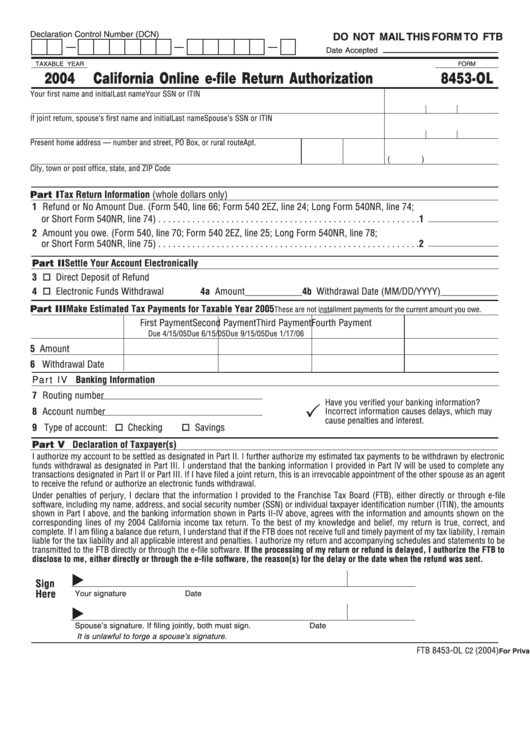

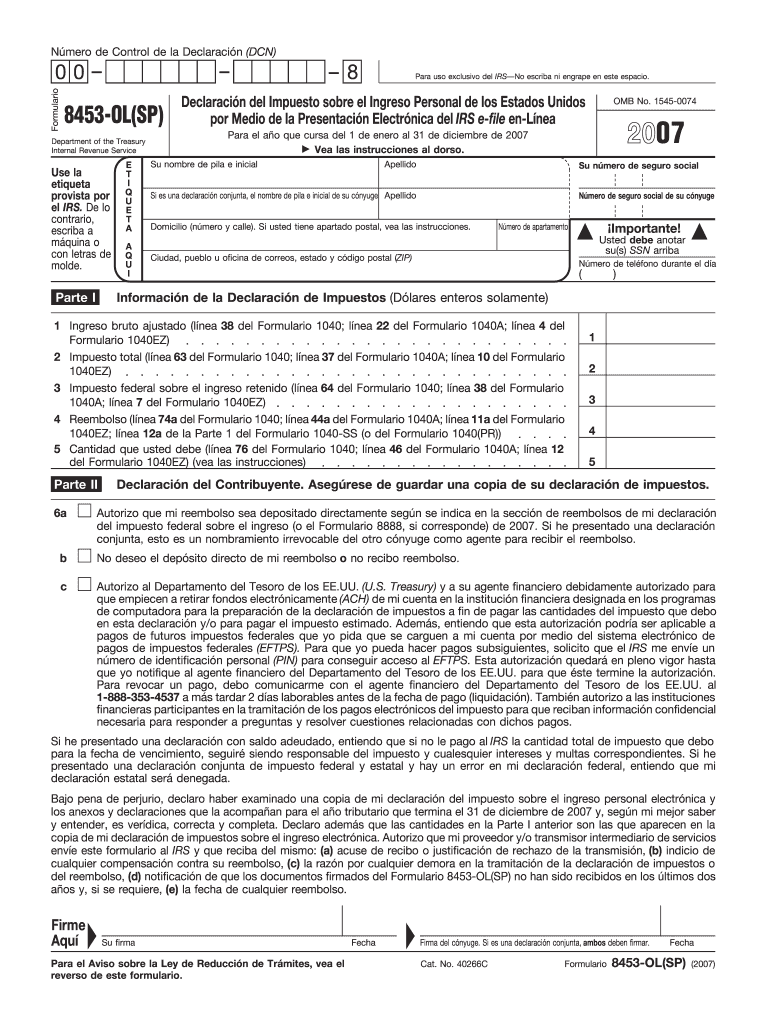

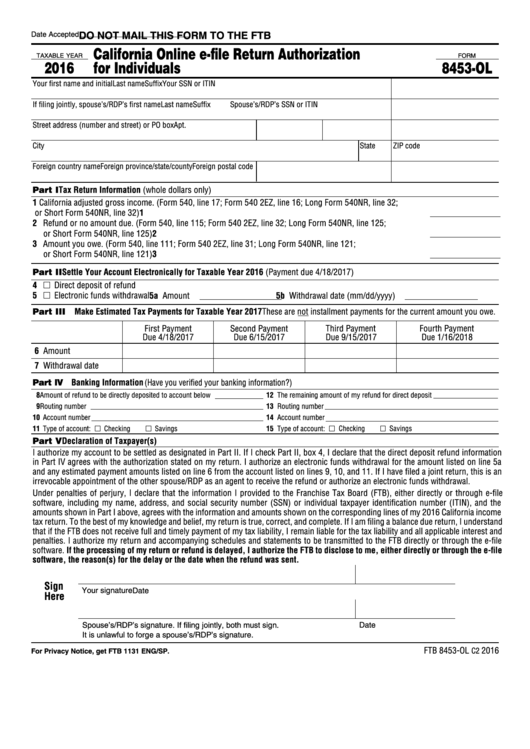

Ca Form 8453-Ol

Ca Form 8453-Ol - Inspect a copy of the. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. And 1099r, distributions from pensions, annuities,. By signing this form, you. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted. You are supposed to sign it after acceptance but you don't actually mail it to ca. Your first name and initial last name suffix your ssn or itin. By signing this form, you. Reconfirm your routing and account numbers. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web schedule rdp, california registered domestic partnership adjustments worksheet. Sign it in a few clicks draw your signature, type it,. Reconfirm your routing and account numbers. By signing this form, you. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted. You are supposed to sign it after acceptance but you don't actually mail it to ca. Reconfirm your routing and account numbers. This form is for income earned in tax year 2022, with tax returns due in april.

Your first name and initial last name suffix your ssn or itin. Reconfirm your routing and account numbers. This form is for income earned in tax year 2022, with tax returns due in april. Web do not mail this form to the ftb. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. By signing this form, you. Inspect a copy of the. Web schedule rdp, california registered domestic partnership adjustments worksheet. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more.

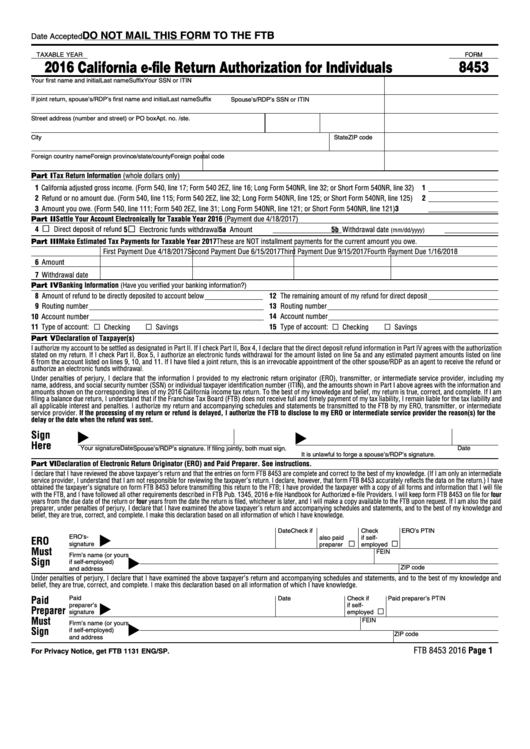

Fillable Form 8453 California EFile Return Authorization For

Web schedule rdp, california registered domestic partnership adjustments worksheet. Your first name and initial last name suffix your ssn or itin. Reconfirm your routing and account numbers. • inspect a copy of the return. Web do not mail this form to the ftb.

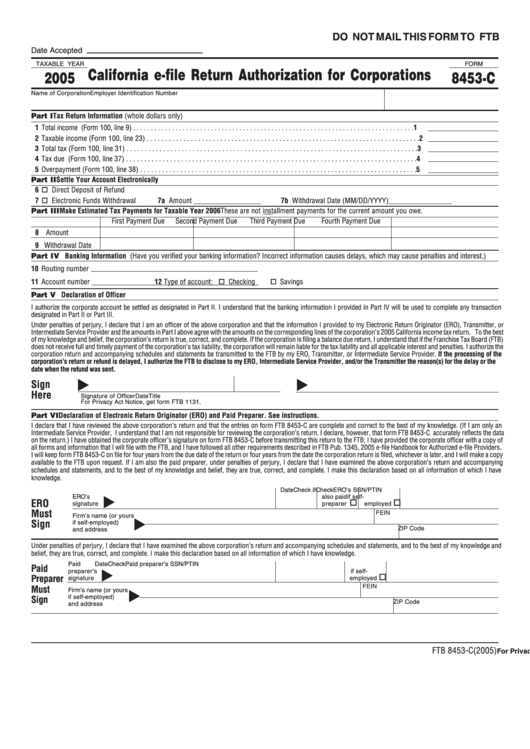

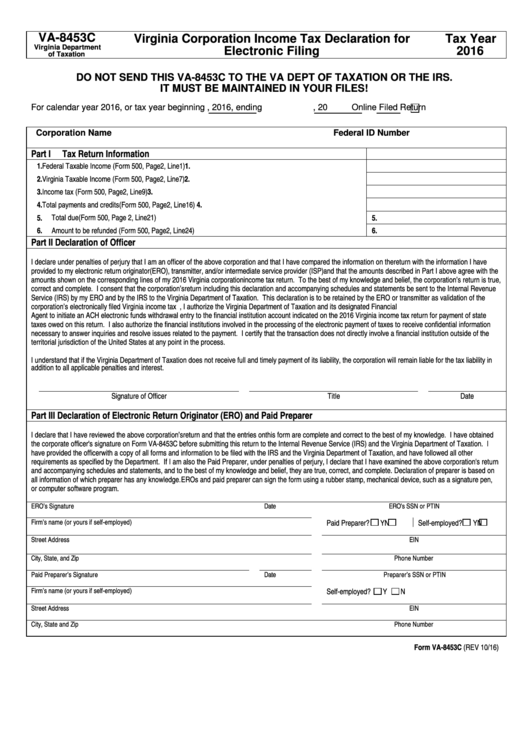

Form 8453C California EFile Return Authorization For Corporations

By signing this form, you. You are supposed to sign it after acceptance but you don't actually mail it to ca. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have.

How Form 8453EMP Helps Completing the Form 941? YouTube

This form is for income earned in tax year 2022, with tax returns due in april. Your first name and initial last name suffix your ssn or itin. Reconfirm your routing and account numbers. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more. Web do not mail this form to the.

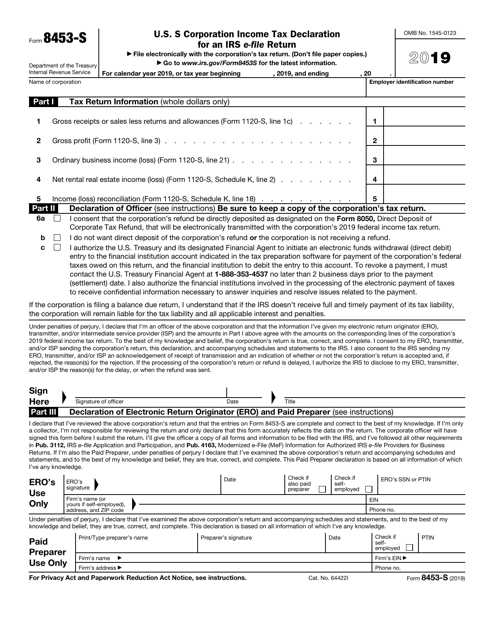

IRS Form 8453S Download Fillable PDF or Fill Online U.S. S Corporation

And 1099r, distributions from pensions, annuities,. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more. Web schedule rdp, california registered domestic partnership adjustments worksheet. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web our records indicate.

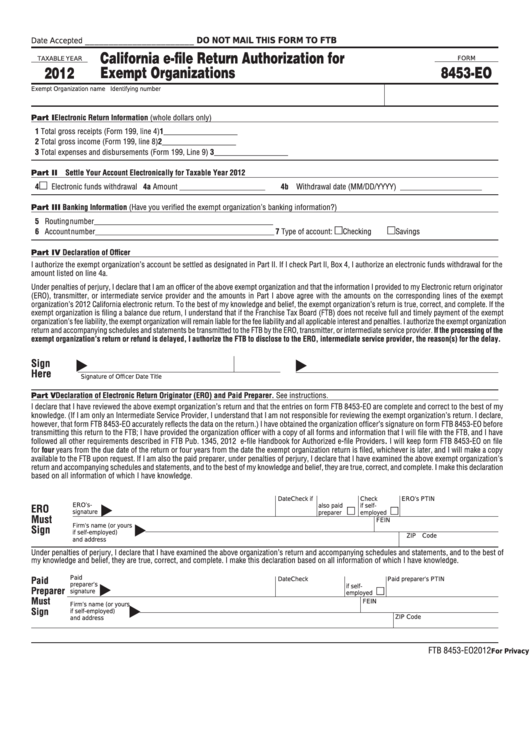

Fillable Form 8453Eo California EFile Return Authorization For

• inspect a copy of the return. Reconfirm your routing and account numbers. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Web do not mail this form to the ftb. Sign it in a few clicks draw your signature, type it,.

What Is IRS Form 8453OL? IRS Tax Attorney

Inspect a copy of the. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. By signing this form, you. Sign it in a few clicks draw your signature, type it,. If a joint return, or request for refund, your spouse must also sign.

Form 8453Ol California Online EFile Return Authorization 2004

Web do not mail this form to the ftb. Reconfirm your routing and account numbers. Web schedule rdp, california registered domestic partnership adjustments worksheet. Reconfirm your routing and account numbers. Inspect a copy of the.

8453 Ol Fill Out and Sign Printable PDF Template signNow

• inspect a copy of the return. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted. You are supposed to sign it after acceptance but you don't actually mail it to ca. Your first name and initial last name suffix your.

Top 10 Form 8453c Templates free to download in PDF format

Web do not mail this form to the ftb. Reconfirm your routing and account numbers. Sign it in a few clicks draw your signature, type it,. Web do not mail this form to the ftb. Edit your 8453 ol form online type text, add images, blackout confidential details, add comments, highlights and more.

Fillable Form 8453Ol California Online EFile Return Authorization

By signing this form, you. Reconfirm your routing and account numbers. Sign it in a few clicks draw your signature, type it,. Your first name and initial last name suffix your ssn or itin. If a joint return, or request for refund, your spouse must also sign.

Sign It In A Few Clicks Draw Your Signature, Type It,.

By signing this form, you. Your first name and initial last name suffix your ssn or itin. And 1099r, distributions from pensions, annuities,. Reconfirm your routing and account numbers.

• Inspect A Copy Of The Return.

Inspect a copy of the. Web schedule rdp, california registered domestic partnership adjustments worksheet. Web do not mail this form to the ftb. Web do not mail this form to the ftb.

Edit Your 8453 Ol Form Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

This form is for income earned in tax year 2022, with tax returns due in april. Reconfirm your routing and account numbers. Web our records indicate the primary taxpayer did not file a prior year individual income tax return and does not have a shared secret (prior year california adjusted. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must.

If A Joint Return, Or Request For Refund, Your Spouse Must Also Sign.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. You are supposed to sign it after acceptance but you don't actually mail it to ca. By signing this form, you.