Dc State Tax Form

Dc State Tax Form - The pension payment system does not withhold taxes for any other states. Web registration and exemption tax forms. Web your browser appears to have cookies disabled. Otr frequently asked questions (faqs) excise tax forms. Cookies are required to use this site. Mailing addresses for dc tax returns. Web tax forms the following forms may be used to make changes to your federal and/or state tax withholding (s). Web state tax form, district of columbia. Web the washington dc income tax rate for tax year 2022 is progressive from a low of 4% to a high of 10.75%. Web dc tax withholding form.

Web your browser appears to have cookies disabled. Web individual income tax forms. Sales and use tax forms. • payments can be made by ach debit, credit/debit card, check or money order (us dollars). Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. If the due date for filing a return falls on a saturday, sunday or legal holiday, the. Recorder of deeds tax forms/publications. The pension payment system does not withhold taxes for any other states. Web dc tax withholding form. Enterprise services (commerce employees only) 1401 constitution ave nw washington, dc 20230 archives;

Cookies are required to use this site. Sales and use tax forms. Web your browser appears to have cookies disabled. Mailing addresses for dc tax returns. The pension payment system does not withhold taxes for any other states. On or before april 18, 2022. If the due date for filing a return falls on a saturday, sunday or legal holiday, the. Web individual income tax forms. Web the washington dc income tax rate for tax year 2022 is progressive from a low of 4% to a high of 10.75%. Otr frequently asked questions (faqs) excise tax forms.

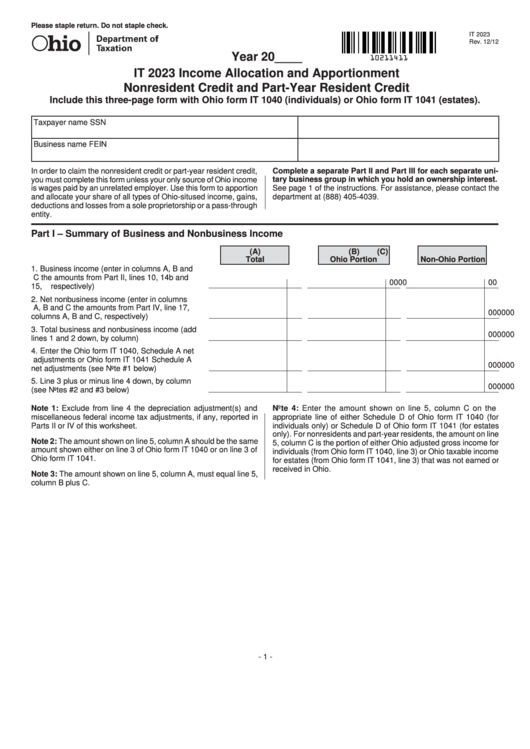

Fillable Form It 2023 Allocation And Apportionment Nonresident

Sales and use tax forms. Mailing addresses for dc tax returns. Cookies are required to use this site. Web registration and exemption tax forms. Web tax forms the following forms may be used to make changes to your federal and/or state tax withholding (s).

How State Taxes Are Paid Matters Stevens and Sweet Financial

Enterprise services (commerce employees only) 1401 constitution ave nw washington, dc 20230 archives; Dc withholding tax forms and publications. Web the washington dc income tax rate for tax year 2022 is progressive from a low of 4% to a high of 10.75%. Web individual income tax forms. The pension payment system does not withhold taxes for any other states.

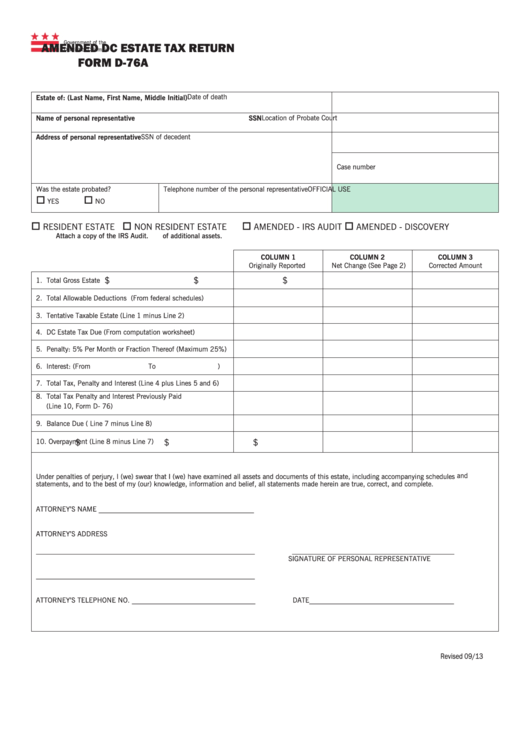

Form D76a Amended Dc Estate Tax Return printable pdf download

Otr frequently asked questions (faqs) excise tax forms. Web tax forms the following forms may be used to make changes to your federal and/or state tax withholding (s). Dc withholding tax forms and publications. If the due date for filing a return falls on a saturday, sunday or legal holiday, the. On or before april 18, 2022.

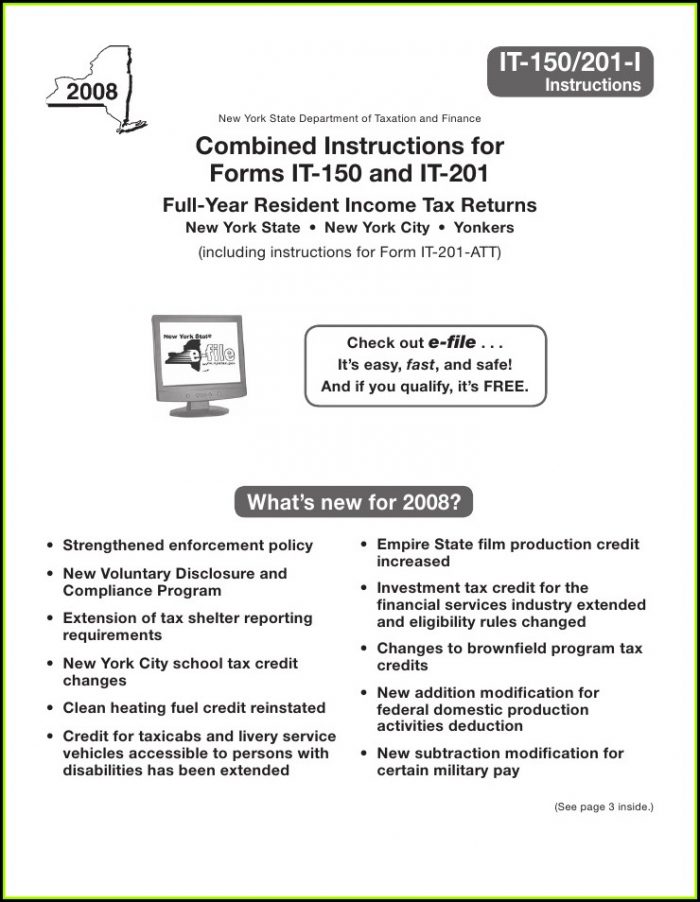

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Web your browser appears to have cookies disabled. Dc withholding tax forms and publications. Web registration and exemption tax forms. On or before april 18, 2022. Recorder of deeds tax forms/publications.

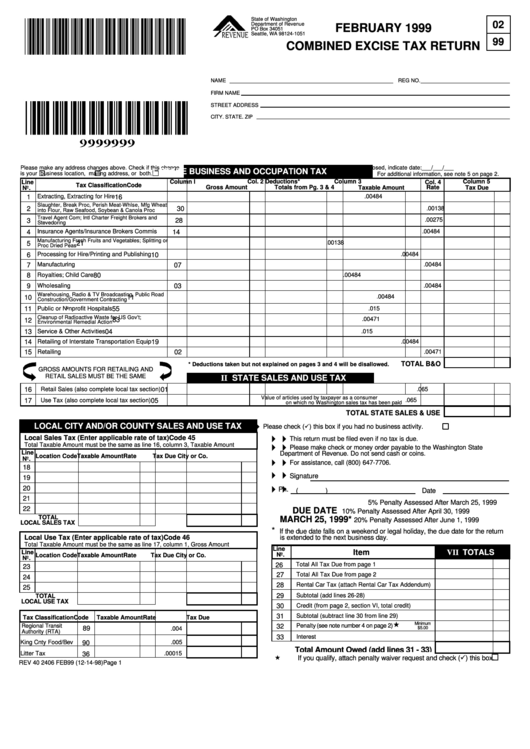

Fillable February 1999 Combined Excise Tax Return Washington

Otr frequently asked questions (faqs) excise tax forms. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web your browser appears to have cookies disabled. Web dc tax withholding form. On or before april 18, 2022.

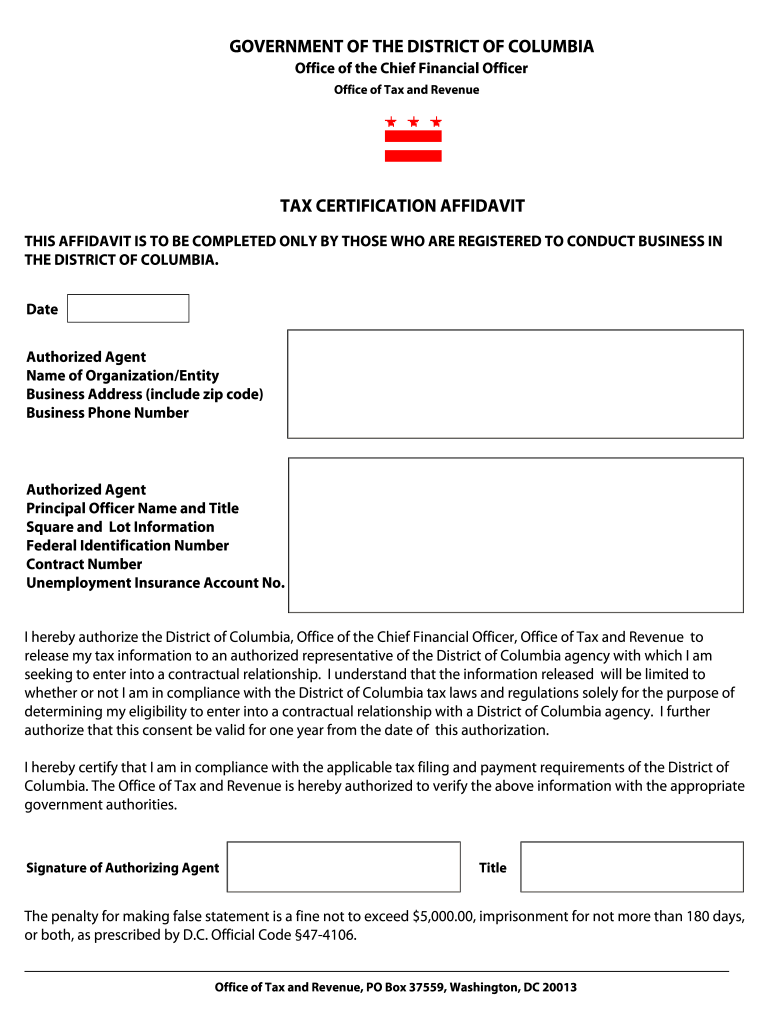

Dc Tax Cert Fill Online, Printable, Fillable, Blank pdfFiller

Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. If the due date for filing a return falls on a saturday, sunday or legal holiday, the. The pension payment system does not withhold taxes for any other states. Otr frequently asked questions (faqs) excise tax forms. Web your browser appears.

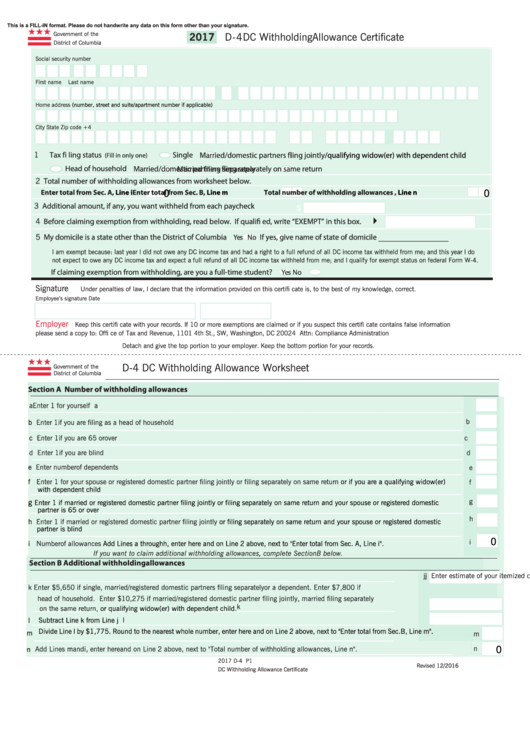

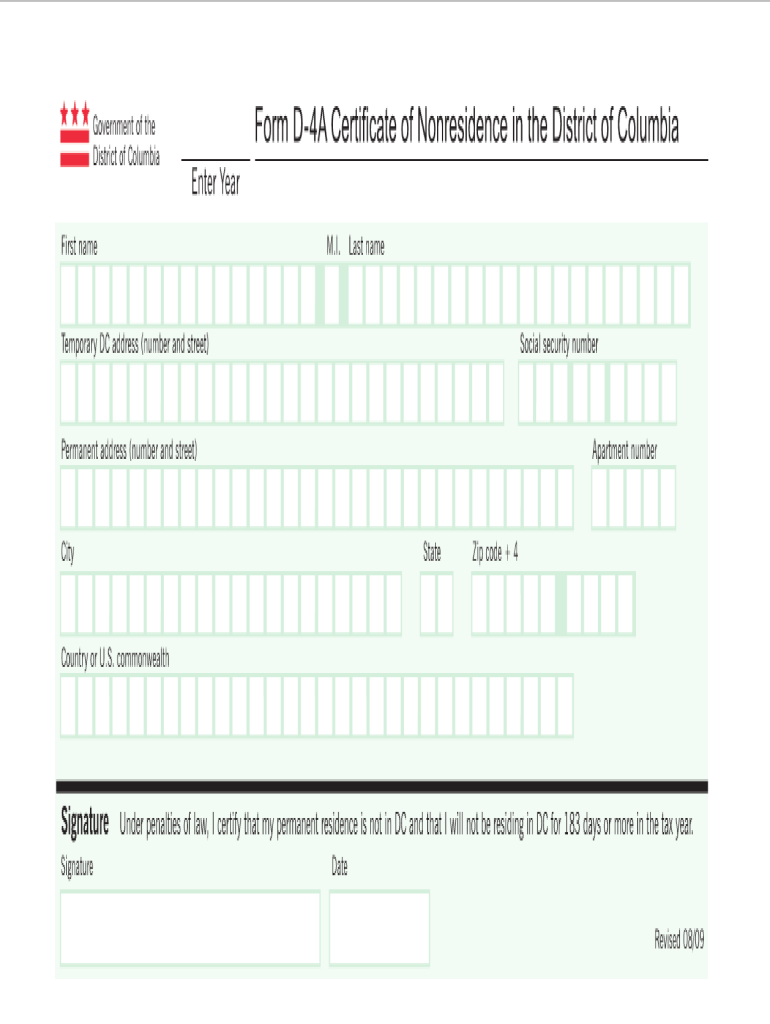

Fillable Form D4 Dc Withholding Allowance Certificate 2017

Real property tax forms and publications. Web registration and exemption tax forms. Web individual income tax forms. Web dc tax withholding form. Web your browser appears to have cookies disabled.

D4 Form Fill Out and Sign Printable PDF Template signNow

Web tax forms the following forms may be used to make changes to your federal and/or state tax withholding (s). If the due date for filing a return falls on a saturday, sunday or legal holiday, the. Web individual income tax forms. On or before april 18, 2022. Dc withholding tax forms and publications.

Maryland Estimated Tax Form 2020

Web individual income tax forms. Cookies are required to use this site. Form d4 dc employee withholding allowance certificate.pdf. The pension payment system does not withhold taxes for any other states. Web dc tax withholding form.

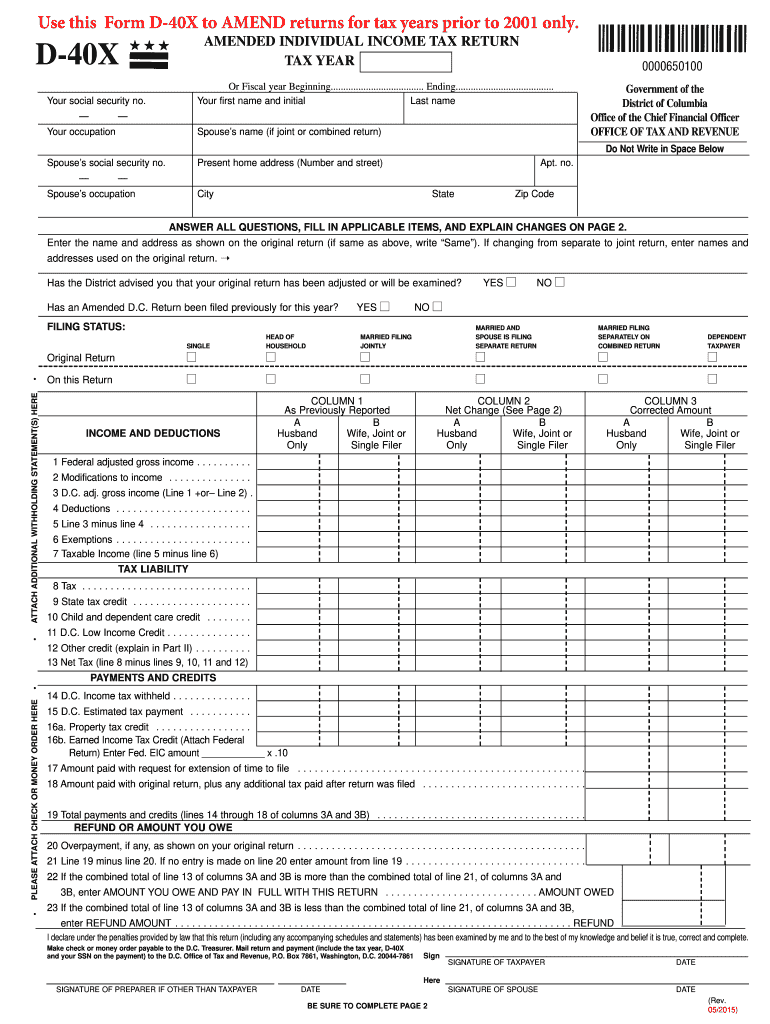

Dc d 40 2019 online fill in form Fill out & sign online DocHub

Web your browser appears to have cookies disabled. Enterprise services (commerce employees only) 1401 constitution ave nw washington, dc 20230 archives; Mailing addresses for dc tax returns. Dc inheritance and estate tax forms. On or before april 18, 2022.

If The Due Date For Filing A Return Falls On A Saturday, Sunday Or Legal Holiday, The.

Web tax forms the following forms may be used to make changes to your federal and/or state tax withholding (s). Web dc tax withholding form. The pension payment system does not withhold taxes for any other states. Mailing addresses for dc tax returns.

Dc Withholding Tax Forms And Publications.

• payments can be made by ach debit, credit/debit card, check or money order (us dollars). Real property tax forms and publications. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Sales and use tax forms.

Enterprise Services (Commerce Employees Only) 1401 Constitution Ave Nw Washington, Dc 20230 Archives;

Cookies are required to use this site. Otr frequently asked questions (faqs) excise tax forms. Web your browser appears to have cookies disabled. Dc inheritance and estate tax forms.

Form D4 Dc Employee Withholding Allowance Certificate.pdf.

On or before april 18, 2022. Web individual income tax forms. Web state tax form, district of columbia. Web the washington dc income tax rate for tax year 2022 is progressive from a low of 4% to a high of 10.75%.