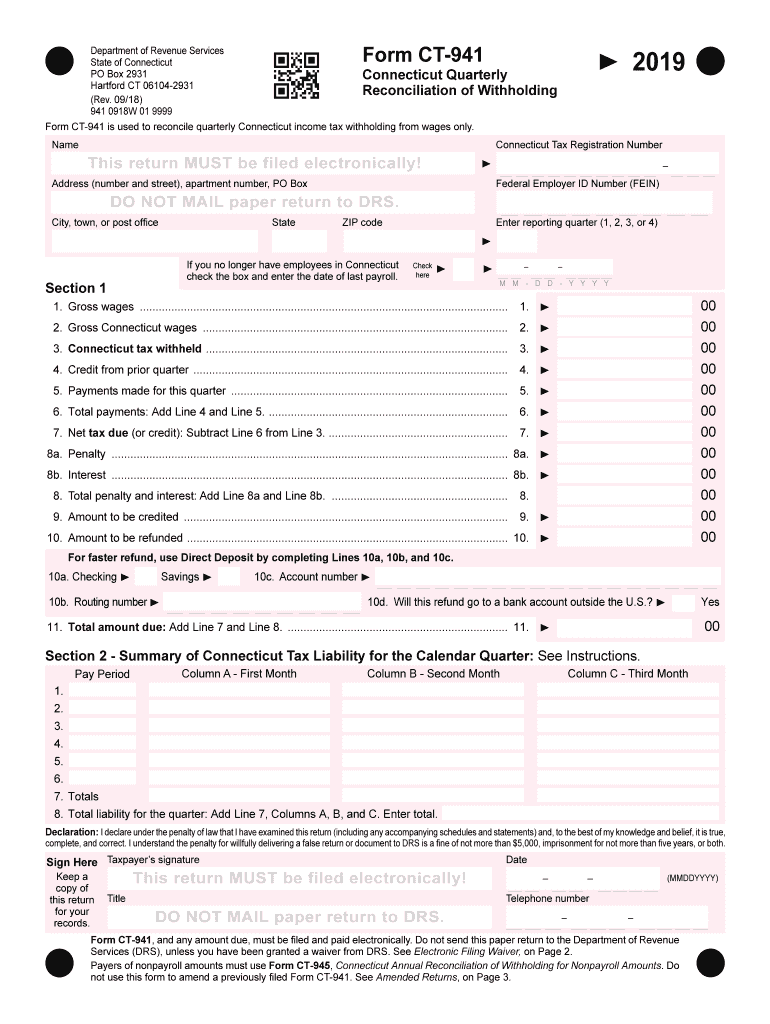

Ct Form 941

Ct Form 941 - See amended returns, on page 1 of the instructions. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Web form 941 for 2023: Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Don't use an earlier revision to report taxes for 2023. Household employers, agricultural employers, payers of nonpayroll amounts, and intermittent filers). Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments First quarter, april 30, 2001; Do not use this form to amend a previously filed form ct‑941 hhe. Pay the employer's portion of social security or medicare tax.

Click the link to load the 2023 form instructions from the. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments First quarter, april 30, 2001; March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Household employers, agricultural employers, payers of nonpayroll amounts, and intermittent filers). Web mailing addresses for forms 941. Don't use an earlier revision to report taxes for 2023. It should not be submitted to the state even if you have an electronic filing waiver. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county Don't use an earlier revision to report taxes for 2023. Click the link to load the 2023 form instructions from the. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; It should not be submitted to the state even if you have an electronic filing waiver. Web no tax was required to be withheld for that quarter. First quarter, april 30, 2001; Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web about form 941, employer's quarterly federal tax return employers use form 941 to: Web form 941 for 2023:

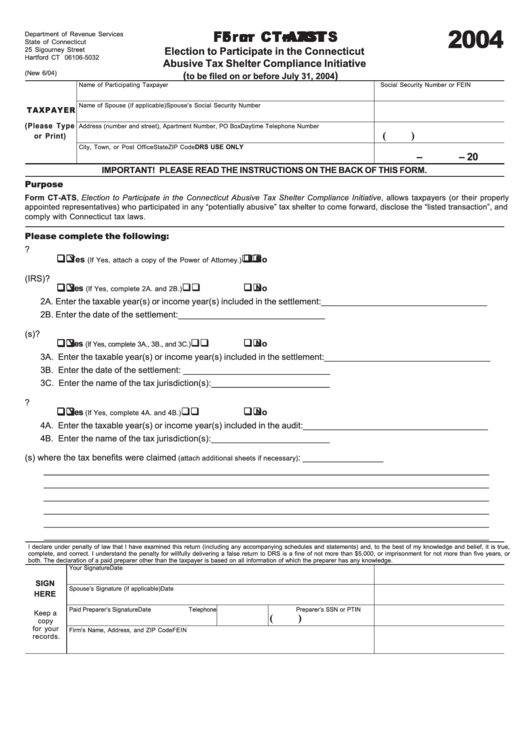

Form CtAts Election To Participate In The Connecticut Abusive Tax

Don't use an earlier revision to report taxes for 2023. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Do not use this form to.

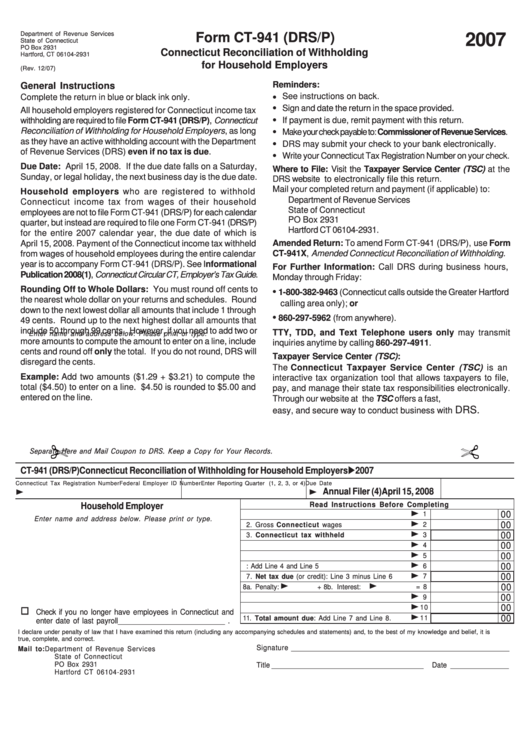

Form Ct941 (Drs/p) Connecticut Reconciliation Of Withholding For

Web form 941 for 2023: At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. Web mailing addresses for forms 941. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web no.

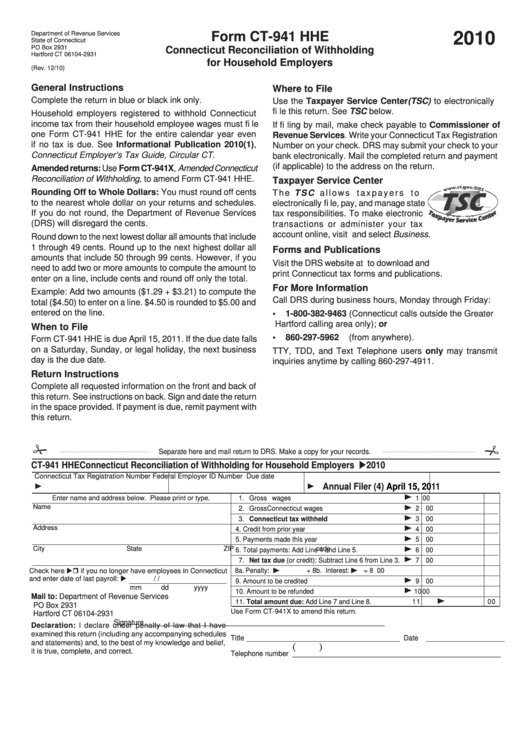

Form Ct941 Hhe Connecticut Reconciliation Of Withholding For

Click the link to load the 2023 form instructions from the. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Web form 941 for 2023: Web no tax was required to be withheld for that quarter. It should not be submitted to the state even if you have an electronic filing waiver.

CT R229 20132021 Fill and Sign Printable Template Online US Legal

Web about form 941, employer's quarterly federal tax return employers use form 941 to: Web form 941 for 2023: It should not be submitted to the state even if you have an electronic filing waiver. Don't use an earlier revision to report taxes for 2023. Web mailing addresses for forms 941.

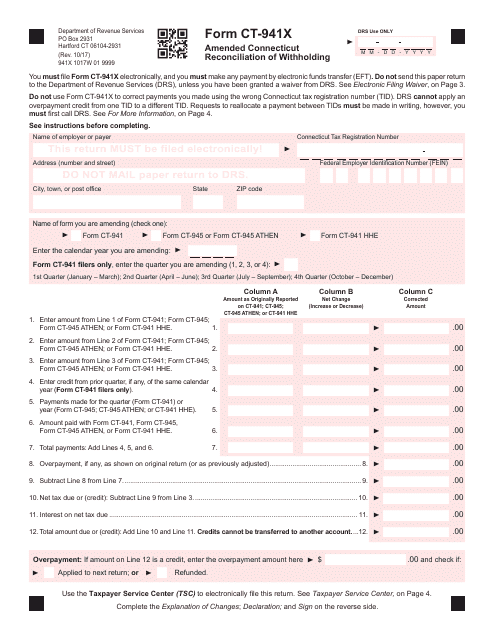

Form CT941X Download Printable PDF or Fill Online Amended Connecticut

See amended returns, on page 1 of the instructions. Household employers, agricultural employers, payers of nonpayroll amounts, and intermittent filers). Do not use this form to amend a previously filed form ct‑941 hhe. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Report income taxes, social security tax, or medicare tax withheld from employee's.

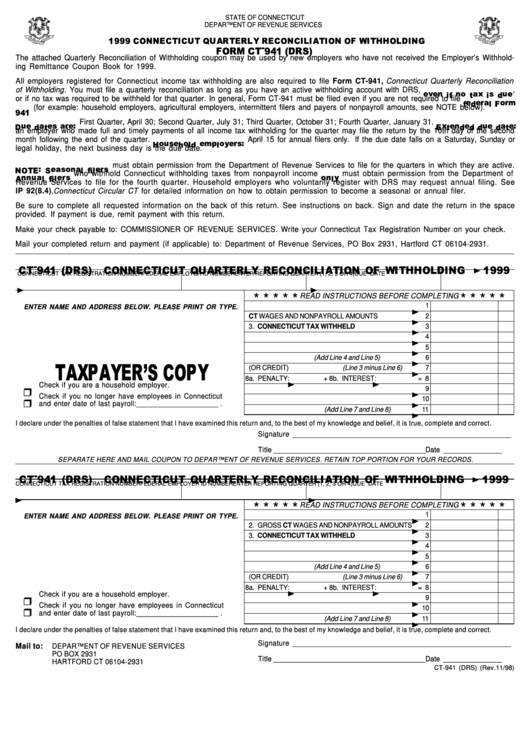

Fillable Form Ct941 (Drs) Connecticut Quarterly Reconciliation Of

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. It should not be submitted to the state even if you have an electronic filing waiver. Don't use an earlier revision to report taxes for 2023. Report income taxes, social security tax, or.

Form Ct941 (Drs) Connecticut Quarterly Reconciliation Of Withholding

Pay the employer's portion of social security or medicare tax. Do not use this form to amend a previously filed form ct‑941 hhe. File this return and make payment electronically using myconnect a t Web about form 941, employer's quarterly federal tax return employers use form 941 to: Web form 941 for 2023:

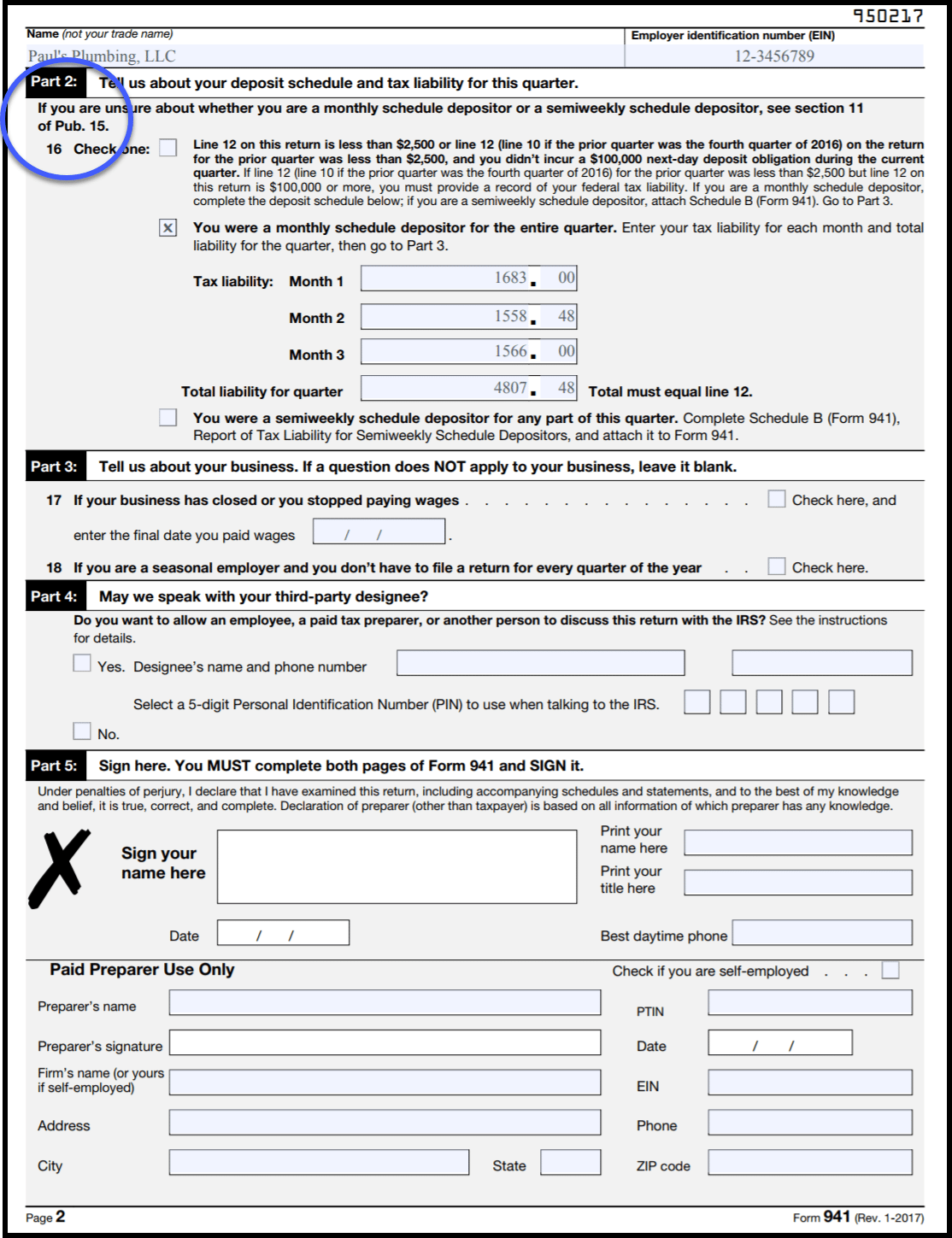

Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address)

Web form 941 for 2023: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county At this time, the irs expects the march 2023 revision.

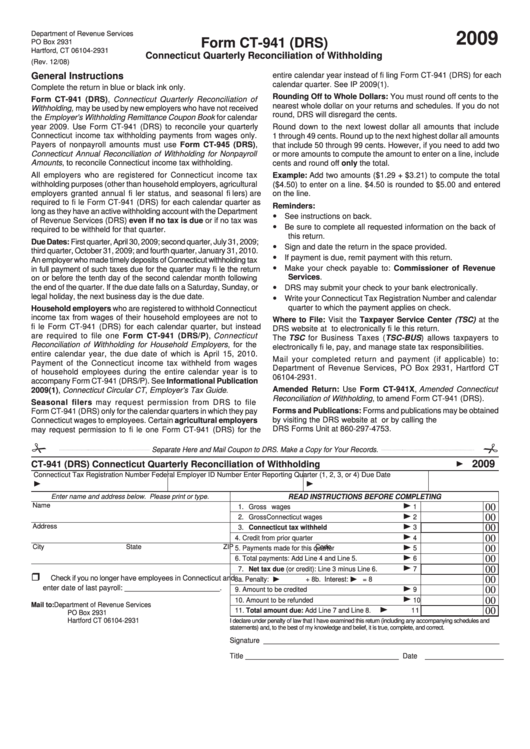

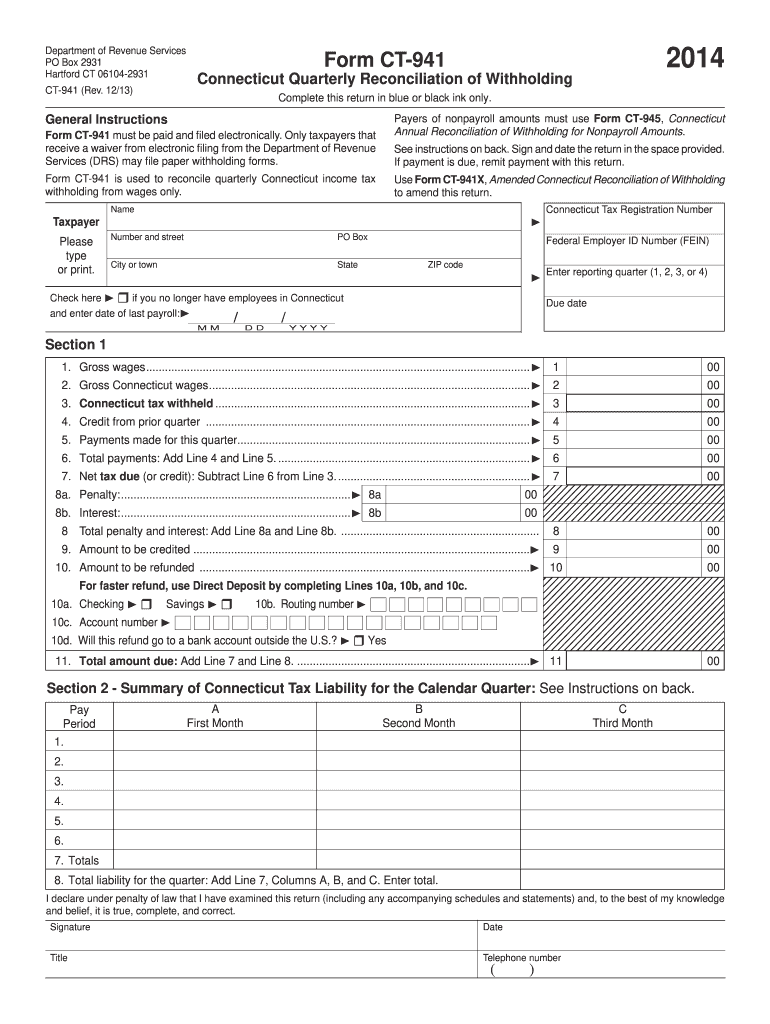

2014 Form CT DRS CT941 Fill Online, Printable, Fillable, Blank pdfFiller

Click the link to load the 2023 form instructions from the. See amended returns, on page 1 of the instructions. Do not use this form to amend a previously filed form ct‑941 hhe. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina..

2018 Form CT DRS CT941 Fill Online, Printable, Fillable, Blank pdfFiller

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Web about form 941, employer's quarterly federal tax return employers use form 941 to: Pay the employer's portion of social security or medicare tax. Do not use this form to amend a previously.

Current Revision Form 941 Pdf Instructions For Form 941 ( Print Version Pdf) Recent Developments

First quarter, april 30, 2001; Web no tax was required to be withheld for that quarter. Web form 941 for 2023: Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.

Web Use The March 2023 Revision Of Form 941 To Report Taxes For The First Quarter Of 2023;

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Web mailing addresses for forms 941. It should not be submitted to the state even if you have an electronic filing waiver. Don't use an earlier revision to report taxes for 2023.

Do Not Use This Form To Amend A Previously Filed Form Ct‑941 Hhe.

See amended returns, on page 1 of the instructions. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county Click the link to load the 2023 form instructions from the. Web about form 941, employer's quarterly federal tax return employers use form 941 to:

Household Employers, Agricultural Employers, Payers Of Nonpayroll Amounts, And Intermittent Filers).

File this return and make payment electronically using myconnect a t Pay the employer's portion of social security or medicare tax. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023.