Distribution Code J On Form 1099-R

Distribution Code J On Form 1099-R - Code j can be combined with the following codes: Taxable amount is blank and it is marked that. Web if no earnings are distributed, enter 0 (zero) in box 2a and code 8 in box 7 for a traditional ira and code j for a roth ira. If earnings are distributed, enter the amount. The amount may or may not be taxable depending on the amount distributed and the. In the distribution code #1 field, select code g from the dropdown menu. Web code h can be combined with the following code: If there is any prior or. Web code j indicates that there was an early distribution from a roth ira. We use these codes and your answers to some interview.

Taxable amount is blank and it is marked that. Web code j indicates that there was an early distribution from a roth ira. Find the explanation for box 7 codes here. In the distribution code #1 field, select code g from the dropdown menu. If earnings are distributed, enter the amount. Web code h can be combined with the following code: This is indexed on box 7. If there is any prior or. Early distribution from a roth ira: Web if the distribution code entered is j, the gross distribution carries to form 8606 as a distribution from a roth ira, but see the following note.

Web if no earnings are distributed, enter 0 (zero) in box 2a and code 8 in box 7 for a traditional ira and code j for a roth ira. Find the explanation for box 7 codes here. Do not combine with any other codes. If earnings are distributed, enter the amount. Early distribution from a roth ira: Do i need to file an amended return for tax year 2019 against the return i filed last year (2020 for tax year. Web but code j says the amount is *taxable in 2019*. The amount may or may not be taxable depending on the amount distributed and the. Web code j indicates that there was an early distribution from a roth ira. Web if the distribution code entered is j, the gross distribution carries to form 8606 as a distribution from a roth ira, but see the following note.

Entering & Editing Data > Form 1099R

Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross. If earnings are distributed, enter the amount. Early distribution from a roth ira: Find the explanation for box 7 codes here. Code j can.

Sample 12r Form Filled Out You Should Experience Sample 12r Form

Early distribution from a roth ira: We use these codes and your answers to some interview. Web code h can be combined with the following code: Web code j indicates that there was an early distribution from a roth ira. If there is any prior or.

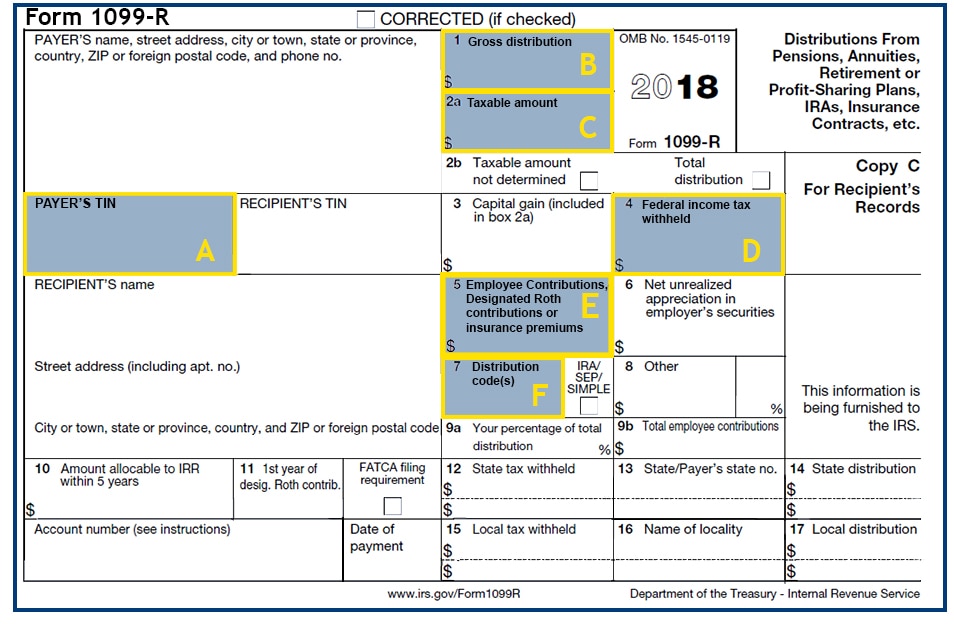

1099R Forms LASERS

Web if no earnings are distributed, enter 0 (zero) in box 2a and code 8 in box 7 for a traditional ira and code j for a roth ira. Do i need to file an amended return for tax year 2019 against the return i filed last year (2020 for tax year. Early distribution from a roth ira: Web 1099r.

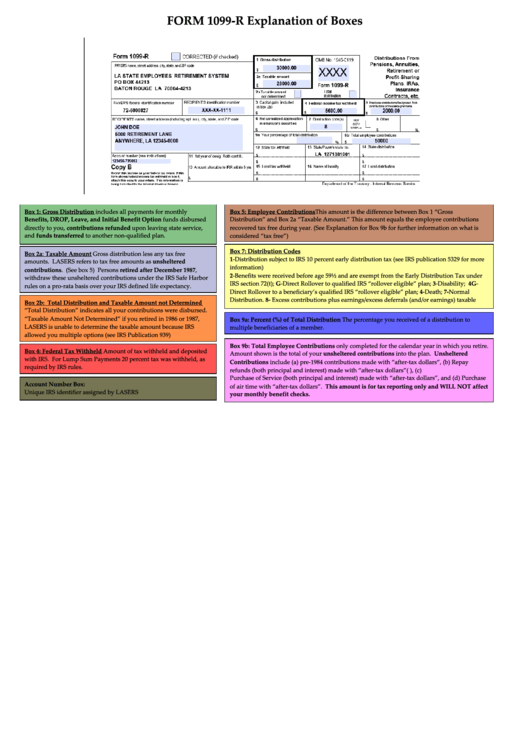

Form 1099R Explanation Of Boxes printable pdf download

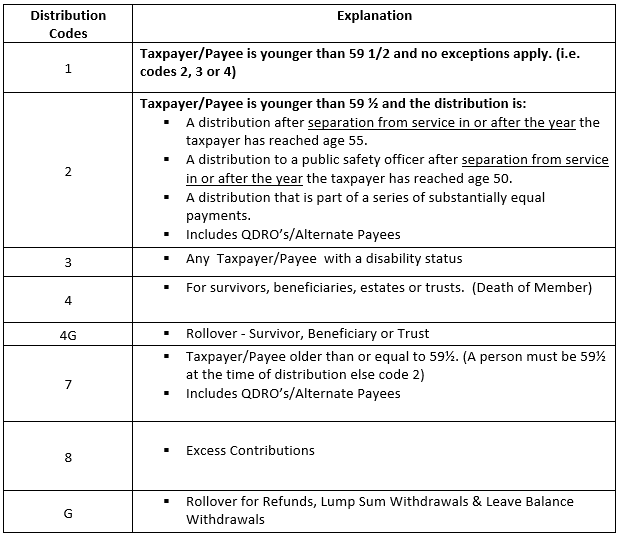

Taxable amount is blank and it is marked that. Find the explanation for box 7 codes here. Early distribution from a roth ira: Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Box 7 codes 1 = early distribution.

How To Fill Out Form 1099 R Universal Network

Do not combine with any other codes. In the distribution code #1 field, select code g from the dropdown menu. Code j can be combined with the following codes: Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to.

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

Web 1099r box 7 says code j but roth ira distribution shouldn't be taxed as it was contributions only, not earnings. Find the explanation for box 7 codes here. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Box 7 codes 1 = early distribution. We use these codes.

1099R Software EFile TIN Matching Print and Mail 1099R Forms

Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Early distribution from a roth ira: Web code h can be combined with the following code: Taxable amount is blank and it is marked that. Code j can be combined with the following codes:

Do I Get A Tax Statement For 401k Tax Walls

Code j can be combined with the following codes: If there is any prior or. Do i need to file an amended return for tax year 2019 against the return i filed last year (2020 for tax year. Web code h can be combined with the following code: We use these codes and your answers to some interview.

IRS Form 1099R Box 7 Distribution Codes — Ascensus

Code j can be combined with the following codes: Box 7 codes 1 = early distribution. Taxable amount is blank and it is marked that. Do not combine with any other codes. Web code j indicates that there was an early distribution from a roth ira.

Client Has A Form 1099R With A Code J In Box 7 Which States Early Distribution From A Roth Ira.

Box 7 codes 1 = early distribution. Web 1099r box 7 says code j but roth ira distribution shouldn't be taxed as it was contributions only, not earnings. Web code j indicates that there was an early distribution from a roth ira. This is indexed on box 7.

Code J Can Be Combined With The Following Codes:

Web but code j says the amount is *taxable in 2019*. Should i change code to q (qualified) &. Do i need to file an amended return for tax year 2019 against the return i filed last year (2020 for tax year. Web if the distribution code entered is j, the gross distribution carries to form 8606 as a distribution from a roth ira, but see the following note.

Do Not Combine With Any Other Codes.

Find the explanation for box 7 codes here. Web code h can be combined with the following code: The amount may or may not be taxable depending on the amount distributed and the. Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross.

Taxable Amount Is Blank And It Is Marked That.

Early distribution from a roth ira: We use these codes and your answers to some interview. If earnings are distributed, enter the amount. If there is any prior or.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)