Cobra Tax Form

Cobra Tax Form - Our customer support center is available for cobra assistance from 7 a.m. Web how do i apply for cobra coverage? Web there is a worksheet provided with the instructions to the irs form 941 that outlines how to calculate the two parts of the tax credit: Get your fillable template and complete it online using the instructions provided. Web you're required to reconcile the advance payment amount on your tax return using form 8962, premium tax credit, with the premium tax credit you are allowed on your return. It also requires employers and plans to provide notice. Pharmacy claim form | download pdf. Click the form name to access the cobra form and learn how to complete it. You must respond to the notice sent to you by the health care provider by the 60th day after the written notice is sent or the day health care. Web while cobra is temporary, in most circumstances, you can stay on cobra for 18 to 36 months.

Web cobra outlines how employees and family members may elect continuation coverage. Web there is a worksheet provided with the instructions to the irs form 941 that outlines how to calculate the two parts of the tax credit: Web how to fill out the cobra election form on the internet: Sign online button or tick the preview image of the form. Cobra allows a terminated employee the right to continue. To start the blank, utilize the fill camp; Web while cobra is temporary, in most circumstances, you can stay on cobra for 18 to 36 months. Click the form name to access the cobra form and learn how to complete it. Create professional documents with signnow. You must respond to the notice sent to you by the health care provider by the 60th day after the written notice is sent or the day health care.

Ad vast library of fillable legal documents. For more information on cobra. Web employer/plan administrator notice to employee of unavailability of continuation coverage. Web while cobra is temporary, in most circumstances, you can stay on cobra for 18 to 36 months. Web there is a worksheet provided with the instructions to the irs form 941 that outlines how to calculate the two parts of the tax credit: Web employer or plan to whom cobra premiums are payable is entitled to a taxit cred for the amount of the prmiume assistance. This coverage period provides flexibility to find other health insurance options. Blue cross blue shield global core. To start the blank, utilize the fill camp; The advanced tools of the editor.

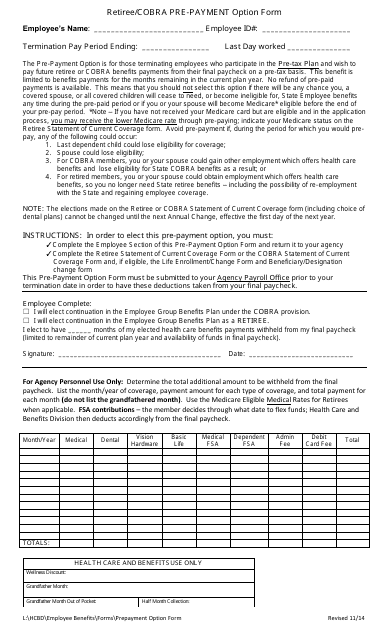

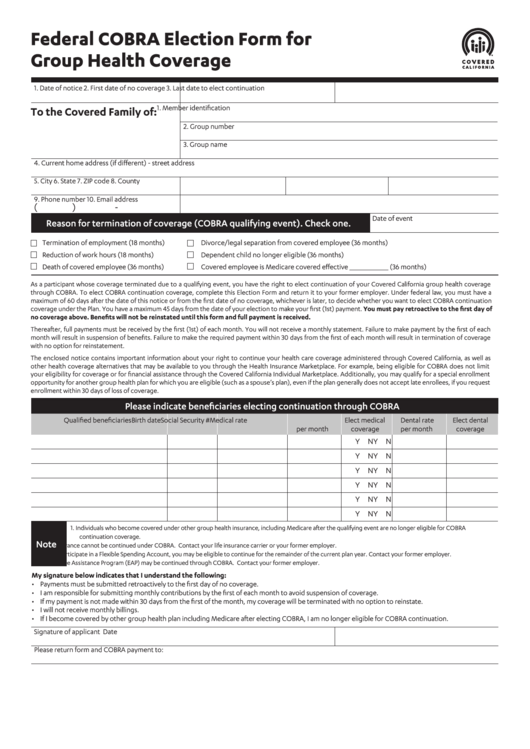

Federal Cobra Election Form For Group Health Coverage printable pdf

Web while cobra is temporary, in most circumstances, you can stay on cobra for 18 to 36 months. Web you're required to reconcile the advance payment amount on your tax return using form 8962, premium tax credit, with the premium tax credit you are allowed on your return. Web how do i apply for cobra coverage? Web the law amends.

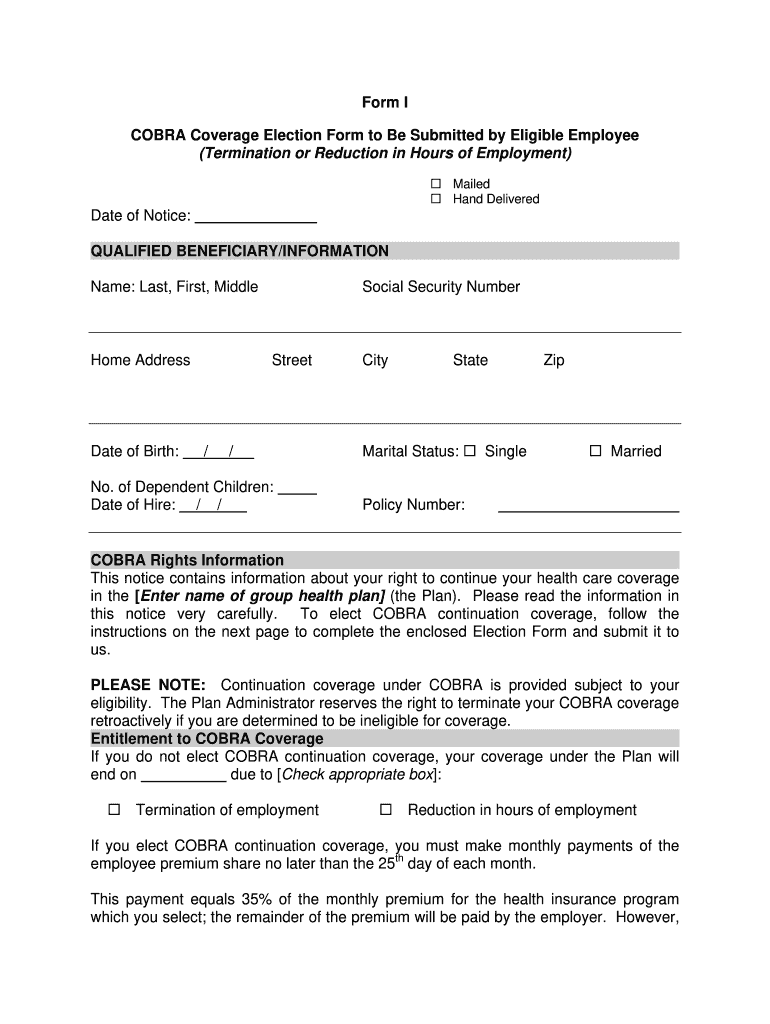

Cobra Letter To Employee 2020 Template Fill Online, Printable

Create professional documents with signnow. For more information on cobra. Ad vast library of fillable legal documents. Web employer/plan administrator notice to employee of unavailability of continuation coverage. Web medical/dental claim form | download pdf.

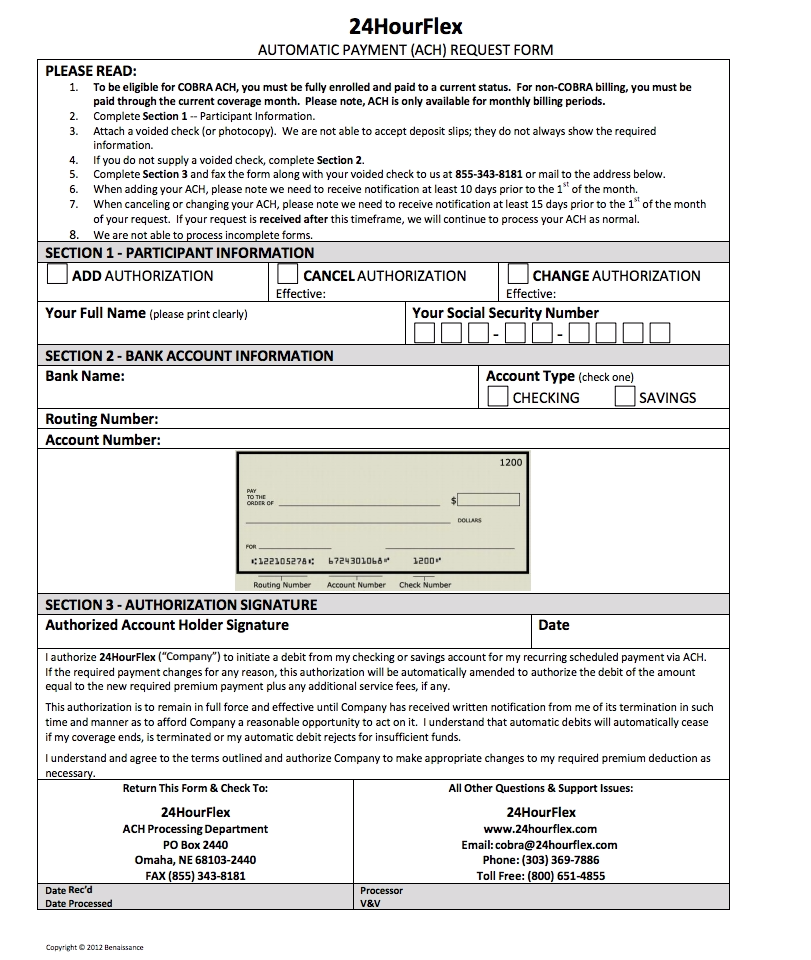

COBRA Making Your Monthly Premium Payments 24HourFlex

Pharmacy claim form | download pdf. Ad vast library of fillable legal documents. It also requires employers and plans to provide notice. For more information on cobra. In the marketplace, you could be eligible for a tax credit that lowers your.

Form 941 Instructions COBRA Subsidy Payments BerniePortal

Sign online button or tick the preview image of the form. Web cobra requires continuation coverage to be offered to covered employees, their spouses, former. Web cobra outlines how employees and family members may elect continuation coverage. Find the cobra forms you need to manage your cobra coverage. Claim inquiry form | download pdf.

Paychex Cobra Fill Online, Printable, Fillable, Blank PDFfiller

For more information on cobra. Web cobra outlines how employees and family members may elect continuation coverage. Blue cross blue shield global core. This coverage period provides flexibility to find other health insurance options. Ad vast library of fillable legal documents.

Solved The yearend financial statements of Rattlers Tax

Create professional documents with signnow. Web employer or plan to whom cobra premiums are payable is entitled to a taxit cred for the amount of the prmiume assistance. Web cobra outlines how employees and family members may elect continuation coverage. Web the law amends the employee retirement income security act, the internal revenue code and the public health service act.

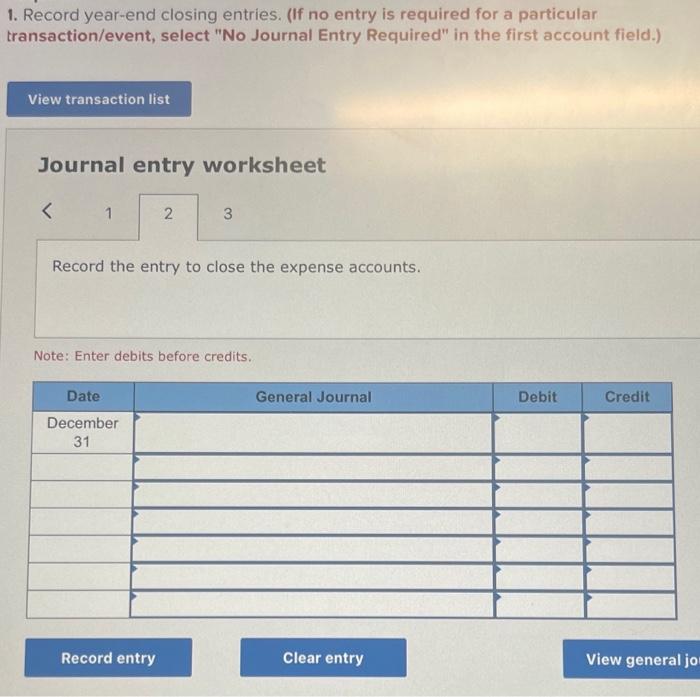

Retiree/Cobra Prepayment Option Form Download Fillable PDF

To start the blank, utilize the fill camp; Web while cobra is temporary, in most circumstances, you can stay on cobra for 18 to 36 months. Our customer support center is available for cobra assistance from 7 a.m. Web employer or plan to whom cobra premiums are payable is entitled to a taxit cred for the amount of the prmiume.

COBRA Election Form for Employee SmartLegalForms

Web how do i apply for cobra coverage? You must respond to the notice sent to you by the health care provider by the 60th day after the written notice is sent or the day health care. Click the form name to access the cobra form and learn how to complete it. Web you're required to reconcile the advance payment.

Can I Elect Cobra Online Form Fill Out and Sign Printable PDF

It also requires employers and plans to provide notice. Pharmacy claim form | download pdf. Cobra allows a terminated employee the right to continue. Web i have a question about cobra. Web you're required to reconcile the advance payment amount on your tax return using form 8962, premium tax credit, with the premium tax credit you are allowed on your.

ARPA Paid Leave and COBRA Tax Credits Ends Today HR Pros

Our customer support center is available for cobra assistance from 7 a.m. The advanced tools of the editor. Web there is a worksheet provided with the instructions to the irs form 941 that outlines how to calculate the two parts of the tax credit: It also requires employers and plans to provide notice. Web you're required to reconcile the advance.

Web If You're Unemployed You May Be Able To Get An Affordable Health Insurance Plan Through The Marketplace, With Savings Based On Your Income And Household Size.

The advanced tools of the editor. Best tool to create, edit & share pdfs. Web employer or plan to whom cobra premiums are payable is entitled to a taxit cred for the amount of the prmiume assistance. Blue cross blue shield global core.

Cobra Allows A Terminated Employee The Right To Continue.

Get your fillable template and complete it online using the instructions provided. It also requires employers and plans to provide notice. Web how to fill out the cobra election form on the internet: You must respond to the notice sent to you by the health care provider by the 60th day after the written notice is sent or the day health care.

Sign Online Button Or Tick The Preview Image Of The Form.

Web while cobra is temporary, in most circumstances, you can stay on cobra for 18 to 36 months. To start the blank, utilize the fill camp; Web you're required to reconcile the advance payment amount on your tax return using form 8962, premium tax credit, with the premium tax credit you are allowed on your return. Our customer support center is available for cobra assistance from 7 a.m.

Claim Inquiry Form | Download Pdf.

Web there is a worksheet provided with the instructions to the irs form 941 that outlines how to calculate the two parts of the tax credit: Find the cobra forms you need to manage your cobra coverage. Create professional documents with signnow. Web cobra outlines how employees and family members may elect continuation coverage.

.jpg)