Cra Tax Disability Form

Cra Tax Disability Form - Web how do i submit form t2201 (disability tax credit certificate) to the cra? The information provided in this form will be used by the canada revenue agency (cra) to. Web social security representatives in the field offices usually obtain applications for disability benefits in person, by telephone, by mail, or by filing online. On this form or when using my account, you should indicate. The information provided in this form will be used by the canada revenue agency (cra) to. If you have a disability but don't. Web for every return you need amended, for up to the past ten years. Web the canada revenue agency (cra) has made it faster and easier than ever for persons with disabilities and their medical practitioners to complete the. Web disability tax credit how to apply eligibility guidelines how eligibility is determined fill out form t2201 submit your filled out form t2201 what happens after form t2201 is sent. The eligibility criteria for mental illnesses and psychological impairments have been modified.

Web if you’re calling on behalf of someone else, they must be present on the call to give their consent, or you must be authorized to call on their behalf. Cra reports annual reports, statistical reports, audit reports, and other. Web how to claim the dtc on your tax return. Web furthermore, the cra has recently developed a new digital application for the disability tax credit, which medical practitioners can use to fill out their portion of the. Web for every return you need amended, for up to the past ten years. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving the. Web forms, publications, and personalized correspondence in formats for persons with disabilities. Complete only the sections of part a that apply to you. The information provided in this form will be used by the canada revenue agency (cra) to. Web the disability must be persistent and continuous for at least one year.

The information provided in this form will be used by the canada revenue agency (cra) to. Web furthermore, the cra has recently developed a new digital application for the disability tax credit, which medical practitioners can use to fill out their portion of the. Web how do i submit form t2201 (disability tax credit certificate) to the cra? To claim the credit for the current tax year, you must enter the disability amount on your tax return. Remember to sign this form. Web the request is made either online using cra’s my account service or mailing a t1adj form to the cra. The eligibility criteria for mental illnesses and psychological impairments have been modified. The disability must be present at least 90% of the time. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving the. Complete only the sections of part a that apply to you.

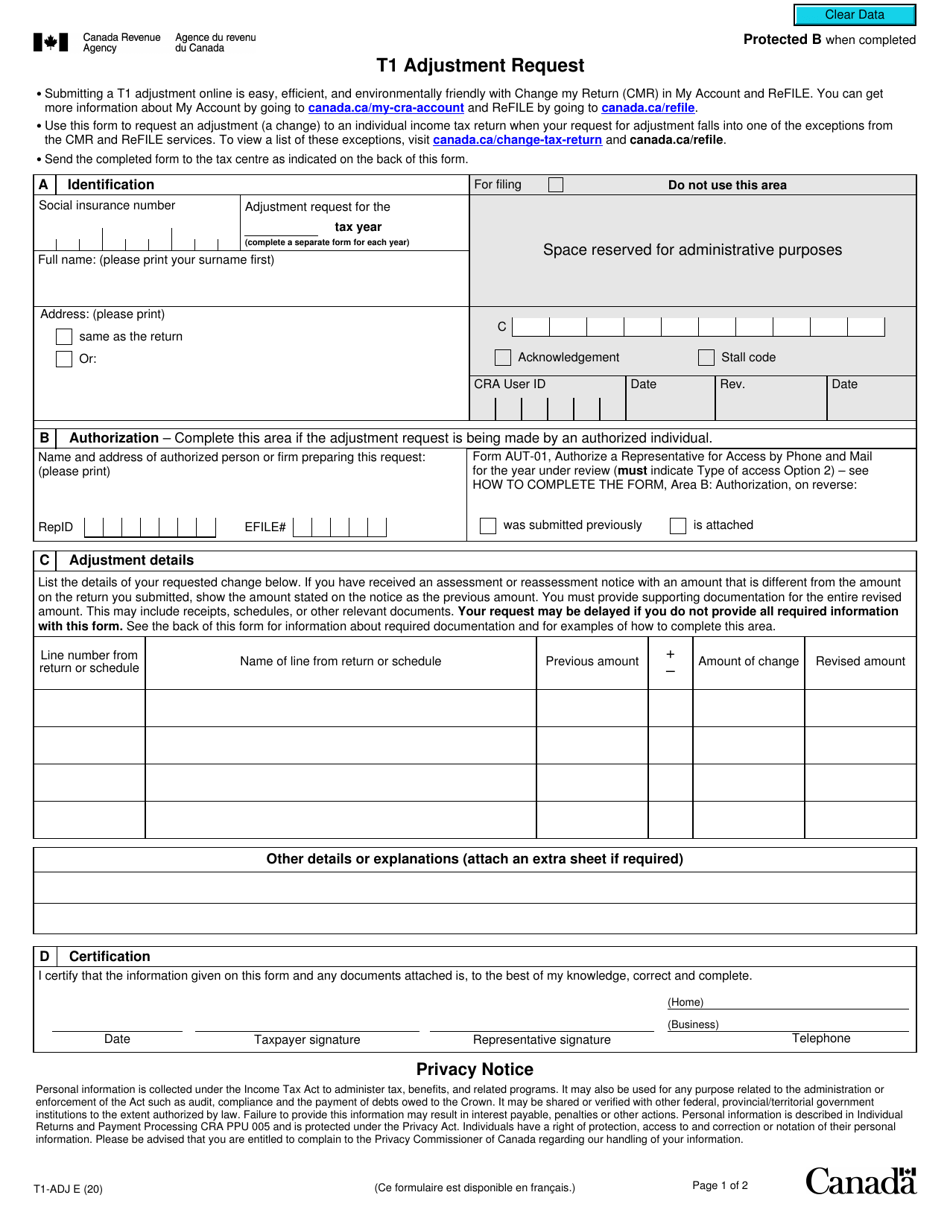

Form T1ADJ Download Fillable PDF or Fill Online T1 Adjustment Request

If you have a disability but don't. Any unused amount may be. Solved•by turbotax•13•updated october 05, 2022. Web the disability must be persistent and continuous for at least one year. Web the request is made either online using cra’s my account service or mailing a t1adj form to the cra.

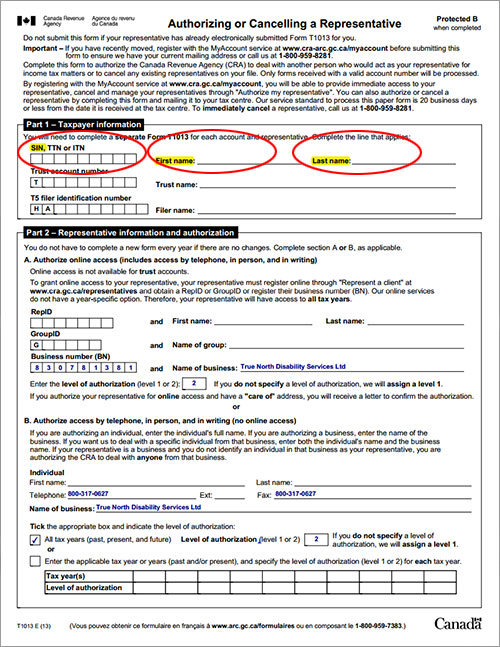

True North Disability Services

Web disability tax credit how to apply eligibility guidelines how eligibility is determined fill out form t2201 submit your filled out form t2201 what happens after form t2201 is sent. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving the..

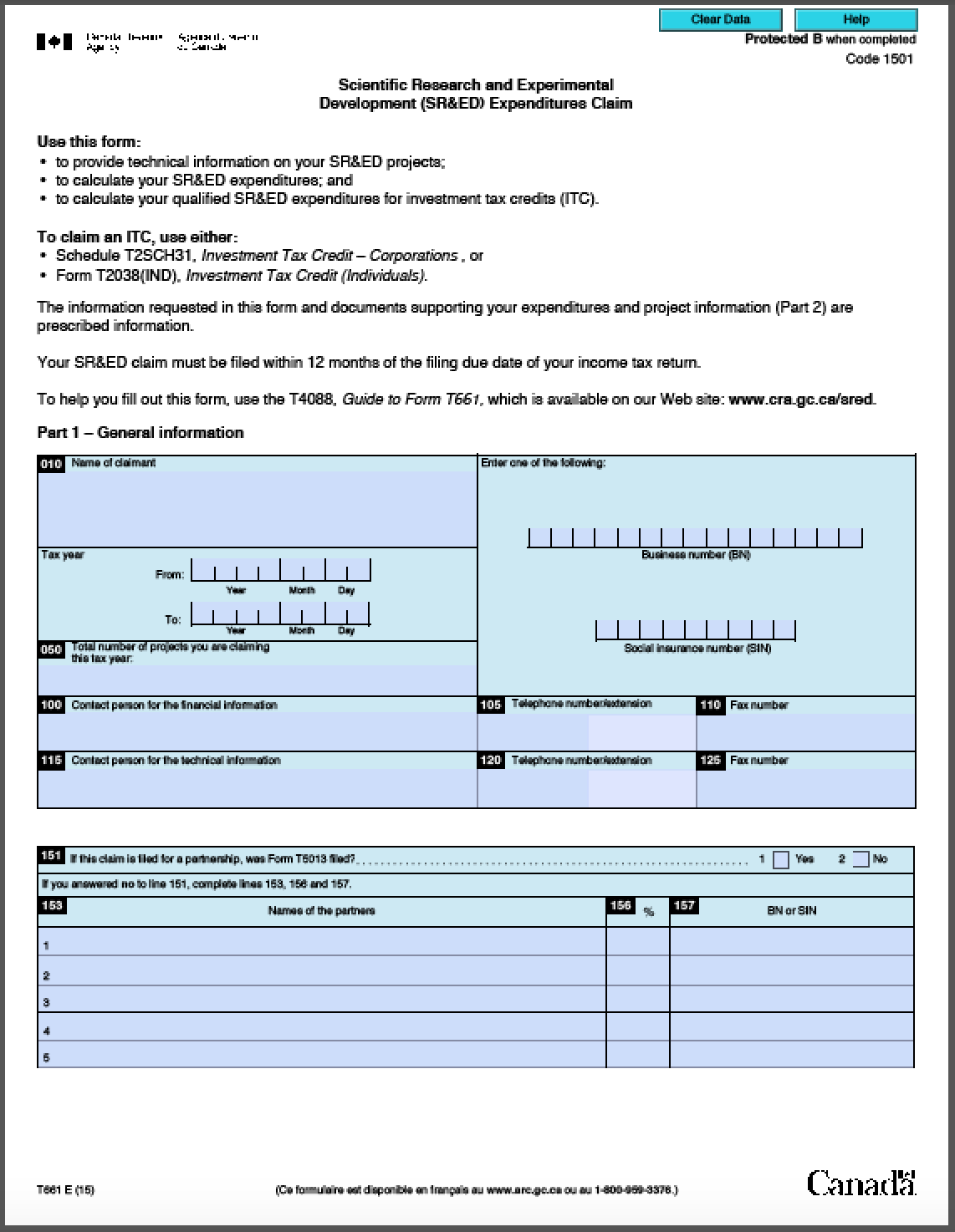

Fill Free fillable Government of Canada PDF forms

Web how do i submit form t2201 (disability tax credit certificate) to the cra? Complete only the sections of part a that apply to you. Web if your application is granted, the amount of any user fee collected in excess of $43 will be applied against your internal revenue code liabilities and reduce the amount of interest. Web forms, publications,.

20182022 Form Canada T2202A Fill Online, Printable, Fillable, Blank

A guide to the disability tax credit certificate. Solved•by turbotax•13•updated october 05, 2022. Web applicants can now complete part a of the dtc application using the new digital form. Complete only the sections of part a that apply to you. Web furthermore, the cra has recently developed a new digital application for the disability tax credit, which medical practitioners can.

21+ Tax Preparer Training Manual Pdf New Server

Web applicants can now complete part a of the dtc application using the new digital form. Remember to sign this form. Web how to claim the dtc on your tax return. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving.

CRA Penalties & Disability Tax Credits The Tax Ladies S1 E12 YouTube

Web furthermore, the cra has recently developed a new digital application for the disability tax credit, which medical practitioners can use to fill out their portion of the. Web if your application is granted, the amount of any user fee collected in excess of $43 will be applied against your internal revenue code liabilities and reduce the amount of interest..

How Much Is Disability Tax Credit Worth

Any unused amount may be. If you have a disability but don't. Web furthermore, the cra has recently developed a new digital application for the disability tax credit, which medical practitioners can use to fill out their portion of the. Web how to claim the dtc on your tax return. Web if you’re calling on behalf of someone else, they.

20202022 Form Canada T1213 Fill Online, Printable, Fillable, Blank

Any unused amount may be. Web applicants can now complete part a of the dtc application using the new digital form. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving the. Web the disability tax credit certificate (form t2201) has.

2022 Form Canada T2201 E Fill Online, Printable, Fillable, Blank

To claim the credit for the current tax year, you must enter the disability amount on your tax return. Remember to sign this form. Solved•by turbotax•13•updated october 05, 2022. On this form or when using my account, you should indicate. If you have a disability but don't.

How To Apply For Disability In Sc Disability Talk

A guide to the disability tax credit certificate. Web the disability must be persistent and continuous for at least one year. The disability must be present at least 90% of the time. Web applicants can now complete part a of the dtc application using the new digital form. Cra reports annual reports, statistical reports, audit reports, and other.

Remember To Sign This Form.

Ask a medical practitioner to complete and certify part b. Complete only the sections of part a that apply to you. Web simply write “disability severance pay” on form 1040x, line 15, and enter the standard refund amount listed below on line 15, column b, and on line 22, leaving the. Web for every return you need amended, for up to the past ten years.

The Information Provided In This Form Will Be Used By The Canada Revenue Agency (Cra) To.

Solved•by turbotax•13•updated october 05, 2022. Web applicants can now complete part a of the dtc application using the new digital form. To claim the credit for the current tax year, you must enter the disability amount on your tax return. If you have a disability but don't.

The Cra Will Review Your Adjustment Requests And Send You Any Refunds You Might Be Owed.

Web how do i submit form t2201 (disability tax credit certificate) to the cra? On this form or when using my account, you should indicate. Web if you’re calling on behalf of someone else, they must be present on the call to give their consent, or you must be authorized to call on their behalf. Web the canada revenue agency (cra) has made it faster and easier than ever for persons with disabilities and their medical practitioners to complete the.

Web Forms, Publications, And Personalized Correspondence In Formats For Persons With Disabilities.

Web the disability must be persistent and continuous for at least one year. Web how to claim the dtc on your tax return. Web furthermore, the cra has recently developed a new digital application for the disability tax credit, which medical practitioners can use to fill out their portion of the. Web social security representatives in the field offices usually obtain applications for disability benefits in person, by telephone, by mail, or by filing online.