Credit Inquiry Form

Credit Inquiry Form - Your credit score and other details can influence the approval process as well as the interest rate for your mortgage. Chat with a live usagov agent. Please provide full account numbers with your request. Complete the credit inquiry request form (pdf*) including account numbers and customer authorization section. These inquiries will impact your credit score because most credit scoring models look at how recently and how frequently you apply for credit. Web a bank or lender makes an inquiry. Use this form if you prefer to write to request your credit report from any, or all, of the nationwide consumer credit reporting companies. Do you have a question? Call and speak to a live usagov agent. Web two types of credit inquiries exist:

Hard credit inquiries and soft credit inquiries—also referred to as hard and soft credit checks. Web for instant access to your free credit report, visit www.annualcreditreport.com. Your credit score and other details can influence the approval process as well as the interest rate for your mortgage. If you apply for a mortgage, you can expect the lender to make a credit inquiry. Call and speak to a live usagov agent. Credit inquiry has two main types, and these are: Reason the inquiry was pulled. They will get you the answer or let you know where to find it. Chat with a live usagov agent. 1) soft inquiry, occurs when you check your own credit report or when employers and landlords do a background check on you.

Call and speak to a live usagov agent. Do you have a question? Web an inquiry refers to a request to look at your credit file, and it generally falls into one of two types. Web two types of credit inquiries exist: Lenders also make inquiries to review your existing accounts. Credit inquiries are typically made by financial institutions to help them determine whether to approve. Credit inquiry has two main types, and these are: Web for instant access to your free credit report, visit www.annualcreditreport.com. Reason the inquiry was pulled. Chat with a live usagov agent.

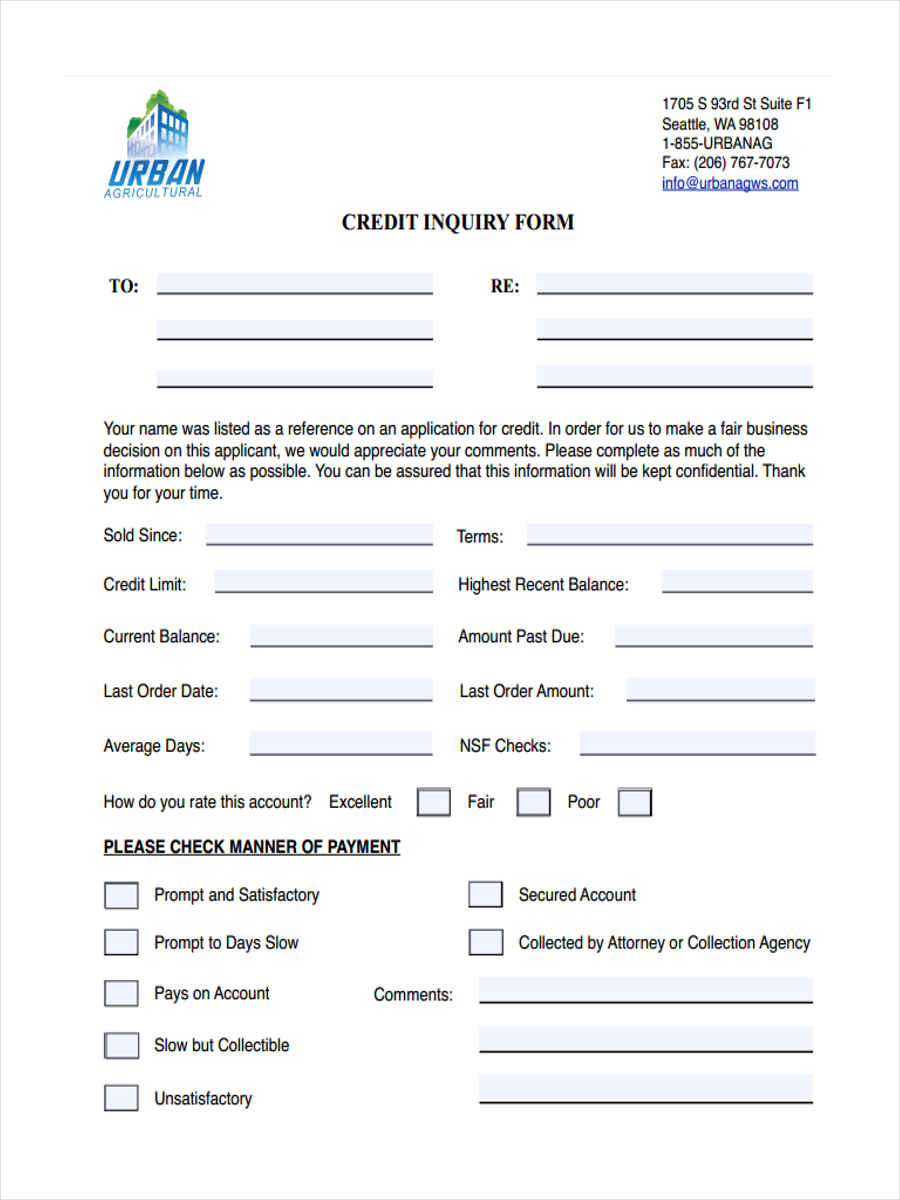

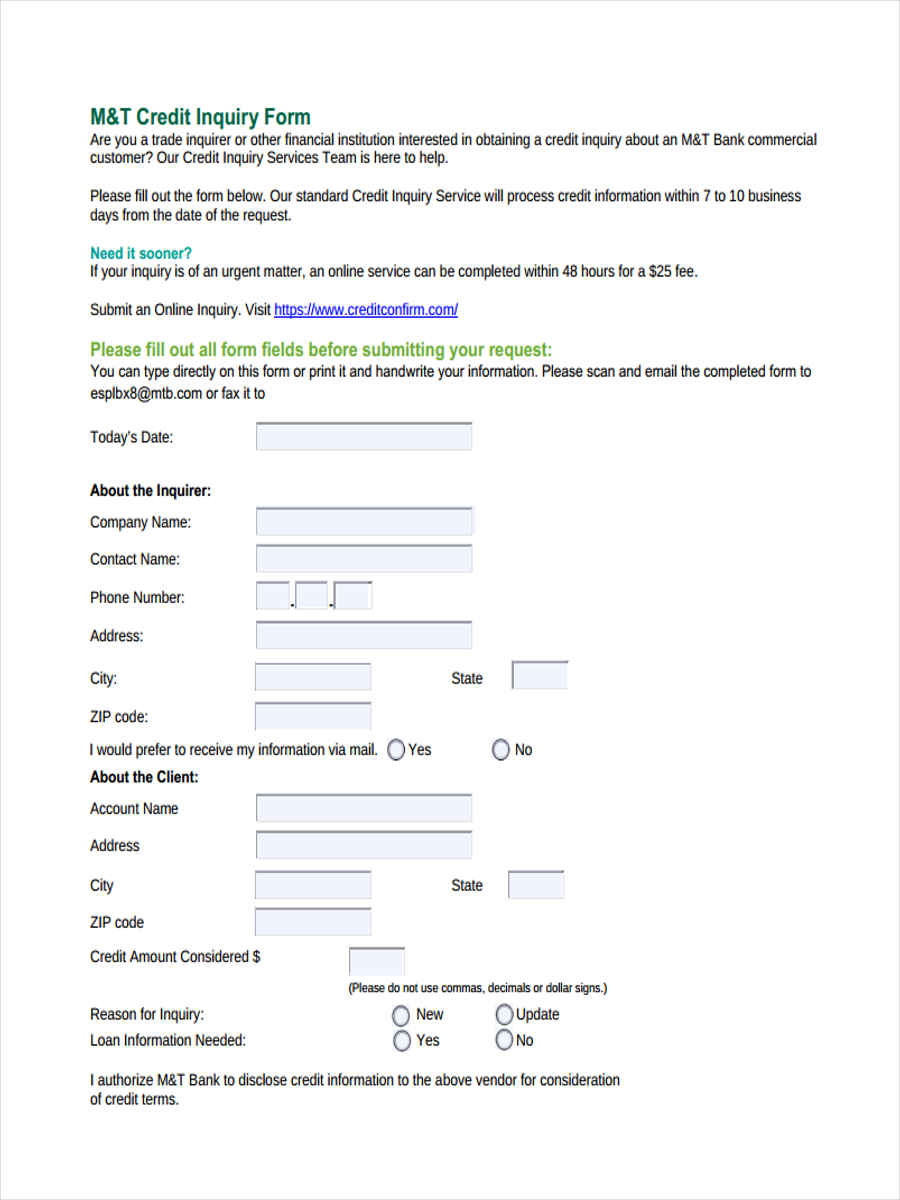

FREE 11+ Credit Inquiry Forms in PDF Ms Word

These are typically inquiries by lenders after you apply for credit. Use this form if you prefer to write to request your credit report from any, or all, of the nationwide consumer credit reporting companies. This letter is to address all credit inquiries reporting on my credit report in the past 120 days. Credit inquiries are typically made by financial.

FREE 11+ Credit Inquiry Forms in PDF Ms Word

Web letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: Web two types of credit inquiries exist: Credit inquiry has two main types, and these are: Web an inquiry refers to a request to look at your credit file, and it generally falls into one of two types. Do you have a.

FREE 11+ Credit Inquiry Forms in PDF Ms Word

2) hard inquiry, occurs when a lending firm checks your credit report to determine your credit worthiness. Reason the inquiry was pulled. If you apply for a mortgage, you can expect the lender to make a credit inquiry. Web two types of credit inquiries exist: Call and speak to a live usagov agent.

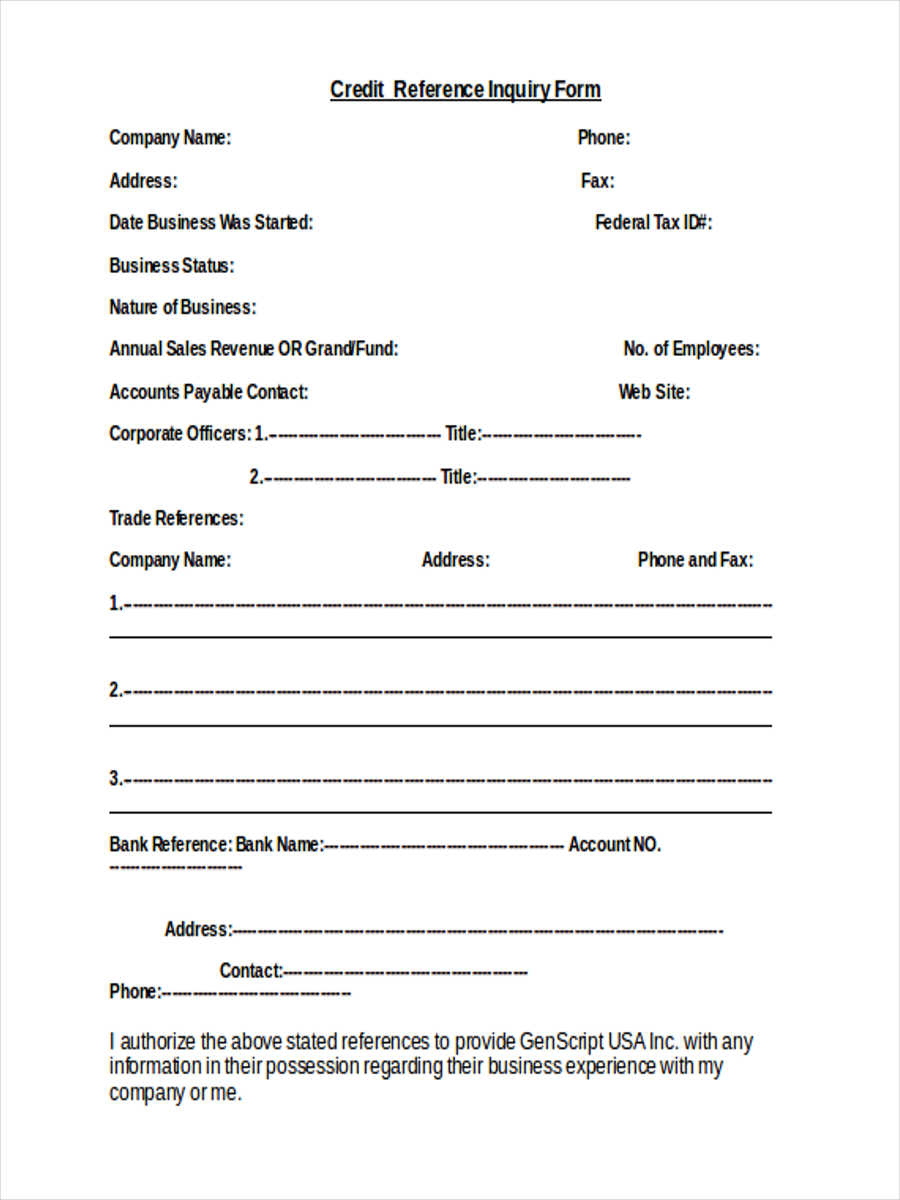

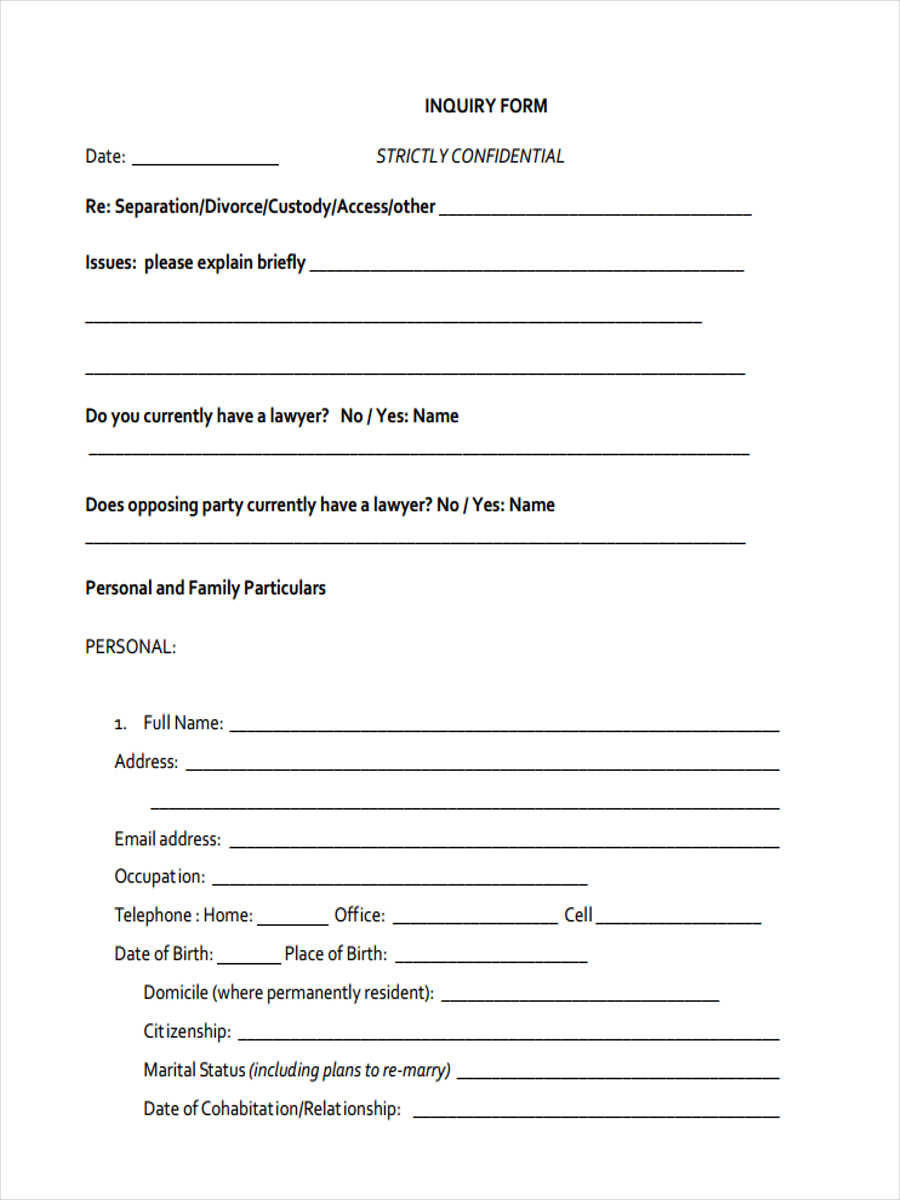

Free 6+ Sample Credit Inquiry Forms In Word Pdf pertaining to Enquiry

1) soft inquiry, occurs when you check your own credit report or when employers and landlords do a background check on you. Reason the inquiry was pulled. Call and speak to a live usagov agent. Web the purpose of credit inquiry is for the bank or any credit issuing company would know the creditworthiness of individual. They will get you.

Letter Of Explanation For Credit Inquiry Database Letter Template

Complete the credit inquiry request form (pdf*) including account numbers and customer authorization section. Reason the inquiry was pulled. Your credit score and other details can influence the approval process as well as the interest rate for your mortgage. Do you have a question? Credit inquiry has two main types, and these are:

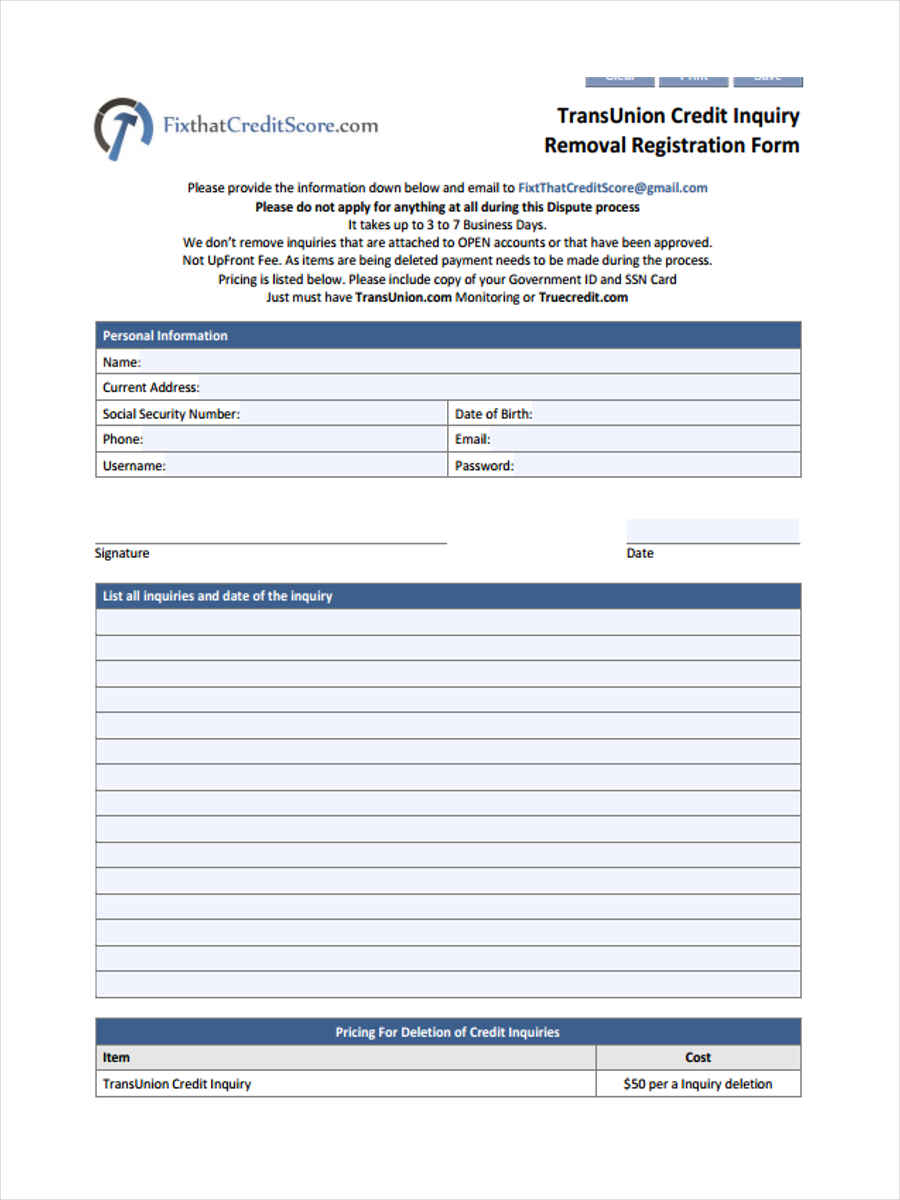

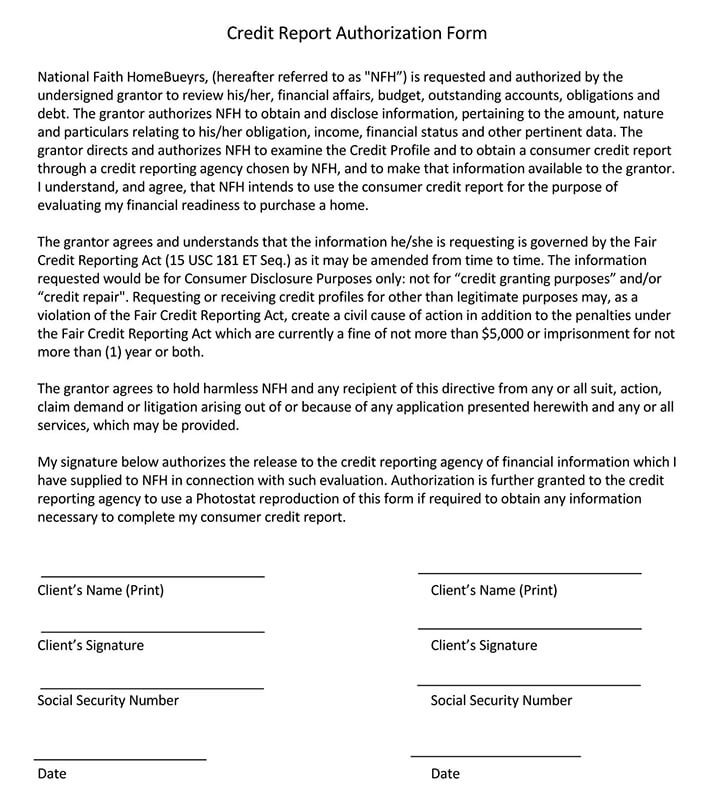

Credit Report Authorization Forms Printable Word PDF

Call and speak to a live usagov agent. Web two types of credit inquiries exist: This letter is to address all credit inquiries reporting on my credit report in the past 120 days. Complete the credit inquiry request form (pdf*) including account numbers and customer authorization section. 2) hard inquiry, occurs when a lending firm checks your credit report to.

FREE 11+ Credit Inquiry Forms in PDF Ms Word

Web submitting a request to avoid processing delays, read important guidelines for completing a credit inquiry request form. If you apply for a mortgage, you can expect the lender to make a credit inquiry. 1) soft inquiry, occurs when you check your own credit report or when employers and landlords do a background check on you. Use this form if.

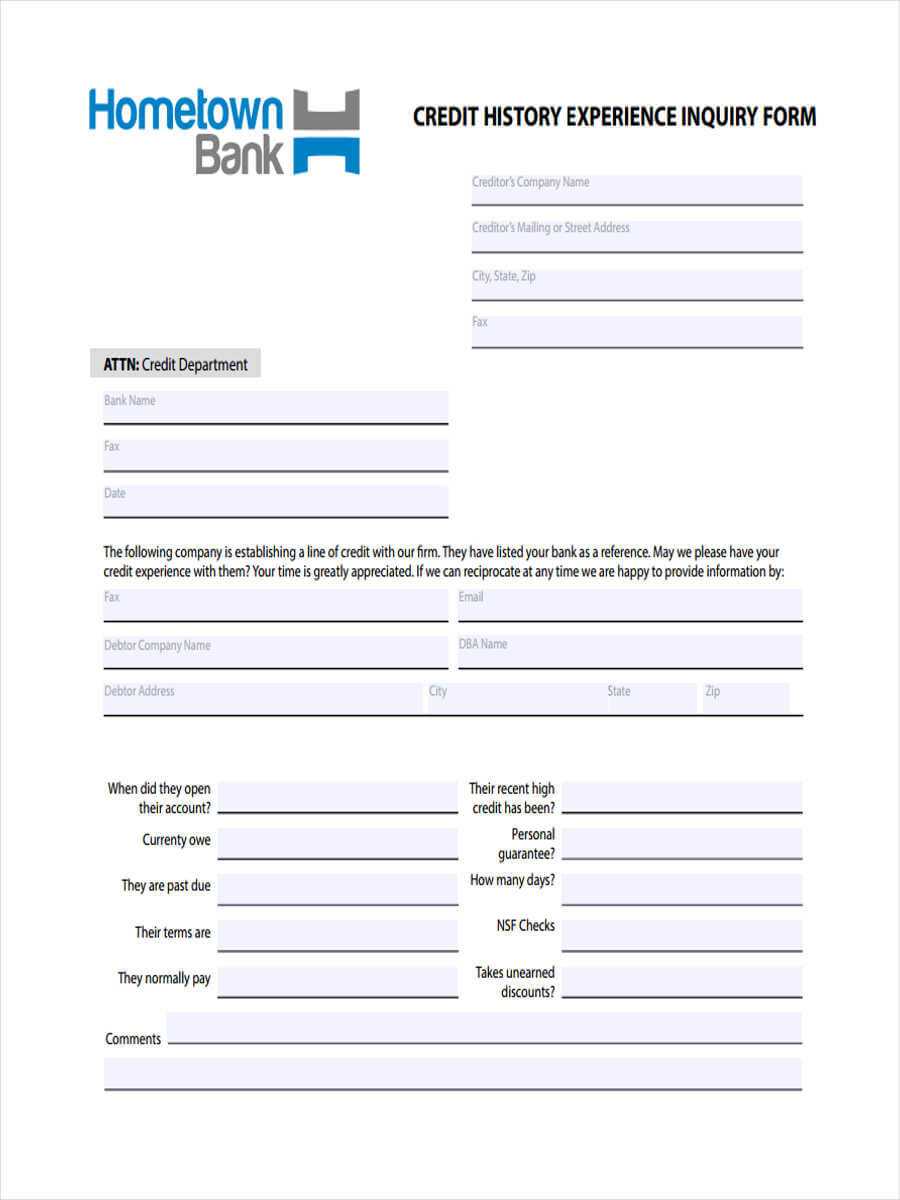

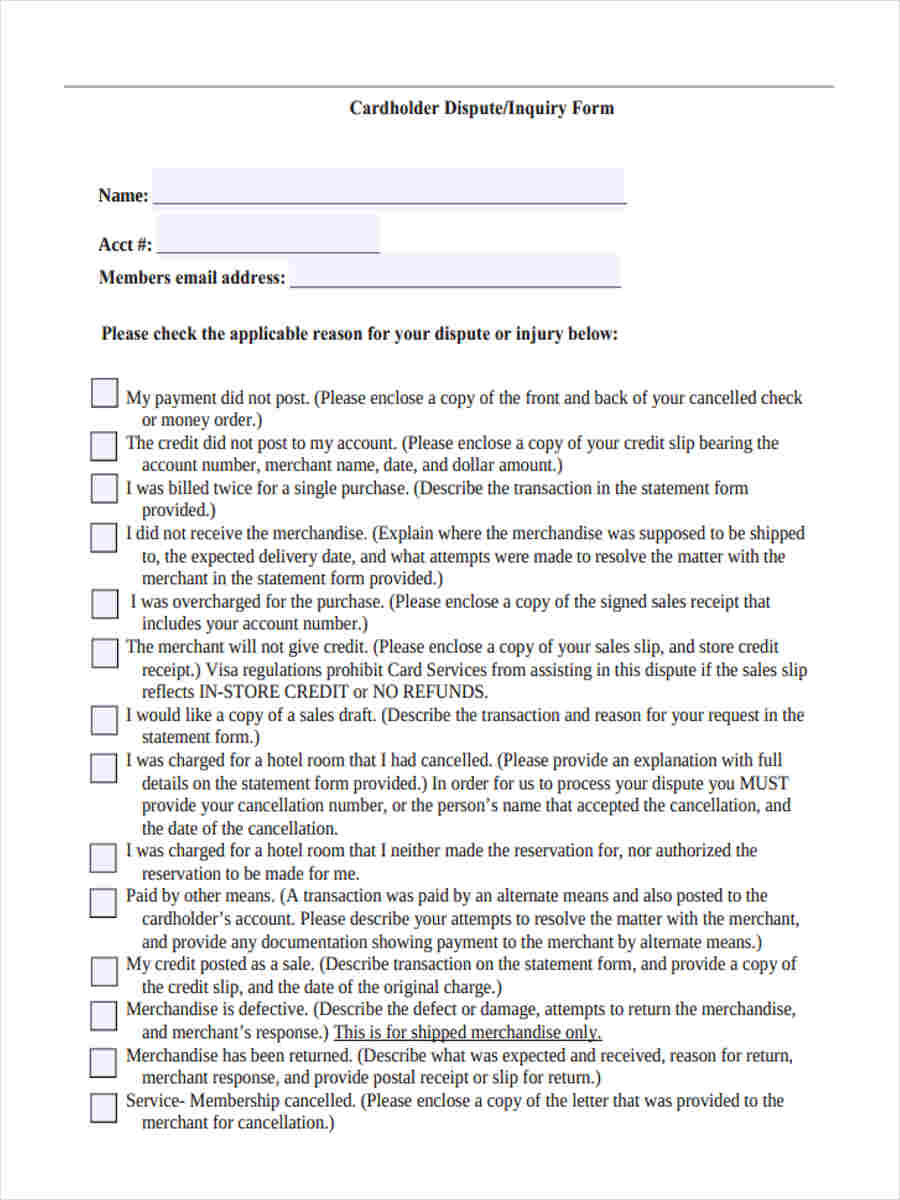

FREE 6+ Sample Credit Inquiry Forms in MS Word PDF

Please provide full account numbers with your request. Complete the credit inquiry request form (pdf*) including account numbers and customer authorization section. These are typically inquiries by lenders after you apply for credit. Web the purpose of credit inquiry is for the bank or any credit issuing company would know the creditworthiness of individual. This letter is to address all.

FREE 11+ Credit Inquiry Forms in PDF Ms Word

Call and speak to a live usagov agent. Lenders also make inquiries to review your existing accounts. Do you have a question? Web submitting a request to avoid processing delays, read important guidelines for completing a credit inquiry request form. Web two types of credit inquiries exist:

FREE 6+ Sample Credit Inquiry Forms in MS Word PDF

Lenders also make inquiries to review your existing accounts. This letter is to address all credit inquiries reporting on my credit report in the past 120 days. Web for instant access to your free credit report, visit www.annualcreditreport.com. These are typically inquiries by lenders after you apply for credit. Hard credit inquiries and soft credit inquiries—also referred to as hard.

These Are Typically Inquiries By Lenders After You Apply For Credit.

They will get you the answer or let you know where to find it. Your credit score and other details can influence the approval process as well as the interest rate for your mortgage. Chat with a live usagov agent. These inquiries will impact your credit score because most credit scoring models look at how recently and how frequently you apply for credit.

If You Apply For A Mortgage, You Can Expect The Lender To Make A Credit Inquiry.

Web a credit inquiry is a request for credit report information from a credit bureau. Lenders also make inquiries to review your existing accounts. 2) hard inquiry, occurs when a lending firm checks your credit report to determine your credit worthiness. Complete the credit inquiry request form (pdf*) including account numbers and customer authorization section.

Please Provide Full Account Numbers With Your Request.

May 25, 2023 share this page: Web for instant access to your free credit report, visit www.annualcreditreport.com. Do you have a question? Call and speak to a live usagov agent.

Web An Inquiry Refers To A Request To Look At Your Credit File, And It Generally Falls Into One Of Two Types.

Credit inquiries are typically made by financial institutions to help them determine whether to approve. Soft inquiry and hard inquiry. Use this form if you prefer to write to request your credit report from any, or all, of the nationwide consumer credit reporting companies. This letter is to address all credit inquiries reporting on my credit report in the past 120 days.