Capital One Tax Form

Capital One Tax Form - Web send copy b of the 1099 int form to the recipient by january 31, 2020. Web for turbotax online, navigate to the tax forms section. But providing this information may allow filers to. Web learn how to view capital one tax forms.our recommended resources : This includes the following forms: If you are required to file. Compare capital one credit cards, banking services, business services & more. Web the corporation begins with federal taxable income from the federal tax return. Web tax forms from capital one. Produced by adrienne hurst and aaron esposito.

If you are required to file. Web sign in to access all of your capital one accounts. The tax rate is 4 percent for tax years beginning on or after january 1, 2020. Produced by adrienne hurst and aaron esposito. You may not need a duplicate tax form. An individual having salary income should collect. Get familiar with the tax forms so you know what to expect. View account balances, pay bills, transfer money and more. Web documents needed to file itr; Web july 30, 2023, 6:00 a.m.

Web options to help you find one that is best for you. If you have more short. As of july 19, the. Web tax forms from capital one. See the instructions for line 16 for. The tax rate is 4 percent for tax years beginning on or after january 1, 2020. Tax forms upon money one get familiar with the trigger paper so you see what for expected. Compare capital one credit cards, banking services, business services & more. Web the tax forms and information taxpayers need to file can vary based on income, employment and marital status. This includes the following forms:

Form 2438 Undistributed Capital Gains Tax Return (2013) Free Download

Web tax forms from capital one. View account balances, pay bills, transfer money and more. Web capital one can help you find the right credit cards; Web options to help you find one that is best for you. Web when fed rates go up, so do credit card rates.

How to Avoid Capital Gains Tax on Real Estate Investment Property

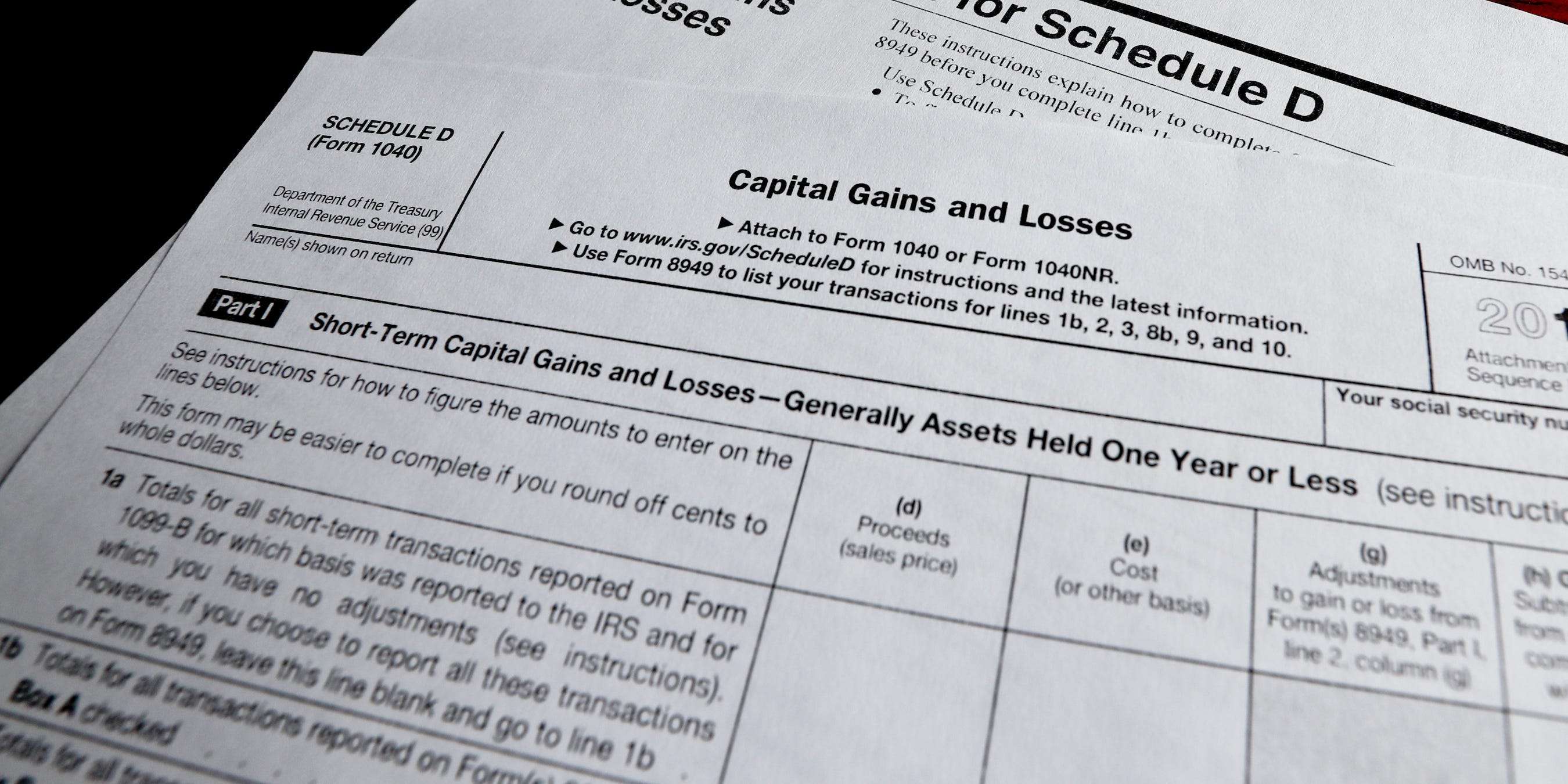

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. An individual having salary income should collect. Web when fed rates go up, so do credit card rates. Some of the links on this page are. Web tax forms from capital one.

Formulário 4506 Pedido de Cópia da Declaração Fiscal Economia e Negocios

Web options to help you find one that is best for you. Web sign in to access all of your capital one accounts. If you have more short. The tax rate is 4 percent for tax years beginning on or after january 1, 2020. You may not need a duplicate tax form.

tax and capital gains.pdf Capital Gains Tax Tax Deduction Free 30

Under your income, choose which tax documents to include, and. Web tax forms from capital one. You can view and print your tax form for your capital one bank accounts online. Web for turbotax online, navigate to the tax forms section. Web send copy b of the 1099 int form to the recipient by january 31, 2020.

Capital Gains Tax How Does the Capital Gains Tax Work Now, and What

An individual having salary income should collect. Web options to help you find one that is best for you. Web get familiar with one tax forms so you know how to expect. Web send copy b of the 1099 int form to the recipient by january 31, 2020. Get familiar with the tax forms so you know what to expect.

Capital Gain Tax Form Editable Forms

Request a duplicate tax form and print for. Web july 30, 2023, 6:00 a.m. Compare capital one credit cards, banking services, business services & more. Web the tax forms and information taxpayers need to file can vary based on income, employment and marital status. View account balances, pay bills, transfer money and more.

Capital gains tax (India) simplified Read this if you invest in stocks

Under your income, choose which tax documents to include, and. Web documents needed to file itr; The tax rate is 4 percent for tax years beginning on or after january 1, 2020. An individual having salary income should collect. Compare capital one credit cards, banking services, business services & more.

Managing Tax Rate Uncertainty Russell Investments

Web documents needed to file itr; Get familiar with the tax forms so you know what to expect. Some of the links on this page are. Web when fed rates go up, so do credit card rates. Web tax forms from capital one.

Barbara Johnson Blog Schedule K1 Tax Form What Is It and Who Needs

Under your income, choose which tax documents to include, and. See the instructions for line 16 for. You may not need a duplicate tax form. Tax forms upon money one get familiar with the trigger paper so you see what for expected. Web when fed rates go up, so do credit card rates.

View Account Balances, Pay Bills, Transfer Money And More.

Web the corporation begins with federal taxable income from the federal tax return. You can expect your tax forms to be available online no later than january 31st. Web july 30, 2023, 6:00 a.m. Produced by adrienne hurst and aaron esposito.

Web Capital One Can Help You Find The Right Credit Cards;

See the instructions for line 16 for. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. This includes the following forms: And other banking services for you or your business

Web Most Tax Forms Will Be Available No Later Than January 31St.

If you are required to file. The first step of filing itr is to collect all the documents related to the process. The tax rate is 4 percent for tax years beginning on or after january 1, 2020. It also will provide you with a payment plan if you can’t pay the full amount at this time.

Web Download Download Your Completed Forms As Pdfs, Or Email Them Directly To Colleagues Feel Like You Are Wasting Time Editing, Filling Or Sending Free Fillable Capital One Pdf.

An individual having salary income should collect. Request a duplicate tax form and print for. Under your income, choose which tax documents to include, and. Get familiar with the tax forms so you know what to expect.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)