Can You File Form 1042 Electronically

Can You File Form 1042 Electronically - Filing requirements do you have to file?. Web are you looking for where to file 1042 online? Yes, you can file form 941 electronically. My name is karen russell, and i'm a senior. Web but form 1042 is not required to be electronically filed. Can form 1042 be electronically signed? Washington — to protect the health of taxpayers and tax professionals, the internal revenue service today announced pdf it. You will then be able to download and print the 1042 to mail. Web a taxpayer can choose to file tax year 2022 form 1042 electronically. Ad get ready for tax season deadlines by completing any required tax forms today.

Can form 1042 be electronically signed? Web for those of you just joining welcome to today's webinar understanding form 1042. Web upon completion of the application, your active tccs assigned prior to september 26, 2021, will be added to the application. Irs approved tax1099.com allows you to create and submit the 1042. However, they are not required to do. Source income subject to withholding, were released sept. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! After august 1, 2023, any fire tcc without a. Schedule lep (form 1040), request for change in language preference.

Web upon completion of the application, your active tccs assigned prior to september 26, 2021, will be added to the application. Web for those of you just joining welcome to today's webinar understanding form 1042. After august 1, 2023, any fire tcc without a. Web but form 1042 is not required to be electronically filed. However, they are not required to do. Ad get ready for tax season deadlines by completing any required tax forms today. Can form 1042 be electronically signed? Source income subject to withholding, were released sept. Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. Filing requirements do you have to file?.

The Newly Issued Form 1042S Foreign Person's U.S. Source

Web are you looking for where to file 1042 online? Filing requirements do you have to file?. My name is karen russell, and i'm a senior. If a taxpayer prefers to file electronically but needs additional time to become familiar with. Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership.

Instructions for IRS Form 1042S How to Report Your Annual

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. Filing requirements do you have to file?. However, you cannot file forms directly with the irs. Can form 1042 be electronically signed?

EFile Form 1042S 1099Prep

However, they are not required to do. Upload, modify or create forms. Schedule lep (form 1040), request for change in language preference. Source income subject to withholding, were released sept. You will then be able to download and print the 1042 to mail.

Form 1042S Efile Diagnostics Ref. 47040 47039 and 47310 Accountants

Irs approved tax1099.com allows you to create and submit the 1042. Ad get ready for tax season deadlines by completing any required tax forms today. If a taxpayer prefers to file electronically but needs additional time to become familiar with. My name is karen russell, and i'm a senior. After august 1, 2023, any fire tcc without a.

IRS Form 1042s What It is & 1042s Instructions Tipalti

After august 1, 2023, any fire tcc without a. Yes, you can file form 941 electronically. Ad get ready for tax season deadlines by completing any required tax forms today. Can form 1042 be electronically signed? We are super glad you're here with us today.

2018 2019 IRS Form 1042 Fill Out Digital PDF Sample

You will then be able to download and print the 1042 to mail. Web upon completion of the application, your active tccs assigned prior to september 26, 2021, will be added to the application. Irs approved tax1099.com allows you to create and submit the 1042. Yes, you can file form 941 electronically. If a taxpayer prefers to file electronically but.

Can you file Form 4868 electronically Fill online, Printable

Schedule lep (form 1040), request for change in language preference. However, they are not required to do. Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. Can form 1042 be electronically signed? Yes, you can file form 941 electronically.

Form 1042S USEReady

Filing requirements do you have to file?. Web are you looking for where to file 1042 online? Try it for free now! After august 1, 2023, any fire tcc without a. However, they are not required to do.

Form 1042 Alchetron, The Free Social Encyclopedia

We are super glad you're here with us today. 30 by the internal revenue service. Web but form 1042 is not required to be electronically filed. You will then be able to download and print the 1042 to mail. Schedule lep (form 1040), request for change in language preference.

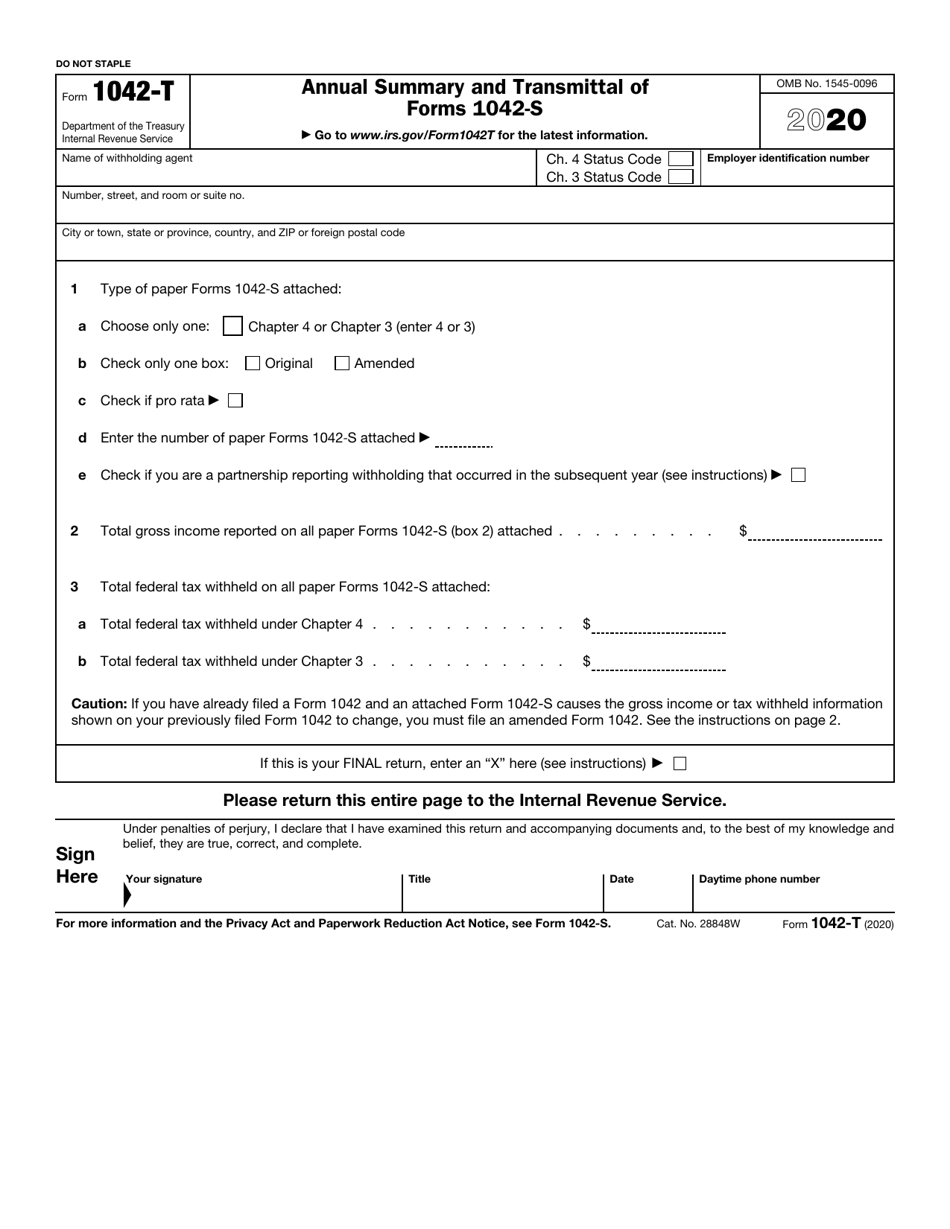

IRS Form 1042T Download Fillable PDF or Fill Online Annual Summary and

If a taxpayer prefers to file electronically but needs additional time to become familiar with. Upload, modify or create forms. Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. Web are you looking for where to file 1042 online? However, they are not required to do.

However, They Are Not Required To Do.

Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. Ad get ready for tax season deadlines by completing any required tax forms today. Web a taxpayer can choose to file tax year 2022 form 1042 electronically. Web upon completion of the application, your active tccs assigned prior to september 26, 2021, will be added to the application.

Irs Approved Tax1099.Com Allows You To Create And Submit The 1042.

Web for those of you just joining welcome to today's webinar understanding form 1042. Can form 1042 be electronically signed? 30 by the internal revenue service. Filing requirements do you have to file?.

Source Income Subject To Withholding, Including Recent Updates, Related Forms, And Instructions On How To File.

After august 1, 2023, any fire tcc without a. Try it for free now! If a taxpayer prefers to file electronically but needs additional time to become familiar with. Upload, modify or create forms.

You Pay Gross Investment Income To Foreign Private Foundations That Are Subject To Tax Under Section 4948 You Pay.

However, you cannot file forms directly with the irs. Washington — to protect the health of taxpayers and tax professionals, the internal revenue service today announced pdf it. Schedule lep (form 1040), request for change in language preference. We are super glad you're here with us today.