Can I Reaffirm A Credit Card In Chapter 7

Can I Reaffirm A Credit Card In Chapter 7 - [1] they must perform their stated intention within 30 days of the. Here are some important steps to begin rebuilding your credit after bankruptcy. Web for instance, if you received a discharge in a chapter 7 case, you can’t receive another chapter 7 discharge for eight years. Web that usually happens about 60 days after your “meeting of creditors,” or about 3 months after your chapter 7 filing. “reaffirmation” refers to the process whereby a debtor agrees to (re)payment terms with the creditor on a debt instead of having it discharged in the. Why you may not wish to reaffirm. Web chapter 7 debtors must file a statement of intention within 30 days of the petition date or the date of the 341 meeting, whichever is earlier. Web creditors can ask the court to deny a discharge if they can prove your debt meets one of the grounds for denying a debt discharge. They come in handy when you want to keep a specific asset while filing for a chapter 7 bankruptcy. Im employed by the dept store that issued the charge, therefore i would like to keep the charge.

If you don't reaffirm, the worst thing a creditor can do. Types of credit cards you can qualify for after filing chapter 7 bankruptcy credit cards that you might qualify for may be secured or unsecured. Web when you can get a credit card after chapter 7. If you file for chapter 7, the creditor can… Web reaffirmation agreements are voluntary, meaning you’re not required to use them. Web creditors can ask the court to deny a discharge if they can prove your debt meets one of the grounds for denying a debt discharge. The grounds for denying an individual debtor a discharge in a chapter 7. Web that usually happens about 60 days after your “meeting of creditors,” or about 3 months after your chapter 7 filing. Web for instance, if you received a discharge in a chapter 7 case, you can’t receive another chapter 7 discharge for eight years. Web regardless of the reason a debtor chooses to reaffirm, their decision is likely to have a quick and positive impact on their credit score, as the creditor will be required to notify the credit bureaus.

Web reaffirming protects against the possibility of getting your property repossessed when you are still making timely payments. You are not required to reaffirm any debt or sign any agreement regarding a debt that has been or will be discharged in your bankruptcy case. If you don't reaffirm, the worst thing a creditor can do. Grounds for denial of a debt discharge. The grounds for denying an individual debtor a discharge in a chapter 7. A reaffirmation agreement is a. Web what is the difference between reaffirming a credit card debt vs not including the debt in chap 7 bankruptcy. Web regardless of the reason a debtor chooses to reaffirm, their decision is likely to have a quick and positive impact on their credit score, as the creditor will be required to notify the credit bureaus. That's because most of your accounts are likely unsecured. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter 7.

Lecture 13Credit Cards (Chapter 6) YouTube

Web in addition, no individual may be a debtor under chapter 7 or any chapter of the bankruptcy code unless he or she has, within 180 days before filing, received credit counseling from an approved credit. A reaffirmation agreement is a. The grounds for denying an individual debtor a discharge in a chapter 7. Here are some important steps to.

Teamsters and IATSE Reaffirm 'Mutual Aid and Assistance Pact

The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. The balance on the majority of the cards in your wallet will get wiped out in chapter 7 bankruptcy. You'll also learn how to qualify for a chapter 7 credit card discharge and whether credit card balances get paid in.

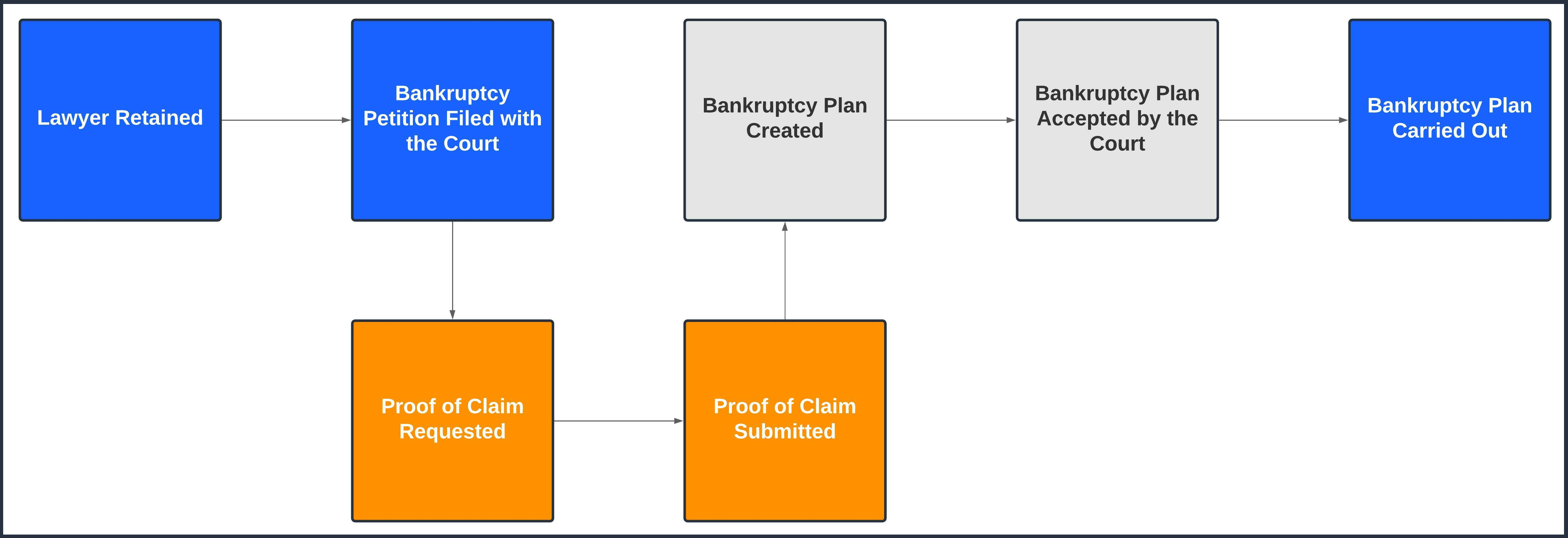

Bankruptcy 101 LoanPro Help

Web if you want to keep your financed car in chapter 7 bankruptcy, your lender might require you to enter into a new contract in a process known as reaffirming the debt. They come in handy when you want to keep a specific asset while filing for a chapter 7 bankruptcy. Web for instance, if you received a discharge in.

6 Things You Can Reaffirm for Positive Change and Validation

The balance on the majority of the cards in your wallet will get wiped out in chapter 7 bankruptcy. Grounds for denial of a debt discharge. Web in addition, no individual may be a debtor under chapter 7 or any chapter of the bankruptcy code unless he or she has, within 180 days before filing, received credit counseling from an.

Nudgee Stakes Kisukano can reaffirm her reputation as one of

Web unsecured credit card debt in chapter 7. In this article, you'll learn about the pros and cons of reaffirming. Web reaffirming protects against the possibility of getting your property repossessed when you are still making timely payments. Web chapter 7 debtors must file a statement of intention within 30 days of the petition date or the date of the.

Reaffirm Your Faith in Him iDisciple

A reaffirmation agreement is a. Web the credit card company knows that you can't file for chapter 7 bankruptcy for another eight years, and so there is lots of time to collect against you, if necessary. Grounds for denial of a debt discharge. The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge.

Agusto, GCR Reaffirm ‘AAA’ Rating, Stable Outlook Of Infracredit

The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. Web for instance, if you received a discharge in a chapter 7 case, you can’t receive another chapter 7 discharge for eight years. You would owe that single debt as if you hadn’t filed the chapter 7. Why you may.

REAFFIRM Synonyms and Related Words. What is Another Word for REAFFIRM

Web unsecured credit card debt in chapter 7. The main consequence of a reaffirmation agreement is that it excludes that particular debt from the discharge of your debts. Web the credit card company knows that you can't file for chapter 7 bankruptcy for another eight years, and so there is lots of time to collect against you, if necessary. Web.

SHOULD I REAFFIRM MY MORTGAGE AGREEMENT AFTER MY CHAPTER 7 BANKRUPTCY?

That's because most of your accounts are likely unsecured. In this article, you'll learn about the pros and cons of reaffirming. If you don't reaffirm, the worst thing a creditor can do. You are not required to reaffirm any debt or sign any agreement regarding a debt that has been or will be discharged in your bankruptcy case. Types of.

ionic 5 tutorials how to create ionic card ionic 5 card chapter 7

Web regardless of the reason a debtor chooses to reaffirm, their decision is likely to have a quick and positive impact on their credit score, as the creditor will be required to notify the credit bureaus. Web when you can get a credit card after chapter 7. You would owe that single debt as if you hadn’t filed the chapter.

The Creditor Can Charge You A Higher Interest Rate.

Web unsecured credit card debt in chapter 7. That's because most of your accounts are likely unsecured. Web chapter 7 debtors must file a statement of intention within 30 days of the petition date or the date of the 341 meeting, whichever is earlier. Web regardless of the reason a debtor chooses to reaffirm, their decision is likely to have a quick and positive impact on their credit score, as the creditor will be required to notify the credit bureaus.

In This Article, You'll Learn About The Pros And Cons Of Reaffirming.

Im employed by the dept store that issued the charge, therefore i would like to keep the charge. Types of credit cards you can qualify for after filing chapter 7 bankruptcy credit cards that you might qualify for may be secured or unsecured. A reaffirmation agreement is a. Web reaffirmation agreements are a special feature of chapter 7 bankruptcy.

Grounds For Denial Of A Debt Discharge.

Web if you want to keep your financed car in chapter 7 bankruptcy, your lender might require you to enter into a new contract in a process known as reaffirming the debt. Web what is the difference between reaffirming a credit card debt vs not including the debt in chap 7 bankruptcy. Web certain debts can not be discharged in a chapter 7 or a chapter 13 bankruptcy case. The balance on the majority of the cards in your wallet will get wiped out in chapter 7 bankruptcy.

They Give Your Creditors A Chance To Get You Back On The Hook For Debt You Would Have Otherwise Discharged In The Bankruptcy By Allowing You To Reaffirm…

Here are some important steps to begin rebuilding your credit after bankruptcy. You would owe that single debt as if you hadn’t filed the chapter 7. “reaffirmation” refers to the process whereby a debtor agrees to (re)payment terms with the creditor on a debt instead of having it discharged in the. The grounds for denying an individual debtor a discharge in a chapter 7.