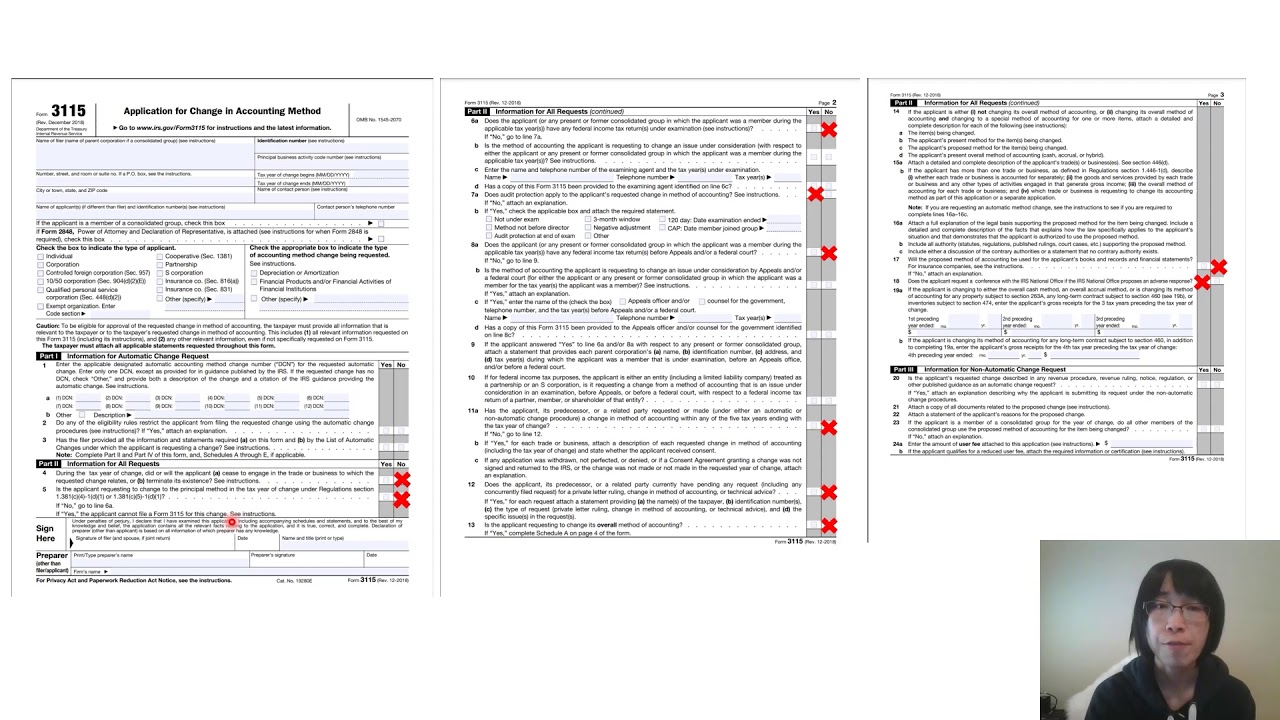

Correcting Depreciation Form 3115 Line-By-Line

Correcting Depreciation Form 3115 Line-By-Line - Web summary of the list of automatic accounting method changes. Electing the section 179 deduction. Web objectives this webinar will cover the following: File an extension in turbotax online before the deadline to avoid a late filing penalty. To change to the correct method, meaning to take the overlooked or correct depreciation requires the filing of the change in. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. In the instructions for information regarding automatic changes under sections 56, 167, 168, 197, 1400i, 1400l,. Web this will take you to screen 66.2, change in depreciation or amort (3115). If you forget to take depreciation on an. Web kristy will take you through line by line of form 3115.

When depreciation errors are detected on. Web you must file form 3115 under the automatic change procedures in duplicate as follows. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Web how do i file an irs extension (form 4868) in turbotax online? Web as i understand, 481(a) adjustment can be taken over 4 tax years (with form 3115). Web about form 3115, application for change in accounting method. Web common questions about form 3115 and regulation change. Web objectives this webinar will cover the following: Web this will take you to screen 66.2, change in depreciation or amort (3115). To change to the correct method, meaning to take the overlooked or correct depreciation requires the filing of the change in.

Figuring any section 179 deduction carryover to the next year. Web kristy will take you through line by line of form 3115. Web objectives this webinar will cover the following: When depreciation errors are detected on. {intermediate} this webinar will provide a synopsis on forms 1040x and 3115. Is there guidance/examples on the calculations? Figuring the maximum section 179 deduction for the current year. Electing the section 179 deduction. Web kristy takes you through line by line of form 3115. How do i clear and.

Chapter 3 add depreciation, closing entries, 4 diff timelines accts,

Web kristy will take you through line by line of form 3115. When depreciation errors are detected on. Web correcting depreciation and form 3115: File an extension in turbotax online before the deadline to avoid a late filing penalty. Web you must file form 3115 under the automatic change procedures in duplicate as follows.

Form 3115 Missed Depreciation printable pdf download

To change to the correct method, meaning to take the overlooked or correct depreciation requires the filing of the change in. Web summary of the list of automatic accounting method changes. How do i clear and. Is there guidance/examples on the calculations? File this form to request a change in either:

Form 3115 App for change in acctg method Capstan Tax Strategies

Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. Web objectives this webinar will cover the following: Web you must file form 3115 under the automatic change procedures in duplicate as follows. Web form 3115, change in accounting method,.

Form 3115 Definition, Who Must File, & More

Web objectives this webinar will cover the following: File an extension in turbotax online before the deadline to avoid a late filing penalty. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Enter the number of form 3115 to which item or class of property relates (defaults to 1)..

Correcting Depreciation Form 3115 LinebyLine

Enter the number of form 3115 to which item or class of property relates (defaults to 1). Web as i understand, 481(a) adjustment can be taken over 4 tax years (with form 3115). Web a change in method form 3115 must be filed. Figuring the maximum section 179 deduction for the current year. Web kristy takes you through line by.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Electing the section 179 deduction. File this form to request a change in either: File an extension in turbotax online before the deadline to avoid a late filing penalty. How do i clear and. Web kristy takes you through line by line of form 3115.

Form 3115 Applying a Cost Segregation Study on a Tax Return The

{intermediate} this webinar will provide a synopsis on forms 1040x and 3115. Figuring any section 179 deduction carryover to the next year. Enter the number of form 3115 to which item or class of property relates (defaults to 1). An overall method of accounting or. Web correcting depreciation and form 3115:

3115 Form now Required for ALL business owners with Depreciation

To change to the correct method, meaning to take the overlooked or correct depreciation requires the filing of the change in. Figuring the maximum section 179 deduction for the current year. Enter the number of form 3115 to which item or class of property relates (defaults to 1). Web common questions about form 3115 and regulation change. An overall method.

Form 3115 Depreciation Guru

Web about form 3115, application for change in accounting method. Figuring any section 179 deduction carryover to the next year. Web objectives this webinar will cover the following: Web a change in method form 3115 must be filed. Web this will take you to screen 66.2, change in depreciation or amort (3115).

How to catch up missed depreciation on rental property (part I) filing

When depreciation errors are detected on. {intermediate} this webinar will provide a synopsis on forms 1040x and 3115. Web objectives this webinar will cover the following: She will also demonstrate a change from an impermissible method of determining depreciation of. Web summary of the list of automatic accounting method changes.

Web You Must File Form 3115 Under The Automatic Change Procedures In Duplicate As Follows.

How do i clear and. She will also demonstrate a change from an impermissible method of determining depreciation of. An overall method of accounting or. Figuring any section 179 deduction carryover to the next year.

{Intermediate} This Webinar Will Provide A Synopsis On Forms 1040X And 3115.

Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. • attach the original form 3115 to the filer's timely filed (including extensions) federal. Web kristy will take you through line by line of form 3115. Web kristy takes you through line by line of form 3115.

Web About Form 3115, Application For Change In Accounting Method.

Web a change in method form 3115 must be filed. Web as i understand, 481(a) adjustment can be taken over 4 tax years (with form 3115). Enter the number of form 3115 to which item or class of property relates (defaults to 1). Web form 3115 correcting depreciation is a change in accounting method this is a 481(a) adjustment and does not cost the taxpayer anything corrects the depreciation for the.

File An Extension In Turbotax Online Before The Deadline To Avoid A Late Filing Penalty.

Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. File this form to request a change in either: Electing the section 179 deduction. Web this will take you to screen 66.2, change in depreciation or amort (3115).