Ca Form 540Nr Instructions 2022

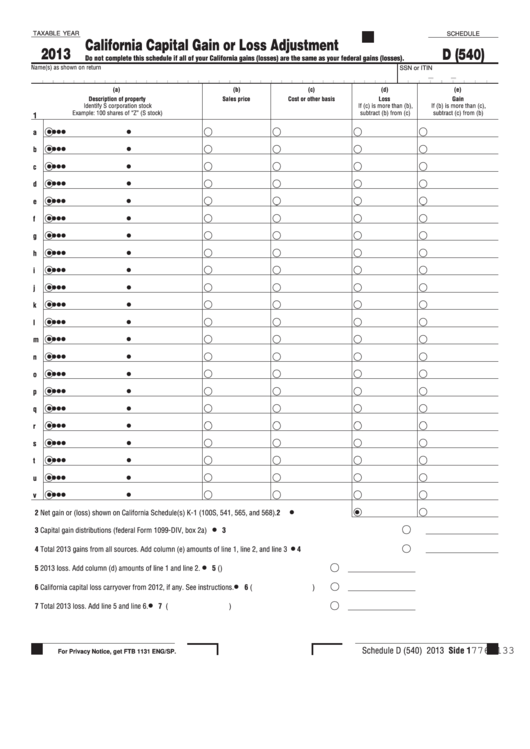

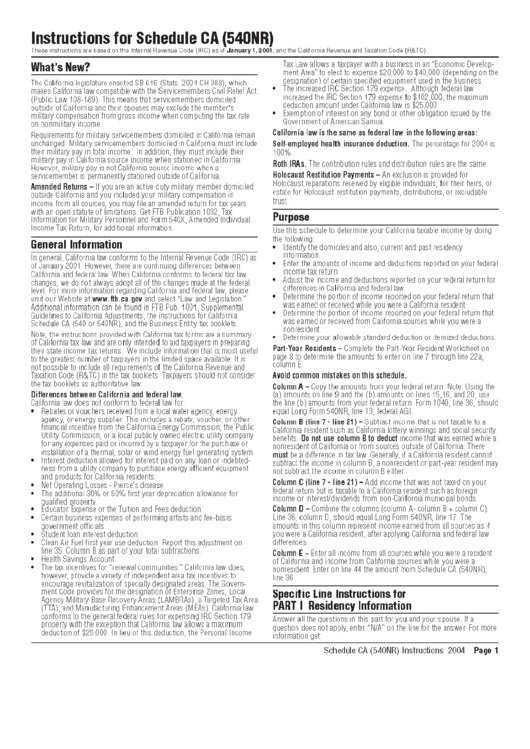

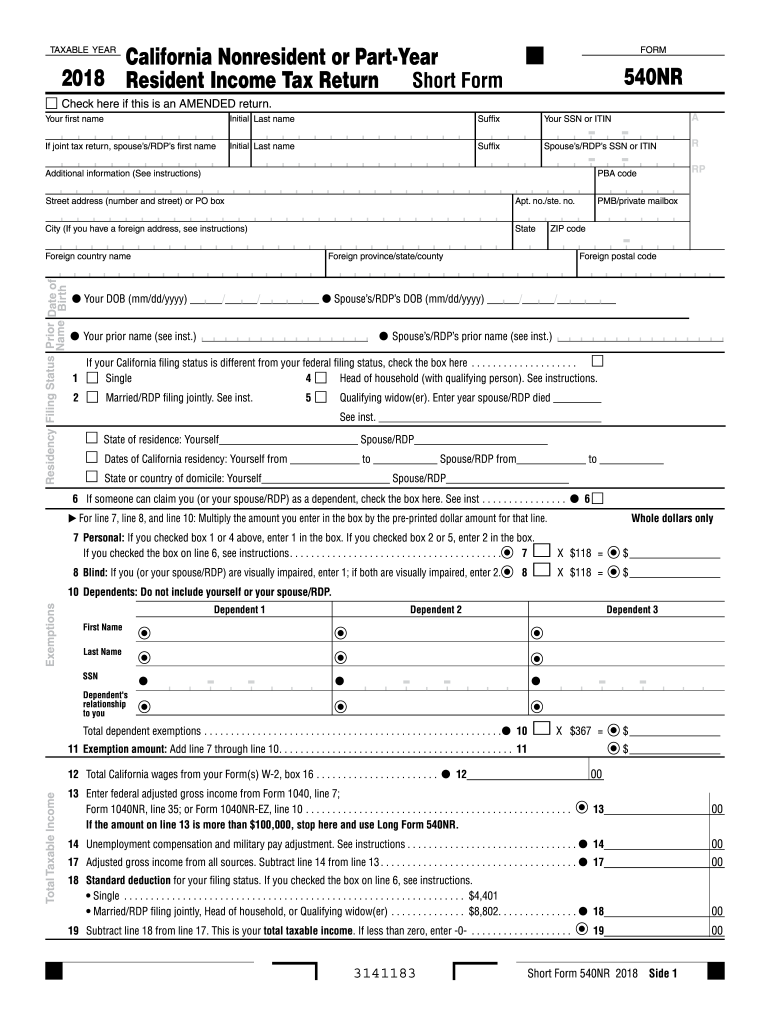

Ca Form 540Nr Instructions 2022 - Is your adjusted gross income (adjusted gross income is computed under california law and. 1120 (pdf) | instructions (pdf) Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or itin r additional information (see instructions) pba code Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Enter month of year end: Web 540nr fiscal year filers only: This calculator does not figure tax for form 540 2ez. 1040 (pdf) | instructions (pdf) 1040a | instructions; Web 540nr form (pdf) | 540nr booklet (instructions included) federal: Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information.

We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. This calculator does not figure tax for form 540 2ez. Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information. However, there are continuing differences between california and federal law. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. 1040 (pdf) | instructions (pdf) 1040a | instructions; 1120 (pdf) | instructions (pdf) This form is for income earned in tax year 2022, with tax returns due in april 2023. Web * required field california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z.

Web 540nr form (pdf) | 540nr booklet (instructions included) federal: 1120 (pdf) | instructions (pdf) 2022 corporation income tax returns due and tax due (for calendar year filers). Web 540nr fiscal year filers only: Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information. 100 form (pdf) | 100 booklet (instructions included) federal: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web * required field california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Enter month of year end: However, there are continuing differences between california and federal law.

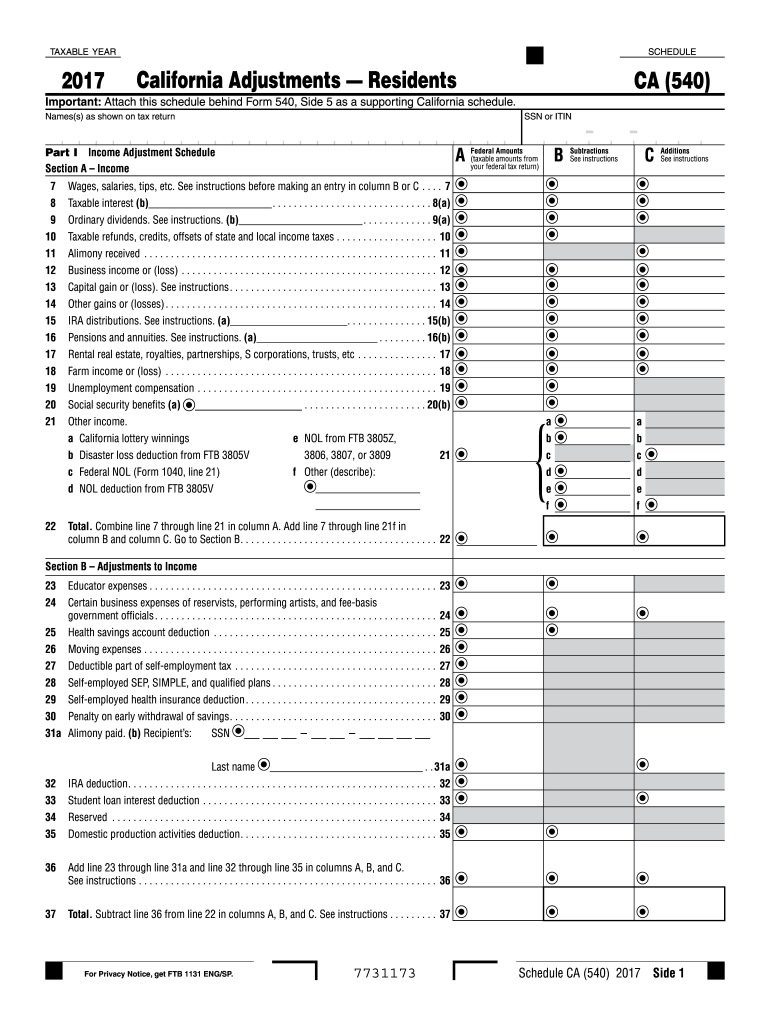

What Is Form 540 Fill Out and Sign Printable PDF Template signNow

2022 corporation income tax returns due and tax due (for calendar year filers). 100 form (pdf) | 100 booklet (instructions included) federal: Is your adjusted gross income (adjusted gross income is computed under california law and. Web 540nr fiscal year filers only: Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information.

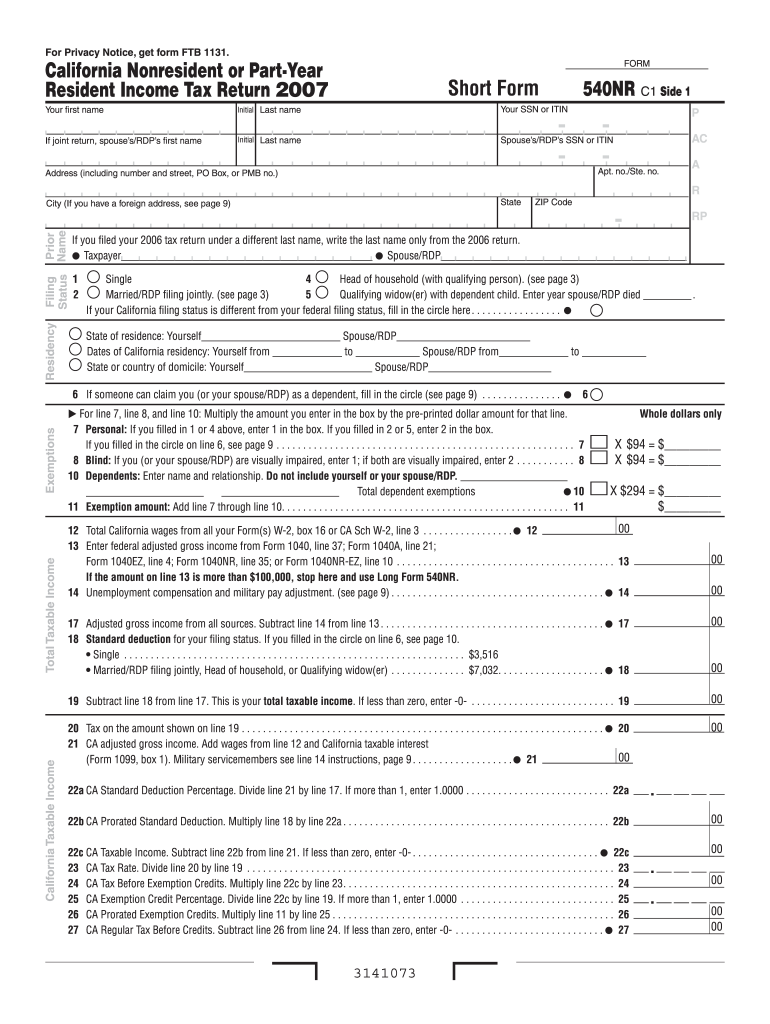

2007 540nr fillable form Fill out & sign online DocHub

Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Enter month of year end: Web * required field california taxable income enter line 19 of 2022 form 540 or form 540nr caution: 2022 corporation income tax returns due and tax due (for calendar year filers). We will update this page with.

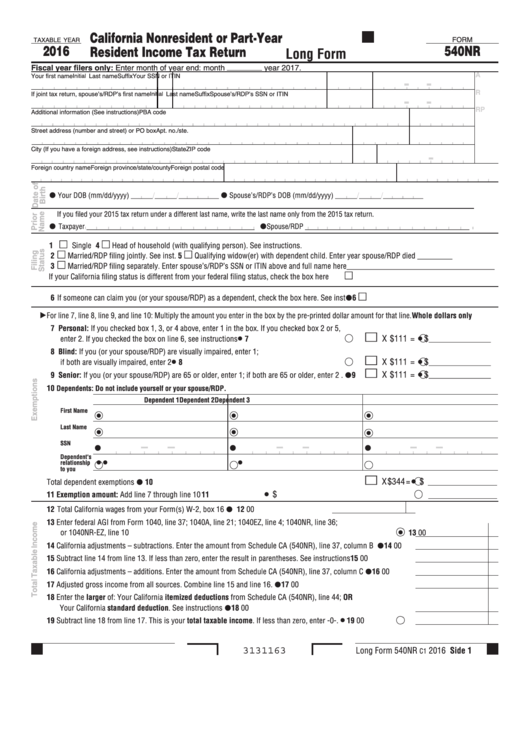

Form 540nr California Nonresident Or PartYear Resident Tax

Is your adjusted gross income (adjusted gross income is computed under california law and. Web 540nr fiscal year filers only: Is your gross income (gross income is computed under california law and consists of all income received from all. Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information. This calculator does not figure.

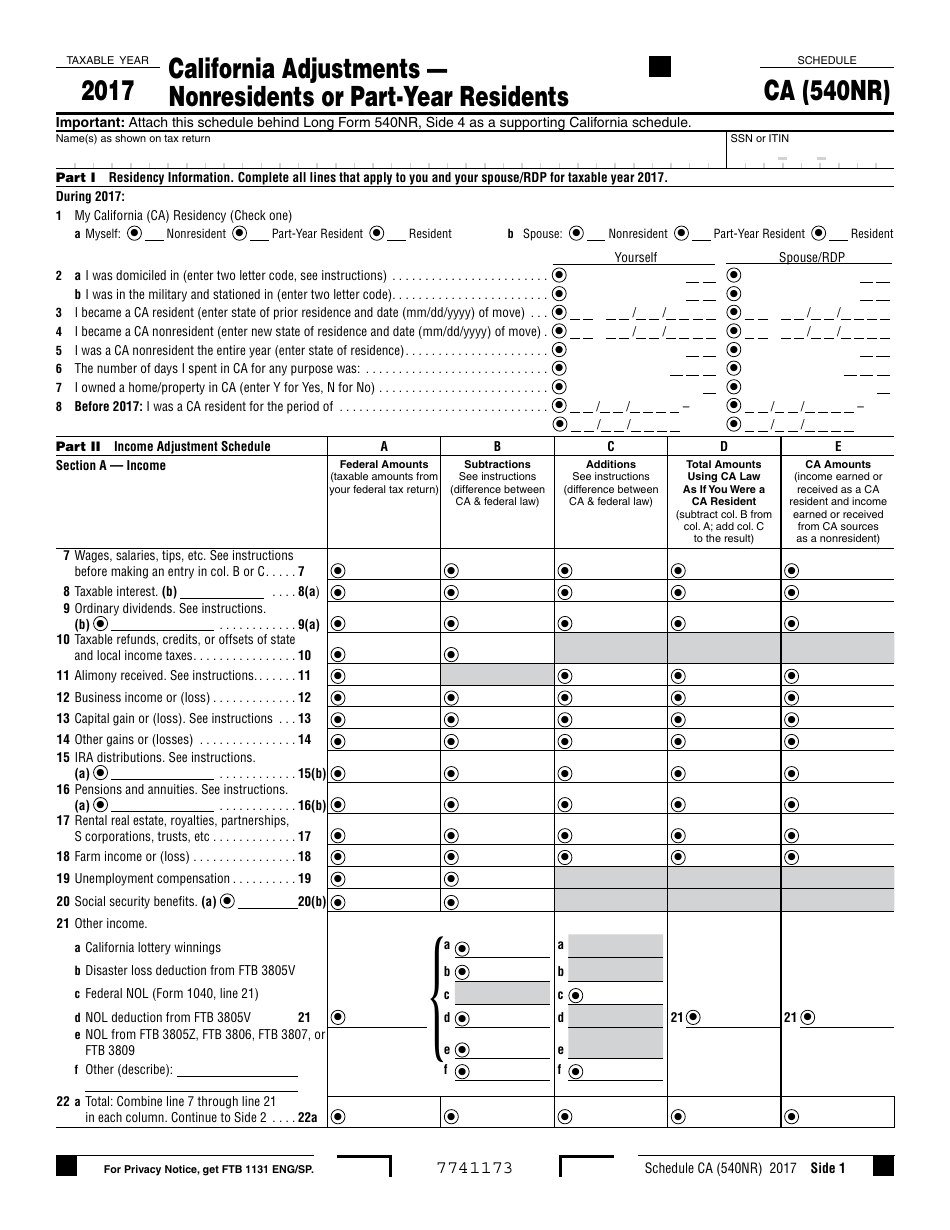

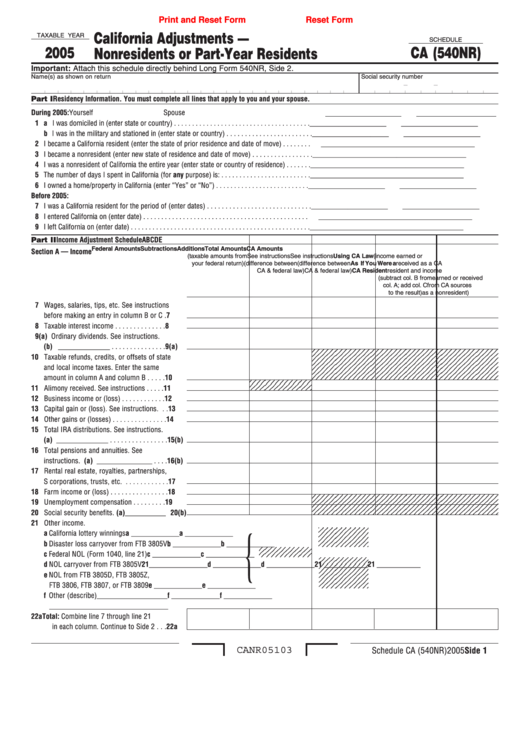

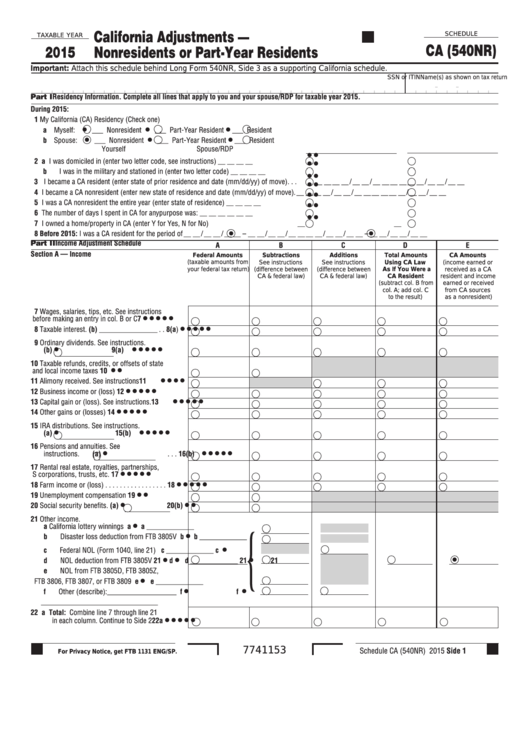

Form 540NR Schedule CA Download Fillable PDF or Fill Online California

Web 540nr form (pdf) | 540nr booklet (instructions included) federal: Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information. 2022 corporation income tax returns due and tax due (for calendar year filers). Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or itin.

Fillable Schedule Ca (Form 540nr) California Adjustments

Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. This calculator does not figure tax for form 540 2ez. Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or.

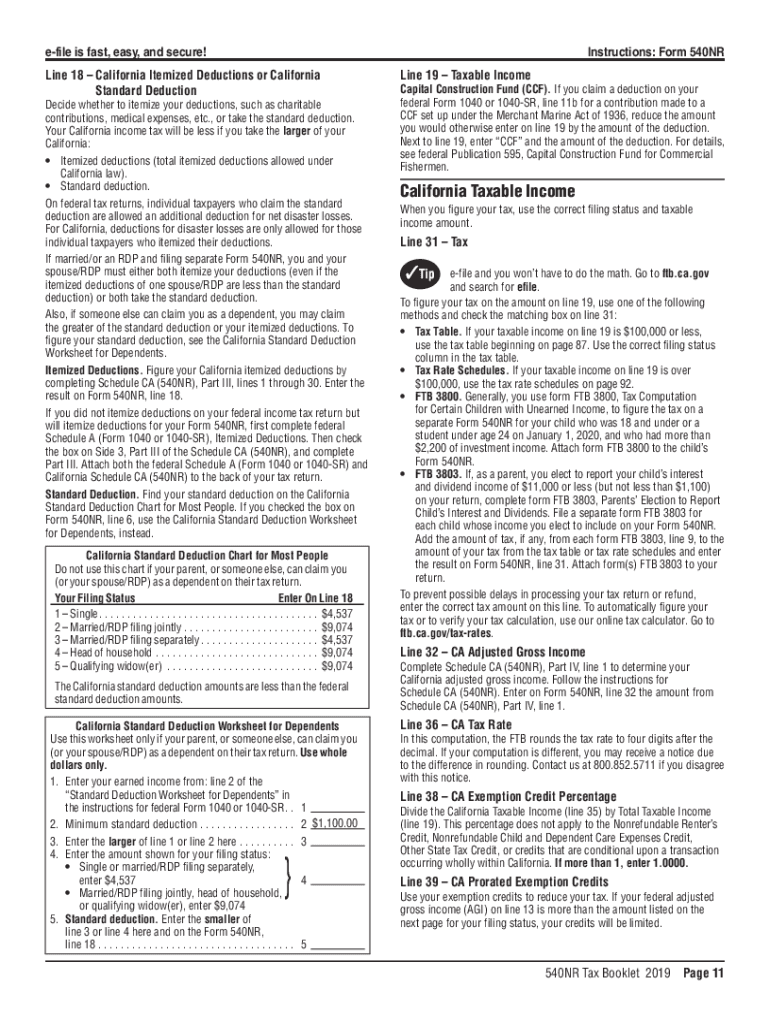

Ca 540Nr Instructions Fill Out and Sign Printable PDF Template signNow

Is your adjusted gross income (adjusted gross income is computed under california law and. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Web 2022 instructions for california schedule d (540nr) california capital gain or loss adjustment general information. Web 540nr fiscal year filers.

Top 22 California Ftb Form 540 Templates free to download in PDF format

We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web 540nr fiscal year filers only: 1120 (pdf) | instructions (pdf) However, there are continuing differences between california.

Instructions For Schedule Ca (540nr) printable pdf download

Web 540nr fiscal year filers only: 1040 (pdf) | instructions (pdf) 1040a | instructions; 2022 corporation income tax returns due and tax due (for calendar year filers). 1120 (pdf) | instructions (pdf) Web 540nr form (pdf) | 540nr booklet (instructions included) federal:

California Nonresident Tax Fill Out and Sign Printable PDF Template

Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Web * required field california taxable income enter line 19 of 2022 form 540 or form 540nr caution: We will update this page with a new version of the form for 2024 as soon as it is made available by the california.

Fillable Schedule Ca (540nr) California Adjustments Nonresidents Or

1040 (pdf) | instructions (pdf) 1040a | instructions; However, there are continuing differences between california and federal law. 100 form (pdf) | 100 booklet (instructions included) federal: Web * required field california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Web 540nr fiscal year filers only:

Web 2022 Instructions For California Schedule D (540Nr) California Capital Gain Or Loss Adjustment General Information.

We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or itin r additional information (see instructions) pba code Use the 540 2ez tax tables on the tax calculator, tables, and rates page. 1120 (pdf) | instructions (pdf)

1040 (Pdf) | Instructions (Pdf) 1040A | Instructions;

However, there are continuing differences between california and federal law. Web * required field california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Enter month of year end: Web 540nr fiscal year filers only:

Is Your Adjusted Gross Income (Adjusted Gross Income Is Computed Under California Law And.

Is your gross income (gross income is computed under california law and consists of all income received from all. This form is for income earned in tax year 2022, with tax returns due in april 2023. 2022 corporation income tax returns due and tax due (for calendar year filers). In general, for taxable years beginning on or after january 1, 2015, california law conforms to the.

100 Form (Pdf) | 100 Booklet (Instructions Included) Federal:

This calculator does not figure tax for form 540 2ez. Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Web 540nr form (pdf) | 540nr booklet (instructions included) federal: