Blanket Tax Exempt Form Ohio

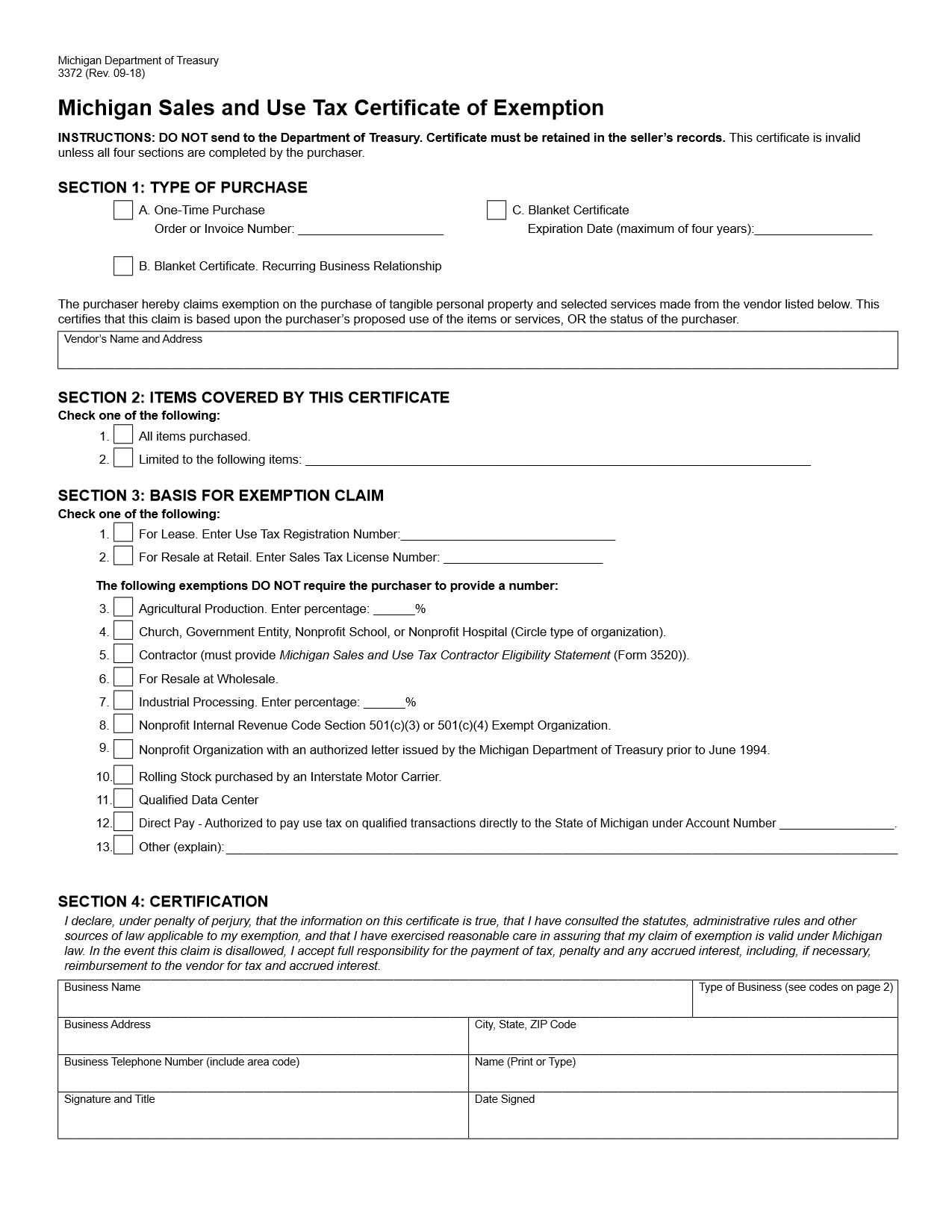

Blanket Tax Exempt Form Ohio - Web no do i need a form? However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax. Check if this certificate is for a single purchase. Access the forms you need to file taxes or do business in ohio. Web up to 4% cash back stec b rev. Usage by an agency of the state of ohio government miami university 107 roudebush hall higher education oxford, oh 45056 tax & comp analyst. This exemption certificate is used to claim exemption or exception on a single purchase. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web tax exempt form ohio.

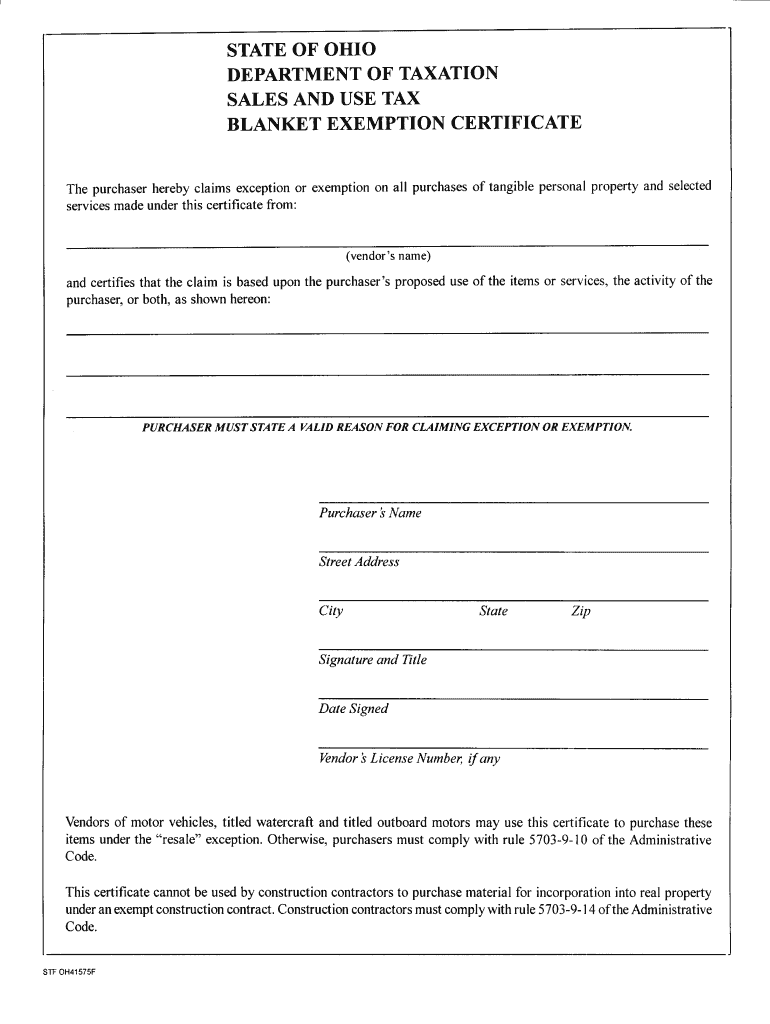

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Show details we are not affiliated with. Web the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from: Check if this certificate is for a single purchase. Web tax exempt form ohio. The contractor may use a blanket exemption certificate, which covers all purchases from that vendor. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Web up to $40 cash back edit state of ohio tax blanket exemption form. Blanket exemption certificate [revised march 2022] the purchaser hereby claims.

Web the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from: Web no do i need a form? Check if this certificate is for a single purchase. This exemption certificate is used to claim exemption or exception on a single purchase. The ohio department of taxation provides a searchable repository of individual tax. Web up to $40 cash back edit state of ohio tax blanket exemption form. Web up to $40 cash back ohio tax exempt form and other documents can be changed, filled out, and signed right in your gmail inbox. However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax. The unit exemption certificate may be. 3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible.

ohio tax exempt form Fill out & sign online DocHub

Show details we are not affiliated with. Access the forms you need to file taxes or do business in ohio. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Web (d) (i) a unit exemption certificate should be used to cover a single purchase and must be maintained with the primary purchase record..

blanket certificate of exemption ohio Fill Online, Printable, Fillable

This exemption certificate is used to claim exemption or exception on a single purchase. Web no do i need a form? Web the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from: The unit exemption certificate may be. Access the forms you need to file taxes or do.

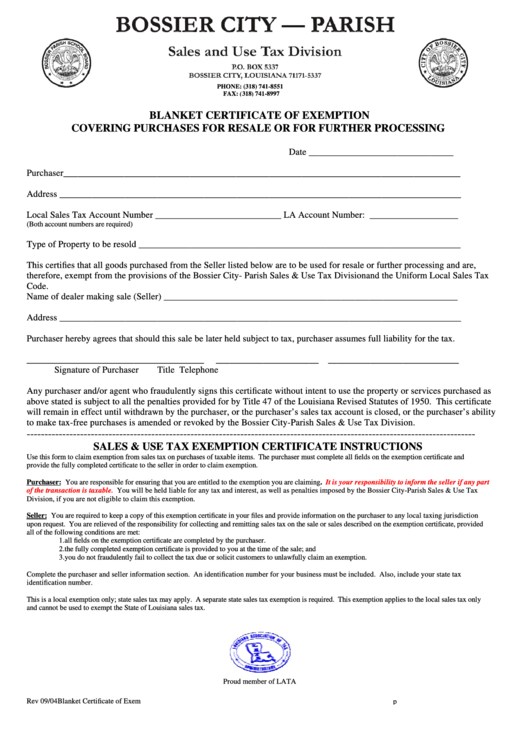

Blanket Certificate Of Exemption Covering Purchases For Resale Or For

Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Show details we are not affiliated with. Blanket exemption certificate [revised march 2022] the purchaser hereby claims. Access the forms you need to file taxes or do business in ohio. 3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser hereby claims exception.

List of Tax Exempt items Baby receiving blankets, Emergency kit, Tax

Web (d) (i) a unit exemption certificate should be used to cover a single purchase and must be maintained with the primary purchase record. Access the forms you need to file taxes or do business in ohio. Show details we are not affiliated with. Get everything done in minutes. 3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser.

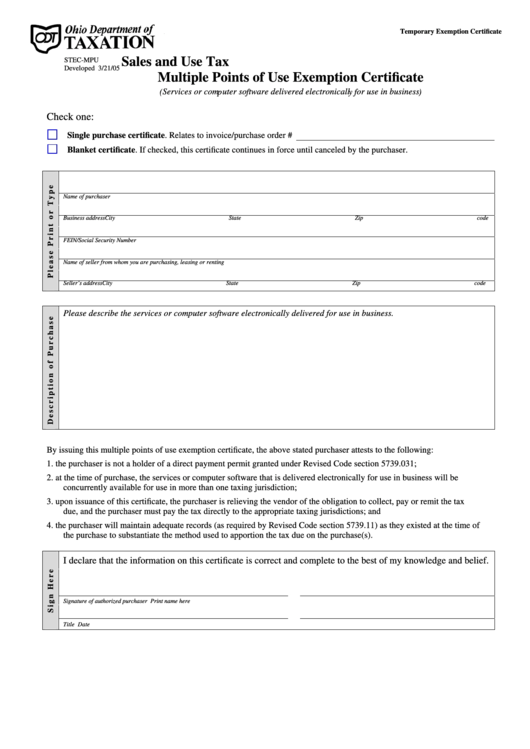

Form StecMpu 2005 Sales And Use Tax Multiple Points Of Use

Show details we are not affiliated with. Web the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from: Check if this certificate is for a single purchase. Enter the id number as required in the. Web up to $40 cash back edit state of ohio tax blanket exemption.

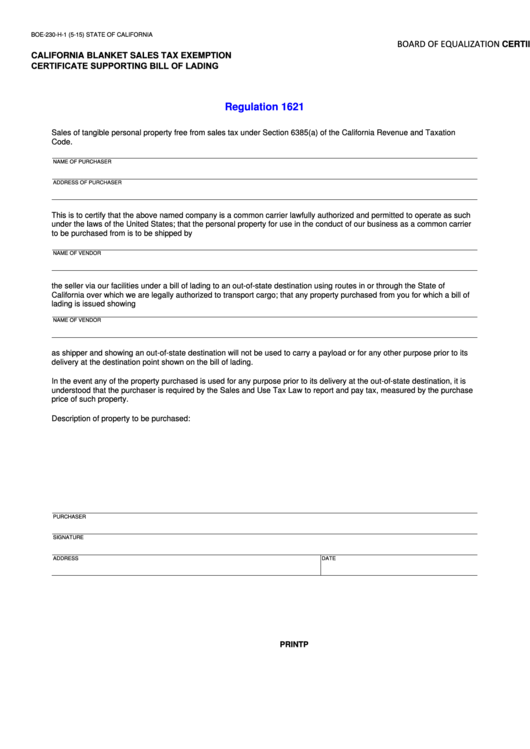

Fillable Certificate B California Blanket Sales Tax Exemption Form

Access the forms you need to file taxes or do business in ohio. Enter the id number as required in the. Web the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from: Web up to $40 cash back edit state of ohio tax blanket exemption form. Check if.

Ohio Sales Tax Blanket Exemption Form 2021

Enter the related invoice/purchase order # a.purchaser's name 5. Check if this certificate is for a single purchase. The unit exemption certificate may be. Blanket exemption certificate [revised march 2022] the purchaser hereby claims. Enter the id number as required in the.

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Access the forms you need to file taxes or do business in ohio. Web up to $40 cash back edit state of ohio tax blanket exemption form. Get everything done in minutes. Show details we are not affiliated with.

Tax Exempt Form Fill Out and Sign Printable PDF Template signNow

Web no do i need a form? Access the forms you need to file taxes or do business in ohio. Get everything done in minutes. The unit exemption certificate may be. Web up to $40 cash back edit state of ohio tax blanket exemption form.

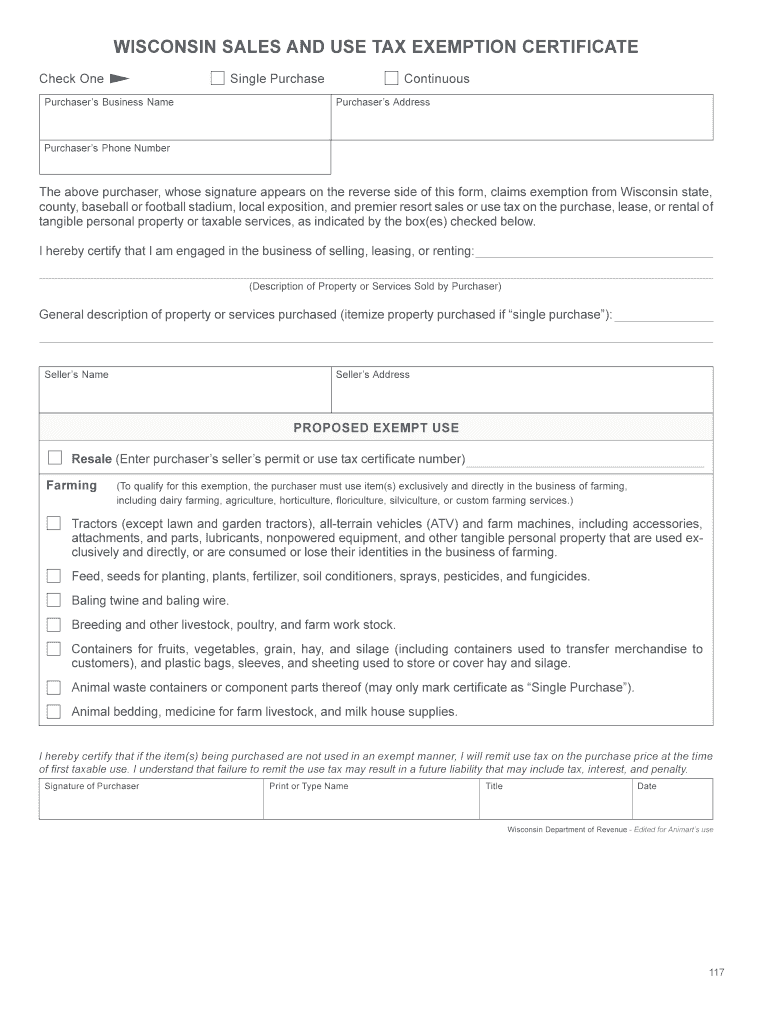

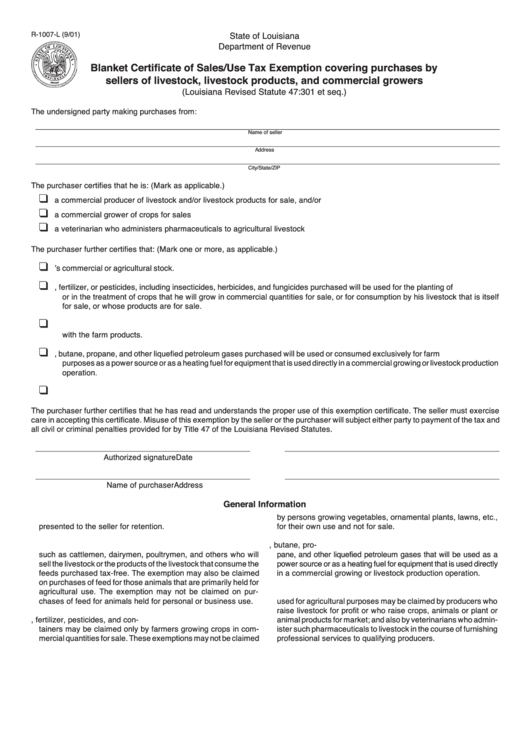

Fillable Form R1007L Blanket Certificate Of Sales/use Tax Exemption

Web up to $40 cash back ohio tax exempt form and other documents can be changed, filled out, and signed right in your gmail inbox. However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax. Access the forms you need to file taxes or do business in ohio. Enter the.

The Ohio Department Of Taxation Provides A Searchable Repository Of Individual Tax.

Access the forms you need to file taxes or do business in ohio. Web the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from: Get everything done in minutes. Web blanket certificate of exemption ohio form get started with a ohio tax exempt form 0, complete it in a few clicks, and submit it securely.

This Exemption Certificate Is Used To Claim Exemption Or Exception On A Single Purchase.

Web (d) (i) a unit exemption certificate should be used to cover a single purchase and must be maintained with the primary purchase record. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web up to $40 cash back edit state of ohio tax blanket exemption form.

Enter The Related Invoice/Purchase Order # A.purchaser's Name 5.

3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible. Use the yellow download button to access the. Check if this certificate is for a single purchase. Show details we are not affiliated with.

Enter The Id Number As Required In The.

Web up to 4% cash back stec b rev. Web no do i need a form? Web ohio blanket tax exempt and unit exemption certificates. However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax.