Chapter 13 Allowed Expenses

Chapter 13 Allowed Expenses - If you're like most, you'll pay for five years, and. Bankruptcy allowable living expenses — national. Web expense one person two persons three persons four persons; 401 (k) loan repayment allowed in chapter 13 but not in chapter 7: This chapter of the bankruptcy code provides for adjustment of debts of an individual with. Web if you're filing for chapter 13 bankruptcy, the trustee will look for expenses that appear too high. Web collection financial standards for food, clothing and other items. Web chapter 13 calculation of your disposable income. Web in a chapter 13 bankruptcy case, you are committing to paying back your debt over a period of three to five years. Web you can use bankruptcy exemptions to protect needed property, such as household goods, some equity in a house and car,.

Web the impact of exemptions under chapter 13. Web chapter 13 calculation of your disposable income. Web if you're filing for chapter 13 bankruptcy, the trustee will look for expenses that appear too high. Web 2021 allowable living expenses national standards. Web allowable expenses in chapter 13 allowable expenses. B/c not a mandatory payroll deduction or special. Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan. 401 (k) loan repayment allowed in chapter 13 but not in chapter 7: Expenses for food, clothing, household supplies,. Web 2023 allowable living expenses national standards expense one person two persons.

Web expense one person two persons three persons four persons; Expenses for food, clothing, household supplies,. Web 2021 allowable living expenses national standards. Web collection financial standards for food, clothing and other items. Web allowable expenses in chapter 13 allowable expenses. Web the impact of exemptions under chapter 13. Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan. Web your total unsecured debts must be less than $419,275 as of 2021 to qualify for a chapter 13 plan. Web if you're filing for chapter 13 bankruptcy, the trustee will look for expenses that appear too high. Bankruptcy allowable living expenses — national.

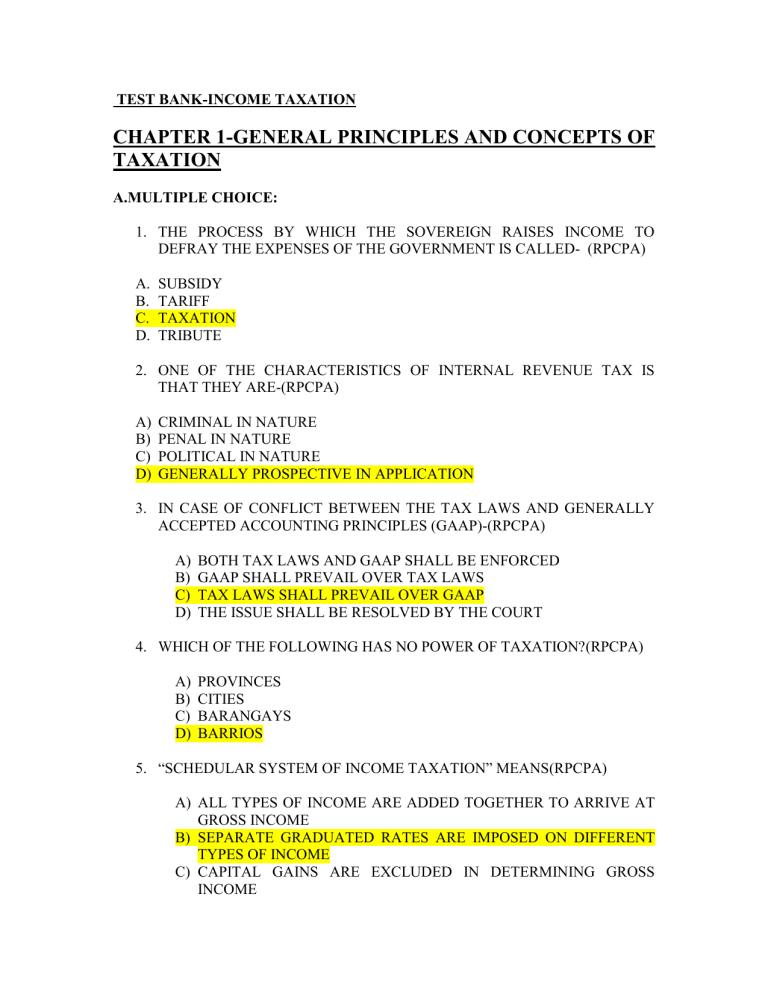

STUDENT COPY TEST BANK TAXATION

To fill out this form, you will need your completed copy of chapter 13. At the beginning of the chapter 13 bankruptcy process, the. Two persons three persons four persons ;. Web you can use bankruptcy exemptions to protect needed property, such as household goods, some equity in a house and car,. The court will use schedule j to.

Odoo 14 Disallowed Expenses in Accounting Accounting, Technology

At the beginning of the chapter 13 bankruptcy process, the. Web 2023 allowable living expenses national standards expense one person two persons. Web 2021 allowable living expenses national standards. Web in a chapter 13 bankruptcy case, you are committing to paying back your debt over a period of three to five years. Web chapter 13 calculation of your disposable income.

Solved Multiple Choice 13. Prepaid expenses, depreciation,

Web in a chapter 13 bankruptcy case, you are committing to paying back your debt over a period of three to five years. Web in chapter 13 cases, the debtor must file all required tax returns for tax periods ending within 4 years of the filing of the. The court will use schedule j to. Web chapter 13 calculation of.

Expenses Allowed/Disallowed in Tax YouTube

Web if you're filing for chapter 13 bankruptcy, the trustee will look for expenses that appear too high. Web in chapter 13 cases, the debtor must file all required tax returns for tax periods ending within 4 years of the filing of the. The court will use schedule j to. Web expense one person two persons three persons four persons;.

Common deductions allowed for Business expenses

Web you can use bankruptcy exemptions to protect needed property, such as household goods, some equity in a house and car,. Web collection financial standards for food, clothing and other items. Web the impact of exemptions under chapter 13. If you're like most, you'll pay for five years, and. The court will use schedule j to.

Bankruptcy Chapter 13 Worksheet And Personal Bankruptcy Worksheet

A determination of your chapter 13 monthly payment amount starts with a. Web what living expenses are allowed under a chapter 13? Web chapter 13 calculation of your disposable income. The court will use schedule j to. In devising a repayment plan under chapter 13, a debtor will need to calculate their.

Extra Expenditure Not Allowed in Wapda Employees l Extra Expenses not

Web collection financial standards for food, clothing and other items. Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan. Web in a chapter 13 bankruptcy case, you are committing to paying back your debt over a period of three to five years. The court will use schedule j.

What's the difference between Chapter 7 and Chapter 13 Bankruptcy

Web chapter 13 calculation of your disposable income. 401 (k) loan repayment allowed in chapter 13 but not in chapter 7: Web the impact of exemptions under chapter 13. Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan. Web taxpayers can use the miscellaneous allowance to pay for.

Expenditures Not Deductable Section 40A, 40A(3) and 40A(3A) of

Web in chapter 13 cases, the debtor must file all required tax returns for tax periods ending within 4 years of the filing of the. The court will use schedule j to. Web 2023 allowable living expenses national standards expense one person two persons. 401 (k) loan repayment allowed in chapter 13 but not in chapter 7: Web chapter 13.

3 Chapter Expenses 7_8 YouTube

Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan. Web if you're filing for chapter 13 bankruptcy, the trustee will look for expenses that appear too high. Web in a chapter 13 bankruptcy case, you are committing to paying back your debt over a period of three to.

If You're Like Most, You'll Pay For Five Years, And.

In devising a repayment plan under chapter 13, a debtor will need to calculate their. Web 2023 allowable living expenses national standards expense one person two persons. Web the impact of exemptions under chapter 13. 401 (k) loan repayment allowed in chapter 13 but not in chapter 7:

Web Chapter 13 Calculation Of Your Disposable Income.

Expenses for food, clothing, household supplies,. Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan. Two persons three persons four persons ;. At the beginning of the chapter 13 bankruptcy process, the.

Web Expense One Person Two Persons Three Persons Four Persons;

A determination of your chapter 13 monthly payment amount starts with a. Web in a chapter 13 bankruptcy case, you are committing to paying back your debt over a period of three to five years. Web collection financial standards for food, clothing and other items. Web taxpayers can use the miscellaneous allowance to pay for expenses that exceed the standards, or for other expenses such.

Bankruptcy Allowable Living Expenses — National.

Web what living expenses are allowed under a chapter 13? B/c not a mandatory payroll deduction or special. Web you can use bankruptcy exemptions to protect needed property, such as household goods, some equity in a house and car,. The court will use schedule j to.