Deduction Under Chapter Vi A

Deduction Under Chapter Vi A - Web deduction limit is rs 5,000 per month or 25 per cent of total income in a year, whichever is less. The excellent download file is in the format of xlsx. Web what is income tax deduction under chapter vi a of income tax act? However, chapter vi a deductions. Web (2) on furnishing of the declaration in form no. A) loan should be sanctioned by the financial institution during the period beginning on. Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Web every individual or huf whose total income before allowing deductions under chapter vi‐ a of the income‐tax act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his. Continue on app (hindi) deduction and exemption under income tax act 1961. Students taking ca final exams or students preparing for dt will find the file.

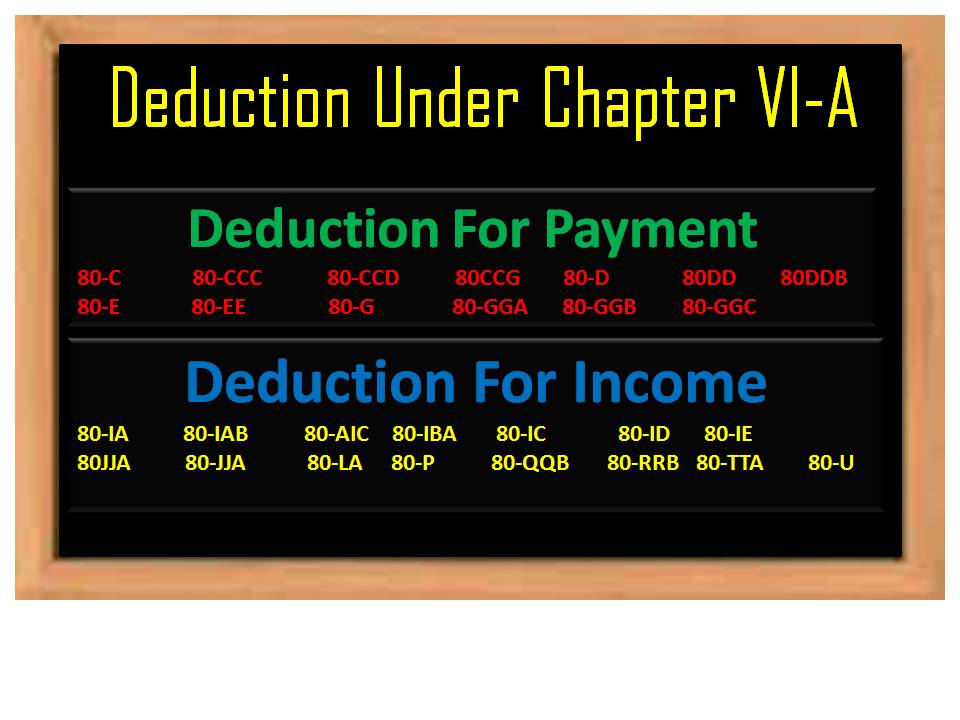

Web deduction limit is rs 5,000 per month or 25 per cent of total income in a year, whichever is less. Continue on app (hindi) deduction and exemption under income tax act 1961. Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. 1,50,000 under section 80eea subject to following conditions: For instance, deductions can be claimed under sections 80c, 80ccc, 80ccd, 80cce, 80d to 80u of the income tax act. Web deduction under chapter vi of the income tax act. Well, therefore, if you earn more than inr 2,50,000 per financial year and are a resident of india, then you are eligible to pay tax. 1 overview (in hindi) 6:01mins. Students taking ca final exams or students preparing for dt will find the file. Exemption is an advantage provided to the.

Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. Exemption is an advantage provided to the. Web every individual or huf whose total income before allowing deductions under chapter vi‐ a of the income‐tax act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his. 1,50,000 under section 80eea subject to following conditions: 1 overview (in hindi) 6:01mins. Do you have to pay income tax? Web what is income tax deduction under chapter vi a of income tax act? Well, therefore, if you earn more than inr 2,50,000 per financial year and are a resident of india, then you are eligible to pay tax. Web an individual can claim deduction of up to rs. 4042, which directed amendment of table of sections for part vi of subchapter a of this chapter by striking items 179a and 198a, was executed by striking items 179a “deduction.

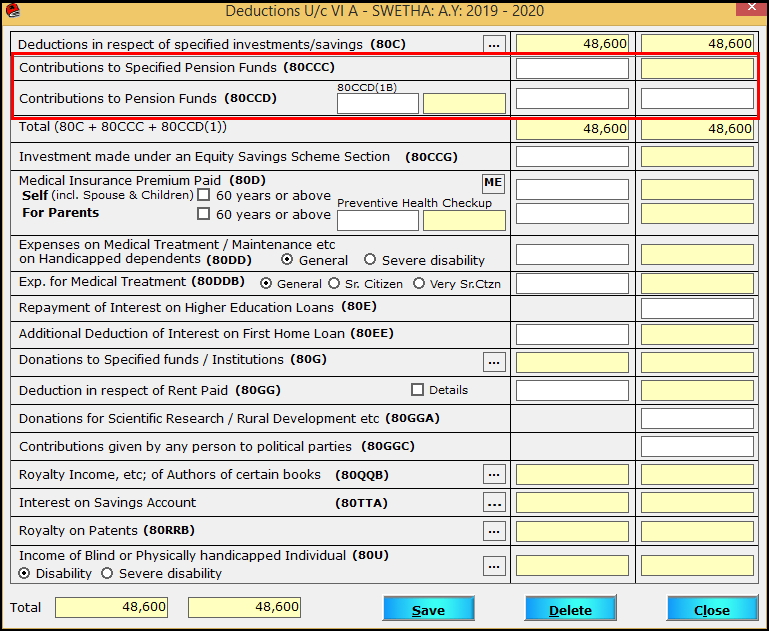

Procedure to enter chapter VIA Deduction in Saral TDS

Continue on app (hindi) deduction and exemption under income tax act 1961. Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. However, chapter vi a deductions. Web an individual can claim deduction of up to rs.

Summary of tax deduction under Chapter VIACA Rajput

Web summary of deductions under chapter vi a is available for download at www.cakart.in. Web the deductions under chapter via are designed to benefit the taxpayer so that the tax burden is reduced. Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. Web an individual can.

TAX BY MANISH DEDUCTIONS UNDER CHAPTER VIA OF THE ACT FOR THE ASSTT

There are a lot of deductions available under various sections to help you bring down the taxable income. Continue on app (hindi) deduction and exemption under income tax act 1961. Web deduction limit is rs 5,000 per month or 25 per cent of total income in a year, whichever is less. The excellent download file is in the format of.

Deductions under Chapter VIA of Tax “Act” 1961 ICL CLASSES

Web deductions under chapter vi a faqs what is chapter vi (a) & the deductions it offers chapter vi a of the income tax act, 1961 contains specifics regarding some of the most popular deductions that one can claim to reduce the annual tax outgo. A) loan should be sanctioned by the financial institution during the period beginning on. Web.

Deduction under Chapter VIA Part 4 .For July 2020 and Nov 2020. CA CS

4042, which directed amendment of table of sections for part vi of subchapter a of this chapter by striking items 179a and 198a, was executed by striking items 179a “deduction. Web deduction limit is rs 5,000 per month or 25 per cent of total income in a year, whichever is less. Web an individual can claim deduction of up to.

Chapter VI Section 80 ERP Human Capital Management SCN Wiki

Web an individual can claim deduction of up to rs. Web the deductions under chapter via are designed to benefit the taxpayer so that the tax burden is reduced. However, chapter vi a deductions. Web what is income tax deduction under chapter vi a of income tax act? The excellent download file is in the format of xlsx.

Deduction under Chapter VIA of the Tax Act With Automated

Web every individual or huf whose total income before allowing deductions under chapter vi‐ a of the income‐tax act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his. There are a lot of deductions available under various sections to help you bring down the taxable income. Well, therefore, if you earn more than.

Section 80C, 80CC Deductions Tax Deductions under Chapter VI

Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. Web an individual can claim deduction of up to rs. There are a lot of deductions available under various sections to help you bring down the taxable income. Continue on app (hindi) deduction and exemption under income tax act 1961. Full deductions.

Deduction Under Chapter VIA Tax Planning with Tax Savings

Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. Full deductions in respect of certain donations for scientific research or rural. For example, you can claim deductions under. Web a, title ii, § 221(a)(34)(a), (35), dec. There are a lot of deductions available under various sections.

Tax Savings & Deductions under Chapter VI A Learn by Quicko

Web what is income tax deduction under chapter vi a of income tax act? Web deduction limit is rs 5,000 per month or 25 per cent of total income in a year, whichever is less. Web deductions under chapter vi a faqs what is chapter vi (a) & the deductions it offers chapter vi a of the income tax act,.

Web Deduction Under Chapter Vi Of The Income Tax Act.

Web deductions under chapter vi a faqs what is chapter vi (a) & the deductions it offers chapter vi a of the income tax act, 1961 contains specifics regarding some of the most popular deductions that one can claim to reduce the annual tax outgo. Web summary of deductions under chapter vi a is available for download at www.cakart.in. Web you can seek a deduction under chapter vi a, which will help you reduce your taxable income. The excellent download file is in the format of xlsx.

Web Every Individual Or Huf Whose Total Income Before Allowing Deductions Under Chapter Vi‐ A Of The Income‐Tax Act, Exceeds The Maximum Amount Which Is Not Chargeable To Income Tax Is Obligated To Furnish His.

Students taking ca final exams or students preparing for dt will find the file. There are a lot of deductions available under various sections to help you bring down the taxable income. 1 overview (in hindi) 6:01mins. 1,50,000 under section 80eea subject to following conditions:

For Instance, Deductions Can Be Claimed Under Sections 80C, 80Ccc, 80Ccd, 80Cce, 80D To 80U Of The Income Tax Act.

Web what is income tax deduction under chapter vi a of income tax act? Continue on app (hindi) deduction and exemption under income tax act 1961. Web a, title ii, § 221(a)(34)(a), (35), dec. 4042, which directed amendment of table of sections for part vi of subchapter a of this chapter by striking items 179a and 198a, was executed by striking items 179a “deduction.

Do You Have To Pay Income Tax?

A) loan should be sanctioned by the financial institution during the period beginning on. Web an individual can claim deduction of up to rs. Section 80ttb , 24 b, 80 qqb of the act covered in this lesson. Before we start with this chapter, let us first understand a few basic and important differences between an exemption and a deduction.