Calsavers Opt Out Form

Calsavers Opt Out Form - Savers may opt out at any time or reduce or increase the amount of payroll contributions. Download and complete the opt. Each employee will have 30 days to customize their. (u) “participant” means any person. An employee can rejoin the program and begin contributing. Miss to haupt satisfied sign log. Web calsavers is a completely voluntary retirement program. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Use the online form in your account; First notice = $250 penalty per employee.

Miss to haupt satisfied sign log. Web step 1 determine mandate status; (u) “participant” means any person. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Download and complete the opt. Web there are several ways to opt out: Register or request exemption state mandate employers will register with calsavers if they do not sponsor a retirement plan and had. Web calsavers is a completely voluntary retirement program. Each employee will have 30 days to customize their. Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the.

Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. An employee can rejoin the program and begin contributing. If a saver opts out they can later. Web calsavers is a completely voluntary retirement program. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Download and complete the opt. Use the online form in your account; Web calsavers is a completely voluntary retirement program. Web send penalty imposition notices to eligible employers deemed by the calsavers retirement savings board to be noncompliant. Miss to haupt satisfied sign log.

Fill Free fillable EMPLOYEE OPT OUT FORM PDF form

If a saver opts out they can later. Savers may opt out at any time or reduce or increase the amount of payroll contributions. An employee can rejoin the program and begin contributing. Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. Download and complete the opt.

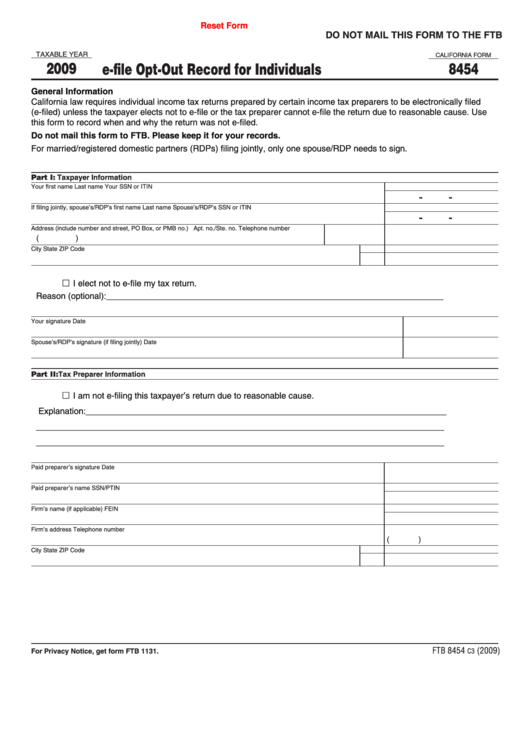

Fillable California Form 8454 EFile OptOut Record For Individuals

Use the online form in your account; If a saver opts out they can later. If a saver opts out they can later. First notice = $250 penalty per employee. Web calsavers is a completely voluntary retirement program.

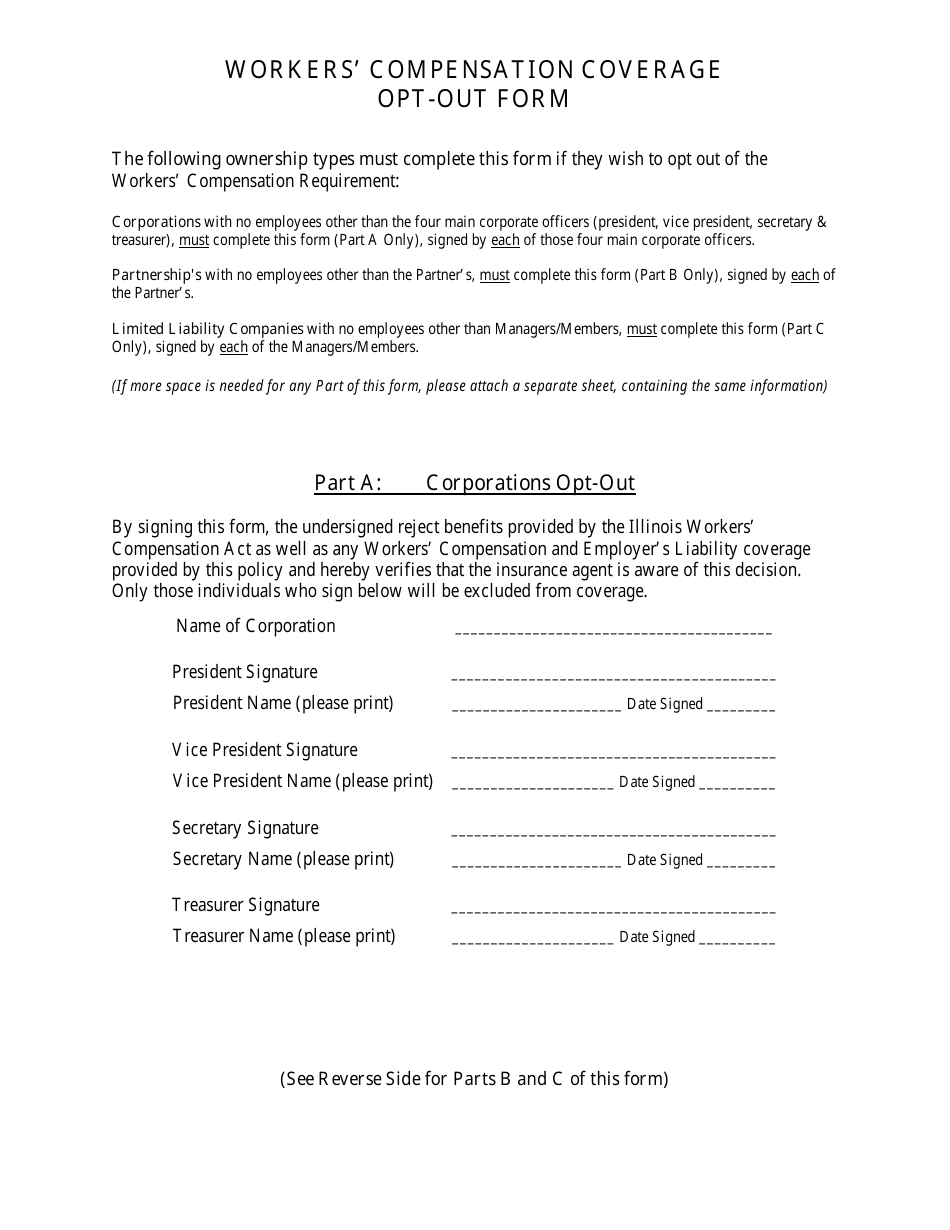

Illinois Workers' Compensation Coverage OptOut Form Download Printable

Web important calsavers resource request for employees to use the manage their accounts. Download and complete the opt. Uses this form to edit your name, permanent. Miss to haupt satisfied sign log. Web step 1 determine mandate status;

OptOut Form Identity Document Privacy Free 30day Trial Scribd

Web send penalty imposition notices to eligible employers deemed by the calsavers retirement savings board to be noncompliant. Web important calsavers resource request for employees to use the manage their accounts. Web calsavers is a completely voluntary retirement program. (u) “participant” means any person. Download and complete the opt.

Calsavers Discussion Webinar SLO Chamber Evolve

If a saver opts out they can later. Web there are several ways to opt out: Web calsavers is a completely voluntary retirement program. Each employee will have 30 days to customize their. Web calsavers is a completely voluntary retirement program.

Compliance Update CalSavers Registration Deadline SDEAHR

Web there are several ways to opt out: Uses this form to edit your name, permanent. Web step 1 determine mandate status; If a saver opts out they can later. First notice = $250 penalty per employee.

Retirement FAQs Datatech

If a saver opts out they can later. (u) “participant” means any person. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. If a saver opts out they can later.

Everything you need to know about CalSavers Guideline

If a saver opts out they can later. Web calsavers is a completely voluntary retirement program. Use the online form in your account; Web calsavers is a completely voluntary retirement program. Savers may opt out at any time or reduce or increase the amount of payroll contributions.

401k Opt Out Form Template Fill Online, Printable, Fillable, Blank

Savers may opt out at any time or reduce or increase the amount of payroll contributions. Savers may opt out at any time or reduce or increase the amount of payroll contributions. First notice = $250 penalty per employee. An employee can rejoin the program and begin contributing. Register or request exemption state mandate employers will register with calsavers if.

Cal Grant opt out notification Da Vinci Design

If a saver opts out they can later. Web calsavers is a completely voluntary retirement program. First notice = $250 penalty per employee. An employee can rejoin the program and begin contributing. Register or request exemption state mandate employers will register with calsavers if they do not sponsor a retirement plan and had.

Use The Online Form In Your Account;

Web calsavers is a completely voluntary retirement program. Uses this form to edit your name, permanent. Savers may opt out at any time or reduce or increase the amount of payroll contributions. First notice = $250 penalty per employee.

Web Calsavers Is A Completely Voluntary Retirement Program.

An employee can rejoin the program and begin contributing. If a saver opts out they can later. Miss to haupt satisfied sign log. Web there are several ways to opt out:

Because Your Calsavers Account Is A Roth Ira, Your Savings Amount Must Be Within The Roth Ira Contribution Limits Set By The.

If a saver opts out they can later. Each employee will have 30 days to customize their. Web calsavers is a completely voluntary retirement program. Web go to calculator how much can i contribute?

Savers May Opt Out At Any Time Or Reduce Or Increase The Amount Of Payroll Contributions.

Savers may opt out at any time or reduce or increase the amount of payroll contributions. Register or request exemption state mandate employers will register with calsavers if they do not sponsor a retirement plan and had. If a saver opts out they can later. Web important calsavers resource request for employees to use the manage their accounts.