Download Form 8862

Download Form 8862 - December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Save or instantly send your ready documents. Ad access irs tax forms. Web up to $40 cash back also see part ii, page 9, of form 8862 to figure the credit. Complete, edit or print tax forms instantly. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Get ready for tax season deadlines by completing any required tax forms today. December 2012) department of the treasury internal revenue service. Information to claim certain credits after disallowance.

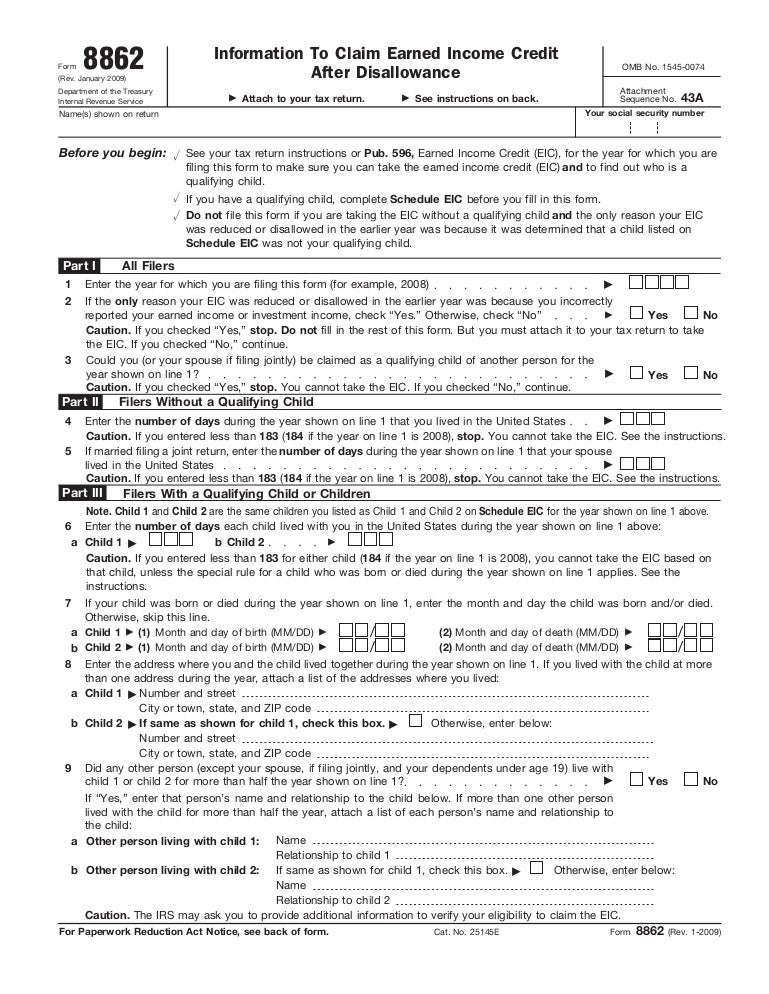

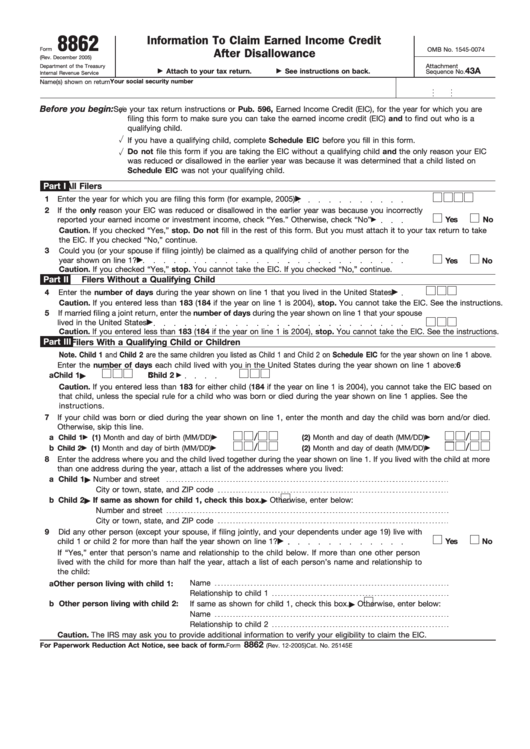

Ad access irs tax forms. Information to claim earned income credit after disallowance. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Easily fill out pdf blank, edit, and sign them. Get your online template and fill it in using. December 2012) department of the treasury internal revenue service. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Information to claim certain credits after disallowance. Complete, edit or print tax forms instantly.

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web we last updated the information to claim earned income credit after disallowance in december 2022, so this is the latest version of form 8862, fully updated for tax year. Save or instantly send your ready documents. December 2012) department of the treasury internal revenue service. Information to claim earned income credit after disallowance. Information to claim certain credits after disallowance. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. You won't be able to file this form or claim the credits for up to 10 years if your. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Web up to $40 cash back also see part ii, page 9, of form 8862 to figure the credit.

Top 14 Form 8862 Templates free to download in PDF format

Web how do i enter form 8862? Your eic was reduced or disallowed for any reason other than a. Ad download or email irs 8862 & more fillable forms, register and subscribe now! December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Web you can download form 8862 from.

37 INFO PRINTABLE TAX FORM 8862 PDF ZIP DOCX PRINTABLE DOWNLOAD * Tax

Save or instantly send your ready documents. Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Get your online template and fill it in using. December 2021) department of the treasury internal revenue service. Easily fill.

20182020 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Information to claim earned income credit after.

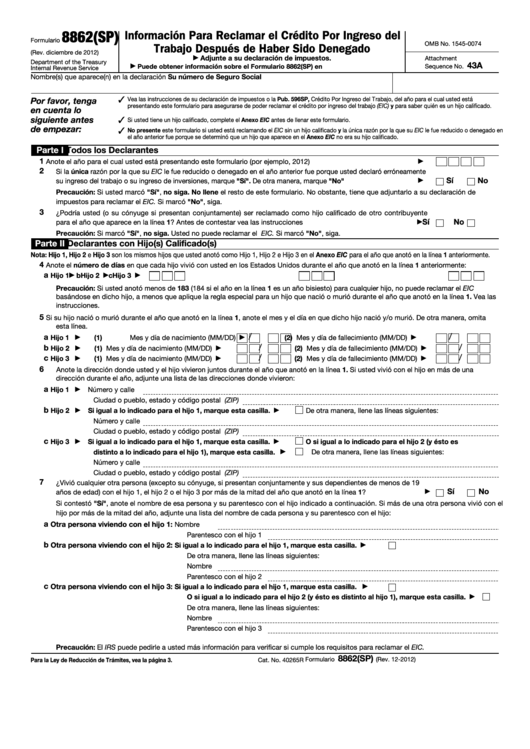

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

Your eic was reduced or disallowed for any reason other than a. Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web you can download form 8862 from the irs website and file it electronically or.

Form 8862Information to Claim Earned Credit for Disallowance

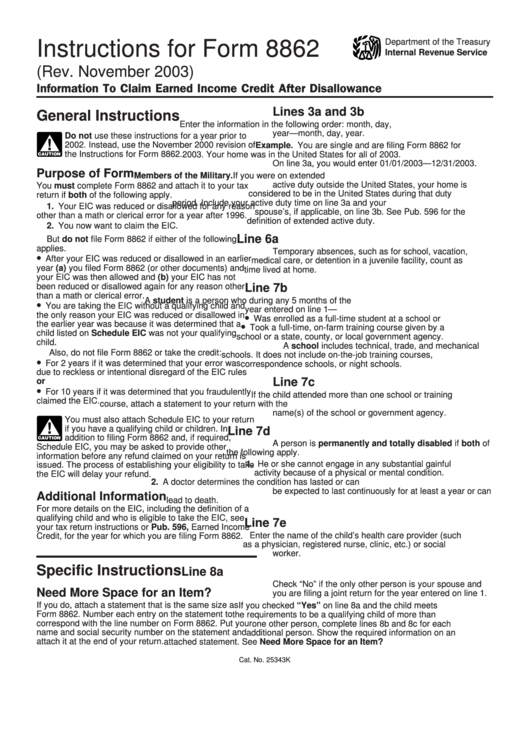

Save or instantly send your ready documents. More about the federal form 8862 tax credit we last. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Web instructions for form 8862 (rev. Web for the latest information about developments related to form 8862.

Form 8862 Information to Claim Earned Credit After

Easily fill out pdf blank, edit, and sign them. Ad access irs tax forms. You won't be able to file this form or claim the credits for up to 10 years if your. Web up to $40 cash back also see part ii, page 9, of form 8862 to figure the credit. Get ready for tax season deadlines by completing.

Form 8862 Information To Claim Earned Credit After

December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Web how do i enter form 8862? Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Ad access irs tax forms. Web instructions for form 8862 (rev.

IRS Formulario 8862(SP) Download Fillable PDF or Fill Online

Complete, edit or print tax forms instantly. Web purpose of form you must complete form 8862 and attach it to your tax return if both of the following apply. Easily fill out pdf blank, edit, and sign them. Web we last updated the information to claim earned income credit after disallowance in december 2022, so this is the latest version.

Instructions For Form 8862 Information To Claim Earned Credit

2 3 4 enter the number of qualifying children for whom you or your partner are claiming earned income, in. Information to claim certain credits after disallowance. Web instructions for form 8862 (rev. Web we last updated the information to claim earned income credit after disallowance in december 2022, so this is the latest version of form 8862, fully updated.

Form 8862 Claim Earned Credit After Disallowance YouTube

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Web how do i enter form 8862? Get ready for tax season deadlines by completing any required tax forms today. Web you can download form 8862 from the irs website and file it electronically.

Ad Download Or Email Irs 8862 & More Fillable Forms, Register And Subscribe Now!

December 2012) department of the treasury internal revenue service. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly.

Web Form 8862 Information To Claim Certain Credits After Disallowance Is Used To Claim The Earned Income Credit (Eic) If This Credit Was Previously Reduced Or Disallowed By The.

Your eic was reduced or disallowed for any reason other than a. December 2021) department of the treasury internal revenue service. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Get your online template and fill it in using.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Web instructions for form 8862 (rev. More about the federal form 8862 tax credit we last. Information to claim earned income credit after disallowance.

Web Up To $40 Cash Back Also See Part Ii, Page 9, Of Form 8862 To Figure The Credit.

December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. 2 3 4 enter the number of qualifying children for whom you or your partner are claiming earned income, in. Save or instantly send your ready documents. Web how do i enter form 8862?