Disclaim Inheritance Form

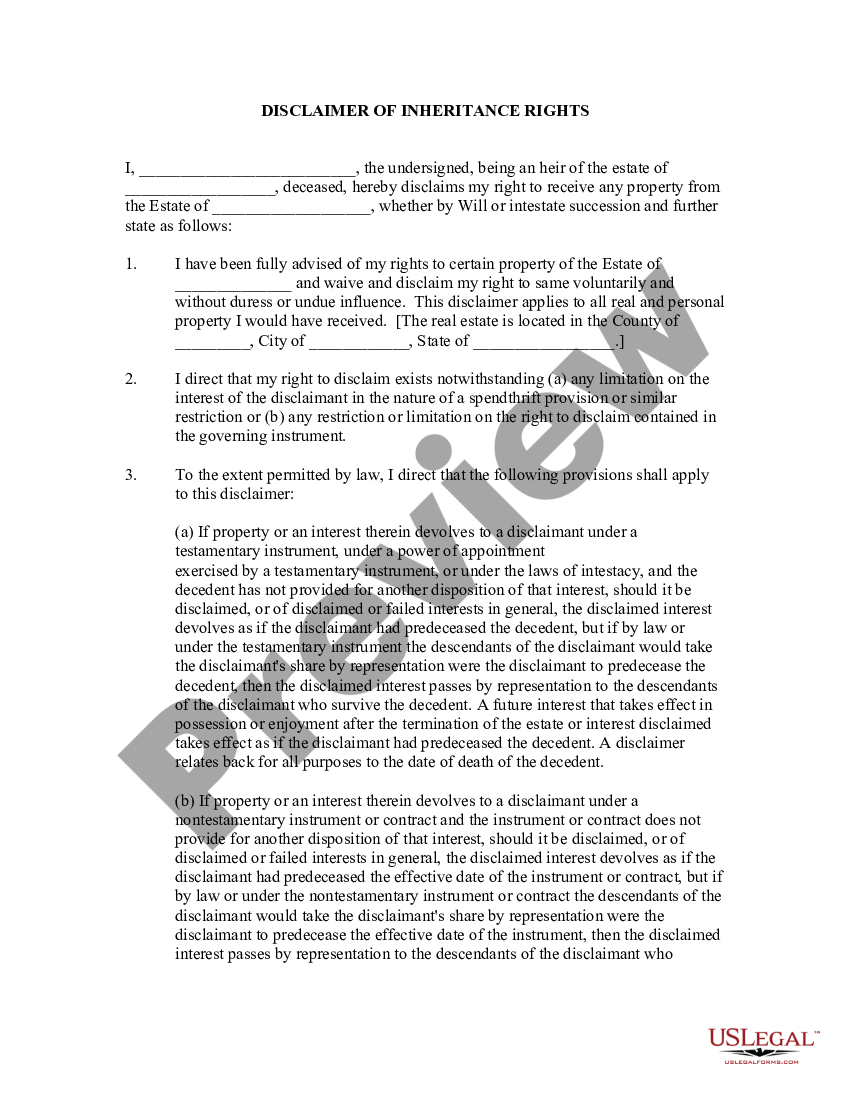

Disclaim Inheritance Form - Make some changes to your document, like adding checkmark, erasing, and other tools in the top toolbar. This form should be signed in front of witnesses. Hit the get form button on this page. Web generally, an inheritance renunciation or disclaimer form must be in writing and must contain the name of the decedent, a description of the inheritance to be disclaimed, a statement of intent to disclaim the inheritance and a description of what portion of the inheritance is disclaimed. Under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and unqualified intent to refuse the bequest. This will enable you to complete this form. The beneficiary has gained an interest in the described property of the decedent. Web irs requirements for refusing an inheritance. You will go to our pdf editor. A disclaimer of right to inherit states that one who should rightly be able to inherit from the deceased, chooses not to partake in his/her inheritance.

Save or instantly send your ready documents. Hit the get form button on this page. This will enable you to complete this form. This form is a renunciation and disclaimer of property acquired by the beneficiary through the last will and testament of the decedent. Web generally, an inheritance renunciation or disclaimer form must be in writing and must contain the name of the decedent, a description of the inheritance to be disclaimed, a statement of intent to disclaim the inheritance and a description of what portion of the inheritance is disclaimed. Web description sample letter to disclaim inherited ira. You will go to our pdf editor. Web the answer is yes. You disclaim the assets within nine months of the death of the person you inherited them from. Web a disclaimer inheritance form is a document that can help avoid potential problems and legal hassles associated with the death of an individual.

Web description sample letter to disclaim inherited ira. You will go to our pdf editor. Under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and unqualified intent to refuse the bequest. Web the answer is yes. This form is available in both word and rich text formats. Web follow these steps to get your disclaimer inheritance edited for the perfect workflow: You disclaim the assets within nine months of the death of the person you inherited them from. This will enable you to complete this form. This form is a renunciation and disclaimer of property acquired by the beneficiary through the last will and testament of the decedent. The beneficiary has gained an interest in the described property of the decedent.

Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation

Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can’t be changed. Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the transferor or his. Web description sample letter to disclaim inherited ira. If you are considering.

Disclaimer of Inheritance Rights for Stepchildren US Legal Forms

Web irs requirements for refusing an inheritance. Hit the get form button on this page. Save or instantly send your ready documents. Make some changes to your document, like adding checkmark, erasing, and other tools in the top toolbar. Web the answer is yes.

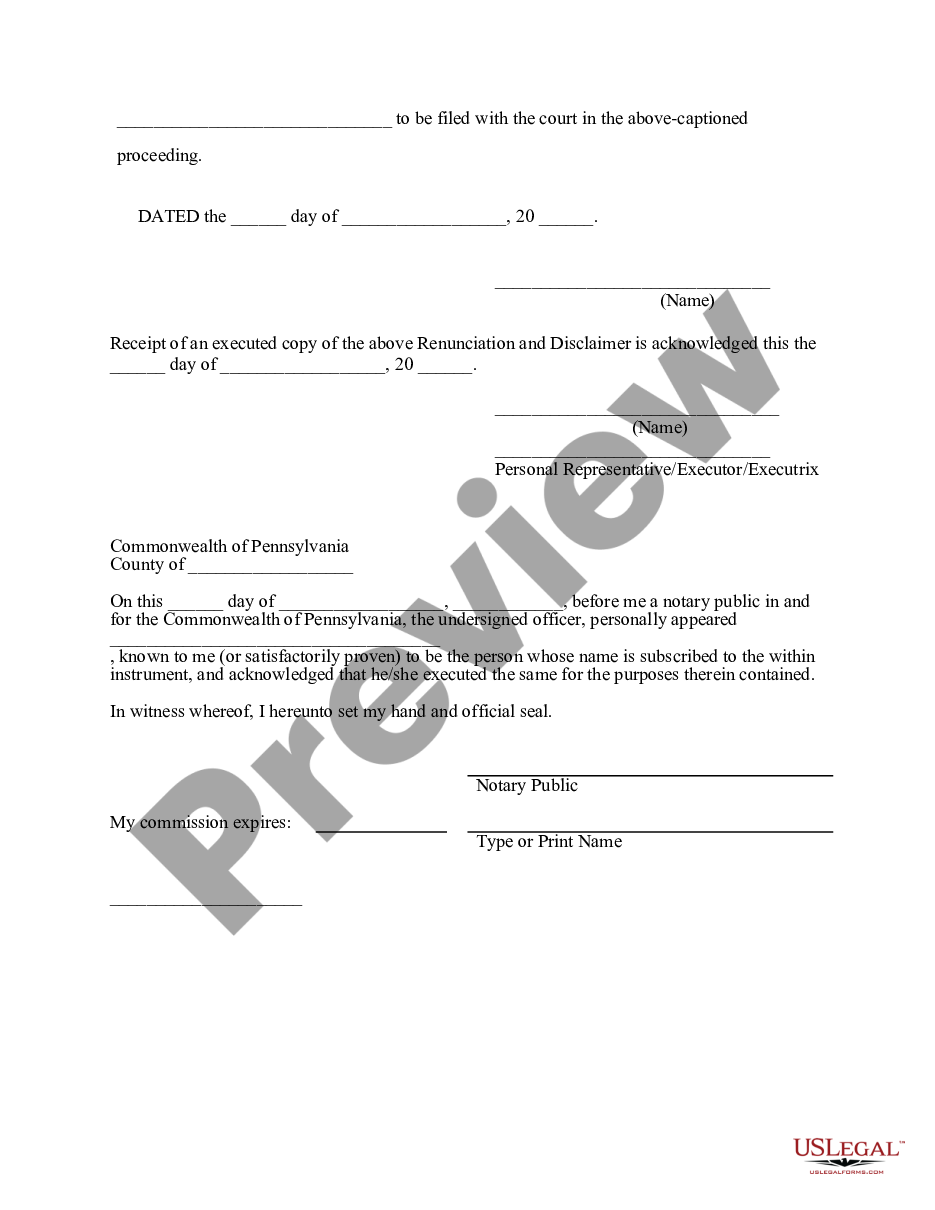

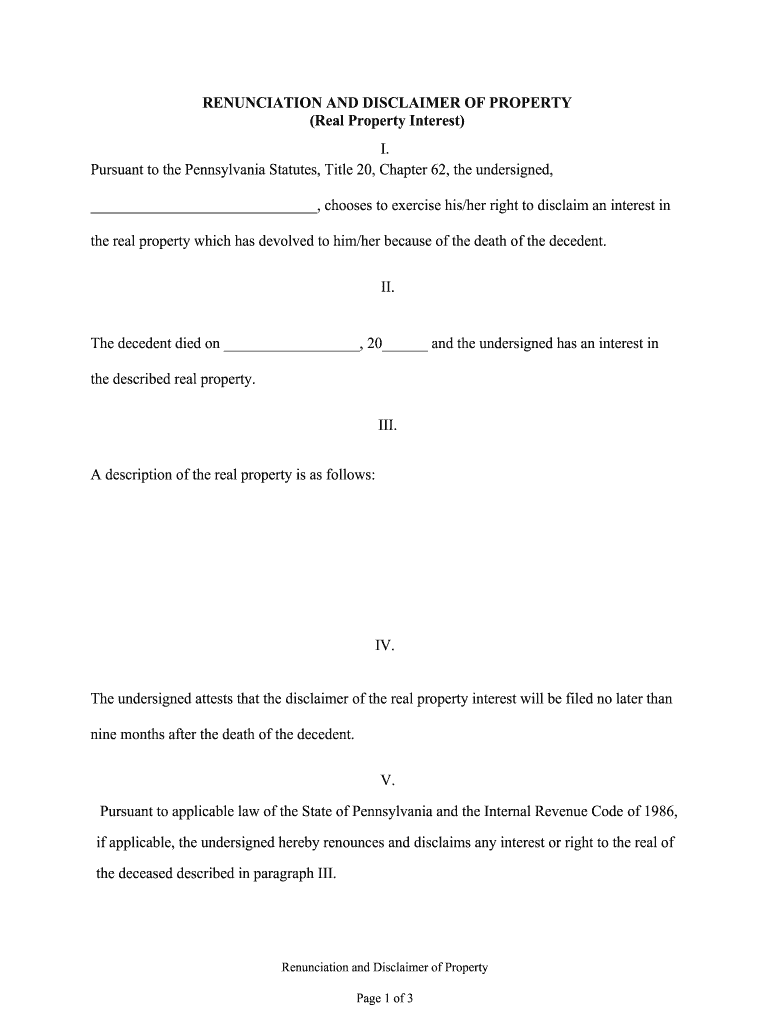

Pennsylvania Renunciation And Disclaimer of Property Received by

Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. This form is available in both word and rich text formats. A disclaimer of right to inherit states that one who should rightly be able to inherit from the deceased, chooses not to partake in his/her inheritance. Web description sample letter to disclaim inherited.

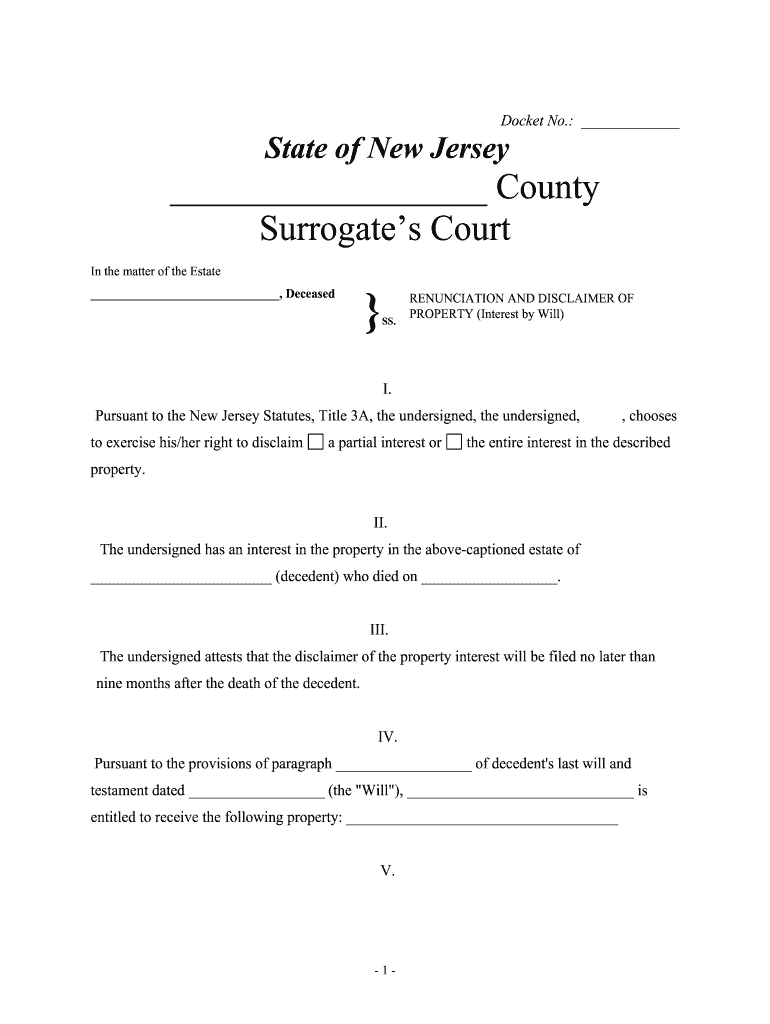

New Jersey Disclaimer of Interest FormsDeeds Com Fill Out and Sign

Web you make your disclaimer in writing. Easily fill out pdf blank, edit, and sign them. You will go to our pdf editor. Web complete sample letter of disclaimer of inheritance online with us legal forms. You disclaim the assets within nine months of the death of the person you inherited them from.

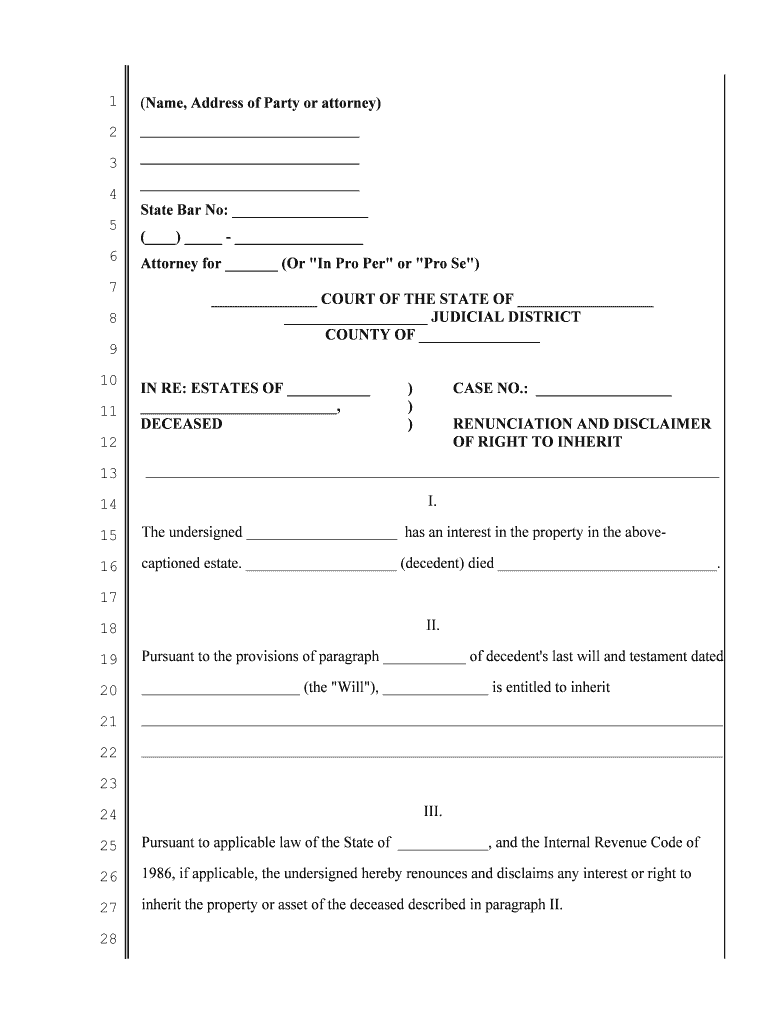

Inheritance Disclaimer Forms Printable Fill Out and Sign Printable

Web complete sample letter of disclaimer of inheritance online with us legal forms. You disclaim the assets within nine months of the death of the person you inherited them from. This will enable you to complete this form. If you are considering disclaiming an inheritance, you need to understand the effect of your refusal—known as the disclaimer—and. Web a disclaimer.

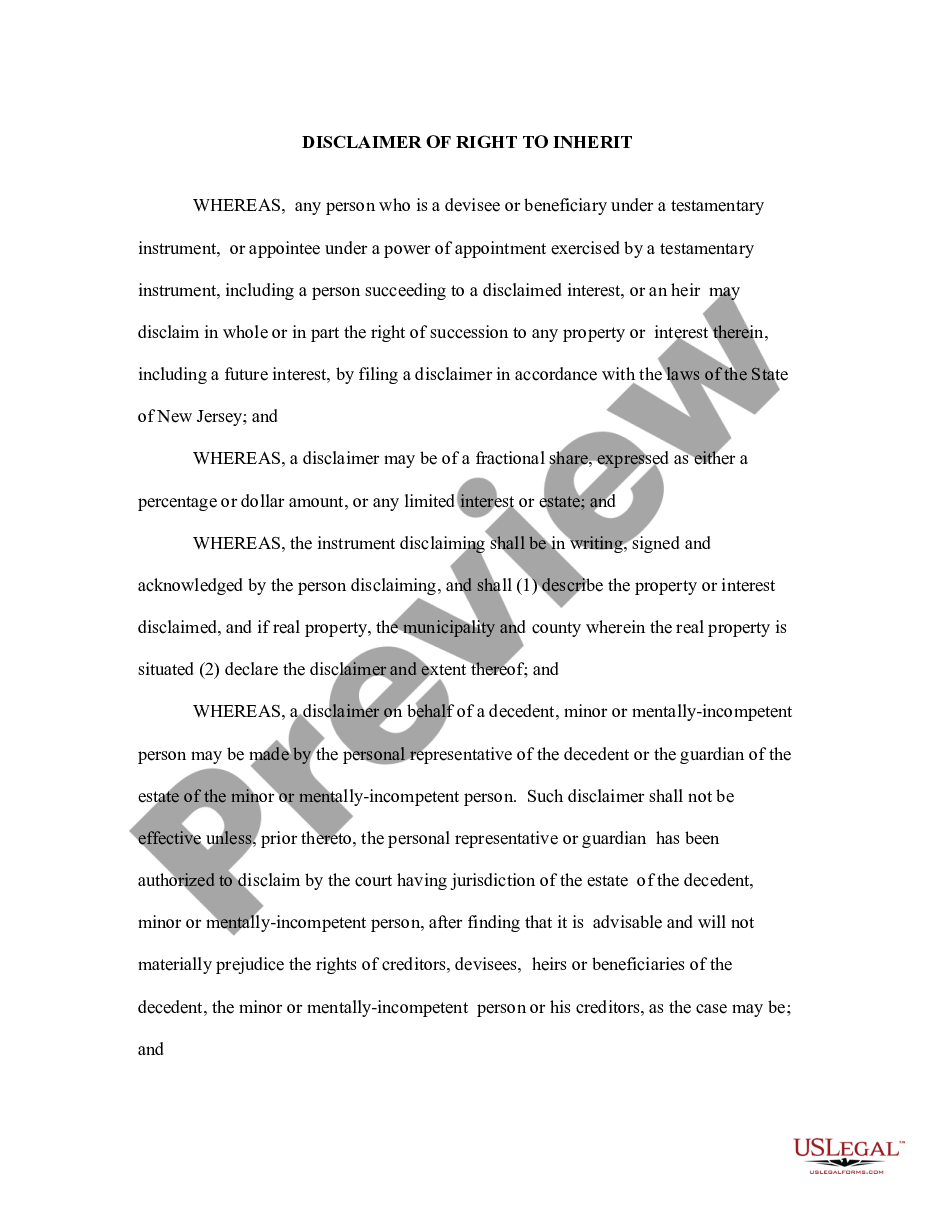

Disclaimer of Right to Inherit or Inheritance New Jersey Disclaim

Web follow these steps to get your disclaimer inheritance edited for the perfect workflow: Web irs requirements for refusing an inheritance. Web generally, an inheritance renunciation or disclaimer form must be in writing and must contain the name of the decedent, a description of the inheritance to be disclaimed, a statement of intent to disclaim the inheritance and a description.

Sample Letter of Disclaimer of Inheritance Form Fill Out and Sign

Web irs requirements for refusing an inheritance. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can’t be changed. If you are considering disclaiming an inheritance, you need to understand the effect of your refusal—known as the disclaimer—and. Under internal revenue service (irs) rules, to refuse an.

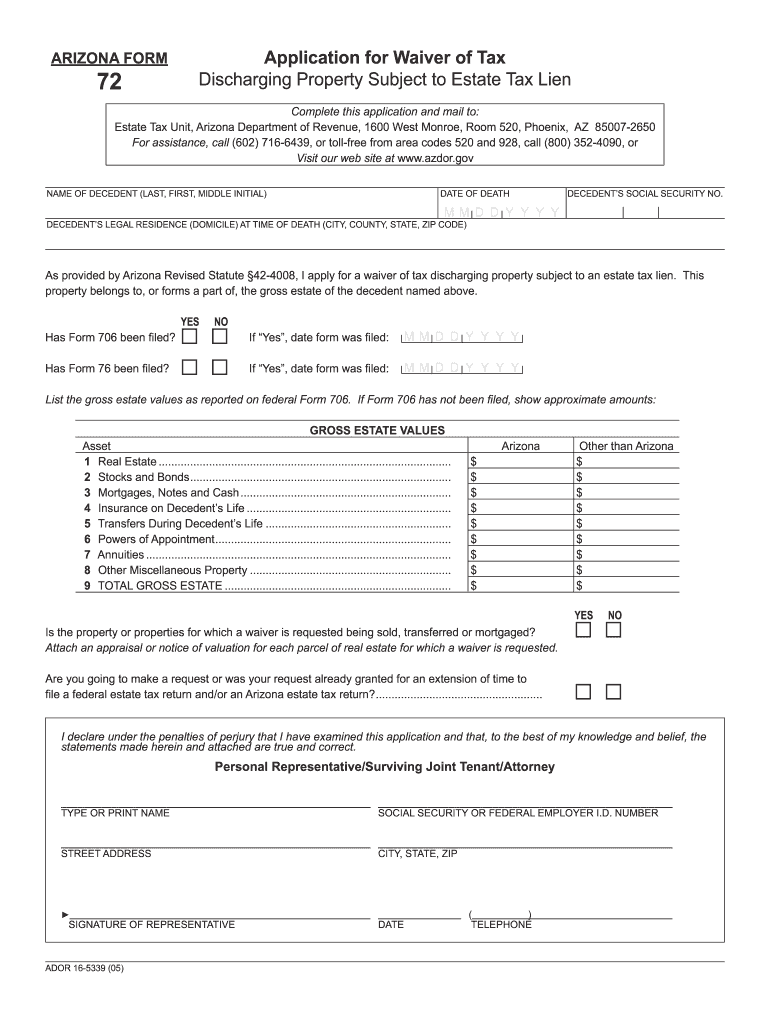

Arizona Inheritance Tax Waiver Form Fill Out and Sign Printable PDF

The beneficiary has gained an interest in the described property of the decedent. The technical term is disclaiming it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusal—known as the disclaimer—and. Web complete sample letter of disclaimer of inheritance online with us legal forms. Click the orange button directly below to start our.

Renunciation Of Inheritance Form Fill Online, Printable, Fillable

Save or instantly send your ready documents. Web a disclaimer inheritance form is a document that can help avoid potential problems and legal hassles associated with the death of an individual. Web generally, an inheritance renunciation or disclaimer form must be in writing and must contain the name of the decedent, a description of the inheritance to be disclaimed, a.

Sample Letter of Disclaimer of Inheritance Form Fill Out and Sign

Web complete sample letter of disclaimer of inheritance online with us legal forms. This form is a renunciation and disclaimer of property acquired by the beneficiary through the last will and testament of the decedent. Save or instantly send your ready documents. Under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly.

Deliver The Disclaimer Within Nine Months Of The Transfer (E.g., The Death Of The Creator Of The Interest) To The Transferor Or His.

A disclaimer of right to inherit states that one who should rightly be able to inherit from the deceased, chooses not to partake in his/her inheritance. Web the answer is yes. This form is a renunciation and disclaimer of property acquired by the beneficiary through the last will and testament of the decedent. Web complete sample letter of disclaimer of inheritance online with us legal forms.

The Technical Term Is Disclaiming It.

If you are considering disclaiming an inheritance, you need to understand the effect of your refusal—known as the disclaimer—and. Under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and unqualified intent to refuse the bequest. Easily fill out pdf blank, edit, and sign them. Hit the get form button on this page.

Click The Orange Button Directly Below To Start Our Pdf Editor.

You will go to our pdf editor. This form should be signed in front of witnesses. Save or instantly send your ready documents. This form is available in both word and rich text formats.

Make Some Changes To Your Document, Like Adding Checkmark, Erasing, And Other Tools In The Top Toolbar.

You disclaim the assets within nine months of the death of the person you inherited them from. This will enable you to complete this form. Web description sample letter to disclaim inherited ira. Web irs requirements for refusing an inheritance.