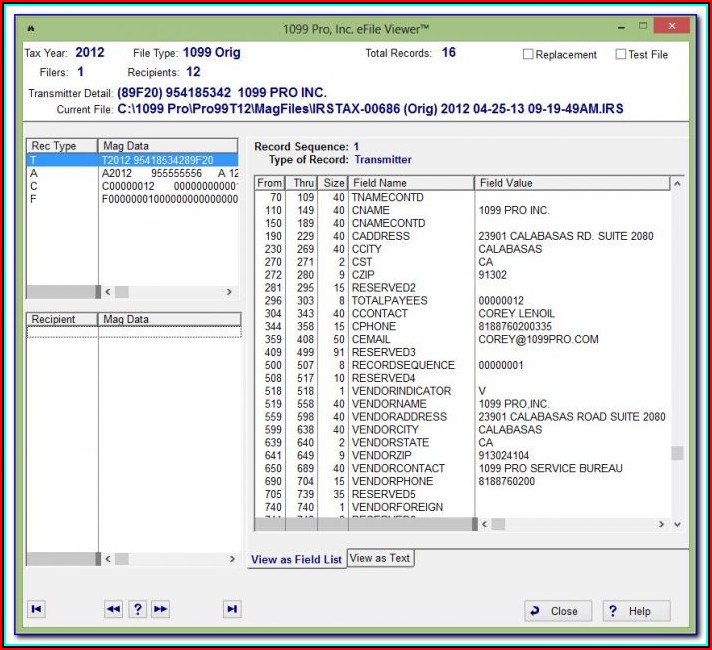

At an office supply store; Web form 1096 is used to transmit paper forms 1099 to the internal revenue service. Official site | smart tools. Do not use form 1096 to transmit electronically. Complete, edit or print tax forms instantly.

What Is Transmittal Form 1096 ? Irs forms, 1099 tax form, Irs

Web each group with a separate form 1096. Send all information returns filed on paper to the following. Complete, edit or print tax forms instantly. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. The mailing address is on the last page of the form 1096 instructions.

Corrected Form 1099 And 1096 Form Resume Examples AjYd6jD2l0

For more information, go to easily e. Web form 1096 (annual summary and transmittal of u.s. Do not use form 1096 to transmit electronically. Web form 1096 summarizes all of your 1099 forms and is filed with the irs. Enter your name, address, and identification numbers in the designated spaces.

1096 Transmittal Form (L1096)

Official site | smart tools. Form 1096 is due by january 31. Complete, edit or print tax forms instantly. Web form 1096 (annual summary and transmittal of u.s. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs.

Benefits_of_e_filing_Form_2290 by steve sanders Issuu

Form 1096 is due by january 31. Provide the total number of information returns being filed. For example, if you must file both forms 1098 and. At an office supply store; Complete, edit or print tax forms instantly.

What You Need to Know About 1096 Forms Blue Summit Supplies

Web form 1096 (annual summary and transmittal of u.s. Send all information returns filed on paper to the following. Complete, edit or print tax forms instantly. Official site | smart tools. Form 1096 is due by january 31.

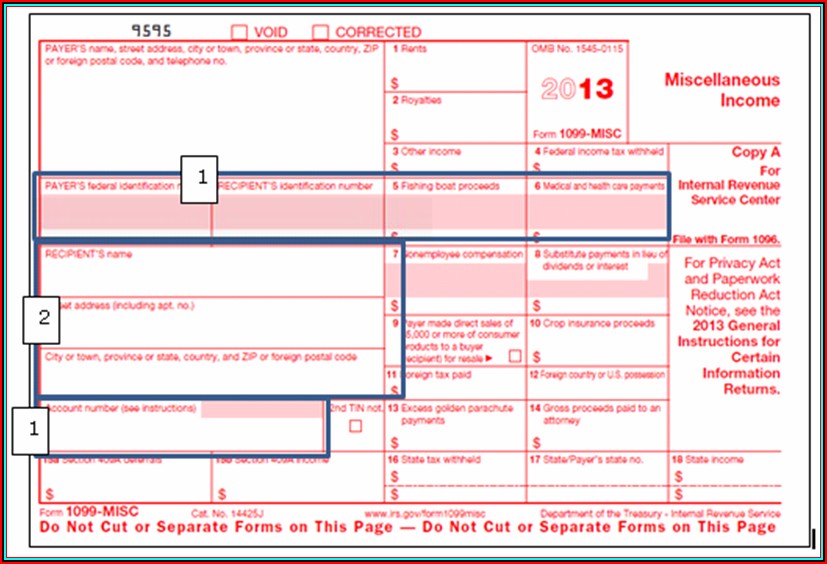

1099 Filing with 1099 Forms, Envelopes, Software, Efile

Official site | smart tools. Web form 1096 summarizes all of your 1099 forms and is filed with the irs. Web form 1096 (annual summary and transmittal of u.s. If you need 1096 forms, you can get them: Send all information returns filed on paper to the following.

Fill Free fillable F1096 2020 Form 1096 PDF form

Provide the total number of information returns being filed. As a business owner or. Enter the number of correctly completed forms, not the number of pages, being transmitted. At an office supply store; For example, if you must file both forms 1098 and.

Downloadable Irs Form 1096 Form Resume Examples N8VZj7DVwe

Send all information returns filed on paper to the following. The due dates for these forms to be. Complete, edit or print tax forms instantly. Do not include blank or voided forms or the form 1096 in your total. Enter your name, address, and identification numbers in the designated spaces.

From An Account, Bookkeeper, Or Payroll Service;

Provide the total number of information returns being filed. Form 1096 is due by january 31. Web form 1096 summarizes all of your 1099 forms and is filed with the irs. As a business owner or.

For More Information, Go To Easily E.

For example, if you must file both forms 1098 and. At an office supply store; Web each group with a separate form 1096. If you need 1096 forms, you can get them:

Do Not Include Blank Or Voided Forms Or The Form 1096 In Your Total.

Web form 1096 (annual summary and transmittal of u.s. Official site | smart tools. Send all information returns filed on paper to the following. Enter the number of correctly completed forms, not the number of pages, being transmitted.

Web Form 1096 Is Used To Transmit Paper Forms 1099 To The Internal Revenue Service.

Do not use form 1096 to transmit electronically. The mailing address is on the last page of the form 1096 instructions. Enter your name, address, and identification numbers in the designated spaces. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs.