Can You Efile Form 709

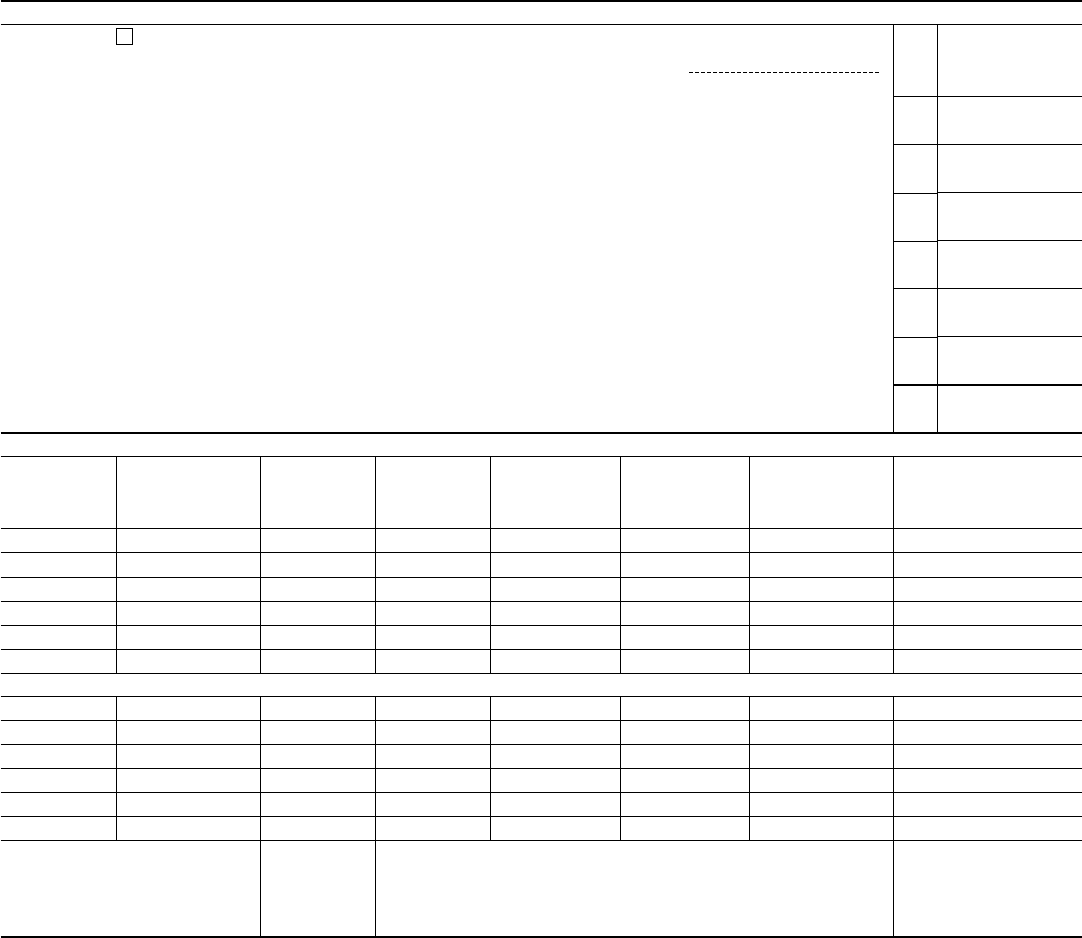

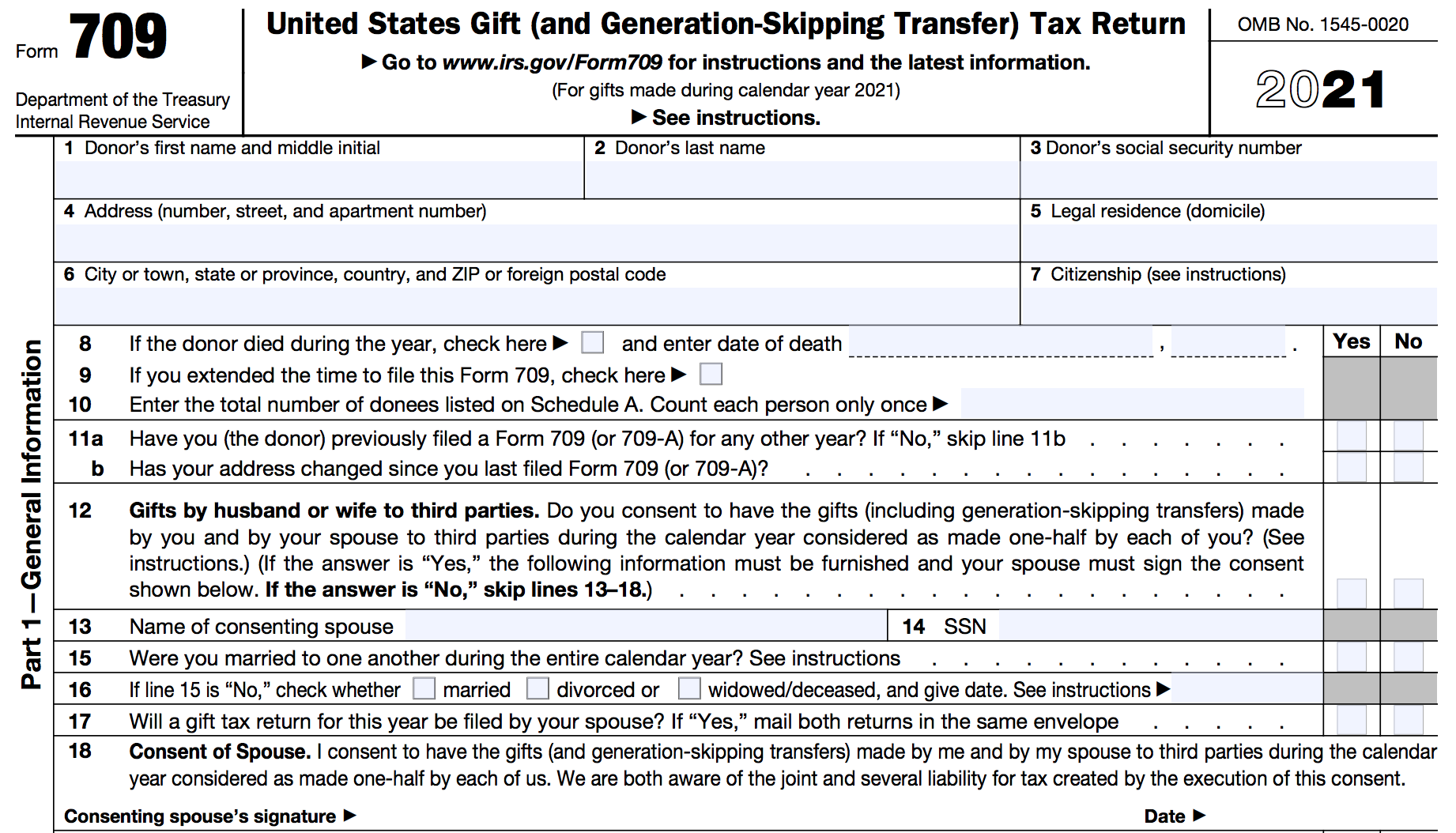

Can You Efile Form 709 - Turbotax security and fraud protection. You can’t efile that form. The instructions for form 709 directs you to mail it to the. Web can form 709 be filedelectronically Web you file jointly as usual but you mail your 709 for your gift indicating on the form that it is not a split gift. Web the program also won't split any gifts made after the death of either the taxpayer or spouse. Web how to fill out form 709. You need to file it sometime after january 1 and by the u.s. Web from our tax experts and community. No 709 is required if the gift is.

Turbotax security and fraud protection. Web the program also won't split any gifts made after the death of either the taxpayer or spouse. Web when should it be filed? You can’t efile that form. What is form 709’s due date? The instructions for form 709 directs you to mail it to the. Web how to fill out form 709. Web can form 709 be filedelectronically Web generally, citizens or residents of the united states are required to file form 709 if they gave gifts to another individual in the 2022 tax year totaling more than. Filing the form with the irs is the responsibility of the giver, but it’s only required in certain gift giving.

The instructions for form 709 directs you to mail it to the. It is separate from income taxes. Web you file jointly as usual but you mail your 709 for your gift indicating on the form that it is not a split gift. Turbotax security and fraud protection. Web you might have to file irs form 709 and pay gift tax if you make one or more transfers of cash or property, but there are several exceptions to know about first. Web from our tax experts and community. What is form 709’s due date? You can’t efile that form. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Web form 709, u.s.

2013 Form 709 Edit, Fill, Sign Online Handypdf

Taxpayers use irs form 709 to report gifts. The instructions for form 709 directs you to mail it to the. No 709 is required if the gift is. Form 709 is an estate and gift tax form. Web form 709 must be filed each year that you make a taxable gift and included with your regular tax return.

Form 709 and You A Primer on Gift Taxation Hammerle Finley Law Firm

First, complete the general information section on part one. Web you might have to file irs form 709 and pay gift tax if you make one or more transfers of cash or property, but there are several exceptions to know about first. You can’t efile that form. Web if a taxpayer makes a gift to a trust and fails to.

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax

It is separate from income taxes. Web you might have to file irs form 709 and pay gift tax if you make one or more transfers of cash or property, but there are several exceptions to know about first. What is form 709’s due date? Web form 709, u.s. Web for tax year 2021, you may give someone cash or.

Efile Atf Form 1 amulette

Web the program also won't split any gifts made after the death of either the taxpayer or spouse. The exclusion applies per person. Web how to fill out form 709. It is separate from income taxes. Who must file form 709?

2013 Form 709 Edit, Fill, Sign Online Handypdf

Filing the form with the irs is the responsibility of the giver, but it’s only required in certain gift giving. First, complete the general information section on part one. Web generally, citizens or residents of the united states are required to file form 709 if they gave gifts to another individual in the 2022 tax year totaling more than. Web.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Web you might have to file irs form 709 and pay gift tax if you make one or more transfers of cash or property, but there are several exceptions to know about first. Web you file jointly as usual but you mail your 709 for your gift indicating on the form that it is not a split gift. First, complete.

Efile form 4 coming means I can finish out my can collection 😎🤣 NFA

Web if a taxpayer makes a gift to a trust and fails to affirmatively elect whether to allocate gst exemption to the transfer on a timely filed form 709, the automatic. Web how to fill out form 709. Turbotax security and fraud protection. Web can form 709 be filedelectronically If you’ve figured out you must fill out a form 709,.

Can You Efile Your Taxes If You Owe Money Tax Walls

If you’ve figured out you must fill out a form 709, follow the instructions below. Web can form 709 be filedelectronically Tax due date of the year after the. The instructions for form 709 directs you to mail it to the. You can’t efile that form.

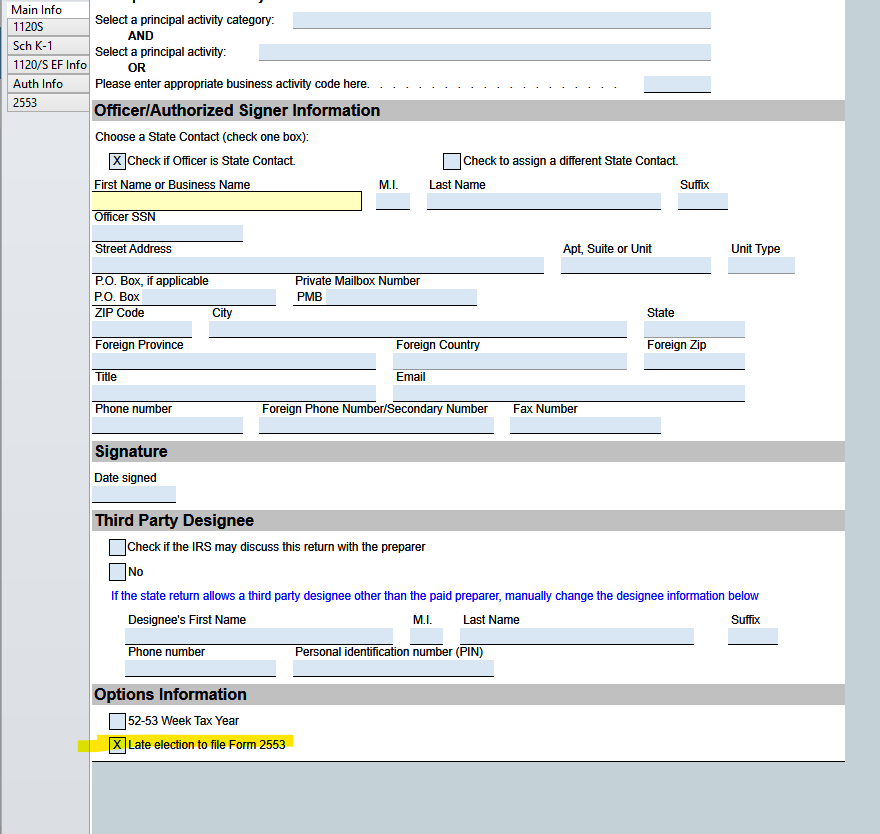

Scorp Late Election, ATX efile, Form 2553 General Chat ATX Community

Form 709 is an estate and gift tax form. Filing the form with the irs is the responsibility of the giver, but it’s only required in certain gift giving. You need to file it sometime after january 1 and by the u.s. Tax due date of the year after the. Web from our tax experts and community.

Solved Can you efile an amended IL 2020 Tas return in Proseries Basic

No 709 is required if the gift is. The instructions for form 709 directs you to mail it to the. Web you might have to file irs form 709 and pay gift tax if you make one or more transfers of cash or property, but there are several exceptions to know about first. Web to help reduce burden for the.

Who Must File Form 709?

First, complete the general information section on part one. Tax due date of the year after the. Web form 709, u.s. The instructions for form 709 directs you to mail it to the.

When You Make A Financial Gift To.

Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Web generally, citizens or residents of the united states are required to file form 709 if they gave gifts to another individual in the 2022 tax year totaling more than. Filing the form with the irs is the responsibility of the giver, but it’s only required in certain gift giving. Web form 709 due date and instructions.

Form 709 Is An Estate And Gift Tax Form.

Web can form 709 be filedelectronically What is form 709’s due date? The exclusion applies per person. If you're splitting gifts, and a gift tax return won't be filed by the.

You Can’t Efile That Form.

Web the program also won't split any gifts made after the death of either the taxpayer or spouse. Web when should it be filed? Web for tax year 2021, you may give someone cash or property valued at up to $15,000 without needing to fill out form 709. Web you might have to file irs form 709 and pay gift tax if you make one or more transfers of cash or property, but there are several exceptions to know about first.