Ca Dissolution Form

Ca Dissolution Form - Web complete all of the following in order to be approved for voluntary administrative dissolution: • all taxes, penalties, and interest paid up to the date the entity ceased doing business. The dissolution was made by a vote of. If you can't afford the fee, you can ask for a fee waiver. January 1, 2020] page 1 of 3 family code, §§ 297, 299, 2320, 2330, 3409 www.courts.ca.gov petitioner: If the form you need is fillable, you will be able to fill and print it out. Web the forms may be posted on their site. File by mail or in person Go to page 2 for a list of forms to file with the sos. For more information, go to.

• all tax returns filed up to the date the entity ceased doing business. Domestic corporations (those originally incorporated in california) legally dissolve. Forms to share financial information (disclosures) you must share financial information with your spouse within 60 days of filing your petition. We registered as domestic partners on (date): File by mail or in person Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing your final tax return. Web file the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. If your business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Web the forms may be posted on their site. January 1, 2020] page 1 of 3 family code, §§ 297, 299, 2320, 2330, 3409 www.courts.ca.gov petitioner:

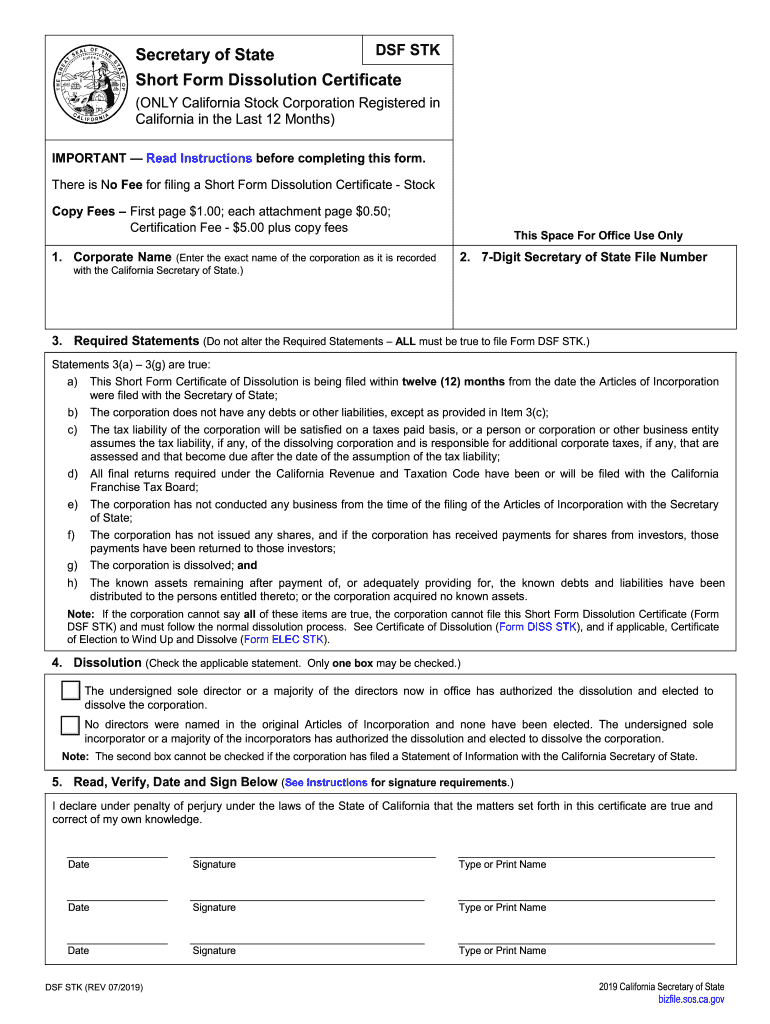

The dissolution was made by a vote of. If not, the site will list the address and phone number of your local courthouse. File by mail or in person Web the forms may be posted on their site. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing your final tax return. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. • all taxes, penalties, and interest paid up to the date the entity ceased doing business. Web complete all of the following in order to be approved for voluntary administrative dissolution: Go to page 2 for a list of forms to file with the sos. Corporate name (enter the exact name of the corporation as it is recorded with the california secretary of state.) 2.

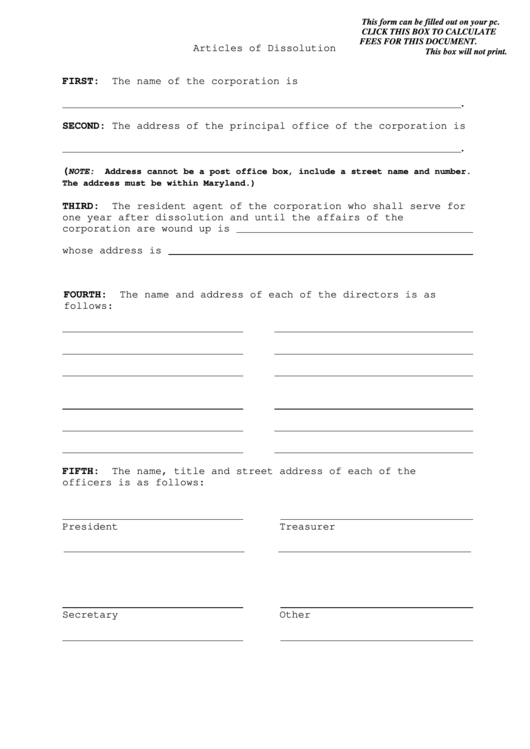

Fillable Articles Of Dissolution Form Maryland printable pdf download

Web complete all of the following in order to be approved for voluntary administrative dissolution: January 1, 2020] page 1 of 3 family code, §§ 297, 299, 2320, 2330, 3409 www.courts.ca.gov petitioner: Corporate name (enter the exact name of the corporation as it is recorded with the california secretary of state.) 2. Petitioner and respondent signed a voluntary declaration of.

62 INFO CORPORATE DISSOLUTION LETTER PDF DOCX PRINTABLE DOWNLOAD

January 1, 2020] page 1 of 3 family code, §§ 297, 299, 2320, 2330, 3409 www.courts.ca.gov petitioner: For more information, go to. Web the forms may be posted on their site. If you can't afford the fee, you can ask for a fee waiver. Web file the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of.

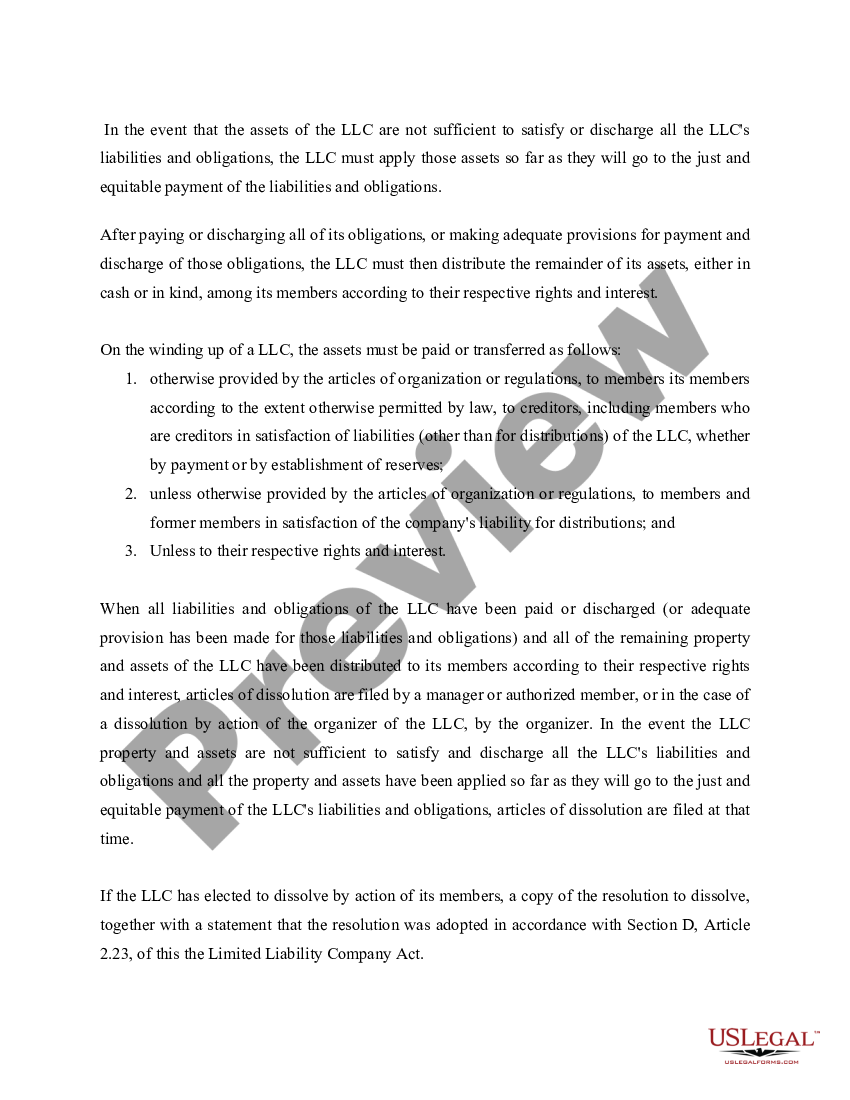

Texas Dissolution Package to Dissolve Limited Liability Company LLC

We registered as domestic partners on (date): Web the forms may be posted on their site. January 1, 2020] page 1 of 3 family code, §§ 297, 299, 2320, 2330, 3409 www.courts.ca.gov petitioner: To download a form (in pdf format), click on the form number in the appropriate table. • all taxes, penalties, and interest paid up to the date.

Business Partnership Breakup Letter Gotilo

If you can't afford the fee, you can ask for a fee waiver. Of the shareholders of the california. Web file the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. • all taxes, penalties, and interest paid up to the date the entity ceased doing business. If your business entity.

Form Dsf Stk Fill Out and Sign Printable PDF Template signNow

Corporate name (enter the exact name of the corporation as it is recorded with the california secretary of state.) 2. File by mail or in person Currently, llcs can submit termination forms online. We registered as domestic partners on (date): Petitioner and respondent signed a voluntary declaration of parentage or paternity.

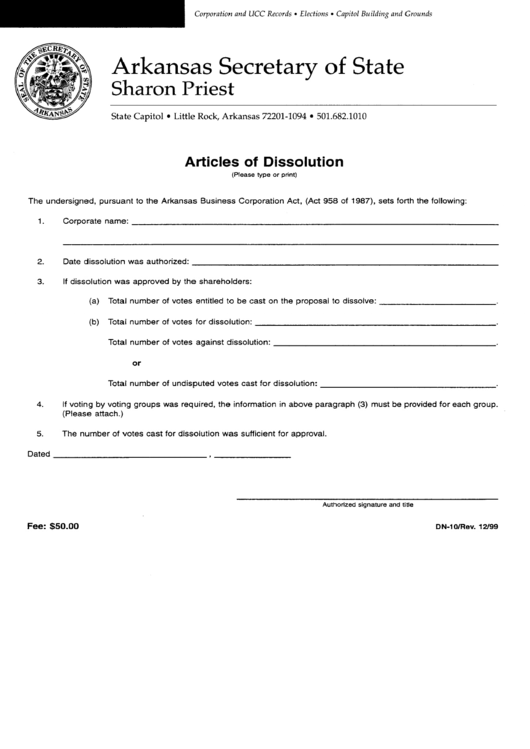

Form Dn10 Articles Of Dissolution printable pdf download

If you can't afford the fee, you can ask for a fee waiver. Of the shareholders of the california. To download a form (in pdf format), click on the form number in the appropriate table. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online..

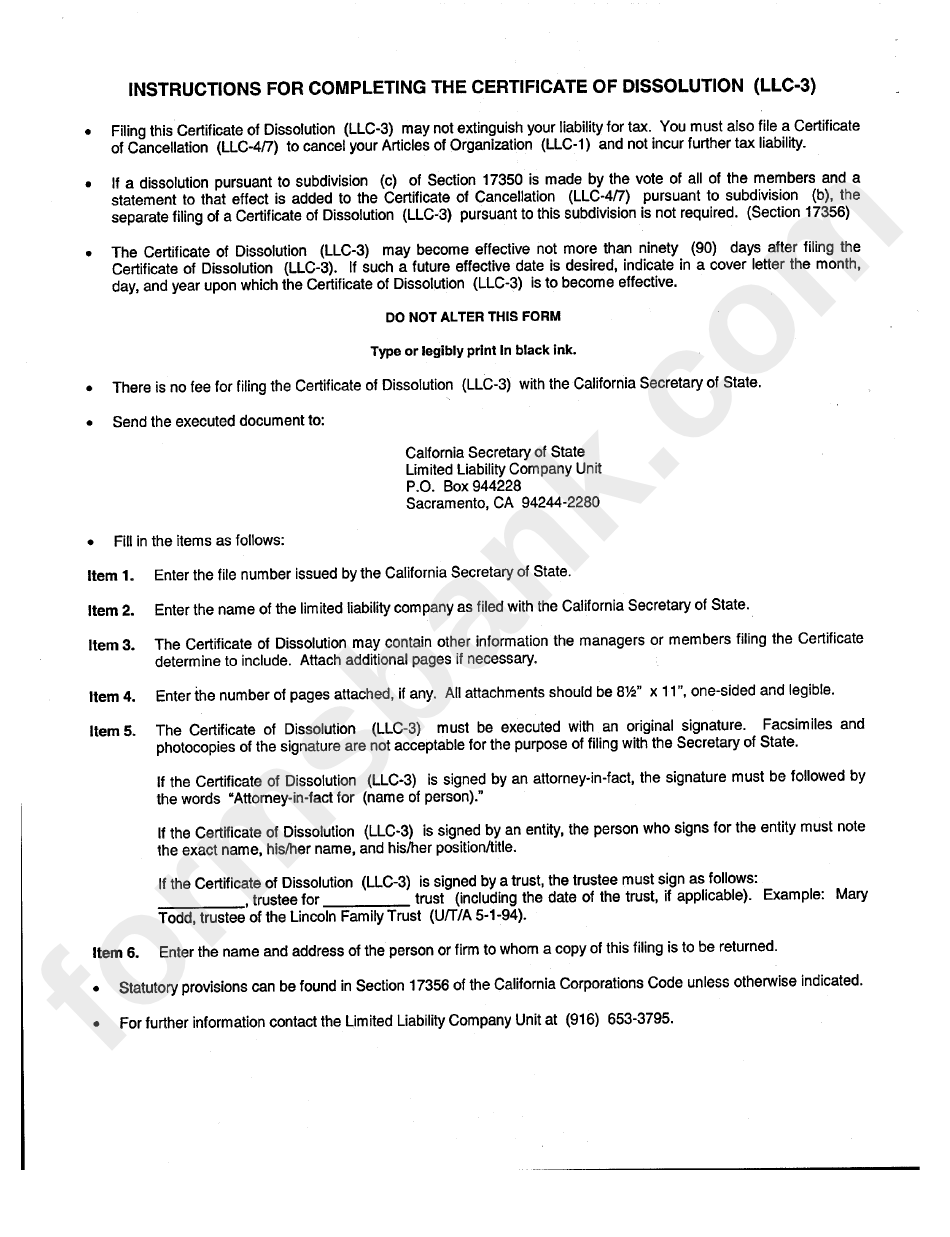

Form Llc3 Instructions Certificate Of Dissolution California

If not, the site will list the address and phone number of your local courthouse. Corporate name (enter the exact name of the corporation as it is recorded with the california secretary of state.) 2. The dissolution was made by a vote of. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of.

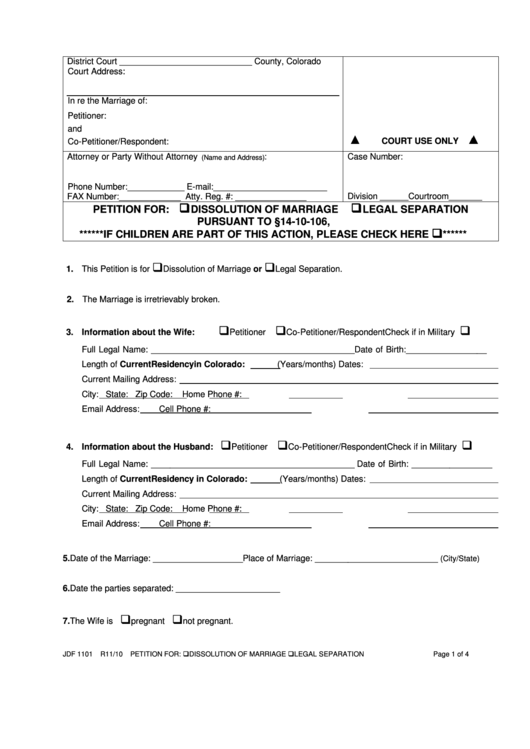

Fillable Petition For Dissolution Of Marriage Form printable pdf download

Forms to share financial information (disclosures) you must share financial information with your spouse within 60 days of filing your petition. Online submission for corporation and partnership dissolution/cancellation forms is. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing your final tax return. File by mail or in person • all.

How To File A Dissolution Of Corporation In California Nicolette Mill

• all taxes, penalties, and interest paid up to the date the entity ceased doing business. Corporate name (enter the exact name of the corporation as it is recorded with the california secretary of state.) 2. To download a form (in pdf format), click on the form number in the appropriate table. If you can't afford the fee, you can.

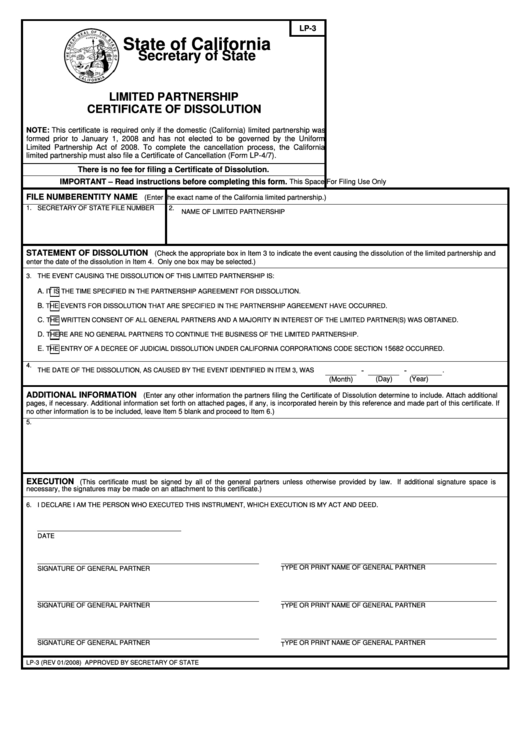

Fillable Form Lp3 Limited Partnership Certificate Of Dissolution

To download a form (in pdf format), click on the form number in the appropriate table. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. If your business entity is suspended or forfeited, it will need to go through the revivor process and be.

January 1, 2020] Page 1 Of 3 Family Code, §§ 297, 299, 2320, 2330, 3409 Www.courts.ca.gov Petitioner:

For more information, go to. To download a form (in pdf format), click on the form number in the appropriate table. File by mail or in person If your business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel.

Less Than Five Years Have Passed Between The Date Of Our Marriage And/Or Registration Of Our Domestic Partnership And The Date Of.

Web complete all of the following in order to be approved for voluntary administrative dissolution: Web file the appropriate dissolution, surrender, or cancellation sos form (s) within 12 months of filing your final tax return. Currently, llcs can submit termination forms online. Forms to share financial information (disclosures) you must share financial information with your spouse within 60 days of filing your petition.

Web The Forms May Be Posted On Their Site.

Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing your final tax return. • all tax returns filed up to the date the entity ceased doing business. Corporate name (enter the exact name of the corporation as it is recorded with the california secretary of state.) 2. Online submission for corporation and partnership dissolution/cancellation forms is.

Of The Shareholders Of The California.

Domestic corporations (those originally incorporated in california) legally dissolve. Web file the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. The dissolution was made by a vote of. Go to page 2 for a list of forms to file with the sos.