De Form 1100 Instructions 2021

De Form 1100 Instructions 2021 - Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Alcoholic beverages business licenses business tax credits. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income. Web home business tax forms 2020 listen please select the type of business from the list below. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. 1101 election to be treated for tax purposes as a “subsidiary corporation” of a delaware chartered banking organization or trust. Electronic filing is fast, convenient, accurate and. We last updated the corporate income. Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code.

Web the corporation must file form 1100 if it does not meet all three eligibility requirements. Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. Web home business tax forms 2020 listen please select the type of business from the list below. This is a form for reporting the income of a corporation. We last updated the corporate income. Web more about the delaware form 1100 corporate income tax tax return ty 2022. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Who is required to file a delaware tax return? Failure to make a declaration or file and pay the required tentative tax. 1101 election to be treated for tax purposes as a “subsidiary corporation” of a delaware chartered banking organization or trust.

Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income. Failure to make a declaration or file and pay the required tentative tax. Failure to make a declaration or file and pay the required tentative tax. This is a form for reporting the income of a corporation. Web home business tax forms 2020 listen please select the type of business from the list below. Web calendar year 2021 and fiscal year ending 2022. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Alcoholic beverages business licenses business tax credits. Who is required to file a delaware tax return? Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year.

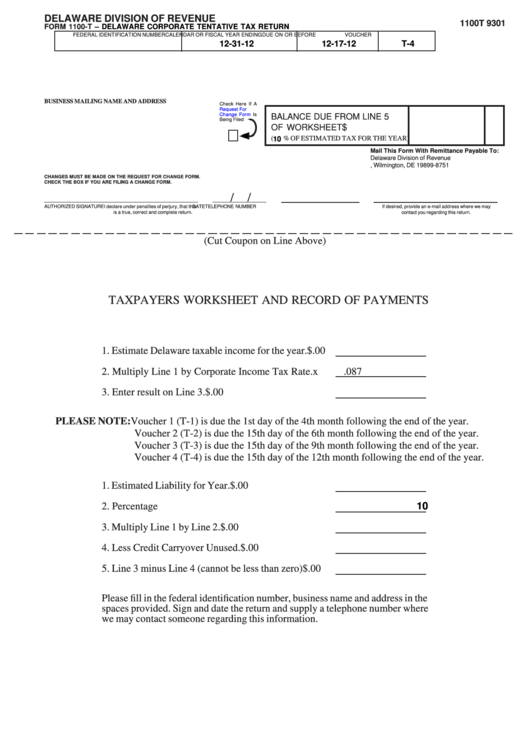

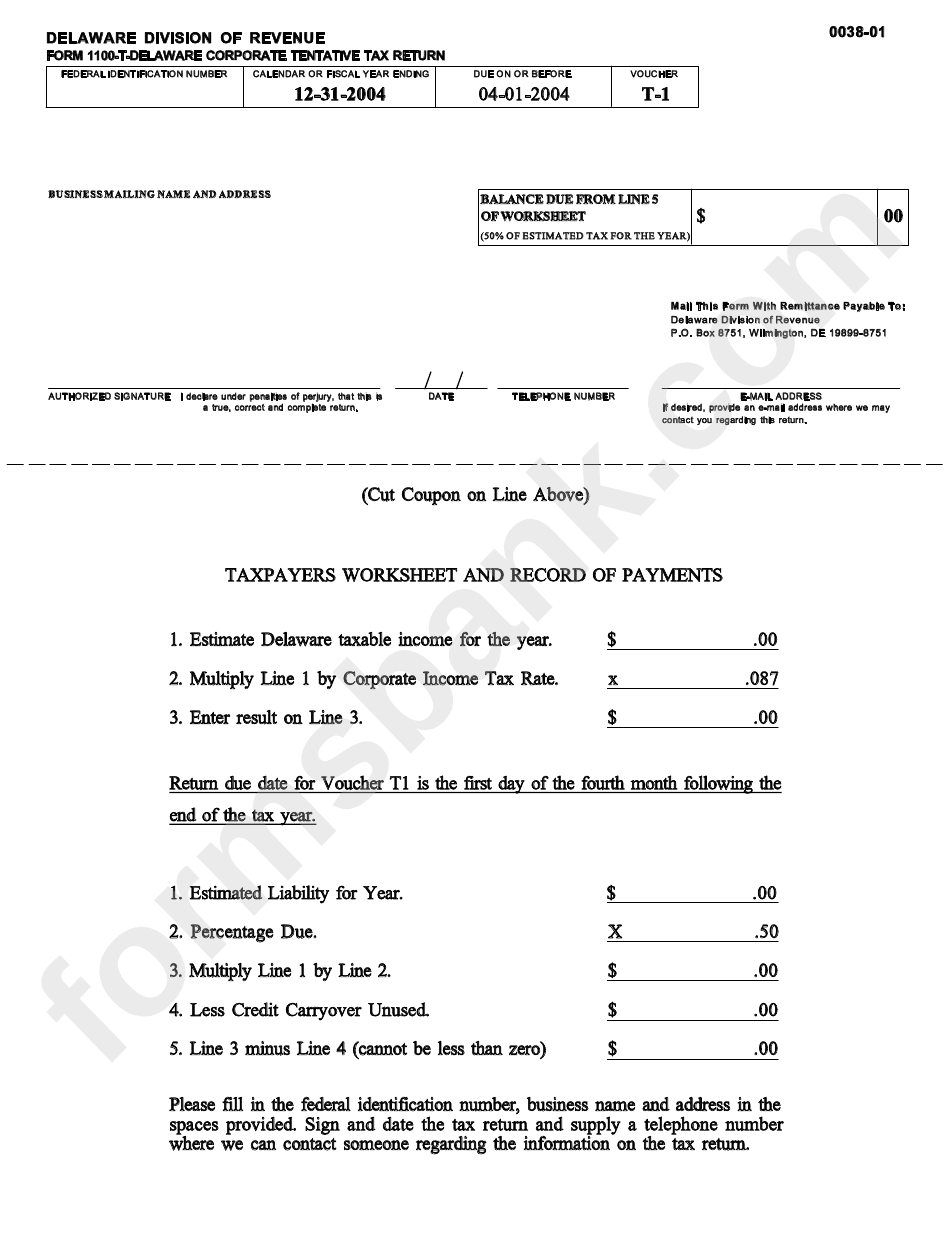

Fillable Form 1100T Delaware Corporate Tentative Tax Return 2012

Electronic filing is fast, convenient, accurate and. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Alcoholic beverages business licenses business tax credits. This is a form for reporting the income of a corporation. Failure to make a declaration or file.

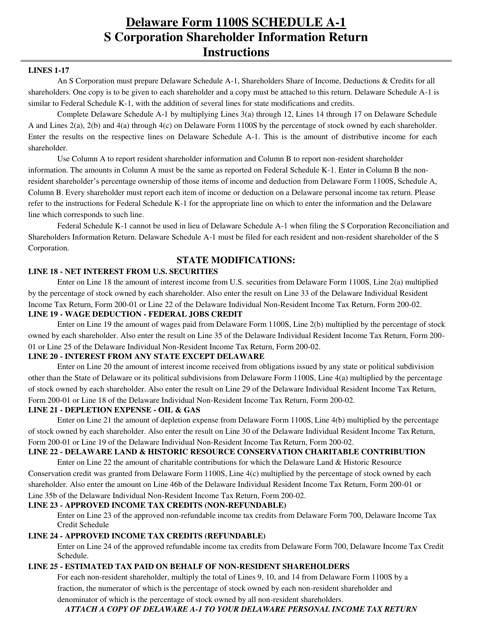

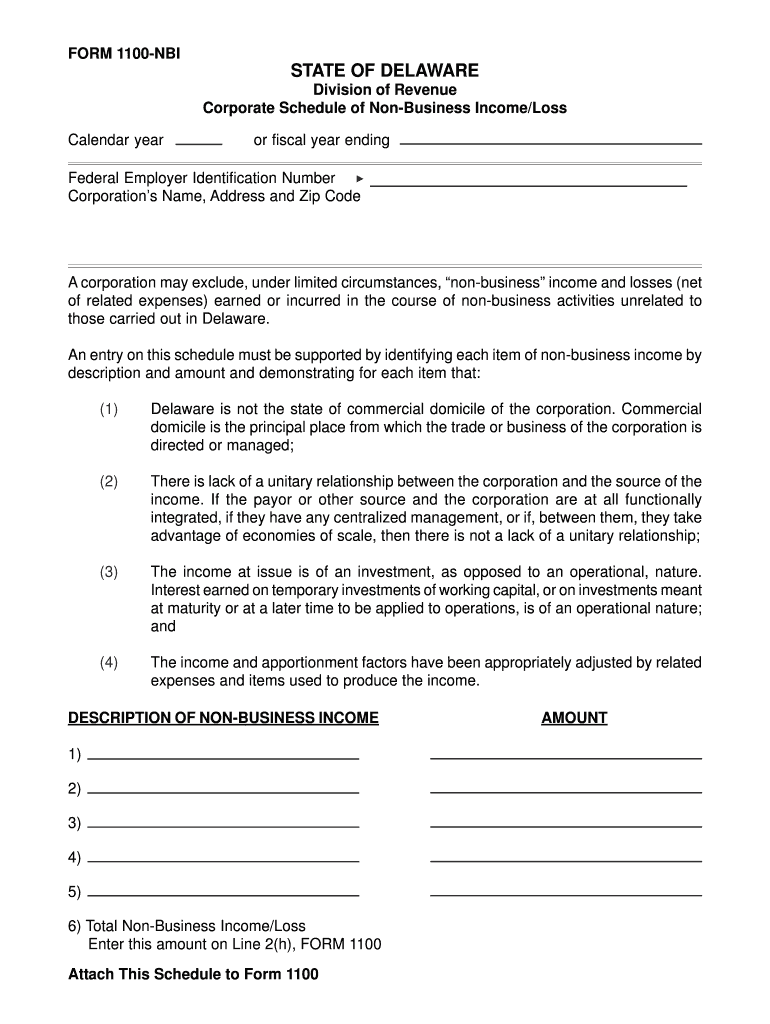

Download Instructions for Form 1100S Schedule A1 S Corporation

Failure to make a declaration or file and pay the required tentative tax. This is a form for reporting the income of a corporation. Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. Electronic filing is fast, convenient, accurate and. Web.

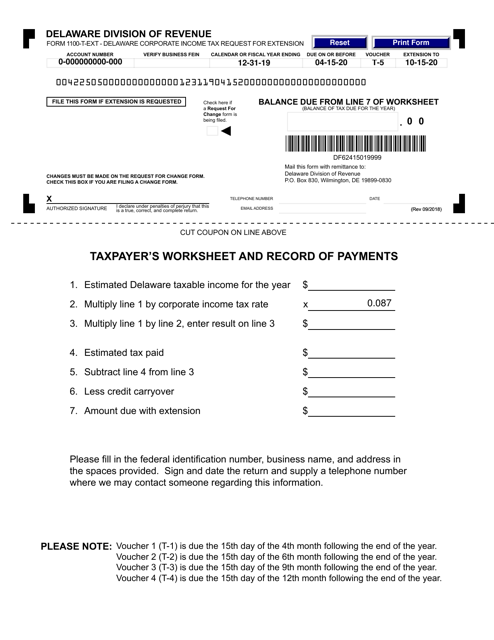

Form 1100TEXT Download Fillable PDF or Fill Online Delaware Corporate

Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income. We last updated the corporate income. This is a form for reporting the income of a corporation. Web more about the delaware form 1100 corporate income tax tax return ty 2022. Failure to.

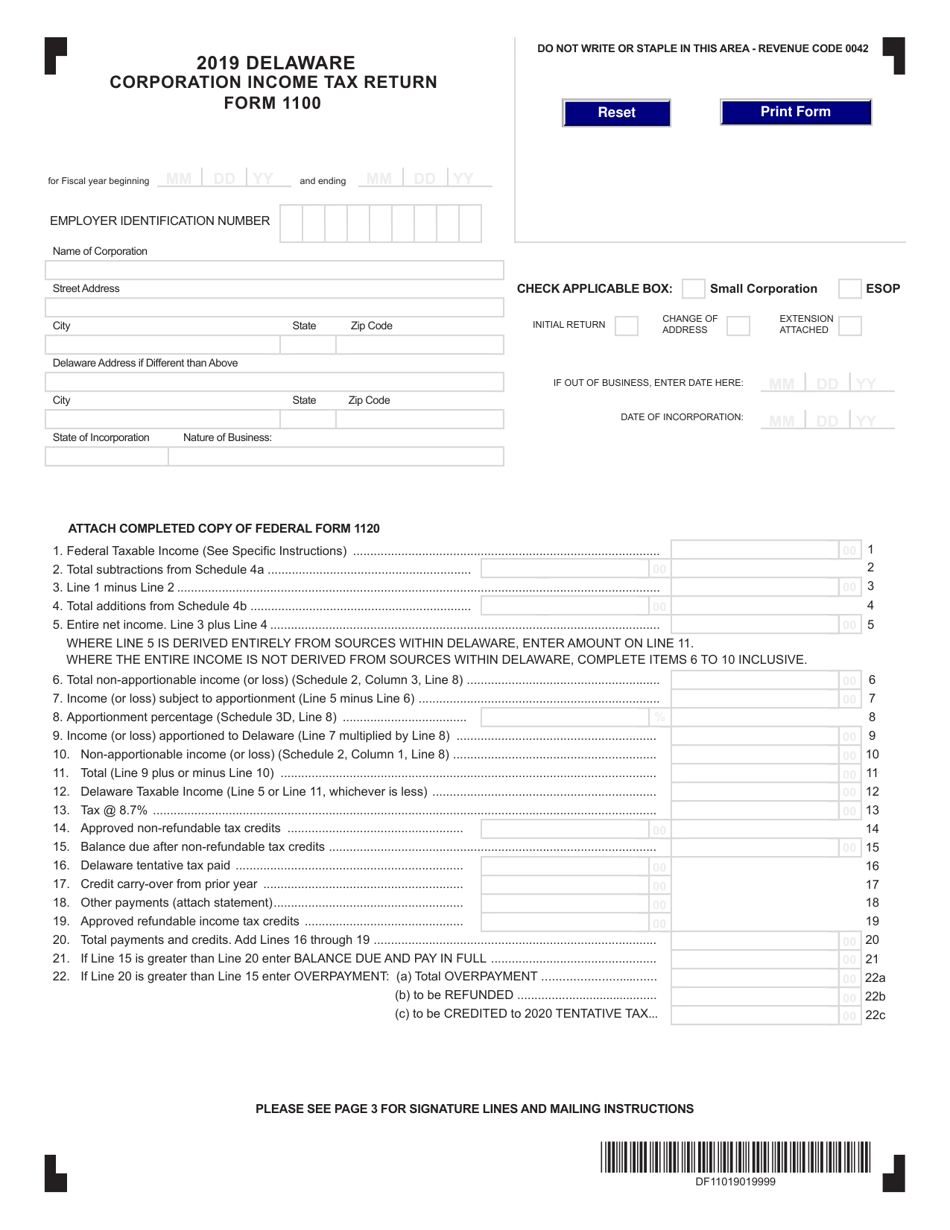

Form 1100 Download Fillable PDF or Fill Online Corporation Tax

This is a form for reporting the income of a corporation. Failure to make a declaration or file and pay the required tentative tax. Web home business tax forms 2020 listen please select the type of business from the list below. Electronic filing is fast, convenient, accurate and. Who is required to file a delaware tax return?

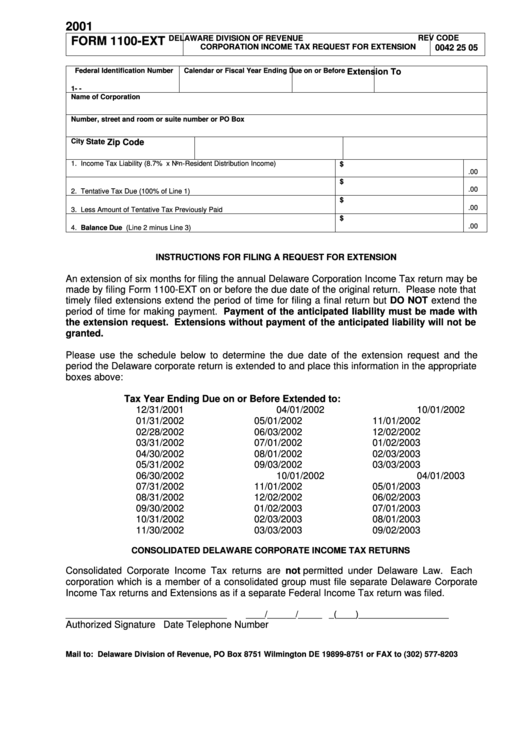

Form 1100Ext Corporation Tax Request For Extension 2001

Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Web calendar year 2021 and fiscal year ending 2022. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s,.

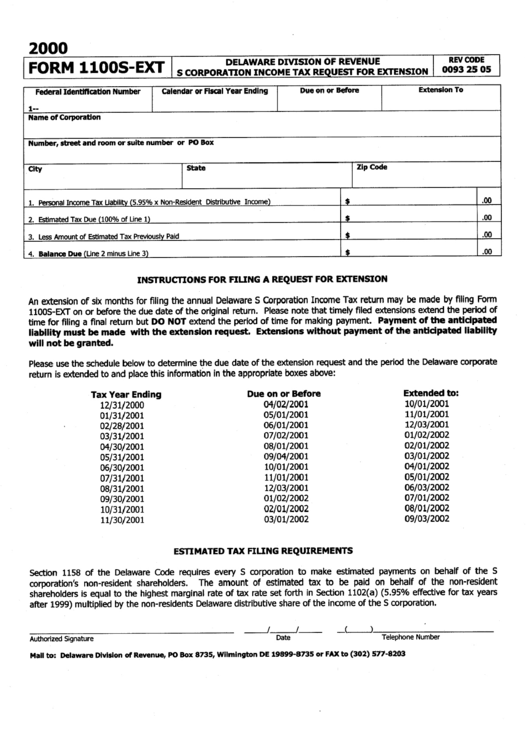

Form 1100sExt S Corporation Tax Request For Extension 2000

Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code. Electronic filing is fast, convenient, accurate and. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. Web.

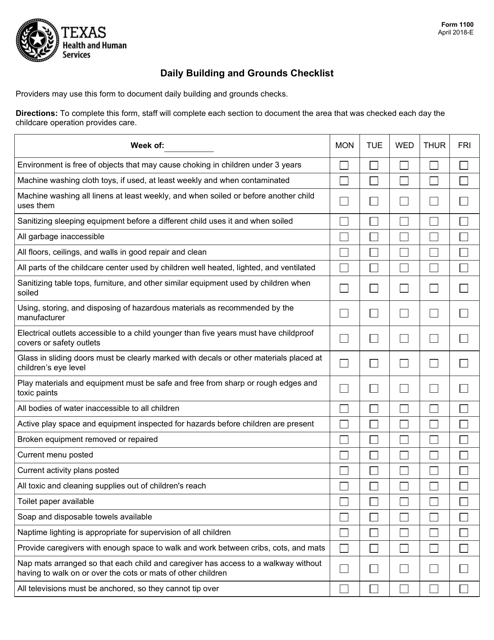

Form 1100 Download Fillable PDF or Fill Online Daily Building and

Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Web the corporation must file form 1100 if it does not meet all three eligibility requirements. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this.

Form 1100S Download Printable PDF 2018, S CORPORATION RECONCILIATION

Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web the corporation must file form 1100 if it does not meet all three eligibility requirements. We last updated the corporate income. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under.

форма 1100 Fill Online, Printable, Fillable, Blank pdfFiller

We last updated the corporate income. Web more about the delaware form 1100 corporate income tax tax return ty 2022. Electronic filing is fast, convenient, accurate and. Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. Who is required to file.

Form 1100T Delaware Corporate Tentative Tax Return 2004 printable

Failure to make a declaration or file and pay the required tentative tax. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Failure to make a declaration or file and pay the required tentative tax. This is a form for reporting.

Alcoholic Beverages Business Licenses Business Tax Credits.

This is a form for reporting the income of a corporation. We last updated the corporate income. Electronic filing is fast, convenient, accurate and. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income.

Web The Corporation Must File Form 1100 If It Does Not Meet All Three Eligibility Requirements.

1101 election to be treated for tax purposes as a “subsidiary corporation” of a delaware chartered banking organization or trust. Web calendar year 2021 and fiscal year ending 2022. Failure to make a declaration or file and pay the required tentative tax. Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year.

Who Is Required To File A Delaware Tax Return?

Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code. Failure to make a declaration or file and pay the required tentative tax. Web more about the delaware form 1100 corporate income tax tax return ty 2022. Web home business tax forms 2020 listen please select the type of business from the list below.

Web Every Domestic Or Foreign Corporation Doing Business In Delaware, Not Specifically Exempt Under Section 1902(B), Title 30, Delaware Code, Is Required To File A Corporate Income Tax.

Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022.