Blank 1099 Nec Form 2021 Printable

Blank 1099 Nec Form 2021 Printable - See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Web to correct blank 1099 nec form 2021 printable version you should: Web print and file a form 1096 downloaded from this website; Web get started free what's included? File copy a of this form with the irs by february 1, 2021. Enter the recipient's name in the space provided. Web processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Report payment information to the irs and the person or business that received the payment. Enter the recipient's ssn or itin in the space provided. A penalty may be imposed for filing with the irs information return forms that can’t be scanned.

Web processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Furnish copy b of this form to the recipient by february 1, 2021. Enter the recipient's name in the space provided. File copy a of this form with the irs by february 1, 2021. Customize the template with exclusive fillable areas. Enter the recipient's ssn or itin in the space provided. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Enter the total amount of the nonemployee compensation in the space provided. Web to correct blank 1099 nec form 2021 printable version you should:

See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Work easily while keeping your data safe with form 1099 nec on the web. Enter the recipient's name in the space provided. Enter the recipient's ssn or itin in the space provided. Web to correct blank 1099 nec form 2021 printable version you should: Web processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Enter the total amount of the nonemployee compensation in the space provided. Furnish copy b of this form to the recipient by february 1, 2021. Involved parties names, places of residence and numbers etc. A penalty may be imposed for filing with the irs information return forms that can’t be scanned.

W9 vs 1099 IRS Forms, Differences, and When to Use Them

Web print and file a form 1096 downloaded from this website; Web get started free what's included? Enter the recipient's name in the space provided. File copy a of this form with the irs by february 1, 2021. Web find the 1099 nec form 2021 you want.

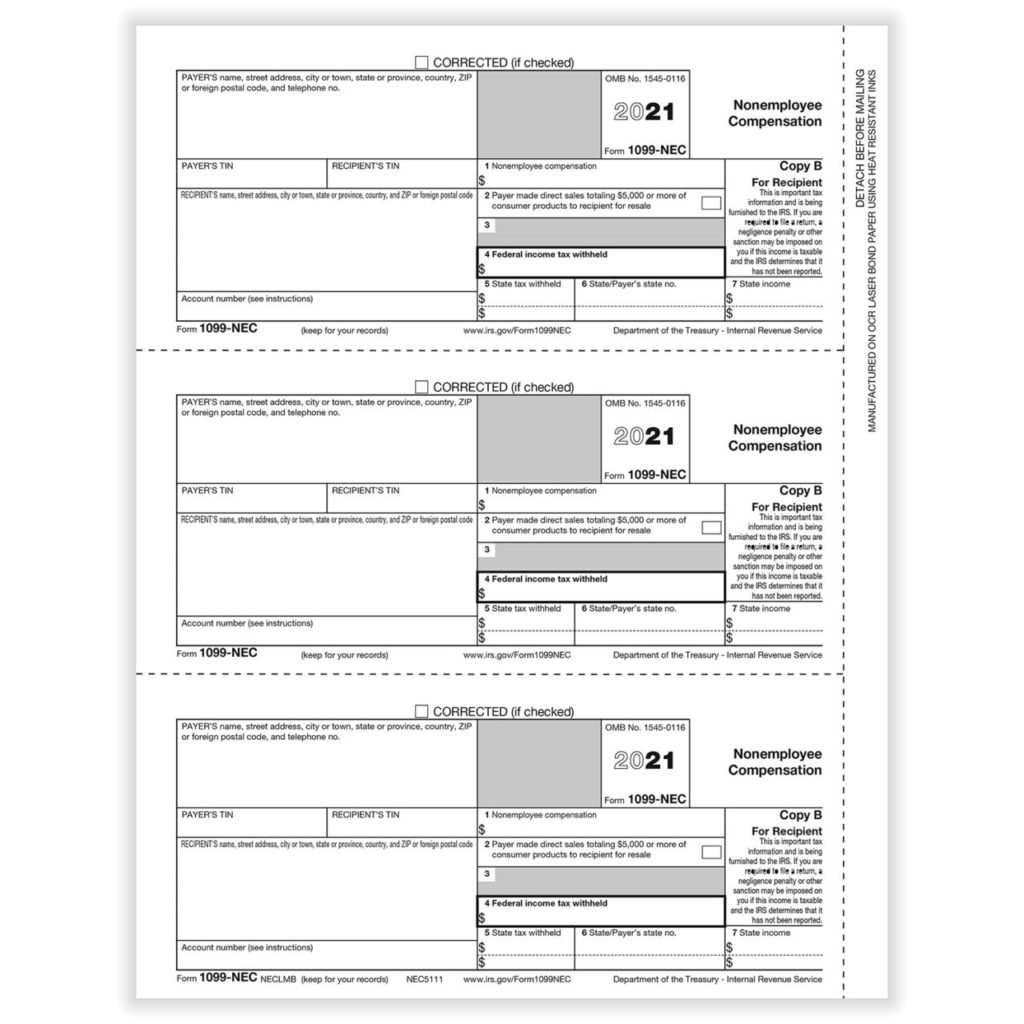

Laser 1099NEC 3up Recipient Copy B NECLMB Forms & Fulfillment

Enter the total amount of the nonemployee compensation in the space provided. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Involved parties names, places of residence and numbers etc. Report payment information to the irs and the person or business that received the payment. Customize the template with exclusive fillable areas.

1099 Tips for your Tech Startup 2021 Shay CPA

A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Work easily while keeping your data safe with form 1099 nec on the web. Customize the template with exclusive fillable areas. Enter the total amount of the nonemployee compensation in the space provided. Furnish copy b of this form to the recipient by.

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Involved parties names, places of residence and numbers etc. File copy a of this form with the irs by february 1, 2021. Web to correct blank 1099 nec form 2021 printable version you should: Furnish copy b of this form to the recipient by february 1, 2021. Work easily while keeping your data safe with form 1099 nec on the.

1099 vs W2 Calculator (To Estimate Your Tax Difference)

Furnish copy b of this form to the recipient by february 1, 2021. Enter the recipient's ssn or itin in the space provided. Involved parties names, places of residence and numbers etc. Report payment information to the irs and the person or business that received the payment. Enter the total amount of the nonemployee compensation in the space provided.

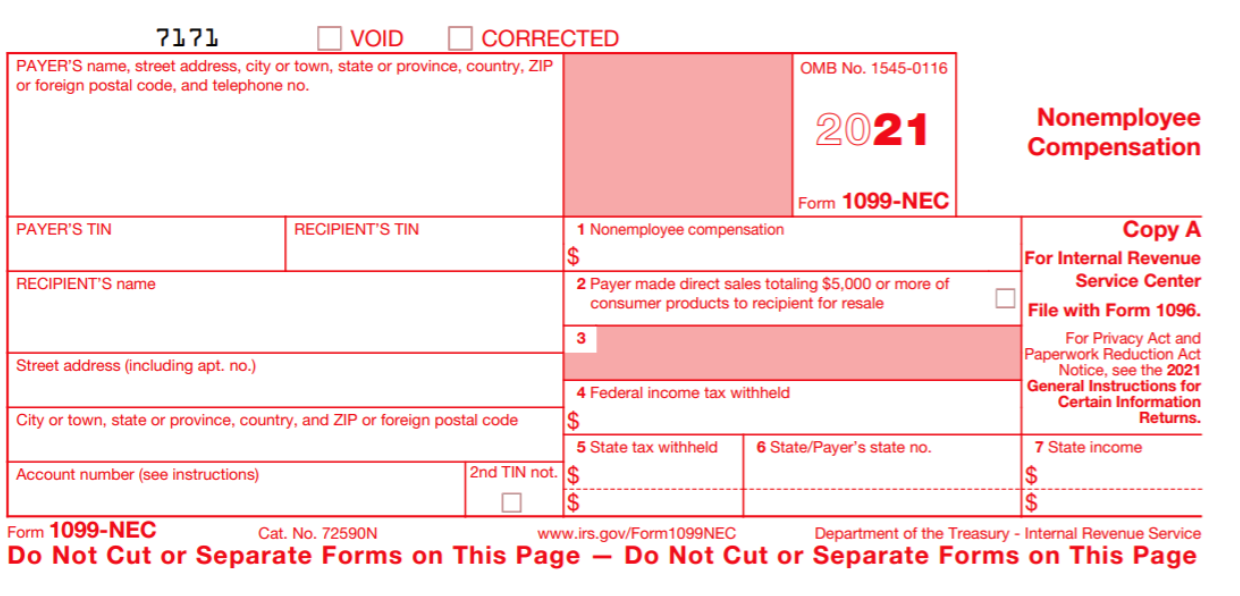

2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

Web print and file a form 1096 downloaded from this website; Enter the recipient's name in the space provided. File copy a of this form with the irs by february 1, 2021. Enter the recipient's ssn or itin in the space provided. Work easily while keeping your data safe with form 1099 nec on the web.

How To File Form 1099 Misc Without Social Security Number Form

File copy a of this form with the irs by february 1, 2021. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Enter the recipient's ssn or itin in the space provided. Web get started free what's included? Report payment information to the irs and the person or business.

Preparing for 2020 NonEmployee Compensation Form 1099NEC

File copy a of this form with the irs by february 1, 2021. Web to correct blank 1099 nec form 2021 printable version you should: Enter the total amount of the nonemployee compensation in the space provided. Enter the recipient's name in the space provided. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099,.

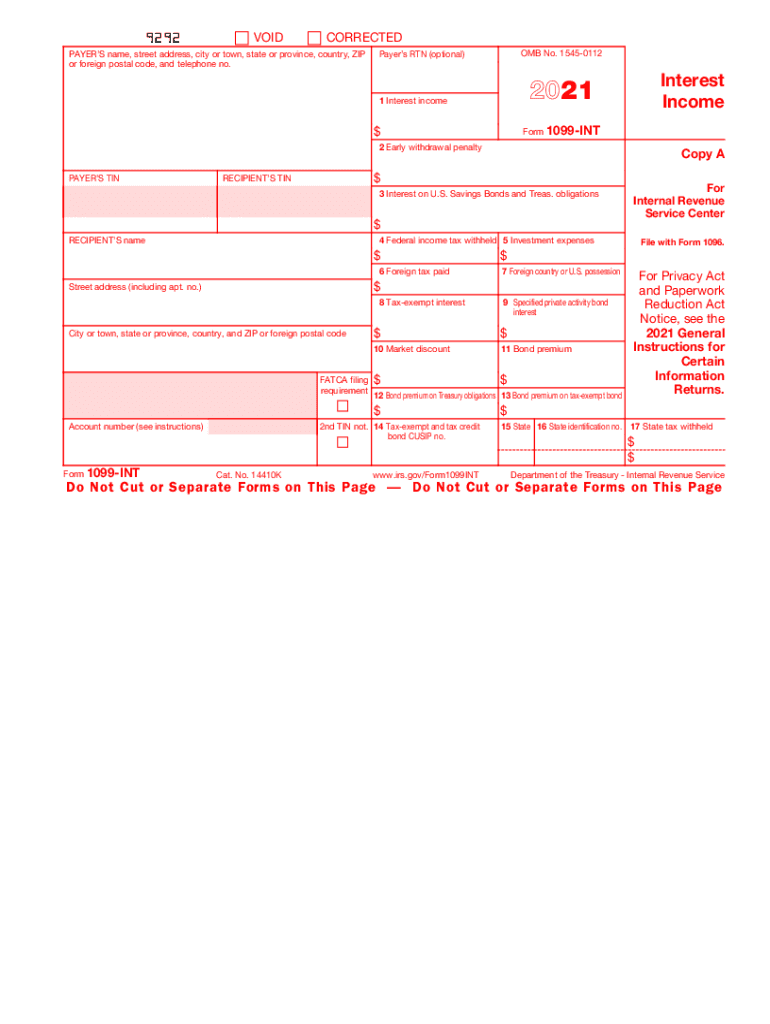

Int Gov Irs Fill Out and Sign Printable PDF Template signNow

Web get started free what's included? Involved parties names, places of residence and numbers etc. Web print and file a form 1096 downloaded from this website; Enter the recipient's ssn or itin in the space provided. A penalty may be imposed for filing with the irs information return forms that can’t be scanned.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Customize the template with exclusive fillable areas. Work easily while keeping your data safe with form 1099 nec on the web. Web to correct blank 1099 nec form 2021 printable version you should: Enter the recipient's ssn or itin in the space provided. Furnish copy b of this form to the recipient by february 1, 2021.

Involved Parties Names, Places Of Residence And Numbers Etc.

Web processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Web to correct blank 1099 nec form 2021 printable version you should: Customize the template with exclusive fillable areas. Web find the 1099 nec form 2021 you want.

See Part O In The Current General Instructions For Certain Information Returns, Available At Www.irs.gov/Form1099, For More Information About Penalties.

A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Web print and file a form 1096 downloaded from this website; Work easily while keeping your data safe with form 1099 nec on the web. Report payment information to the irs and the person or business that received the payment.

File Copy A Of This Form With The Irs By February 1, 2021.

Enter the recipient's name in the space provided. Enter the recipient's ssn or itin in the space provided. Web get started free what's included? Enter the total amount of the nonemployee compensation in the space provided.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)