Chapter 3 Test A Accounting

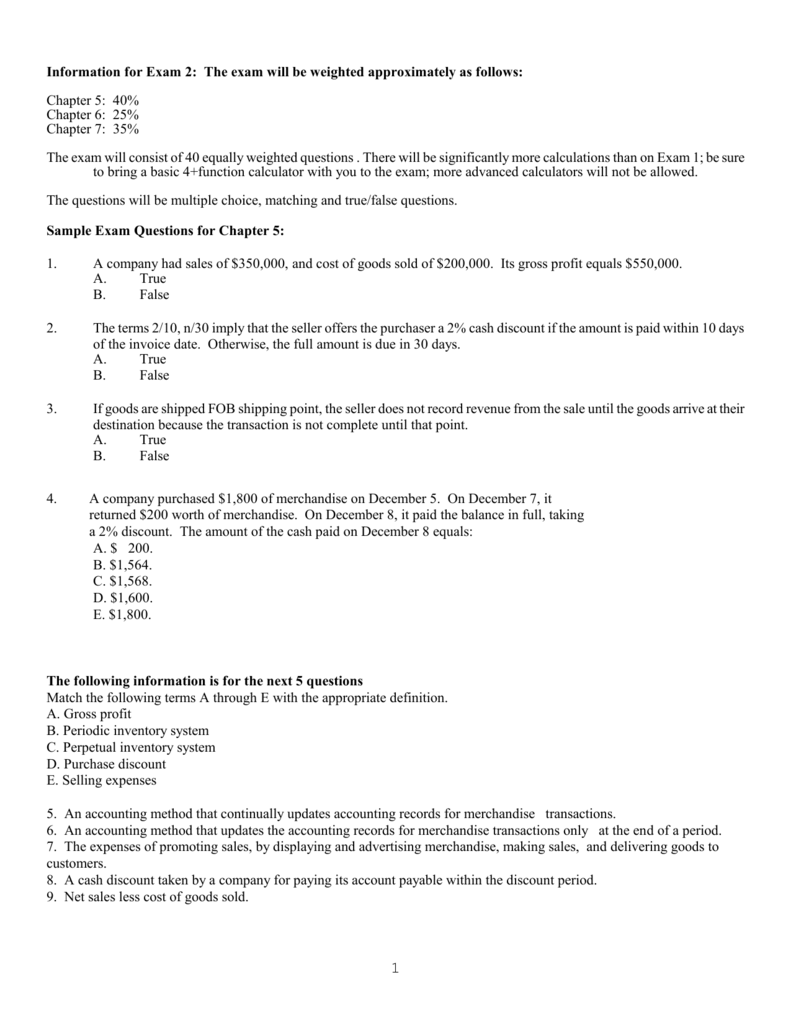

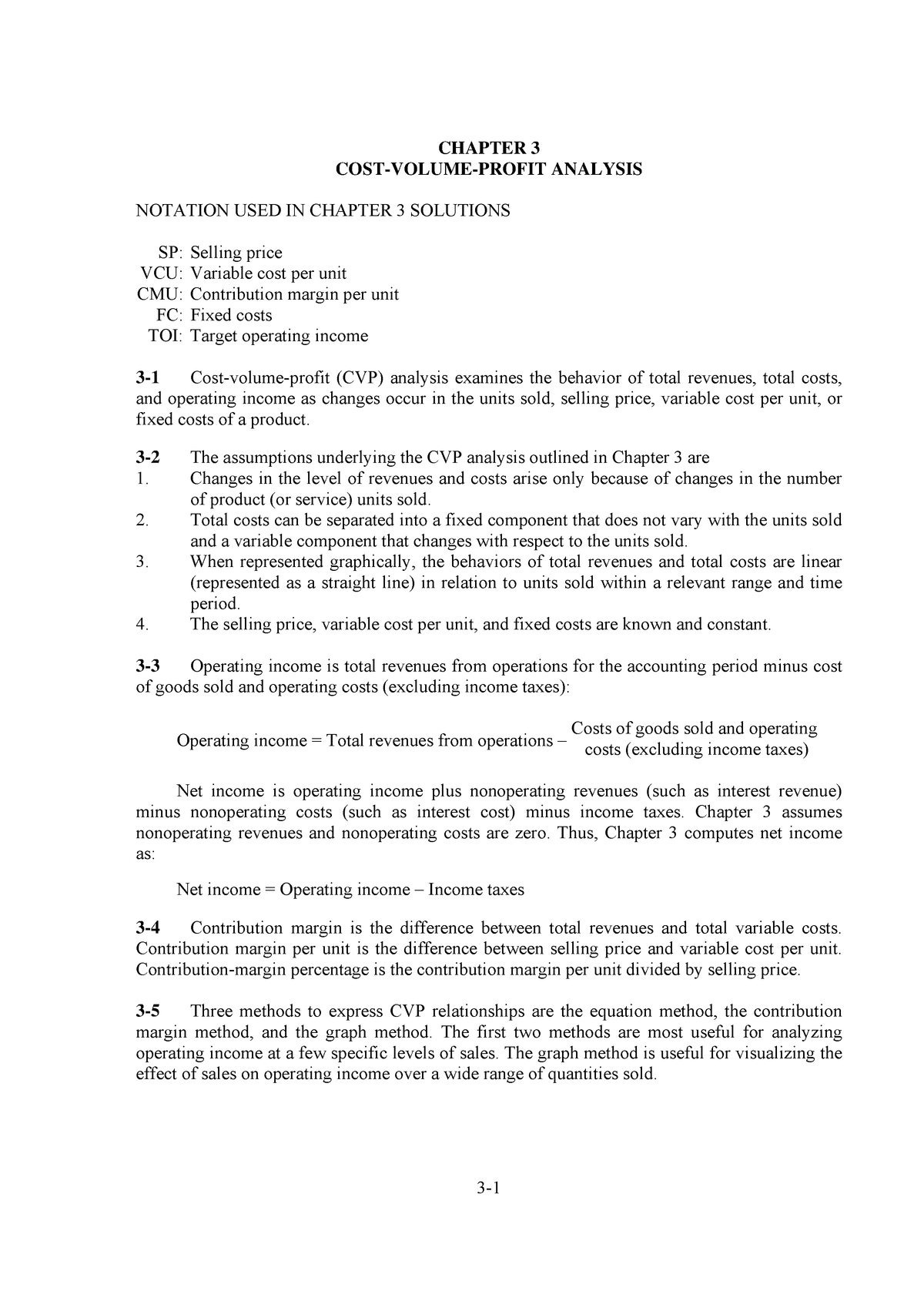

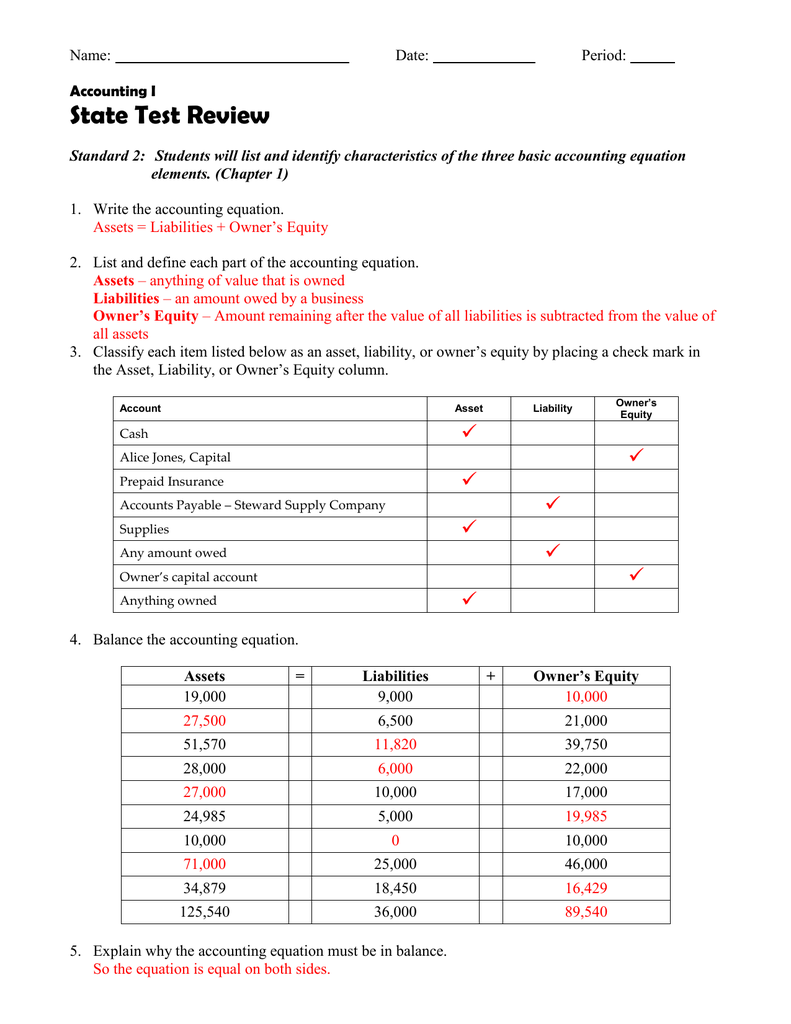

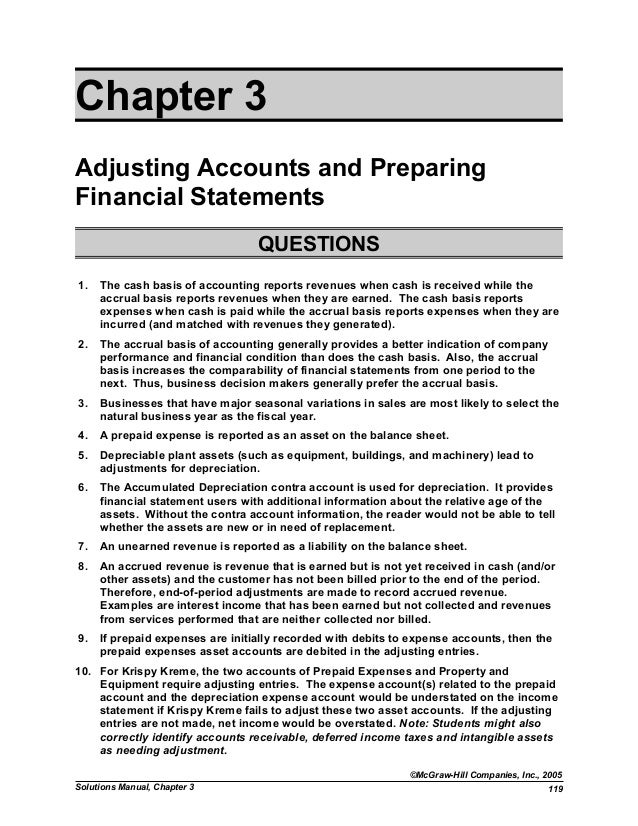

Chapter 3 Test A Accounting - Explain the reasons for preparing adjusting entries. Answers with explanations are at the end of the test. Web chapter 3 questions multiple choice the revenue recognition principle state that: Web terms in this set (14) true. The source document for all cash payments is a check. Web chapter 3 the accounting information system ifrs questions are available at the end of this chapter. The recording of debit and credit parts of a transaction. Web identify steps in the accounting cycle. Accounting principles keiso chapter 3 test bank chapter adjusting the accounts. Explain the time period assumption.

Differentiate the cash basis of accounting from the accrual basis of accounting… A receipt is the source document for cash received from transactions other than sales. Web 1.1 explain the importance of accounting and distinguish between financial and managerial accounting; When you reach the second objective. Multiperiod costs and revenues that must be split among two or more accounting. Explain the time period assumption. Web chapter 3 questions multiple choice the revenue recognition principle state that: Web chapter 3 the accounting information system ifrs questions are available at the end of this chapter. The 35 questions include many topics covered in a typical accounting 101 class. Explain the reasons for preparing adjusting entries.

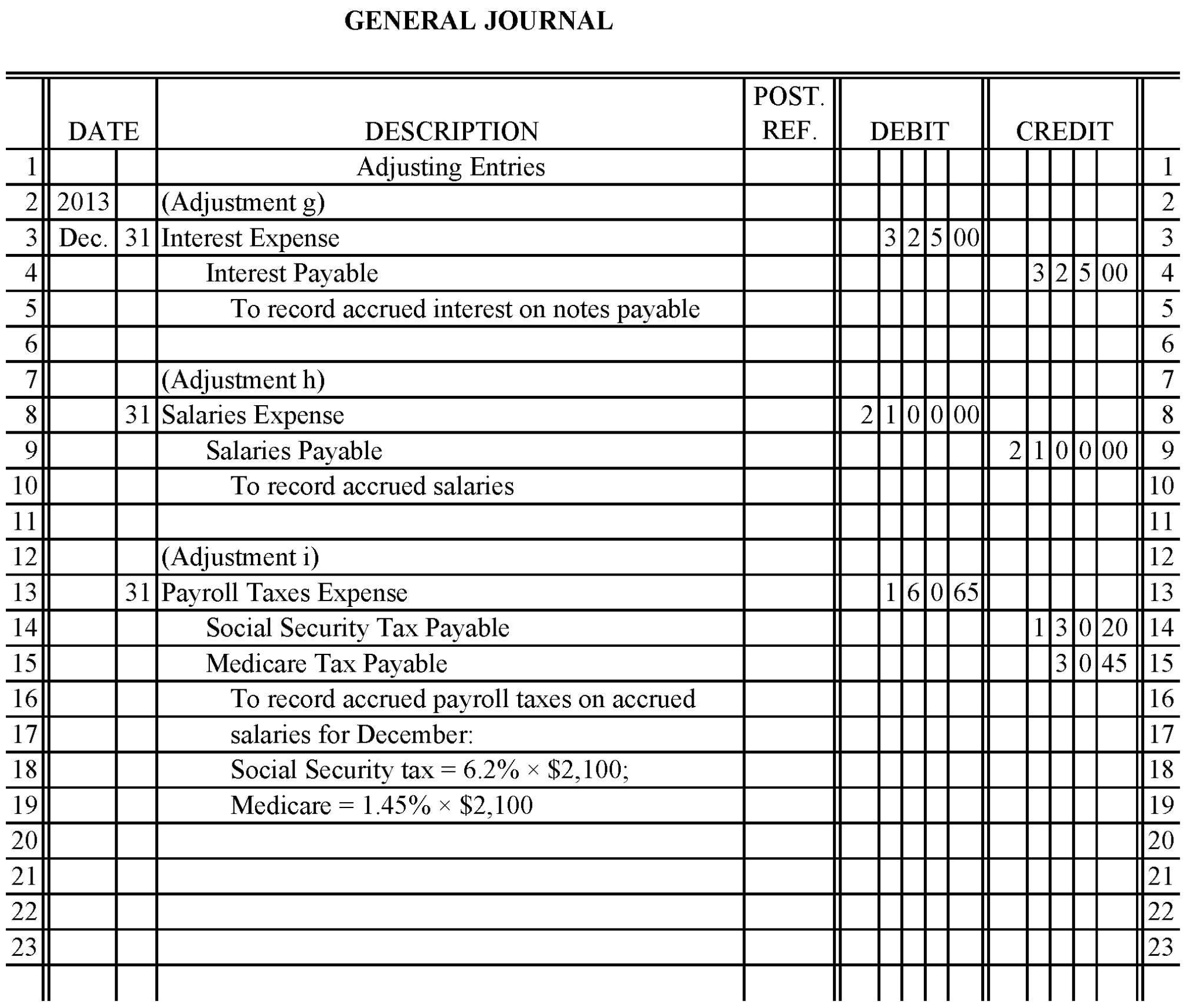

Web chapter 3 the accounting information system ifrs questions are available at the end of this chapter. Prepare financial statements from the adjusted trial balance. The major types of adjusting entries are deferrals (prepaid expenses and unearned revenues) and accruals (accrued revenues and accrued expenses). Kristina russo | cpa, mba, author. The 35 questions include many topics covered in a typical accounting 101 class. The source document for all cash payments is a check. Web 35 basic accounting test questions. Click the card to flip 👆. Web accounting test chapter 3. The recording of debit and credit parts of a transaction.

Chapter 13 Solutions College Accounting ( Chapters 130) 13th Edition

Expenses should be matched with revenues revenue should be recognized in the accounting period in which a performance. Web chapter 3 the accounting information system ifrs questions are available at the end of this chapter. The major types of adjusting entries are deferrals (prepaid expenses and unearned revenues) and accruals (accrued revenues and accrued expenses). A business form ordering a.

Ch03 Summary Financial Accounting IFRS, 3rd Edition CHAPTER 3

Explain the time period assumption. Web accounting chapter 3 quiz. Web accounting chapter 3 test a. Explain the accrual basis of accounting. Web accounting test chapter 3.

Chapter 6 Study Guide Accounting True And False Study Poster

Web chapter 3 questions multiple choice the revenue recognition principle state that: Kristina russo | cpa, mba, author. Web accounting chapter 3 test a. Click the card to flip 👆. Expenses should be matched with revenues revenue should be recognized in the accounting period in which a performance.

College Accounting, Chapters 1 15, 23rd Edition 9781337794763 Cengage

Our solutions are written by chegg experts so you can be assured of the highest quality! Record transactions in journals, post to ledger accounts, and prepare a trial balance. The source document for all cash payments is a check. Web chapter 3 questions multiple choice the revenue recognition principle state that: Take this short quiz to assess your knowledge of.

Accounting Course Pdf Download Design Pro Makerr

Explain the reasons for preparing adjusting entries. Web accounting test chapter 3. Web accounting chapter 3 quiz. There could be an equal decrease. A business paper from which information is.

Chapter 3 Review Business Transactions And The Accounting Equation

Expenses should be matched with revenues revenue should be recognized in the accounting period in which a performance. Web 1.1 explain the importance of accounting and distinguish between financial and managerial accounting; Web accounting chapter 3 test a. Click the card to flip 👆. The recording of debit and credit parts of a transaction.

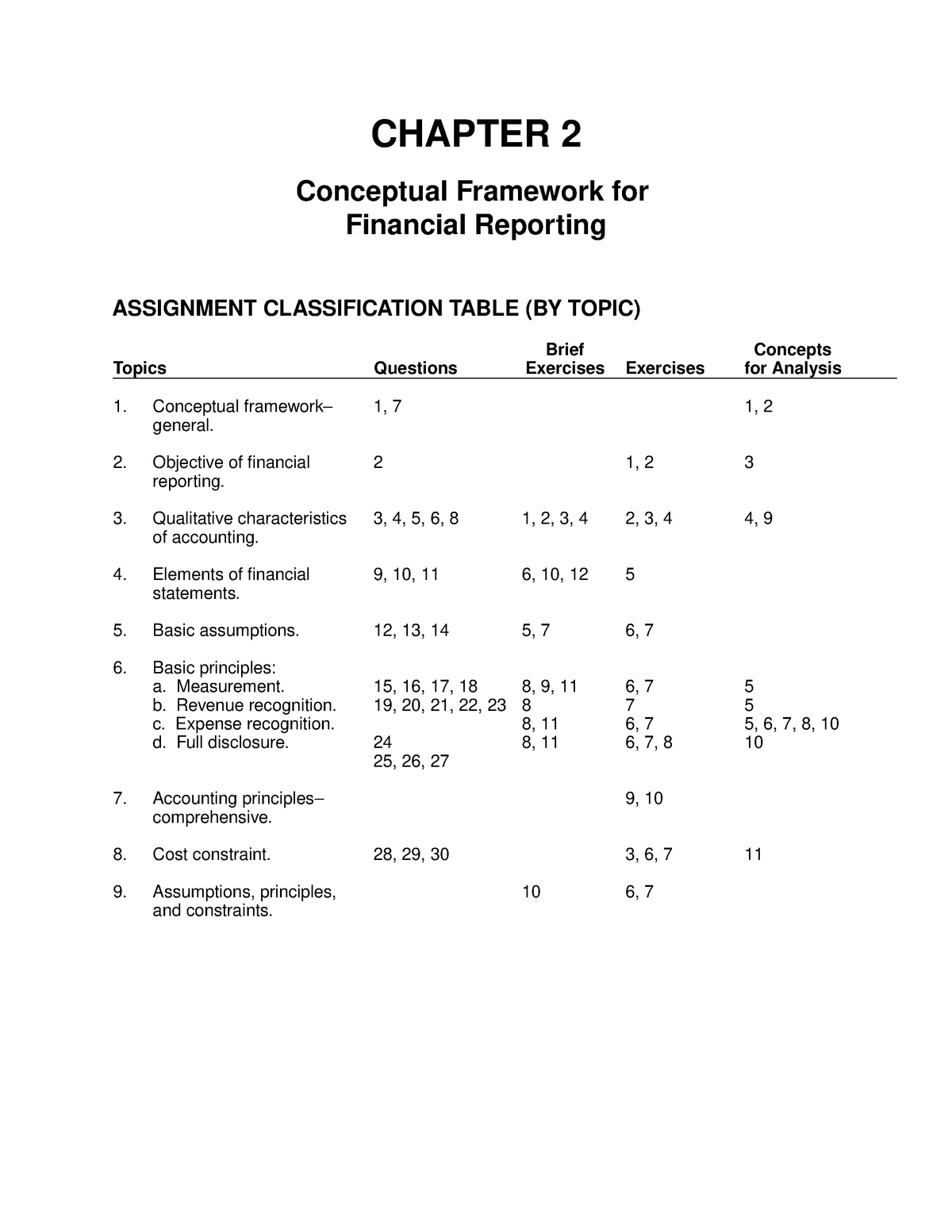

Intermediate Accounting Chapter 2 Solutions ACCT 310 StuDocu

Record transactions in journals, post to ledger accounts, and prepare a trial balance. The time period assumption assumes that the economic life of a business is divided into artificial time periods. When you reach the second objective. Other sets by this creator. Kristina russo | cpa, mba, author.

Solution manual chapter 3 fap

Web chapter 3 questions multiple choice the revenue recognition principle state that: Explain the time period assumption. (b) there must always be entries made on both sides of the accounting. Explain the reasons for preparing adjusting entries. Record transactions in journals, post to ledger accounts, and prepare a trial balance.

Advanced accounting 12th edition fischer solutions manual by Duchac Issuu

Web access principles of cost accounting 17th edition chapter 3 solutions now. The time period assumption assumes that the economic life of a business is divided into artificial time periods. Web terms in this set (14) true. If an individual asset is increased, then. Multiperiod costs and revenues that must be split among two or more accounting.

Chapter 3 Accounting Systems Test

Web chapter 3 questions multiple choice the revenue recognition principle state that: A receipt is the source document for cash received from transactions other than sales. Explain the reasons for preparing adjusting entries. Web 1.1 explain the importance of accounting and distinguish between financial and managerial accounting; Explain the accrual basis of accounting.

_____________ Records Revenues When Services Are Provided, And Records Expenses When Incurred.

Expenses should be matched with revenues revenue should be recognized in the accounting period in which a performance. Click the card to flip 👆. Survey the uninhabited floating city. Record transactions in journals, post to ledger accounts, and prepare a trial balance.

Web Accounting Test Chapter 3.

The 35 questions include many topics covered in a typical accounting 101 class. Our solutions are written by chegg experts so you can be assured of the highest quality! Web 1.1 explain the importance of accounting and distinguish between financial and managerial accounting; (b) there must always be entries made on both sides of the accounting.

Terms In This Set (21) Source Document.

Web chapter 3 questions multiple choice the revenue recognition principle state that: Explain the accrual basis of accounting. The major types of adjusting entries are deferrals (prepaid expenses and unearned revenues) and accruals (accrued revenues and accrued expenses). A receipt is the source document for cash received from transactions other than sales.

When You Reach The Second Objective.

Accounting principles keiso chapter 3 test bank chapter adjusting the accounts. There could be an equal decrease in stockholders' equity. Differentiate the cash basis of accounting from the accrual basis of accounting… Prepare financial statements from the adjusted trial balance.