Dc Form D 40B

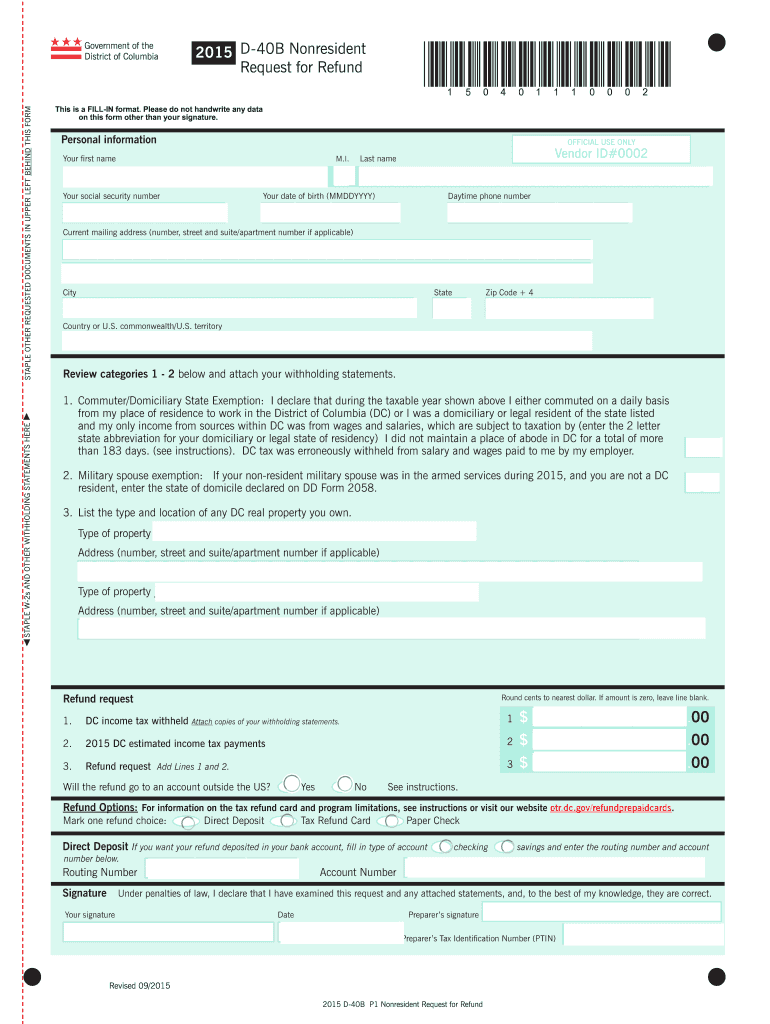

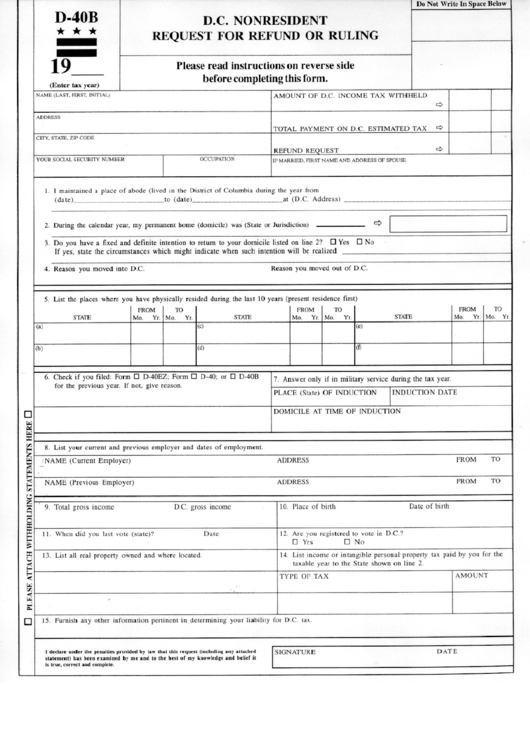

Dc Form D 40B - A nonresident is anyone whose permanent. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Monday to friday, 9 am to 4 pm, except district holidays. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. Leave lines blank that do not apply. Print in capital letters using black ink. Web form d 40b 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign dc tax form d 40b online? Get your online template and fill it in. You are not a dc.

Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web office of tax and revenue. 1101 4th street, sw, suite 270 west,. If you earned wages or. A nonresident is anyone whose permanent. Get your online template and fill it in. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. Print in capital letters using black ink. Monday to friday, 9 am to 4 pm, except district holidays. Leave lines blank that do not apply.

Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. Leave lines blank that do not apply. 1101 4th street, sw, suite 270 west,. You are not a dc. If you earned wages or. A nonresident is anyone whose permanent. Web office of tax and revenue. Monday to friday, 9 am to 4 pm, except district holidays. Web form d 40b 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign dc tax form d 40b online?

2015 Form DC D40B Fill Online, Printable, Fillable, Blank pdfFiller

If you earned wages or. Leave lines blank that do not apply. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web office of tax and revenue. Monday to friday, 9 am to 4 pm, except district holidays.

DC Form Jacket evo

Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. 1101 4th street, sw, suite 270 west,. Web office of tax and revenue. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. Any nonresident of dc claiming a refund.

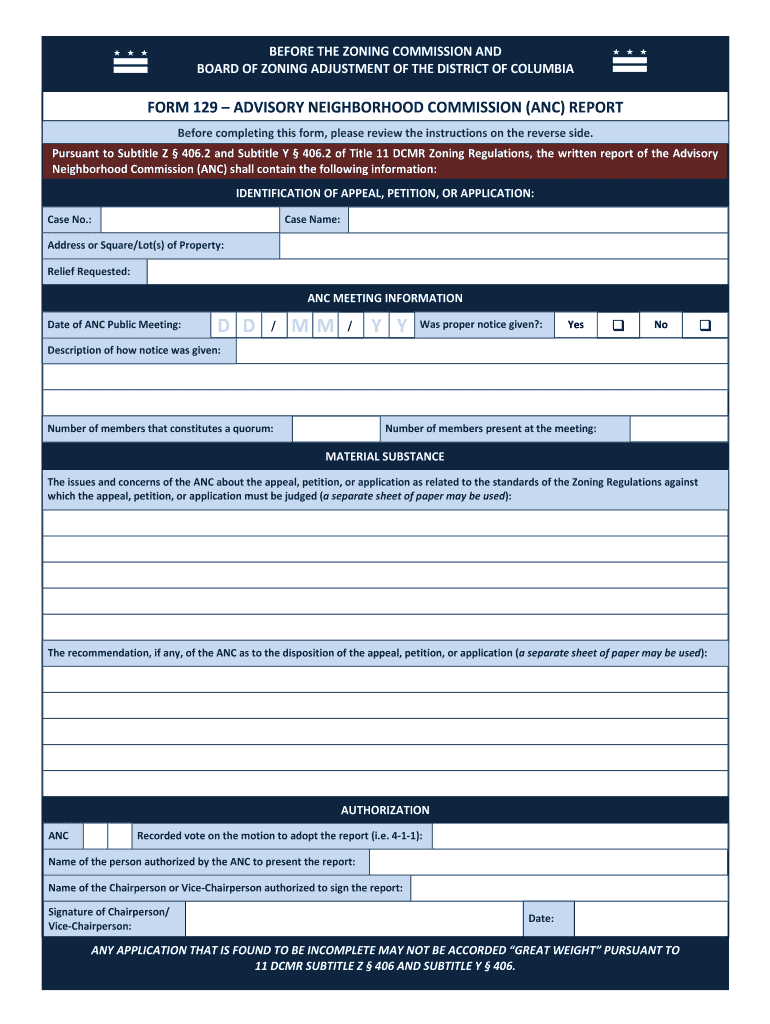

DC Form 129 20162022 Fill and Sign Printable Template Online US

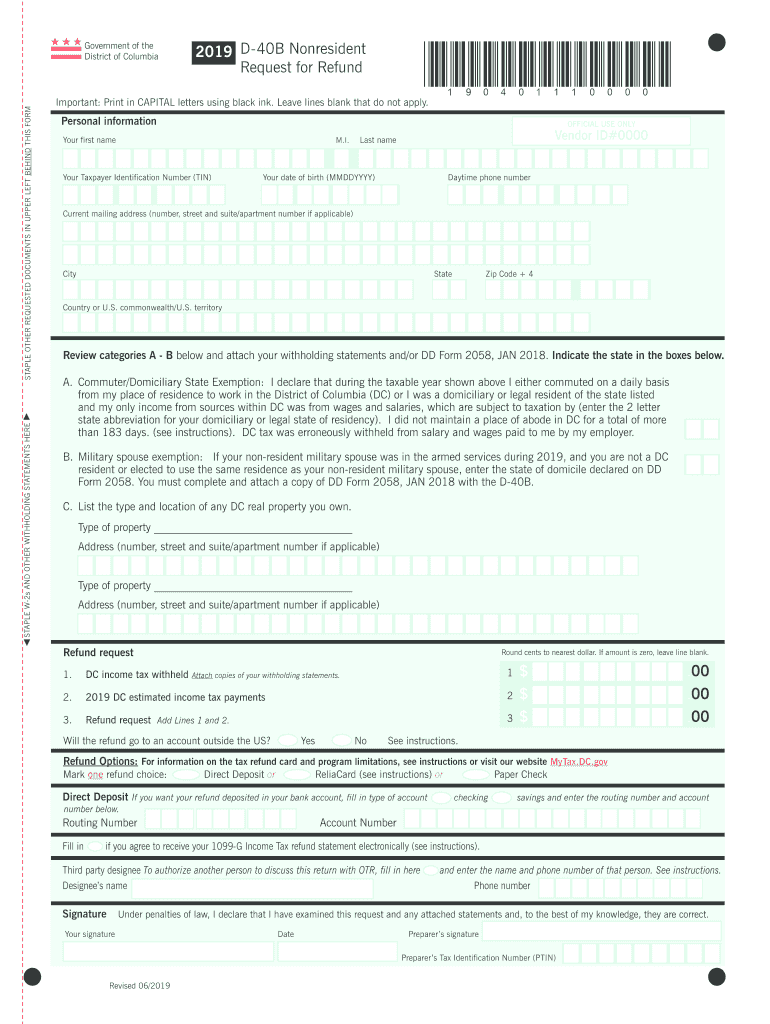

Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments. Web form d 40b 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign dc tax form d 40b online? Get your online template and.

2019 Form DC D40B Fill Online, Printable, Fillable, Blank pdfFiller

Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. If you earned wages or. Get your online template and fill it in. You are not a dc. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments.

Form Cc Dc Cr 078 Fill Online, Printable, Fillable, Blank pdfFiller

You are not a dc. 1101 4th street, sw, suite 270 west,. If you earned wages or. Monday to friday, 9 am to 4 pm, except district holidays. Leave lines blank that do not apply.

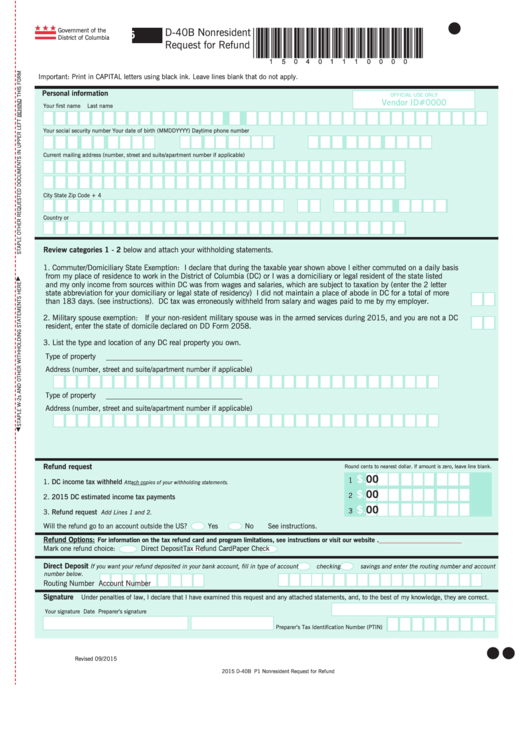

D40b Nonresident Request For Refund printable pdf download

Get your online template and fill it in. Monday to friday, 9 am to 4 pm, except district holidays. A nonresident is anyone whose permanent. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. 1101 4th street, sw, suite 270 west,.

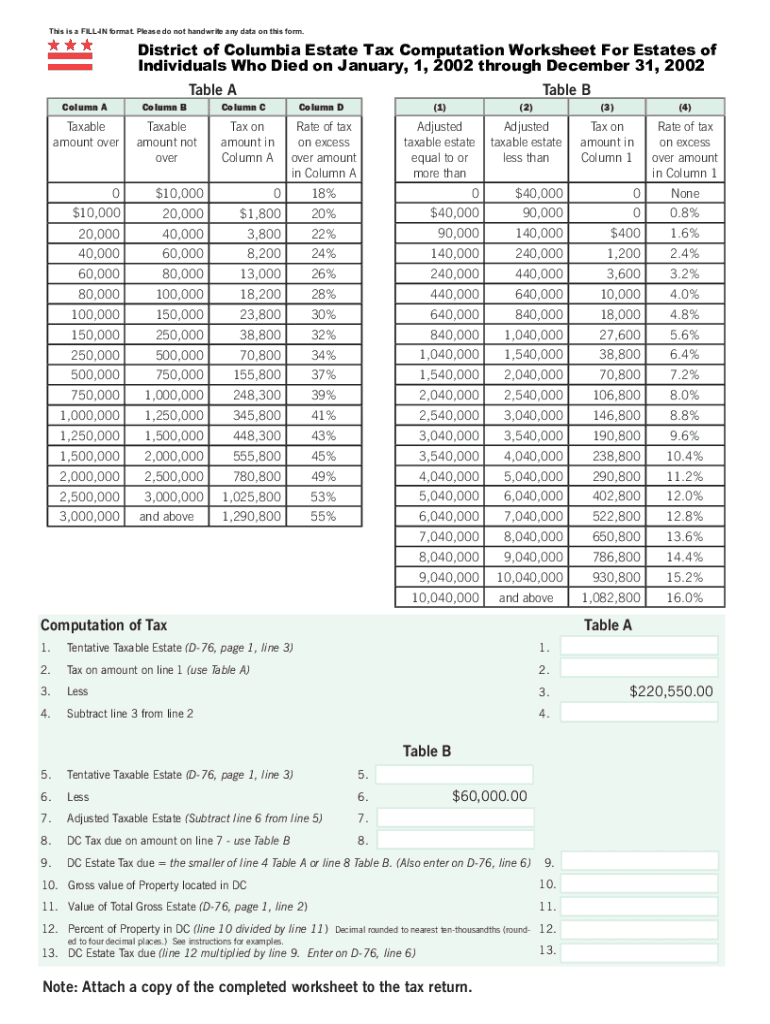

2020 Form DC OTR D76 Fill Online, Printable, Fillable, Blank pdfFiller

Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments. Leave lines blank that do not apply. Any nonresident of dc claiming a refund of dc income tax withheld or paid by.

Fillable Form D40b Nonresident Request For Refund Or Ruling

If you earned wages or. Print in capital letters using black ink. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. Get your online template and fill it in.

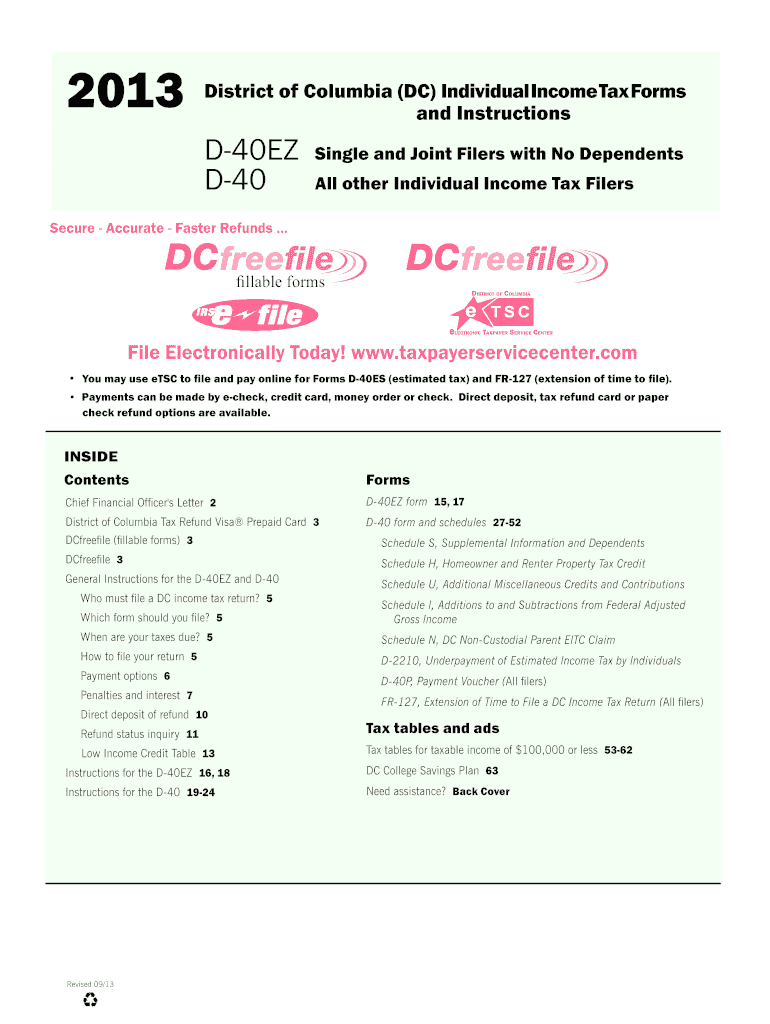

2013 Form DC D40EZ & D40 Fill Online, Printable, Fillable, Blank

Leave lines blank that do not apply. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web office of tax and revenue. Any nonresident of dc claiming a refund.

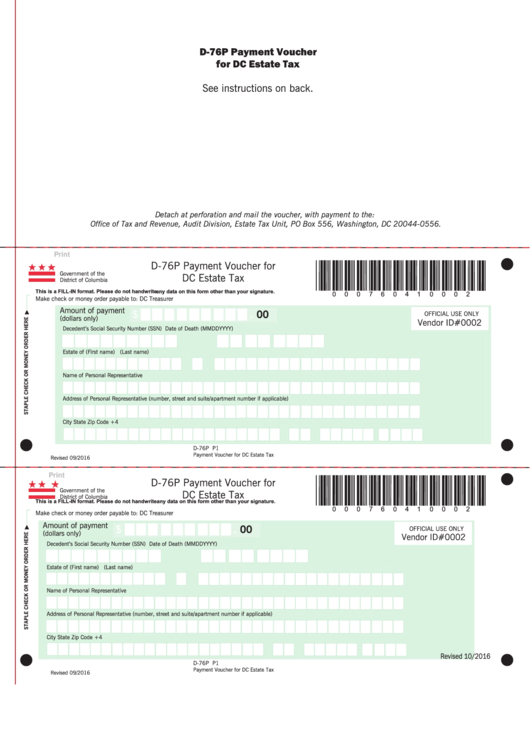

Fillable Form D76p Payment Voucher For Dc Estate Tax printable pdf

Web form d 40b 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign dc tax form d 40b online? Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. If you earned.

Web Office Of Tax And Revenue.

Monday to friday, 9 am to 4 pm, except district holidays. A nonresident is anyone whose permanent. Print in capital letters using black ink. Leave lines blank that do not apply.

You Are Not A Dc.

Web form d 40b 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign dc tax form d 40b online? 1101 4th street, sw, suite 270 west,. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments must file. Get your online template and fill it in.

If You Earned Wages Or.

Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Any nonresident of dc claiming a refund of dc income tax withheld or paid by estimated tax payments.