Citibank Ira Withdrawal Form

Citibank Ira Withdrawal Form - Insured money market accounts or certificates of deposit (cds). A roth ira conversion cannot be undone or recharacterized. You cannot make a contribution to an inherited ira. When returning this form by mail, please mail to: Web provide the necessary information and documents to verify your ira beneficiaries. Click the arrow with the inscription next to move from one field to another. Web these traditional ira plan documents will provide you with information concerning your traditional ira and your savings and investment choices. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. That way, citi can add beneficiaries to your ira safely and securely. When returning this form by mail, please mail to:.

Complete the required fields which are colored in yellow. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. Click the arrow with the inscription next to move from one field to another. That way, citi can add beneficiaries to your ira safely and securely. Choose your product with an ira with citibank, you can choose from two types of deposit accounts: A roth ira conversion cannot be undone or recharacterized. When returning this form by mail, please mail to:. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Insured money market accounts or certificates of deposit (cds). A roth ira conversion cannot be undone or recharacterized.

When returning this form by mail, please mail to: That way, citi can add beneficiaries to your ira safely and securely. Web please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. Choose your product with an ira with citibank, you can choose from two types of deposit accounts: • a roth ira conversion cannot be undone or recharacterized. Insured money market accounts or certificates of deposit (cds). Web provide the necessary information and documents to verify your ira beneficiaries. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. A roth ira conversion cannot be undone or recharacterized. Click the arrow with the inscription next to move from one field to another.

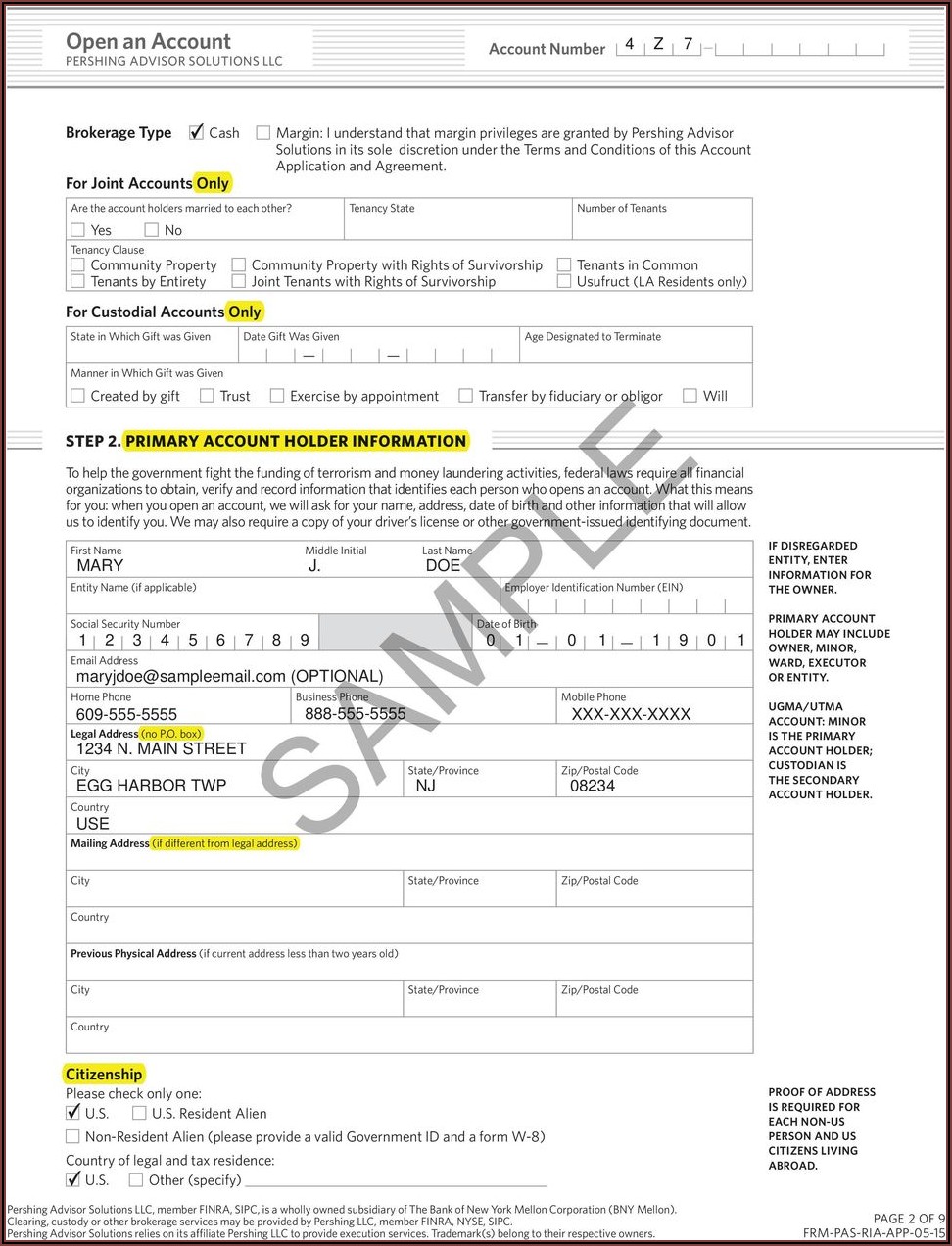

Pershing Ira Withdrawal Form Form Resume Examples goVLdJqpVv

Web provide the necessary information and documents to verify your ira beneficiaries. Web converting a traditional ira to a roth ira • please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. Web the candidates must submit it before the laps of the deadline, which can be checked from the table below.application.

Hr Block Ira Withdrawal Form Universal Network

When returning this form by mail, please mail to:. Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: Web converting a traditional ira to a roth ira • please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. If you already have a citibank roth.

What You Need to Know About Withdrawing from an IRA (Infographic)

Web please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. • a roth ira conversion cannot be undone or recharacterized. When returning this form by mail, please mail to: You cannot make a contribution to an inherited ira. That way, citi can add beneficiaries to your ira safely and securely.

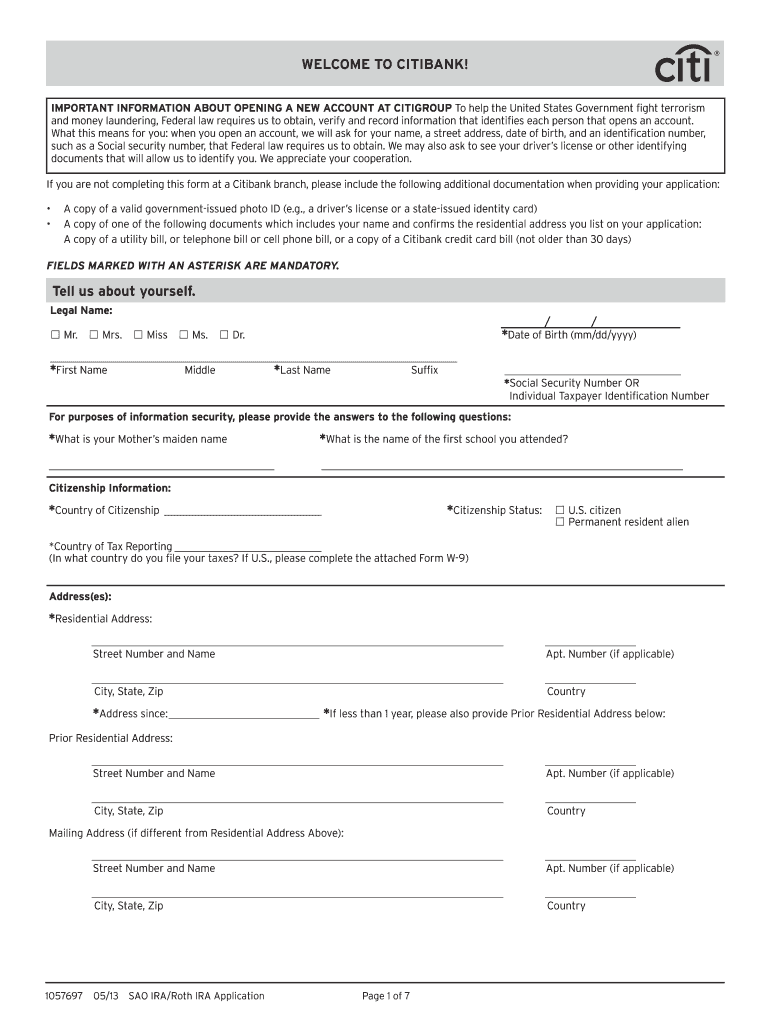

Citibank Ira Withdrawal Form Fill Out and Sign Printable PDF Template

That way, citi can add beneficiaries to your ira safely and securely. Web these traditional ira plan documents will provide you with information concerning your traditional ira and your savings and investment choices. • if a completed roth ira application form. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a.

Ira Mandatory Withdrawal Formula Universal Network

If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. A roth ira conversion cannot be undone or recharacterized. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. Web.

Fidelity Ira Distribution Request Form Universal Network

A roth ira conversion cannot be undone or recharacterized. Click the arrow with the inscription next to move from one field to another. That way, citi can add beneficiaries to your ira safely and securely. • attach a completed citibank ira and roth ira withdrawal and tax withholding election form. If you already have a citibank roth ira, please use.

ads/responsive.txt John Hancock Ira withdrawal form Best Of Unnecessary

Web the candidates must submit it before the laps of the deadline, which can be checked from the table below.application form released onjuly 25, 2017last date to submit application form(for national candidates)september 08, 2017 september 15, 2017last date to submit the application form(by foreign national and nri)february 15, 2018iift mba ib. Complete the required fields which are colored in yellow..

Ira Withdrawal Formula Universal Network

• a roth ira conversion cannot be undone or recharacterized. Complete the required fields which are colored in yellow. Web please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. A roth ira conversion cannot be undone or recharacterized. Insured money market accounts or certificates of deposit (cds).

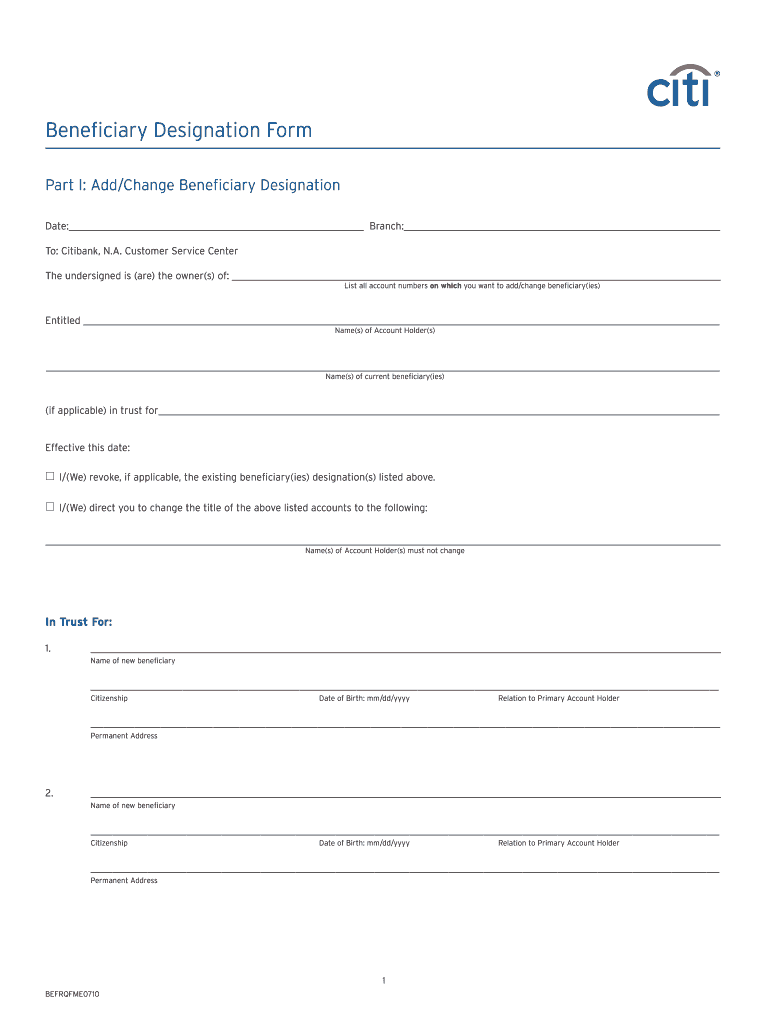

Beneficiary Form Fill Out and Sign Printable PDF Template signNow

Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web converting a traditional ira to a roth ira • please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. If you already have a citibank roth ira, please use the roth ira contribution form to convert.

Ira Withdrawal Form Citibank Universal Network

A roth ira conversion cannot be undone or recharacterized. Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: You cannot make a contribution to an inherited ira. When returning this form by mail, please mail to:. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form.

• Attach A Completed Citibank Ira And Roth Ira Withdrawal And Tax Withholding Election Form.

Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: When returning this form by mail, please mail to:. Complete the required fields which are colored in yellow. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form.

Web These Traditional Ira Plan Documents Will Provide You With Information Concerning Your Traditional Ira And Your Savings And Investment Choices.

When returning this form by mail, please mail to: Choose your product with an ira with citibank, you can choose from two types of deposit accounts: Web please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. A roth ira conversion cannot be undone or recharacterized.

Insured Money Market Accounts Or Certificates Of Deposit (Cds).

Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web the candidates must submit it before the laps of the deadline, which can be checked from the table below.application form released onjuly 25, 2017last date to submit application form(for national candidates)september 08, 2017 september 15, 2017last date to submit the application form(by foreign national and nri)february 15, 2018iift mba ib. A roth ira conversion cannot be undone or recharacterized. • a roth ira conversion cannot be undone or recharacterized.

That Way, Citi Can Add Beneficiaries To Your Ira Safely And Securely.

• if a completed roth ira application form. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. Web converting a traditional ira to a roth ira • please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. Click the arrow with the inscription next to move from one field to another.