Do I Have To File Form 2290 Every Year

Do I Have To File Form 2290 Every Year - The current period begins july 1 and ends june 30 of the. In the next tax year, you can file one form 2290 for all the vehicles you will have on the. You must file form 2290 annually for each taxable heavy vehicle you own and operate on public. This revision if you need to file a. Web who must file & who is exempt. Web irs 2290 form should be filed for each month a taxable vehicle is first used on public highways during the current tax year. Web please review the information below. Yes, if you own a heavy vehicle with a gross weight of 55,000 pounds or more and use it on public highways, you must file form 2290. Where do i file the 2290 form? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Yes, if you own a heavy vehicle with a gross weight of 55,000 pounds or more and use it on public highways, you must file form 2290. The current tax period begins on july 1 and ends. This july 2021 revision is for the tax period beginning on july 1, 2021, and ending on june 30, 2022. With full payment and that payment is not drawn from. In the next tax year, you can file one form 2290 for all the vehicles you will have on the. Web who must file & who is exempt. Web do i have to file form 2290 every year? What is a 2290 in trucking? Web john uses a taxable vehicle on a public highway by driving it home from the dealership on july 2, 2023, after purchasing it. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

The tax period to file your return begins july 1 and ends on june 30 every year. The vehicle is required to be registered in his name. If you are filing a form 2290 paper return: Do your truck tax online & have it efiled to the irs! The form 2290 tax year begins on july 1 and ends on june 30 of the following year. Web please review the information below. File your 2290 online & get schedule 1 in minutes. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web your tax will be more for the vehicle that was used first during the period. This revision if you need to file a.

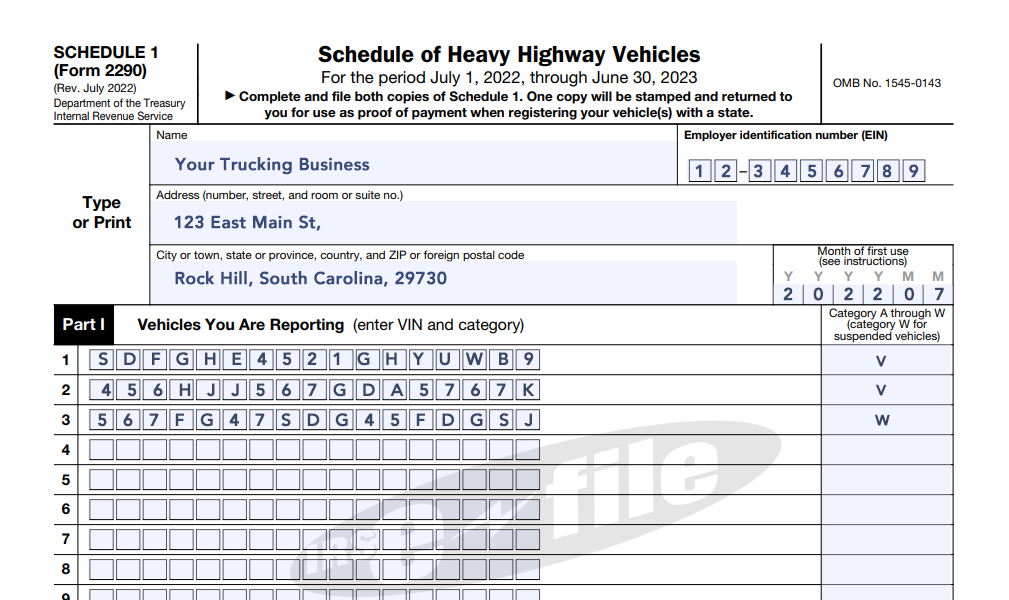

File IRS 2290 Form Online for 20222023 Tax Period

The vehicle is required to be registered in his name. Web irs 2290 form should be filed for each month a taxable vehicle is first used on public highways during the current tax year. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2022, through june 30, 2023, were not.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Yes, if you own a heavy vehicle with a gross weight of 55,000 pounds or more and use it on public highways, you must file form 2290. This revision if you need to file a. In the next tax year, you can file one form 2290 for all the vehicles you will have on the. The vehicle is required to.

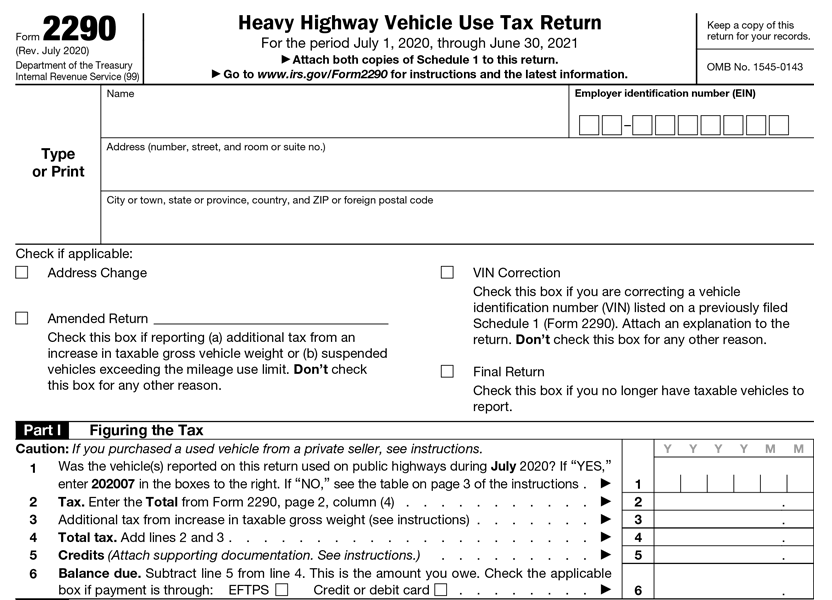

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Web do i have to file form 2290 every year? Web form 2290 is an irs tax return filed by owners/drivers of heavy vehicles that are operated on public highways to calculate and pay the heavy vehicle use tax every. With full payment and that payment is not drawn from. The current period begins july 1 and ends june 30.

A Guide to Form 2290 Schedule 1

With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. The tax period to file your return begins july 1 and ends on june 30 every year. What is a 2290 in trucking? Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2022,.

Notifications for every situation when you efile Form 2290 Online

Do your truck tax online & have it efiled to the irs! The tax period to file your return begins july 1 and ends on june 30 every year. Web if you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august.

Get Your Stamped Schedule 1 (Form 2290) Online in Minutes

Web if you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31. Web form 2290 is an irs tax return filed by owners/drivers of heavy vehicles that are operated on public highways to calculate and pay the heavy vehicle use.

What Happens If You Don't File HVUT Form 2290 Driver Success

What is form 2290 used for? The form 2290 tax year begins on july 1 and ends on june 30 of the following year. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. With full payment and that payment.

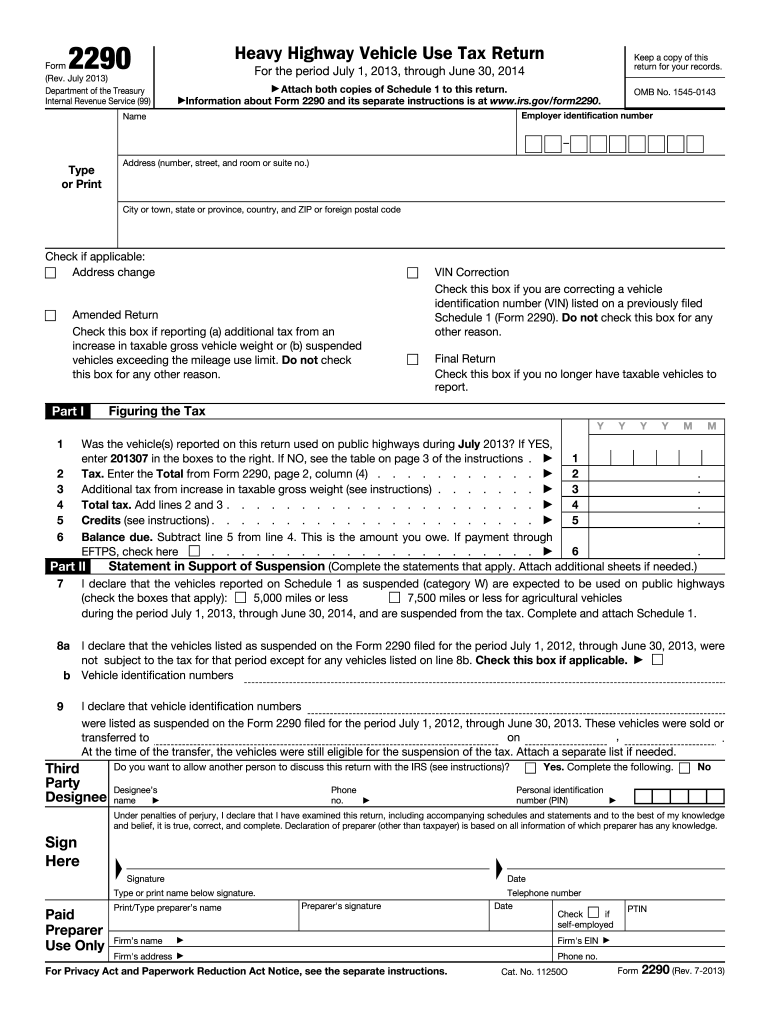

2013 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

File your 2290 online & get schedule 1 in minutes. In the next tax year, you can file one form 2290 for all the vehicles you will have on the. What is form 2290 used for? If you are filing a form 2290 paper return: With full payment and that payment is not drawn from.

new tax season 20222023 IRS Authorized Electronic

The form 2290 tax year begins on july 1 and ends on june 30 of the following year. What is form 2290 used for? Web form 2290 is a federal tax return that must be filed every year by owners/drivers of heavy vehicles to calculate and pay the heavy vehicle use tax. Web yes, form 2290 is an annual tax.

What Is The Best Way To File Your Form 2290? Blog ExpressTruckTax

The current period begins july 1 and ends june 30 of the. Web form 2290 is an irs tax return filed by owners/drivers of heavy vehicles that are operated on public highways to calculate and pay the heavy vehicle use tax every. Easy, fast, secure & free to try. Web do you have to file form 2290 every year? Where.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

File your 2290 online & get schedule 1 in minutes. Web yes, form 2290 is an annual tax return that must be filed every tax year. You must file form 2290 annually for each taxable heavy vehicle you own and operate on public. With full payment and that payment is not drawn from.

Web I Declare That The Vehicles Listed As Suspended On The Form 2290 Filed For The Period July 1, 2022, Through June 30, 2023, Were Not Subject To The Tax For That Period Except For Any.

Web form 2290 must be filed for each month a taxable vehicle is first used on public highways during the current period. The vehicle is required to be registered in his name. Web who must file & who is exempt. The tax period to file your return begins july 1 and ends on june 30 every year.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

If you are filing a form 2290 paper return: This revision if you need to file a. What is a 2290 in trucking? Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

Web John Uses A Taxable Vehicle On A Public Highway By Driving It Home From The Dealership On July 2, 2023, After Purchasing It.

With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web irs 2290 form should be filed for each month a taxable vehicle is first used on public highways during the current tax year. This july 2021 revision is for the tax period beginning on july 1, 2021, and ending on june 30, 2022. Easy, fast, secure & free to try.