Building Wealth Chapter 3 Lesson 5

Building Wealth Chapter 3 Lesson 5 - What percent of americans have 0 dollars saved for retirement? A beginner’s guide to securing your financial future may be reproduced in whole or in part for training purposes, provided it includes credit to the publication and the federal reserve bank. (5 levels of wealth) take your finances to the next level ️ subscribe now: Building wealth publication 4 an investment in knowledge always pays the best interest. Housing and real estate chapter 12: Which method should catherine use to. A debt that is owed, like a. Web use a monthly budget. Web what are two things that it takes to build wealth? Learning objectives briefly describes the.

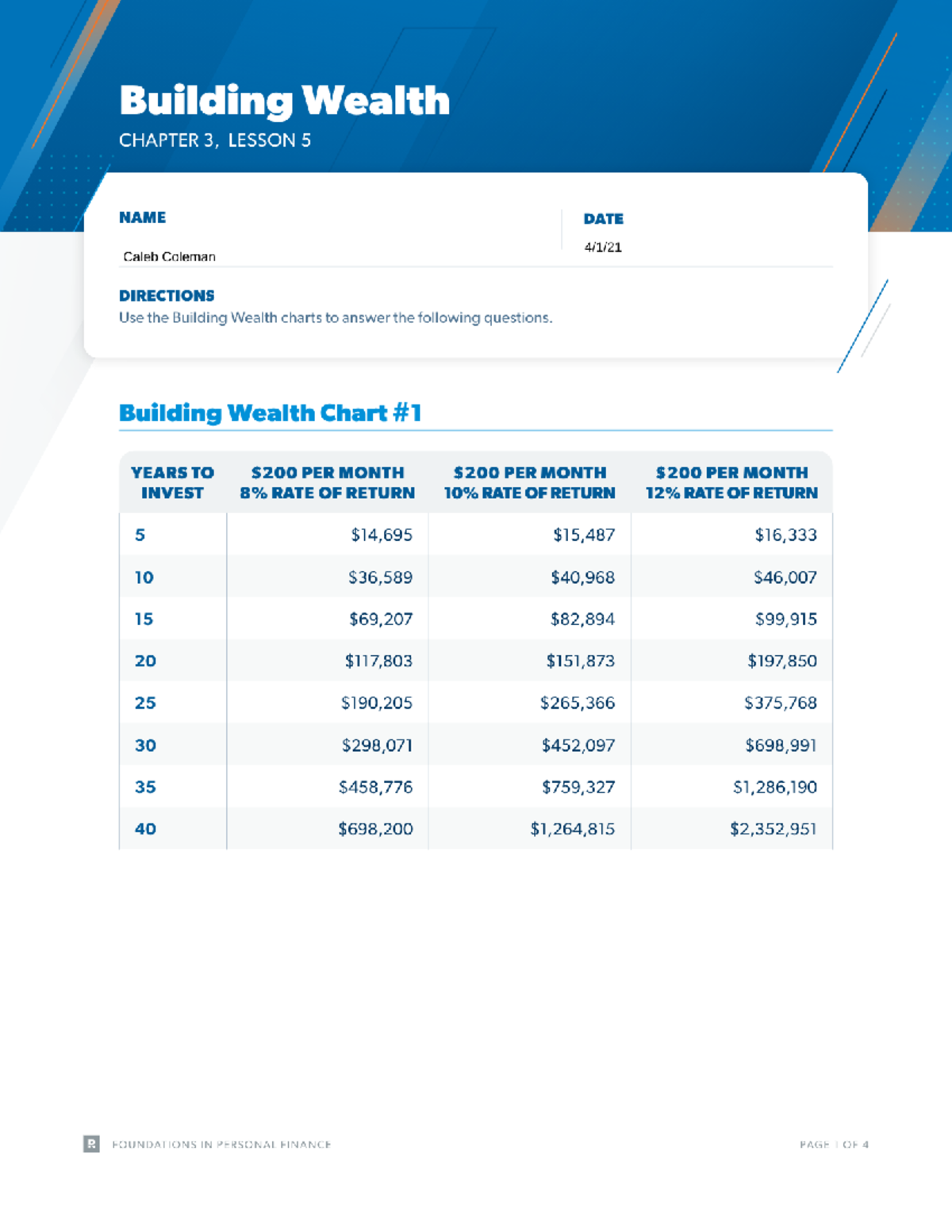

The best way to build wealth. Housing and real estate chapter 12: Web page 1 of 4date directions use the building wealth charts to answer the following questions.namebuilding wealth chapter 3,lesson 5 building wealth chart #1 years to invest $200 per month 8% rate of return $200 per month 10% rate of return $200 per month 12% rate of return 5. (5 levels of wealth) take your finances to the next level ️ subscribe now: Web use a monthly budget. A beginner’s guide to securing your financial future may be reproduced in whole or in part for training purposes, provided it includes credit to the publication and the federal reserve bank. The role of insurance chapter 10: Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically builds wealth. You'll have less freedom with your money if you. Once you have a $500 emergency fund, you should.

The role of insurance chapter 10: Which method should catherine use to. Web 47% of americans have less than $1,000 saved for a (n) __________. Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically builds wealth. Web describe how spending less and investing more can contribute to wealth building.building wealth chapter 3,lesson 5 foundations in personal financean 8% rate of return would keep you from. If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? The first step you should take when you want to make a large purchase is. Income and taxes chapter 11: Once you have a $500 emergency fund, you should. (5 levels of wealth) take your finances to the next level ️ subscribe now:

7 Important Keys To Building Wealth In 2021 Transform Your Life

The first step you should take when you want to make a large purchase is. Web use a monthly budget. Income and taxes chapter 11: Building wealth publication 4 an investment in knowledge always pays the best interest. Web studyer1 terms in this set (30) assets valuable possessions and monetary items that people own;

3 ways Anyone can Build more Wealth Squire Wealth Advisors

Web 47% of americans have less than $1,000 saved for a (n) __________. A beginner’s guide to securing your financial future may be reproduced in whole or in part for training purposes, provided it includes credit to the publication and the federal reserve bank. Something you have or something that's owned liability money that someone owes; The best way to.

Wealth Building Strategies millionaires use and broke people don't

What percent of americans have 0 dollars saved for retirement? Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically builds wealth. Build credit and control debt; The role of insurance chapter 10: Web studyer1 terms in this set.

5 Important WealthBuilding Lessons Shared By MultiMillionaires

The money you save on investment costs will more than make up for the price of the wine you’ll most definitely need to bribe people to come to this, um, party. Web describe how spending less and investing more can contribute to wealth building.building wealth chapter 3,lesson 5 foundations in personal financean 8% rate of return would keep you from..

Your Finance Formulas 5 Great Tips To Manage Your Money And Build Your

Which method should catherine use to. Web studyer1 terms in this set (30) assets valuable possessions and monetary items that people own; Use gifts and extra money wisely. You'll have less freedom with your money if you. The money you save on investment costs will more than make up for the price of the wine you’ll most definitely need to.

14 Wealth Building Secrets You Need To Know The Kickass Entrepreneur

Once you have a $500 emergency fund, you should. Something you have or something that's owned liability money that someone owes; If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? A debt.

5 Critical Steps to Building Wealth How to build wealth Financial

Which method should catherine use to. You'll have less freedom with your money if you. Something you have or something that's owned liability money that someone owes; Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically builds wealth..

Podcast The NoBS Stages To Building Massive Wealth (Part 3)

Housing and real estate chapter 12: If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? Web studyer1 terms in this set (30) assets valuable possessions and monetary items that people own; (5.

Chapter 3 Lesson 5 Work for Molecular Biology. BP 723 StuDocu

You'll have less freedom with your money if you. Web use a monthly budget. The money you save on investment costs will more than make up for the price of the wine you’ll most definitely need to bribe people to come to this, um, party. Once you have a $500 emergency fund, you should. Web what are two things that.

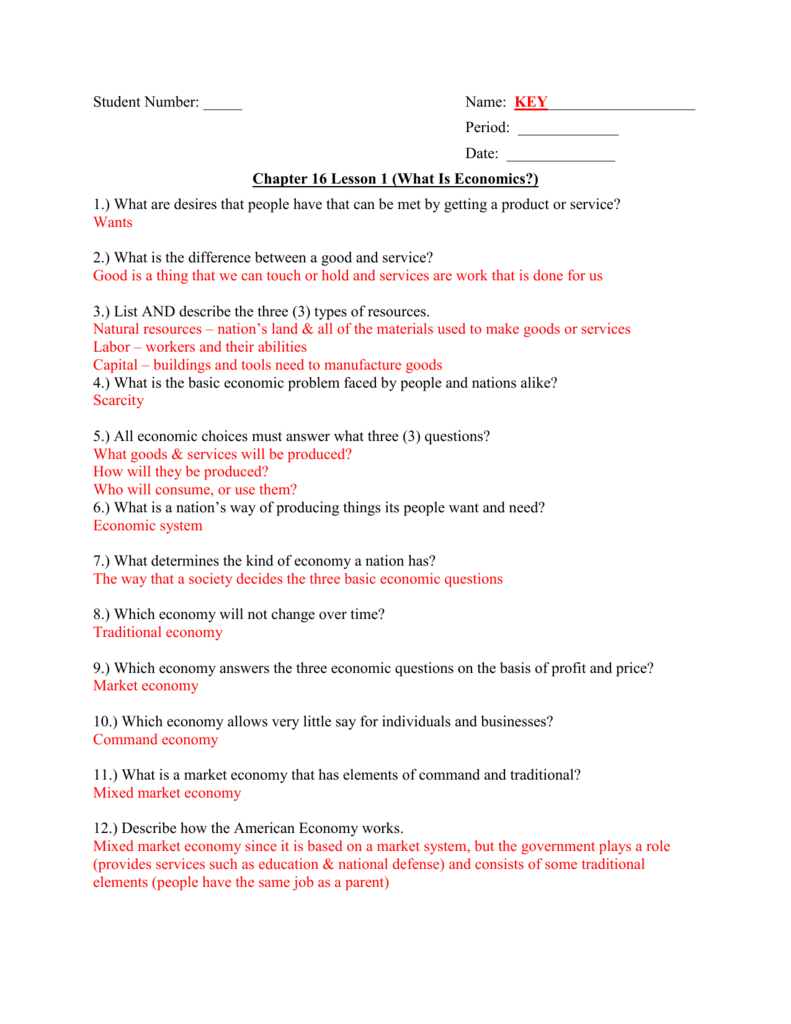

Chapter 16 Lesson 1 (What Is Economics?)

Building wealth publication 4 an investment in knowledge always pays the best interest. A beginner’s guide to securing your financial future may be reproduced in whole or in part for training purposes, provided it includes credit to the publication and the federal reserve bank. Income and taxes chapter 11: Web page 1 of 4date directions use the building wealth charts.

Housing And Real Estate Chapter 12:

Web in the building wealth topic, the students gain a fundamental understanding of the steps they can take to help their money grow and begin planning for life’s financial events. What percent of 10,000 millionaires interviewed said their wealth came from. Credit and debt chapter 5: A beginner’s guide to securing your financial future may be reproduced in whole or in part for training purposes, provided it includes credit to the publication and the federal reserve bank.

Web Finally, It Is Time To Invest.

If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? Which method should catherine use to. Learning objectives briefly describes the. Web describe how spending less and investing more can contribute to wealth building.building wealth chapter 3,lesson 5 foundations in personal financean 8% rate of return would keep you from.

A Debt That Is Owed, Like A.

(5 levels of wealth) take your finances to the next level ️ subscribe now: What percent of americans have 0 dollars saved for retirement? The best way to build wealth. Something you have or something that's owned liability money that someone owes;

Web Page 1 Of 4Date Directions Use The Building Wealth Charts To Answer The Following Questions.namebuilding Wealth Chapter 3,Lesson 5 Building Wealth Chart #1 Years To Invest $200 Per Month 8% Rate Of Return $200 Per Month 10% Rate Of Return $200 Per Month 12% Rate Of Return 5.

The money you save on investment costs will more than make up for the price of the wine you’ll most definitely need to bribe people to come to this, um, party. Web use a monthly budget. Build credit and control debt; Web 47% of americans have less than $1,000 saved for a (n) __________.