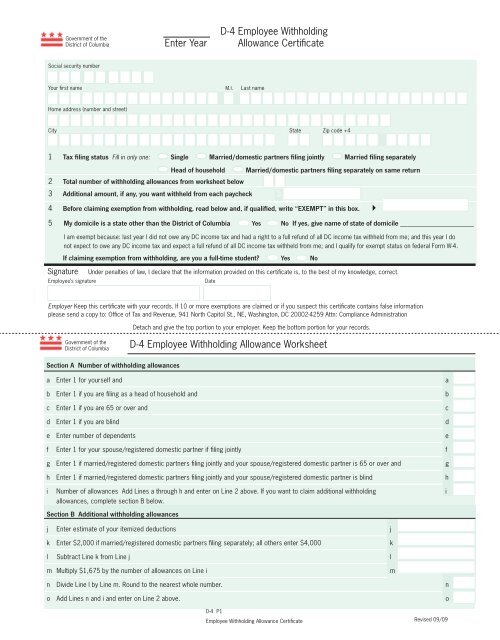

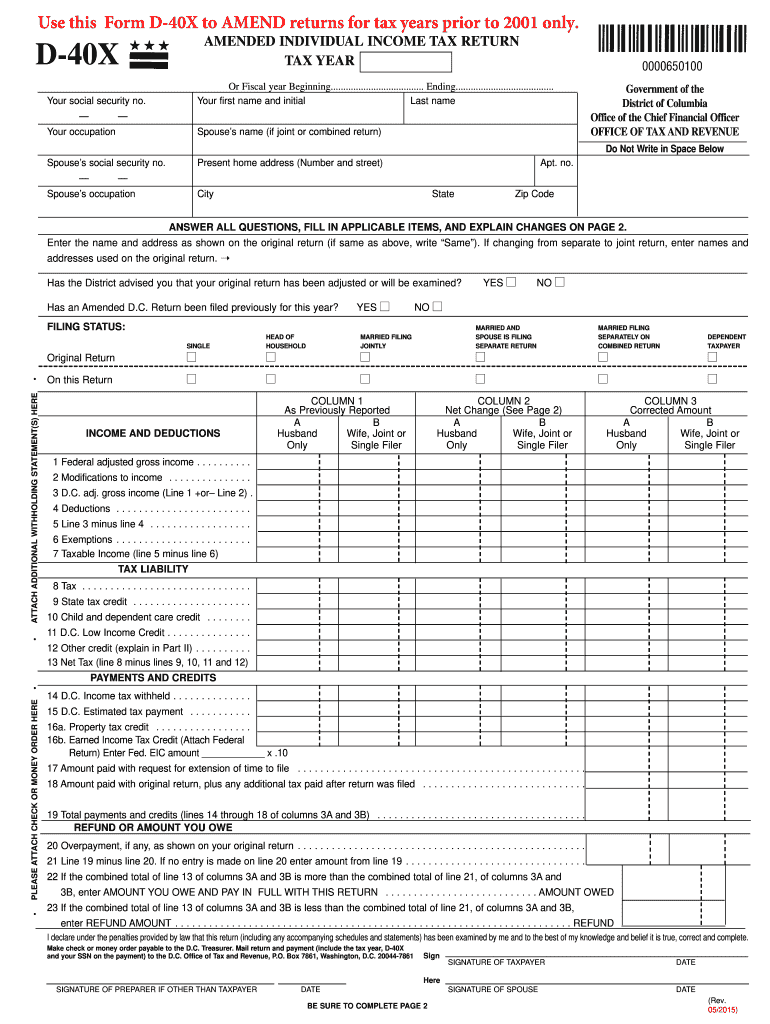

Dc D40 Tax Form

Dc D40 Tax Form - Here label state zip code you must enter your ssn apt. This extension is automatic and does not require. On or before april 18, 2023. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. If the due date for. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Official use only amount you owe overpayment voluntary contribution sign 11. Tax amendment on efile.com, however you cannot submit it. On or before may 17, 2021.

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web mailing addresses for all types of returns: Use this address if you are not enclosing a payment use this. Web in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. 13844 (january 2018) application for reduced user fee for installment agreements. You can prepare a current washington, d.c. Official use only amount you owe overpayment voluntary contribution sign 11. This extension is automatic and does not require. Web transfer tax exemptions;

On or before april 18, 2023. Official use only amount you owe overpayment voluntary contribution sign 11. Web in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. 13844 (january 2018) application for reduced user fee for installment agreements. Individual, corporation, partnership, and many others. Use this address if you are not enclosing a payment use this. Here label state zip code you must enter your ssn apt. Web a foreign country, u.s. This extension is automatic and does not require. Tax amendment on efile.com, however you cannot submit it.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Individual, corporation, partnership, and many others. Tax amendment on efile.com, however you cannot submit it. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Use this address if you are not enclosing a payment use this. On or before may 17, 2021.

SANYO DCD40 SERVICE MANUAL Pdf Download ManualsLib

Each form number has its own page with the needed address for example 1040,. Web in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. Official use only amount you owe overpayment voluntary contribution sign 11. On or before april 18,.

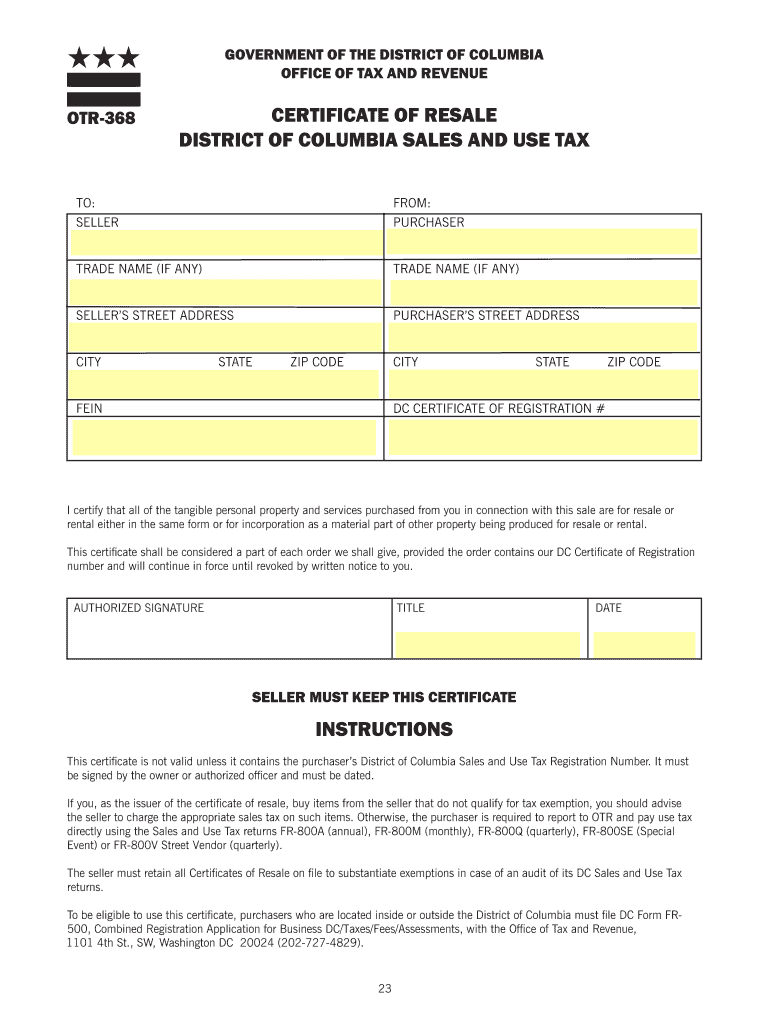

DC OTR368 2016 Fill out Tax Template Online US Legal Forms

This extension is automatic and does not require. Tax amendment on efile.com, however you cannot submit it. On or before may 17, 2021. 13844 (january 2018) application for reduced user fee for installment agreements. Web transfer tax exemptions;

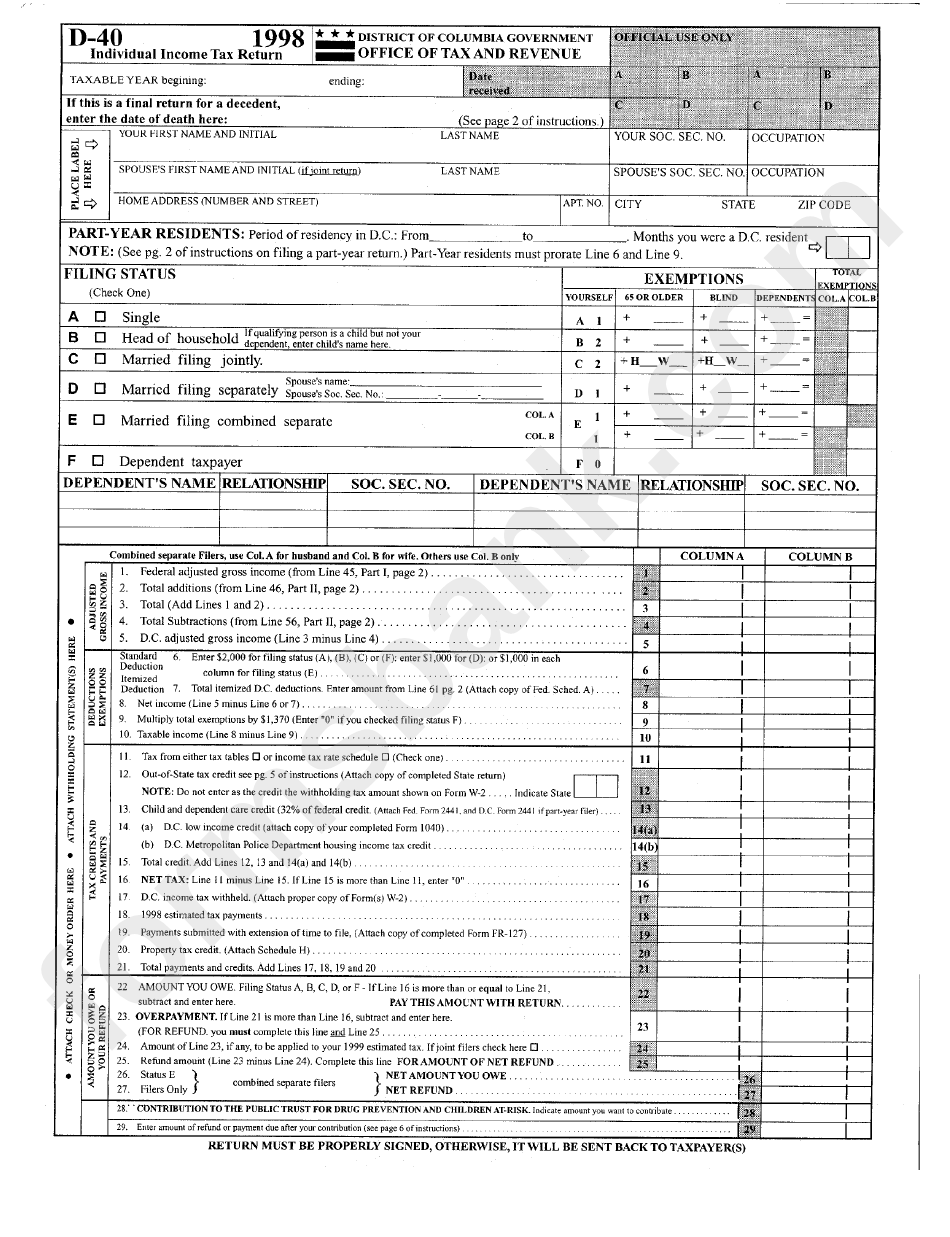

Fillable Form D40 Individual Tax Return 1998 printable pdf

If the due date for. Each form number has its own page with the needed address for example 1040,. Individual, corporation, partnership, and many others. Tax amendment on efile.com, however you cannot submit it. 13844 (january 2018) application for reduced user fee for installment agreements.

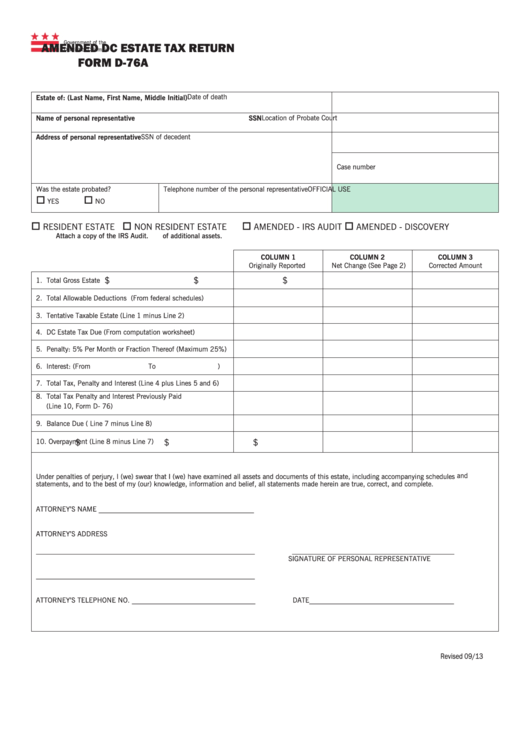

Form D76a Amended Dc Estate Tax Return printable pdf download

Web transfer tax exemptions; Web in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. This extension is automatic and does not require. On or before may 17, 2021. Use this address if you are not enclosing a payment use this.

SANYO DCD40 Service Manual download, schematics, eeprom, repair info

Individual, corporation, partnership, and many others. Official use only amount you owe overpayment voluntary contribution sign 11. Web mailing addresses for all types of returns: Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. If the due date for.

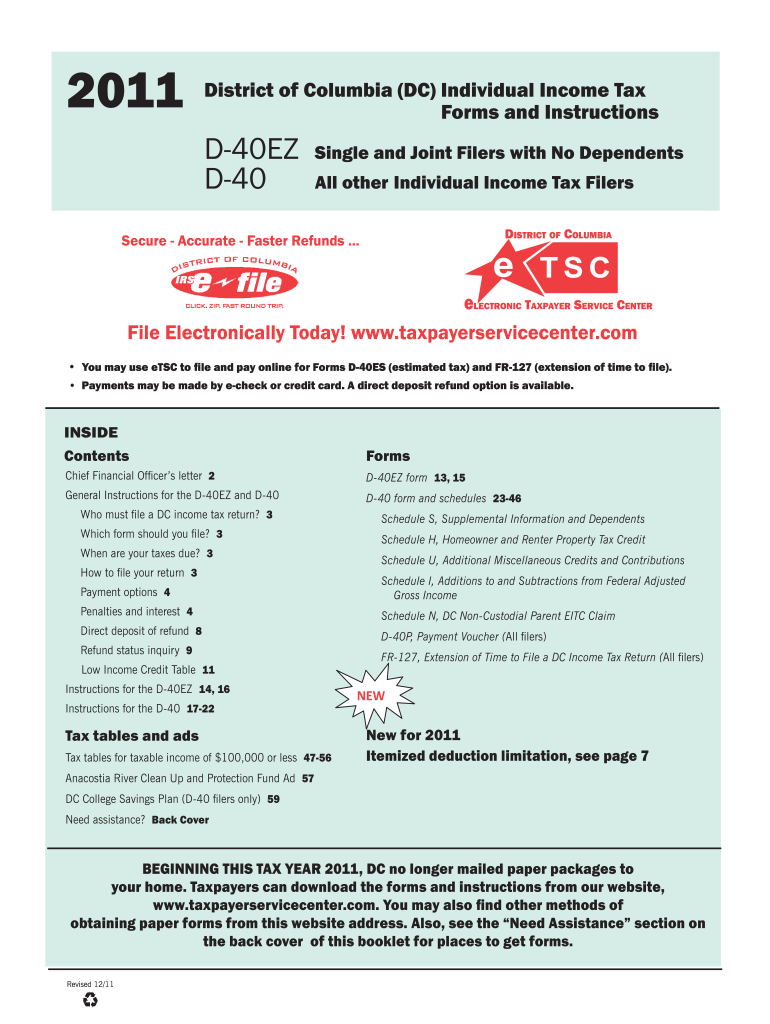

2011 dc tax forms Fill out & sign online DocHub

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. If the due date for. Web transfer tax exemptions; Each form number has its own page with the needed address for example.

Washington DC Tax Form 2010 Teach for America

Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. If the due date for. Individual, corporation, partnership, and many others. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. On or before may 17, 2021.

20222023 form 1040 schedule 5 Fill online, Printable, Fillable Blank

If the due date for. Web in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. Web a foreign country, u.s. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax..

Dc d 40 2019 online fill in form Fill out & sign online DocHub

You can prepare a current washington, d.c. On or before may 17, 2021. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web transfer tax exemptions;

Individual, Corporation, Partnership, And Many Others.

On or before may 17, 2021. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Here label state zip code you must enter your ssn apt. This extension is automatic and does not require.

Any Nonresident Of The District Claiming A Refund Of District Income Tax Withheld Or Paid By Declaration Of Estimated Tax.

You can prepare a current washington, d.c. Web a foreign country, u.s. Use this address if you are not enclosing a payment use this. On or before april 18, 2023.

Web Transfer Tax Exemptions;

Tax amendment on efile.com, however you cannot submit it. 13844 (january 2018) application for reduced user fee for installment agreements. Official use only amount you owe overpayment voluntary contribution sign 11. If the due date for.

Web Mailing Addresses For All Types Of Returns:

Each form number has its own page with the needed address for example 1040,. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web in addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster.