Depreciation And Balance Sheet

Depreciation And Balance Sheet - Web depreciation is typically tracked one of two places: For income statements, depreciation is listed as an expense. An asset's original value is adjusted during each fiscal year to. Depreciation represents how much of the asset's value has been used up in. (an asset is something that has continuing value, like a computer, a car, or a piece of machinery.) it represents the decrease in. Web depreciation is a way to account for changes in the value of an asset. Web depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. The cost for each year you own the asset becomes a business expense for that. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet.

Depreciation represents how much of the asset's value has been used up in. The cost for each year you own the asset becomes a business expense for that. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet. On an income statement or balance sheet. Web depreciation is typically tracked one of two places: For income statements, depreciation is listed as an expense. It accounts for depreciation charged to expense for the. An asset's original value is adjusted during each fiscal year to. Web depreciation is a way to account for changes in the value of an asset.

Depreciation represents how much of the asset's value has been used up in. An asset's original value is adjusted during each fiscal year to. It accounts for depreciation charged to expense for the. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The cost for each year you own the asset becomes a business expense for that. Web depreciation is typically tracked one of two places: Web depreciation is a way to account for changes in the value of an asset. Web depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. For income statements, depreciation is listed as an expense. (an asset is something that has continuing value, like a computer, a car, or a piece of machinery.) it represents the decrease in.

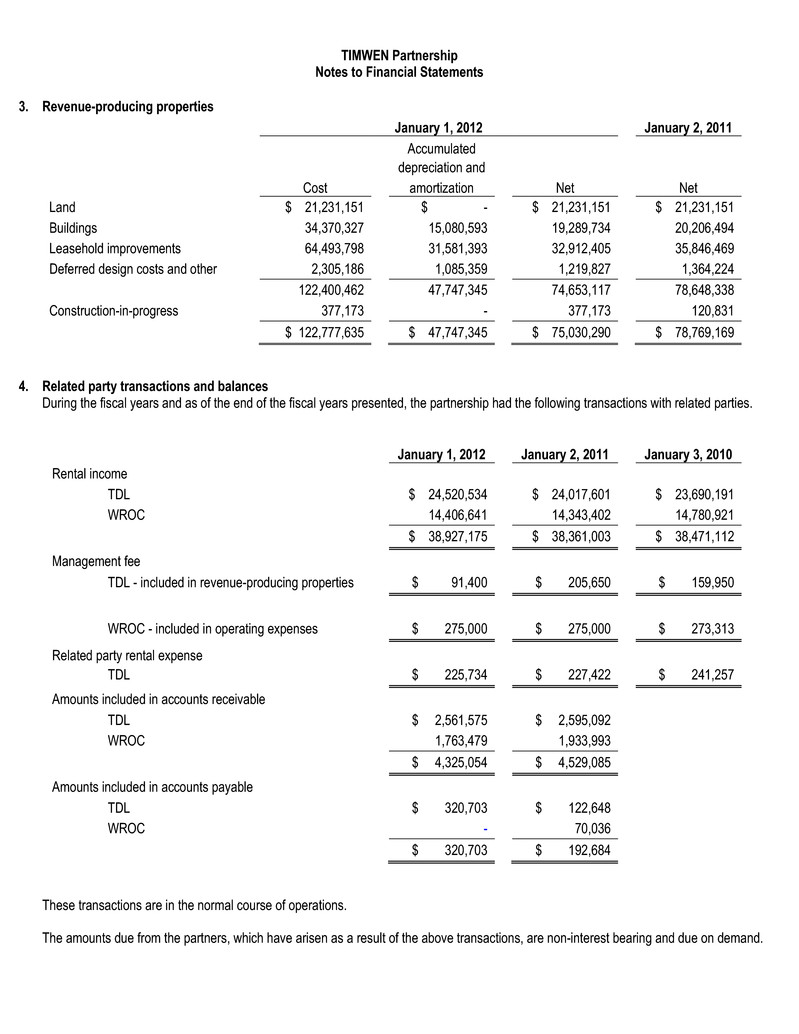

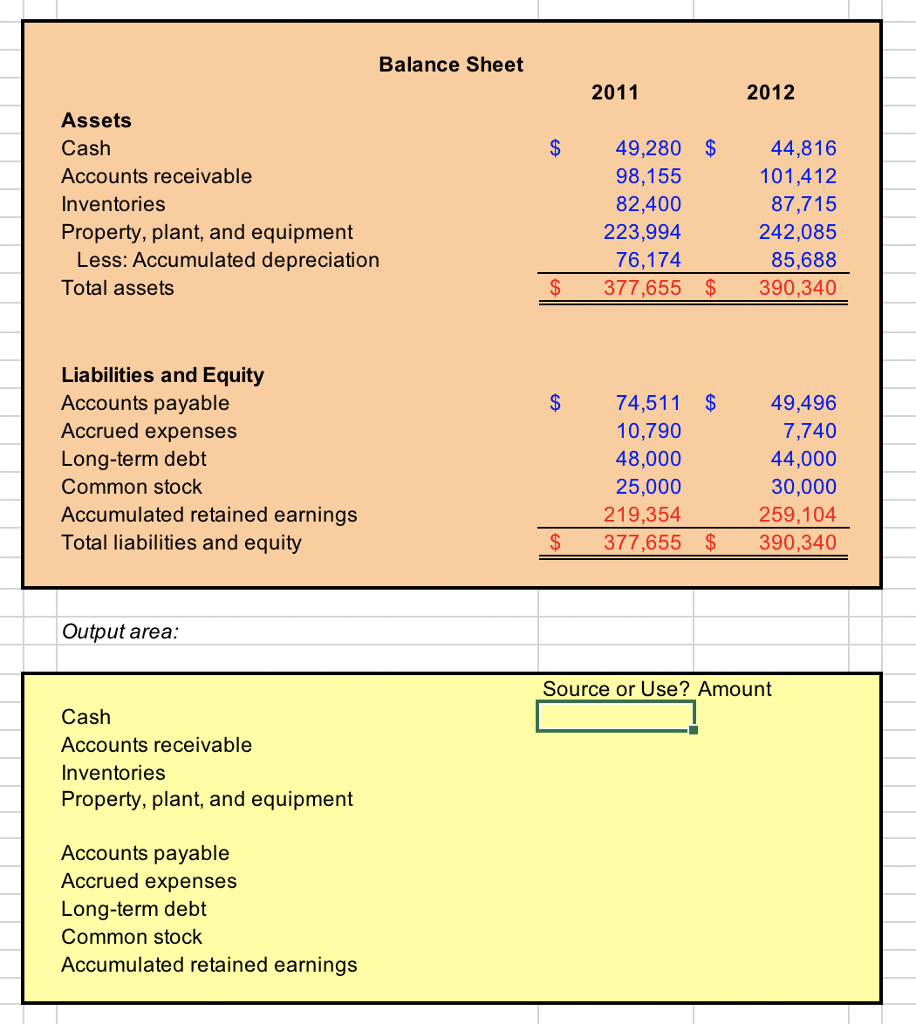

You may have to read this Accumulated Depreciation Balance Sheet

Depreciation represents how much of the asset's value has been used up in. On an income statement or balance sheet. (an asset is something that has continuing value, like a computer, a car, or a piece of machinery.) it represents the decrease in. An asset's original value is adjusted during each fiscal year to. For income statements, depreciation is listed.

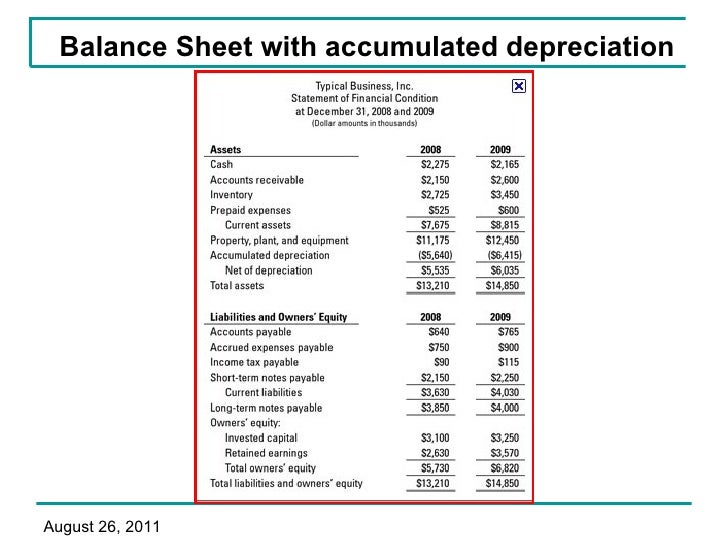

balance sheet Expense Depreciation

It accounts for depreciation charged to expense for the. On an income statement or balance sheet. Depreciation represents how much of the asset's value has been used up in. An asset's original value is adjusted during each fiscal year to. Web depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful.

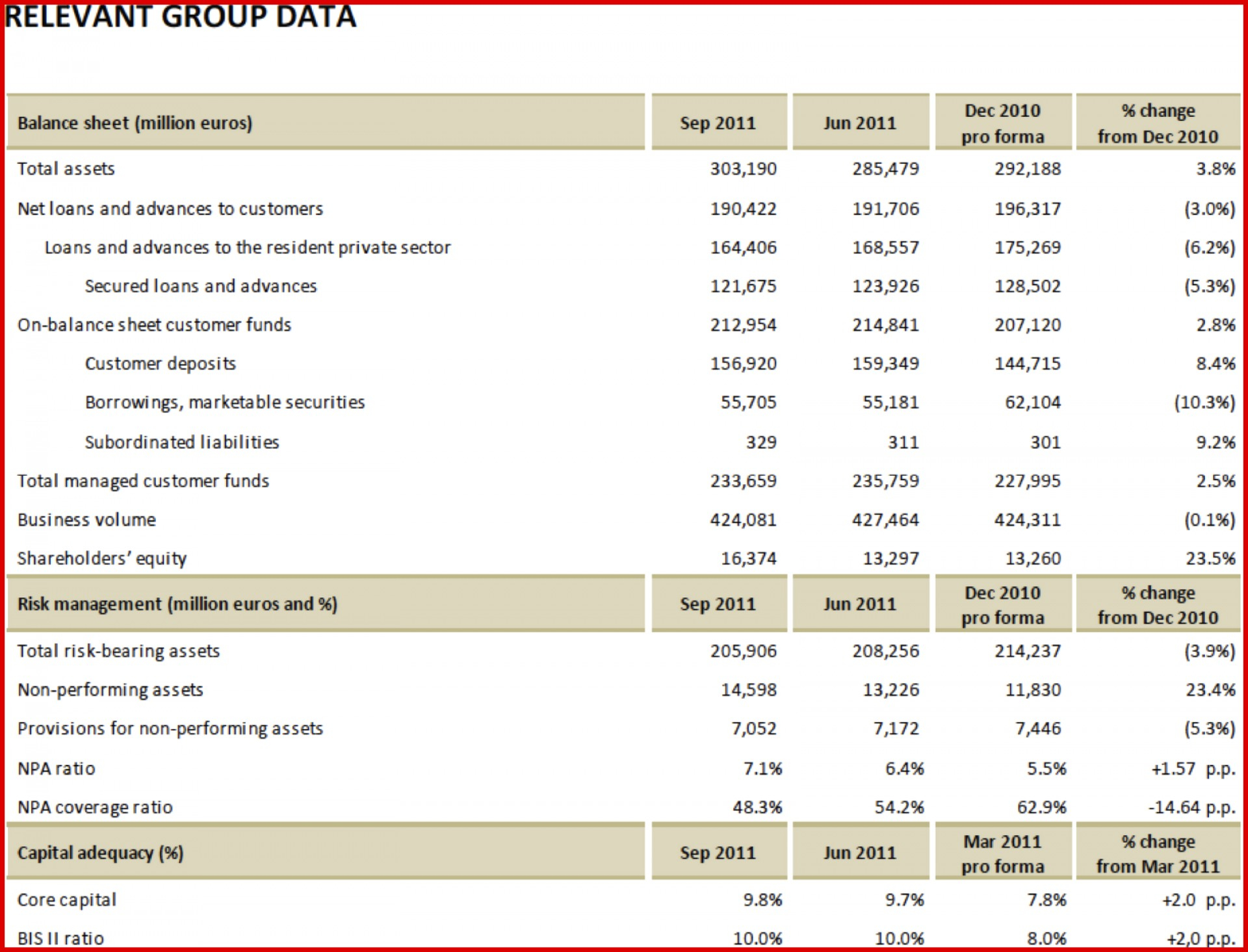

Depreciation

For income statements, depreciation is listed as an expense. Web accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet. Depreciation represents how much of the asset's value has been used up in. Web depreciation is an accounting practice used to spread the cost of a tangible or physical asset over.

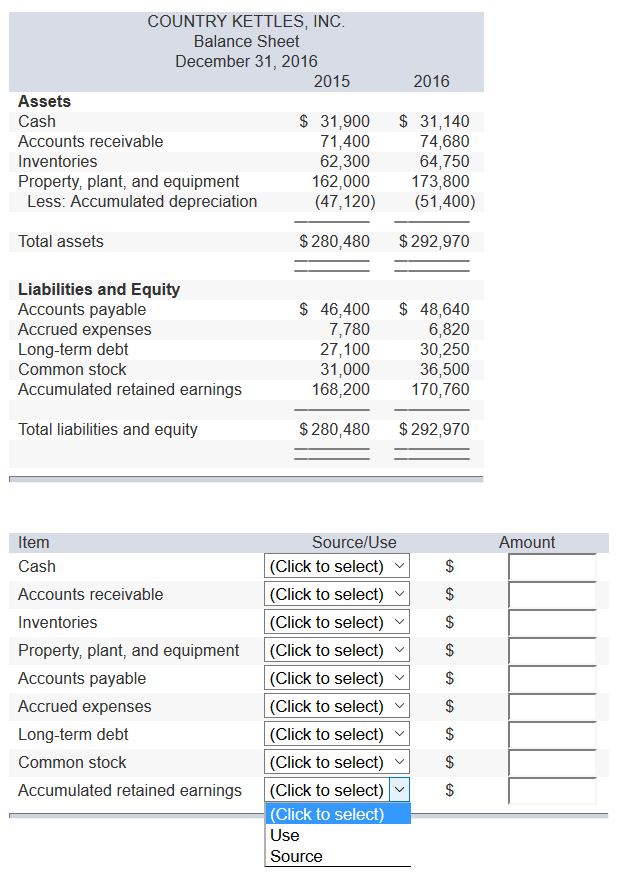

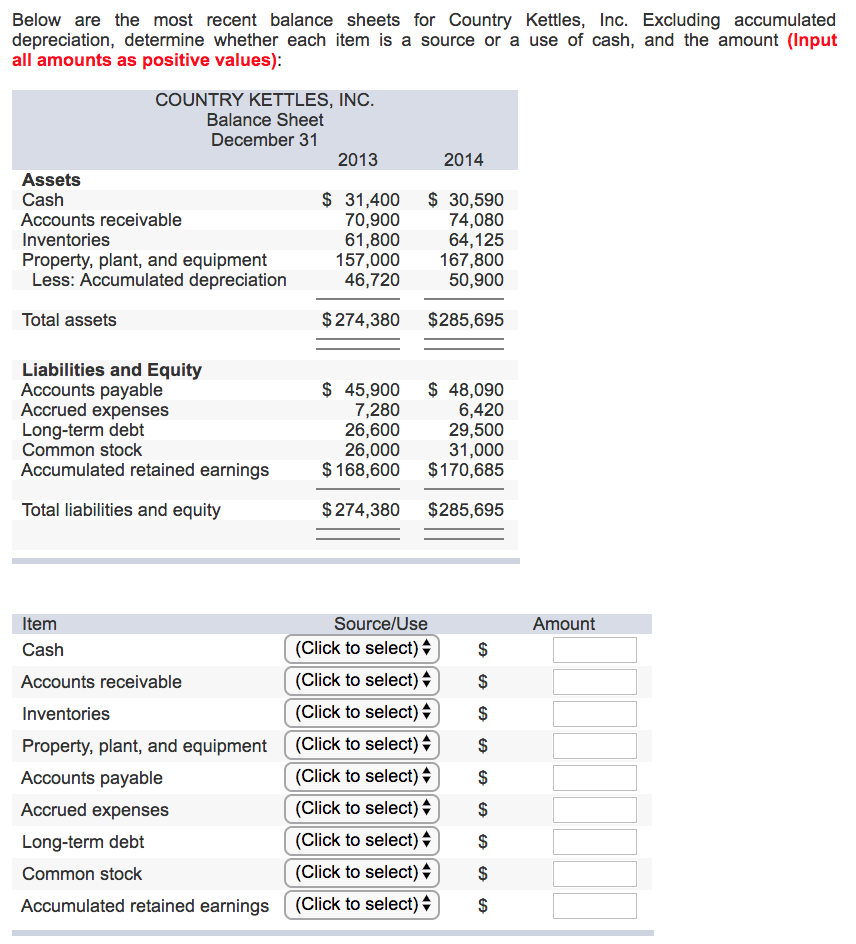

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

It accounts for depreciation charged to expense for the. Web accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet. Web depreciation is typically tracked one of two places: Depreciation represents how much of the asset's value has been used up in. (an asset is something that has continuing value, like.

What is Accumulated Depreciation? Formula + Calculator

On an income statement or balance sheet. An asset's original value is adjusted during each fiscal year to. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. For income statements, depreciation is listed as an expense. Web depreciation is an accounting practice used to spread the cost.

Accumulated Depreciation Balance Sheet / Why do we show an asset at

It accounts for depreciation charged to expense for the. Web depreciation is a way to account for changes in the value of an asset. For income statements, depreciation is listed as an expense. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. On an income statement or.

What Is Accumulated Depreciation / Why Is Accumulated Depreciation A

Web depreciation is typically tracked one of two places: Web accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet. It accounts for depreciation charged to expense for the. Depreciation represents how much of the asset's value has been used up in. Web depreciation is an accounting practice used to spread.

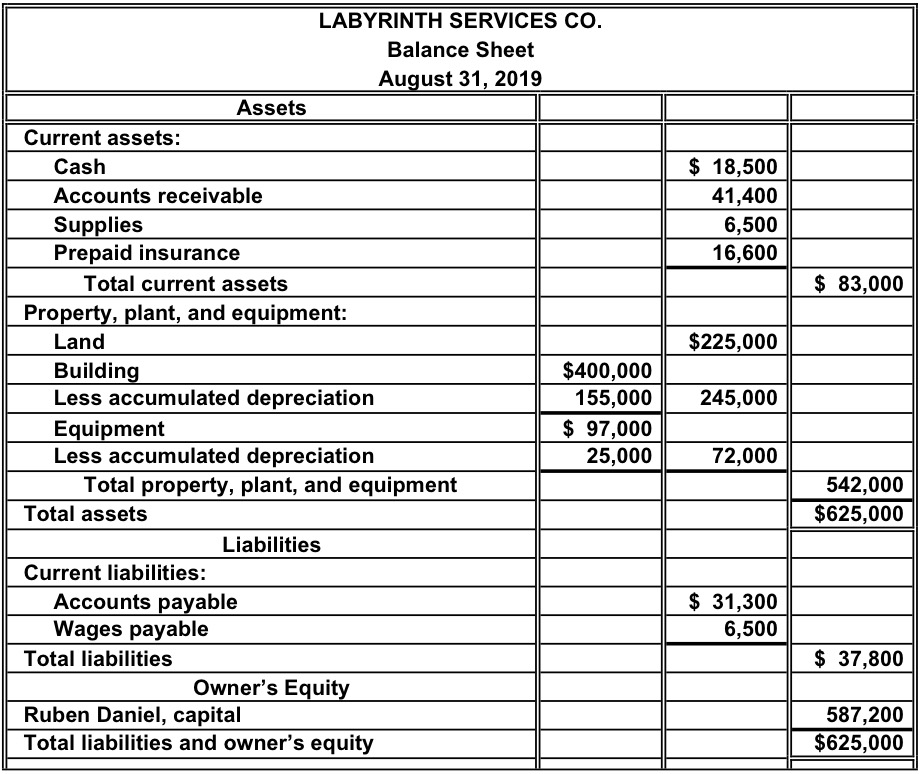

Accounting Questions and Answers EX 413 Balance sheet

Web accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. An asset's original value is adjusted during each fiscal year to. Web depreciation is a way to account.

Accumulated Depreciation Balance Sheet / Why do we show an asset at

(an asset is something that has continuing value, like a computer, a car, or a piece of machinery.) it represents the decrease in. The cost for each year you own the asset becomes a business expense for that. For income statements, depreciation is listed as an expense. Depreciation represents how much of the asset's value has been used up in..

Balance Sheet Depreciation Understanding Depreciation

(an asset is something that has continuing value, like a computer, a car, or a piece of machinery.) it represents the decrease in. It accounts for depreciation charged to expense for the. Web depreciation is a way to account for changes in the value of an asset. For income statements, depreciation is listed as an expense. Web accumulated depreciation is.

(An Asset Is Something That Has Continuing Value, Like A Computer, A Car, Or A Piece Of Machinery.) It Represents The Decrease In.

On an income statement or balance sheet. Web depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. An asset's original value is adjusted during each fiscal year to. Web accumulated depreciation is a running total of depreciation expense for an asset that is recorded on the balance sheet.

Web Depreciation Is Typically Tracked One Of Two Places:

Depreciation represents how much of the asset's value has been used up in. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The cost for each year you own the asset becomes a business expense for that. Web depreciation is a way to account for changes in the value of an asset.

For Income Statements, Depreciation Is Listed As An Expense.

It accounts for depreciation charged to expense for the.