Chapter 13 Bankruptcy Repossession

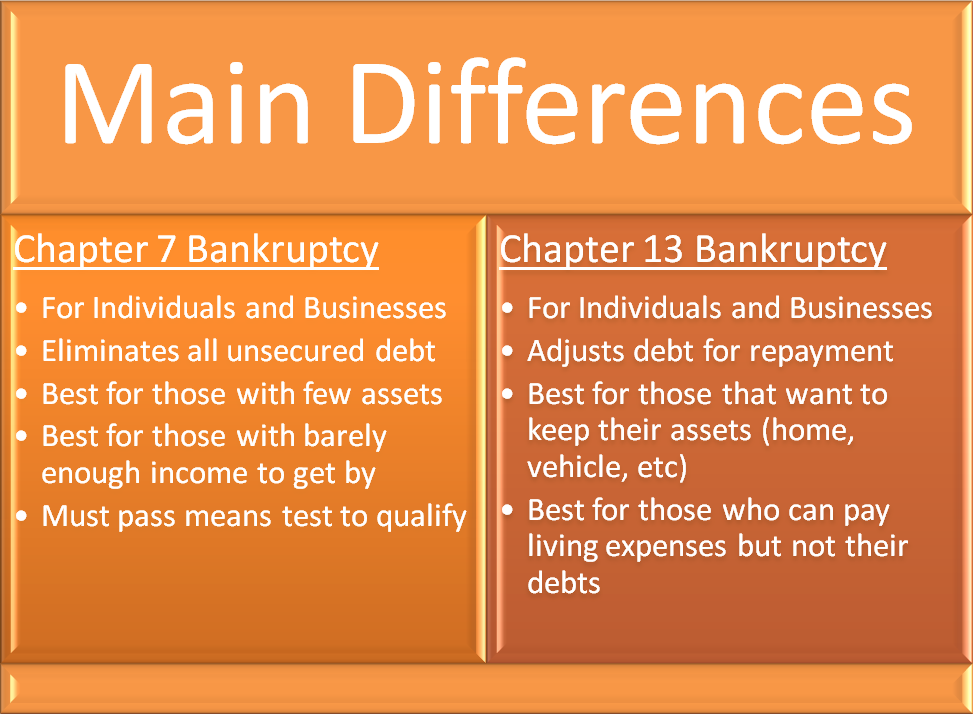

Chapter 13 Bankruptcy Repossession - If your lender is suing you for a deficiency balance, filing for bankruptcy relief can stop the lawsuit. Falling behind on your car payments might have you wondering if you could use bankruptcy. This allows a bankruptcy filer to keep their car by preventing the car loan from being discharged in the bankruptcy. Or you can contact us online and schedule your free chapter 13 bankruptcy consultation. Web attorney fees (collectively referred to as “safe harbor fees”) incurred by lawyers representing secured creditors shall be presumed reasonable in chapter 13 cases if such fees are timely. Web a chapter 13 bankruptcy attorney can help make sure this does not happen. Chapter 13 bankruptcy, commonly known as a wage earner’s plan, presents a lifeline to individuals seeking to reorganize their debts and create a manageable repayment strategy. Contrary to chapter 7 bankruptcy, which necessitates the liquidation of assets, chapter. Web in chapter 13, you might have an option called the cramdown by which you repay the lender the market value of your vehicle instead of what you actually owe on the loan. Web let's be clear, filing a chapter 13 bankruptcy isn't the best way to avoid auto repossession.

Chapter 13 bankruptcy, commonly known as a wage earner’s plan, presents a lifeline to individuals seeking to reorganize their debts and create a manageable repayment strategy. To learn more about this option, see car loan cramdowns in bankruptcy. How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court. A chapter 7 or chapter 13 bankruptcy discharge can eliminate. This will prevent foreclosure and/or property repossession. If your lender is suing you for a deficiency balance, filing for bankruptcy relief can stop the lawsuit. Web if your automobile is repossessed before you file a chapter 13 bankruptcy, the creditor will need to return the vehicle to you in most situations. Contrary to chapter 7 bankruptcy, which necessitates the liquidation of assets, chapter. Web what is chapter 13 bankruptcy and how can it help prevent vehicle repossession? Web a charge off and a repossession are two very different things—although both could happen to one debt.

How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court. Web if your automobile is repossessed before you file a chapter 13 bankruptcy, the creditor will need to return the vehicle to you in most situations. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. Web chapter 13 and vehicle repossession filing for bankruptcy does not always mean that a person has to surrender all his or her assets, including a new car. Kentucky residents might be relieved to learn that a chapter 13 bankruptcy. Contrary to chapter 7 bankruptcy, which necessitates the liquidation of assets, chapter. Certain debts are nondischareable in bankruptcy. Web a chapter 13 bankruptcy attorney can help make sure this does not happen. Web what is chapter 13 bankruptcy and how can it help prevent vehicle repossession? It does temporarily prevent repossession with an automatic stay, but you still have to pay your car loan.

Five Tips On Getting Your Car Back After A Repossession Brine

Take inventory of the property you have. This will prevent foreclosure and/or property repossession. Web bankruptcy can eliminate a deficiency after repossession. A chapter 13 plan must conform to local bankruptcy form m. Web to keep your home in chapter 13, you must stay current on your mortgage.

Chapter 13 bankruptcy explained YouTube

A chapter 13 plan must conform to local bankruptcy form m. One tool is a reaffirmation agreement in a chapter 7 case. Web what is chapter 13 bankruptcy and how can it help prevent vehicle repossession? Web in a nutshell you have options for what to do with a car loan when filing a chapter 7 case, including reaffirmation, redemption,.

Chapter 7 Bankruptcy Do you qualify, how to file

Repayment of the loan is dealt with later in the bankruptcy case in the debtor’s chapter 13. Falling behind on your car payments might have you wondering if you could use bankruptcy. Web bankruptcy can eliminate a deficiency after repossession. Web a chapter 13 bankruptcy attorney can help make sure this does not happen. It does temporarily prevent repossession with.

Cost of filing Chapter 13 bankruptcy A quick overview Galler Law Firm

Web unexpired lease and arising from the foreclosure, repossession, or surrender of collateral. A chapter 13 plan must conform to local bankruptcy form m. Web what is chapter 13 bankruptcy and how can it help prevent vehicle repossession? Web a charge off and a repossession are two very different things—although both could happen to one debt. Web attorney fees (collectively.

Things NOT to Do Before Filing for Bankruptcy Loan Lawyers

A chapter 7 or chapter 13 bankruptcy discharge can eliminate. It does temporarily prevent repossession with an automatic stay, but you still have to pay your car loan. Web attorney fees (collectively referred to as “safe harbor fees”) incurred by lawyers representing secured creditors shall be presumed reasonable in chapter 13 cases if such fees are timely. Web in chapter.

The Chapter 13 Discharge Chapter 13 Bankruptcy Attorney

What are the steps to filing a chapter 13 bankruptcy? Web a chapter 13 bankruptcy allows them to make up their overdue payments over time and to reinstate the original agreement. Web bankruptcy can eliminate a deficiency after repossession. All chapter 13 plans must be signed by the debtor and are subject to local bankruptcy. Kentucky residents might be relieved.

BANKRUPTCY BASICS PART 7 CHAPTER 13 Chapter 7 & Chapter 13

Web to keep your home in chapter 13, you must stay current on your mortgage. Where a debtor has valuable nonexempt property and wants to keep it, a chapter 13. We can explain when you should file a proof of claim on behalf of creditors and answer other questions you may have throughout your case. Or you can contact us.

Chapter 13 Bankrutpcy Will Prevent Repossession Of Your Vehicle

Web in a nutshell you have options for what to do with a car loan when filing a chapter 7 case, including reaffirmation, redemption, or surrender. Entering into a reaffirmation agreement can lead to new debt problems if you default on your car loan payments after bankruptcy. This will prevent foreclosure and/or property repossession. Web what is chapter 13 bankruptcy.

How Long Does Chapter 13 Bankruptcy Take in &

Contrary to chapter 7 bankruptcy, which necessitates the liquidation of assets, chapter. Web bankruptcy can eliminate a deficiency after repossession. Kentucky residents might be relieved to learn that a chapter 13 bankruptcy. Web unexpired lease and arising from the foreclosure, repossession, or surrender of collateral. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession.

Chapter 7 Bankruptcy vs Chapter 13 Bankruptcy Arizona Bankruptcy

Web a charge off and a repossession are two very different things—although both could happen to one debt. Web both chapter 7 and chapter 13 bankruptcy provide useful tools that may make avoiding repossession possible. How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court. Web the automatic stay prevents a.

Web Vehicle Repossession & Chapter 13 Bankruptcy If Your Car Is Still In Your Possession Let’s Summarize… Car Repossession Naturally Causes A Lot Of Stress And Worry.

Web both chapter 7 and chapter 13 bankruptcy provide useful tools that may make avoiding repossession possible. This allows a bankruptcy filer to keep their car by preventing the car loan from being discharged in the bankruptcy. Take inventory of the property you have. This will prevent foreclosure and/or property repossession.

Web What Is Chapter 13 Bankruptcy?

Web if your automobile is repossessed before you file a chapter 13 bankruptcy, the creditor will need to return the vehicle to you in most situations. A chapter 13 plan must conform to local bankruptcy form m. Web what is chapter 13 bankruptcy and how can it help prevent vehicle repossession? Web bankruptcy can eliminate a deficiency after repossession.

Web Let's Be Clear, Filing A Chapter 13 Bankruptcy Isn't The Best Way To Avoid Auto Repossession.

Entering into a reaffirmation agreement can lead to new debt problems if you default on your car loan payments after bankruptcy. All chapter 13 plans must be signed by the debtor and are subject to local bankruptcy. Web a chapter 13 bankruptcy attorney can help make sure this does not happen. How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court.

In This Article, You'll Learn What Each Term Means, As Well As How The Bankruptcy Court Handles These Events In Chapter 7 And Chapter 13 Bankruptcy.

Falling behind on your car payments might have you wondering if you could use bankruptcy. Where a debtor has valuable nonexempt property and wants to keep it, a chapter 13. It does temporarily prevent repossession with an automatic stay, but you still have to pay your car loan. Kentucky residents might be relieved to learn that a chapter 13 bankruptcy.