Can You File Form 8840 Online

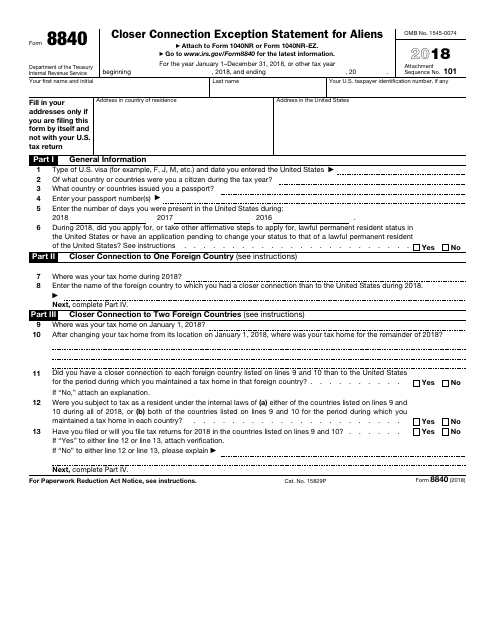

Can You File Form 8840 Online - Visa (for example, f, j, m, etc.) and date you entered the united states 2 of what country or countries were you a citizen during the tax year? Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web form 5695 credit cannot be electronically filed for more than one main home. Web general information 1 type of u.s. Each alien individual must file a separate form 8840. Web canadian snowbirds who qualify for the exemption and file form 8840 by the june 15th deadline can stay in the u.s. When a person is neither a u.s. Web line 6 if you checked the “yes” box on line 6, do not file form 8840. The filing deadline for form 8840 is. Ad access irs tax forms.

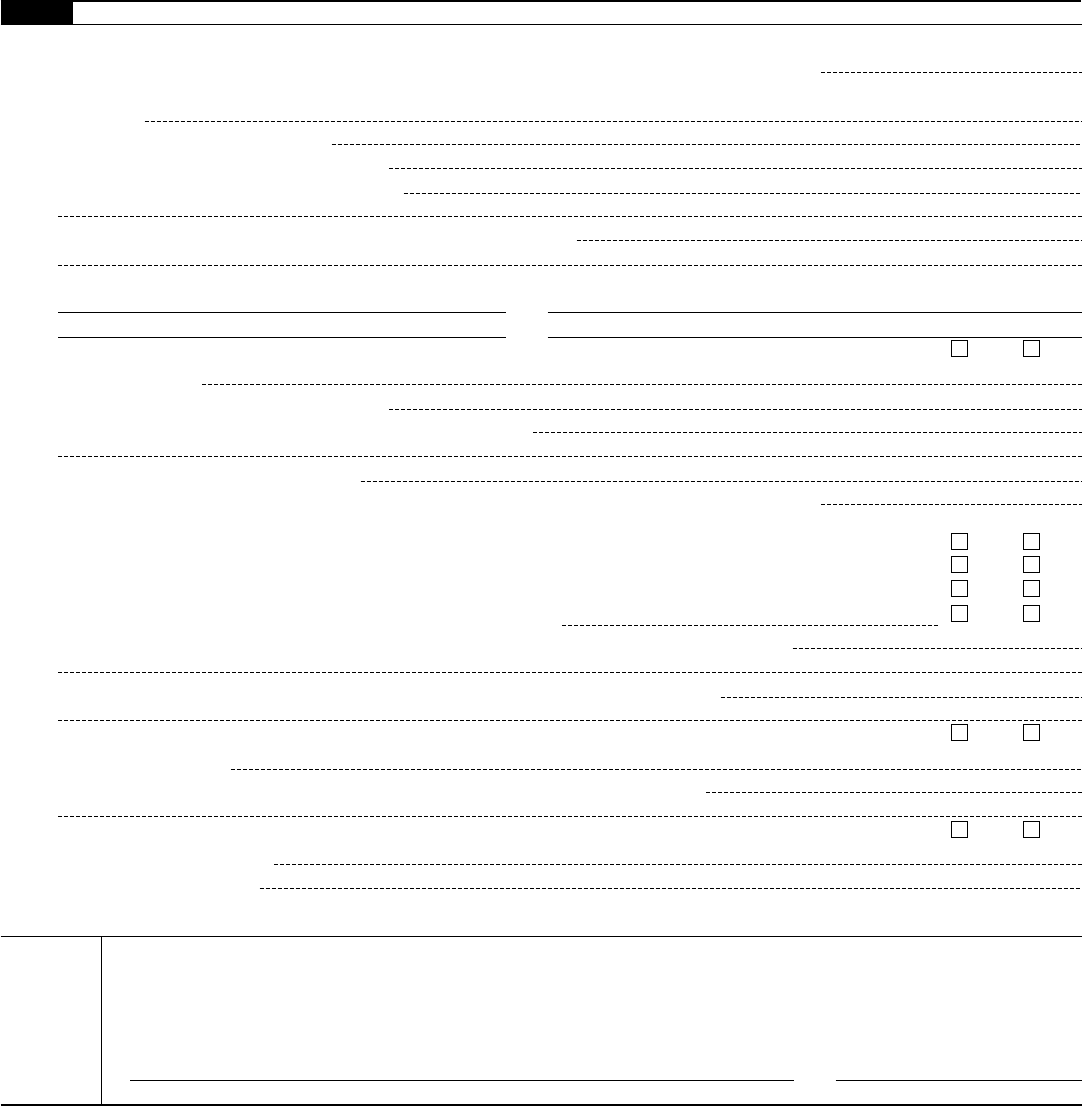

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web edit, sign, and share 8840 form online. My husband and i have been advised that we should file a form 8840 with the irs to avoid paying taxes in the u.s. When a person is neither a u.s. For up to 182 days without being considered a u.s. You are not eligible for the closer connection exception. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Easily fill out pdf blank, edit, and sign them. Start completing the fillable fields and. Form 8854 can be electronically filed with form 1040nr returns except when there is the following:.

This is a positive acknowledgment that you are entering the. Easily fill out pdf blank, edit, and sign them. Web edit, sign, and share 8840 form online. Start completing the fillable fields and. For up to 182 days without being considered a u.s. Use get form or simply click on the template preview to open it in the editor. Web general information 1 type of u.s. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Ad access irs tax forms.

IRS Form 8840 Download Fillable PDF or Fill Online Closer Connection

Form 8854 can be electronically filed with form 1040nr returns except when there is the following:. No need to install software, just go to dochub, and sign up instantly and for free. Complete irs tax forms online or print government tax documents. It is secure and accurate. Web watch newsmax live for the latest news and analysis on today's top.

Its IRS Form 8840 Time Again. SimplySOLD

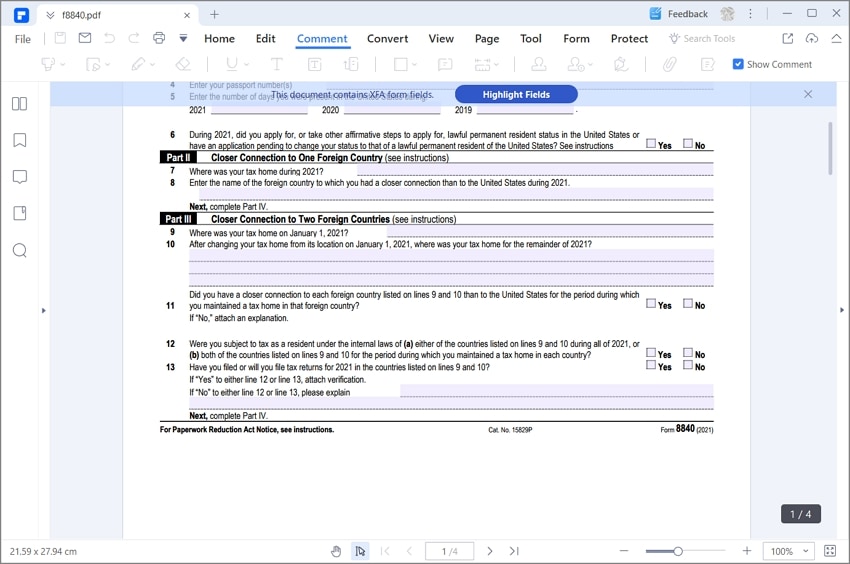

Form 8854 can be electronically filed with form 1040nr returns except when there is the following:. Save or instantly send your ready documents. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. You are not eligible for the closer connection exception..

Fill Free fillable Closer Connection Exception Statement for Aliens

It is secure and accurate. 940, 941, 943, 944 and 945. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Complete, edit or print tax forms instantly. My husband and i have been advised that we should file a form 8840.

Why Is IRS Tax Form 8840 Important for Canadian Snowbirds?

This is a positive acknowledgment that you are entering the. Get ready for tax season deadlines by completing any required tax forms today. Web general information 1 type of u.s. Web canadian snowbirds who qualify for the exemption and file form 8840 by the june 15th deadline can stay in the u.s. Ad access irs tax forms.

Case 8840 Windrower Service Manual PDF Download

Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. Ad access irs tax forms. This is a positive acknowledgment that you are entering the. Start completing the fillable fields and. Complete irs tax forms online or print government tax documents.

2017 Form 8840 Edit, Fill, Sign Online Handypdf

Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. Web form 5695 credit cannot be electronically filed for more than one main home. Web line 6 if you checked the “yes” box on line 6, do not file form 8840. Web what is the.

IRS Form 8840 How to Fill it Right and Easily

Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead. Start completing the fillable fields and. Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents. When a person.

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web general information 1 type of u.s. Ad access irs tax forms. However, you may qualify for nonresident status by. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Form 8840 year 2023 Fill online, Printable, Fillable Blank

Complete, edit or print tax forms instantly. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Visa (for example, f, j, m, etc.) and date you entered the united states 2 of what country or countries were you a citizen during the tax year? Web the 1040 form is the official.

The Animal Photo Archive KeithParkinsonArt332KnightsRiding

Complete, edit or print tax forms instantly. Web canadian snowbirds who qualify for the exemption and file form 8840 by the june 15th deadline can stay in the u.s. This is a positive acknowledgment that you are entering the. Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Form 8854 can be electronically filed with form 1040nr returns except when there is the following:. Start completing the fillable fields and. Complete, edit or print tax forms instantly. The form 8840 is an international tax form that is used as an irs exception to the substantial presence test.

Ad Access Irs Tax Forms.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web edit, sign, and share 8840 form online. 940, 941, 943, 944 and 945. Get ready for tax season deadlines by completing any required tax forms today.

My Husband And I Have Been Advised That We Should File A Form 8840 With The Irs To Avoid Paying Taxes In The U.s.

Web form 5695 credit cannot be electronically filed for more than one main home. Use get form or simply click on the template preview to open it in the editor. Web what is the filing deadline for irs form 8840? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

When A Person Is Neither A U.s.

This is a positive acknowledgment that you are entering the. Complete irs tax forms online or print government tax documents. Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead. Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception.