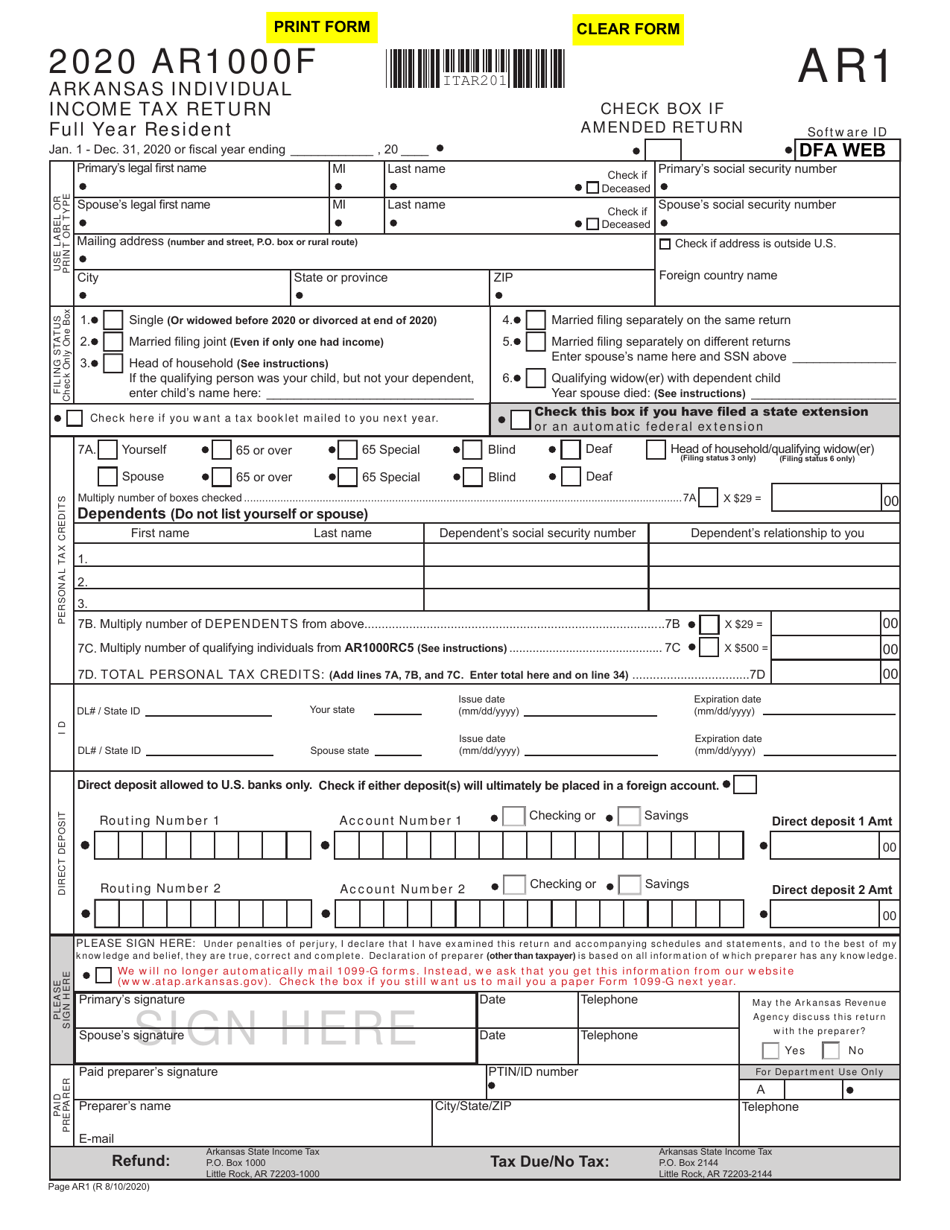

Arkansas Income Tax Form

Arkansas Income Tax Form - Complete, edit or print tax forms instantly. Check the status of your refund get. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Fiduciary and estate income tax forms. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web showing 1 to 25 of 31 entries previous 1 2 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income. Web file now with turbotax other arkansas individual income tax forms: Every employer with one (1) or more employees must file form. You qualify for the low income tax rates if your. Web our combined gross income from all sources will not exceed $17,200.

Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. All other filing statuses must. [ ] i am married filing jointly with my spouse. Web 2021 tax year forms. Every employer with one (1) or more employees must file form. Download or email ar1000f & more fillable forms, register and subscribe now! Web for irs or federal back taxes, access the tax forms here. Earned income credit (eitc) advance child tax credit; Who must pay by eft? If you make $70,000 a year living in arkansas you will be taxed $11,683.

Web arkansas state websitesmall business events in your area. Web showing 1 to 25 of 31 entries previous 1 2 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income. Filing and pay due date. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Ar1000es individual estimated tax vouchers for 2021. Complete, edit or print tax forms instantly. Claim additional amounts of withholding tax if desired. Details on how to only prepare and print an arkansas tax. Earned income credit (eitc) advance child tax credit; Who must pay by eft?

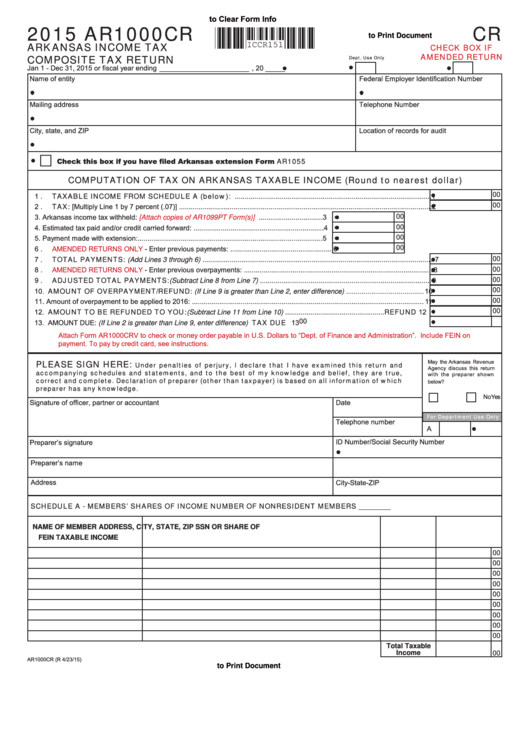

Fillable Form Ar1000cr Arkansas Tax Composite Tax Return

Estimated tax paid or credit brought forward from last year: You qualify for the low income tax rates if your. Web for irs or federal back taxes, access the tax forms here. [ ] i am married filing jointly with my spouse. Complete, edit or print tax forms instantly.

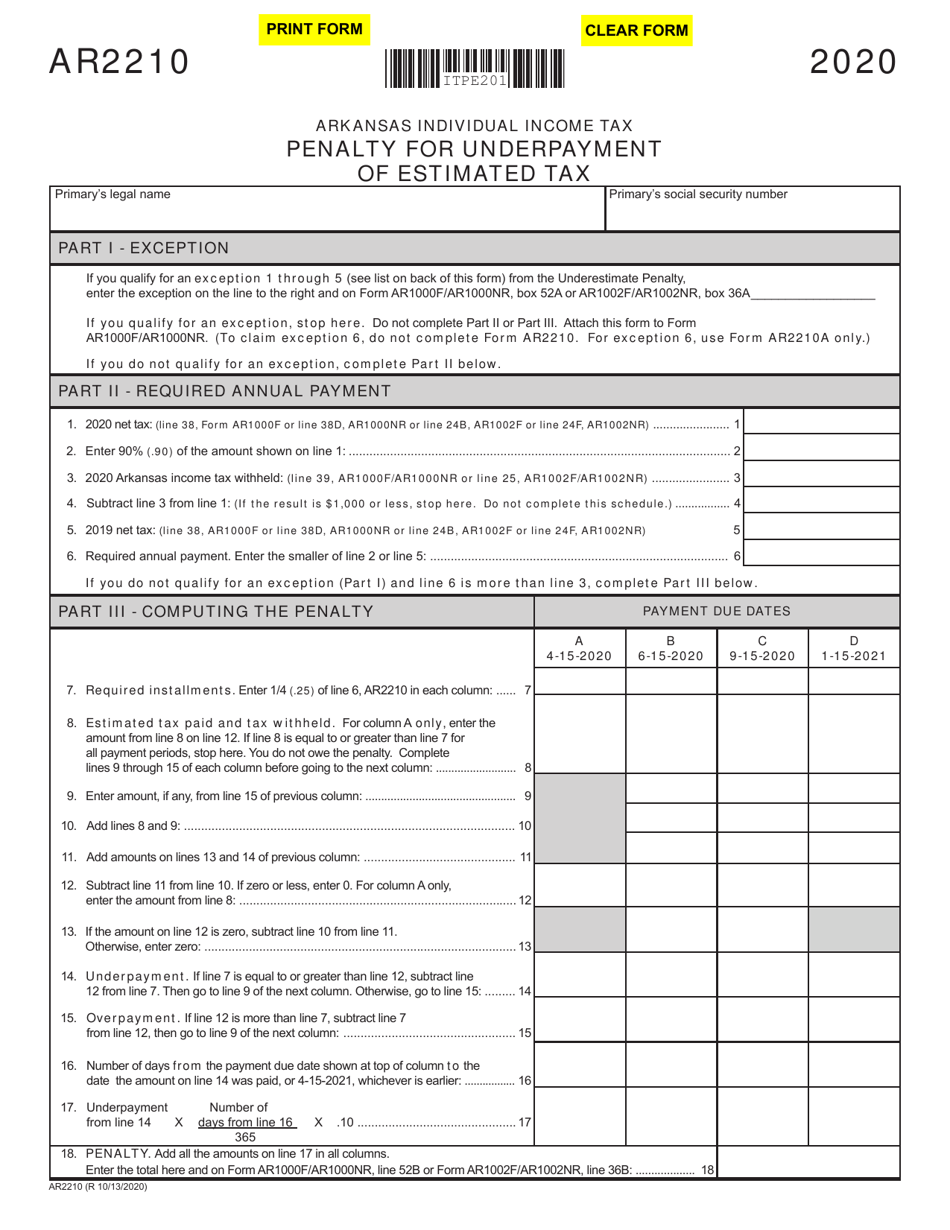

Form AR2210 Download Fillable PDF or Fill Online Penalty for

Web arkansas state websitesmall business events in your area. Fill, sign, email ar1000f & more fillable forms, register and subscribe now! Web showing 1 to 25 of 31 entries previous 1 2 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income. Web 2021 tax.

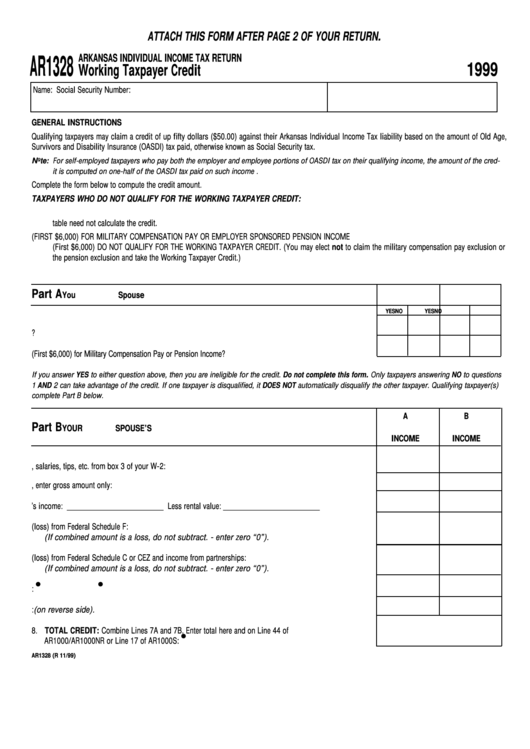

Form Ar1328 Arkansas Individual Tax Return printable pdf download

Below find links to other important arkansas income tax return information and other related features (e.g. Estimated tax paid or credit brought forward from last year: Web for irs or federal back taxes, access the tax forms here. Check the status of your refund get. All other filing statuses must.

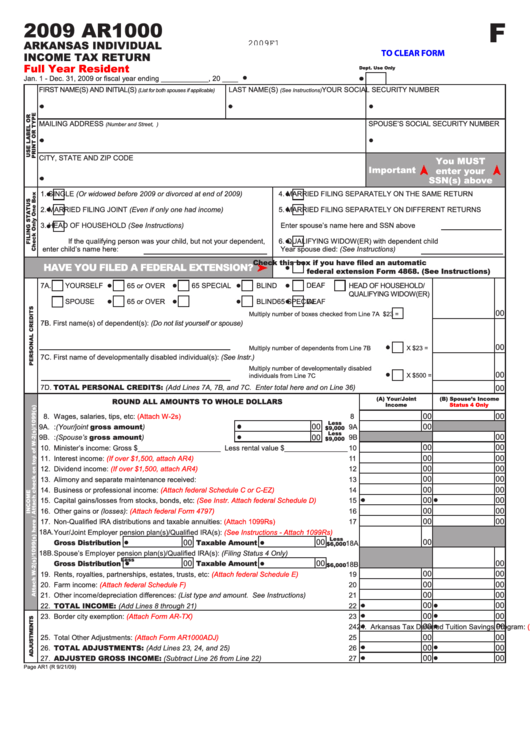

Fillable Form Ar1000 Arkansas Individual Tax Return 2009

Below find links to other important arkansas income tax return information and other related features (e.g. Web showing 1 to 25 of 31 entries previous 1 2 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income. Otherwise, your employer must withhold state income tax.

Form AR1000F Download Fillable PDF or Fill Online Arkansas Full Year

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Download or email ar1000f & more fillable forms, register and subscribe now! Ar1000es individual estimated tax vouchers for 2021. Filing and pay due date. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas.

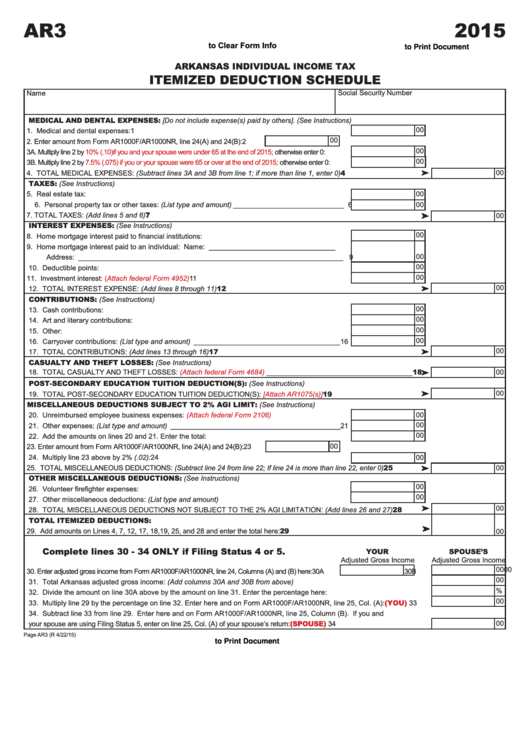

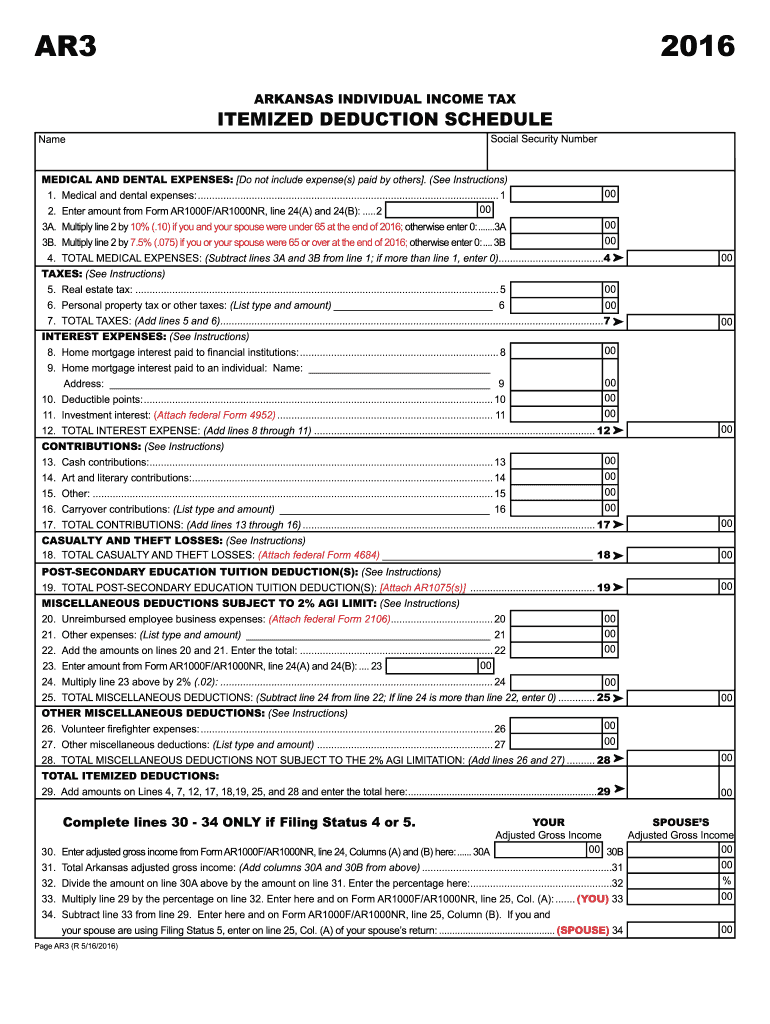

Fillable Form Ar3 Itemized Deduction Schedule Arkansas Individual

Earned income credit (eitc) advance child tax credit; Check the status of your refund get. Web arkansas state websitesmall business events in your area. Web file this form with your employer. All other filing statuses must.

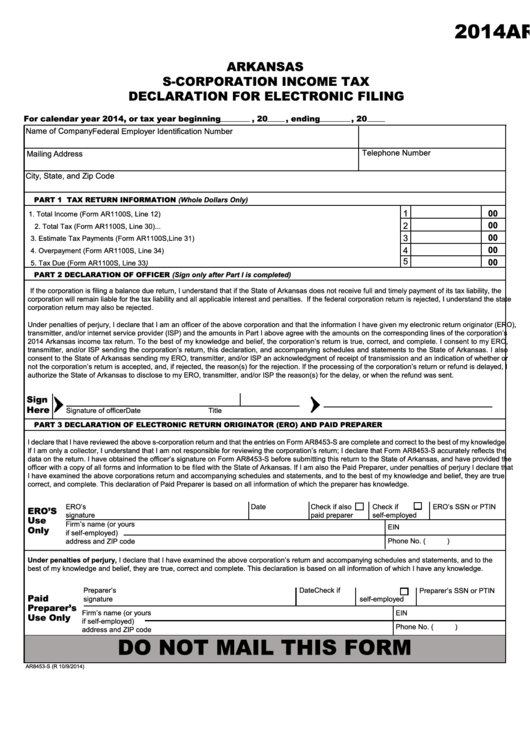

Fillable Form Ar8453S Arkansas SCorporation Tax Declaration

Earned income credit (eitc) advance child tax credit; Fill, sign, email ar1000f & more fillable forms, register and subscribe now! Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. We have two or more dependents, and our combined gross. Complete, edit or print tax forms instantly.

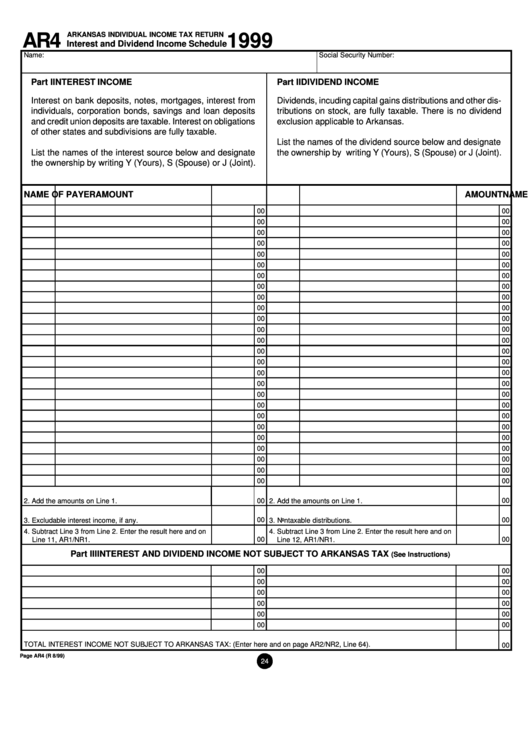

Form Ar4 Arkansas Individual Tax Return Interest And Dividend

Every employer with one (1) or more employees must file form. All other filing statuses must. You qualify for the low income tax rates if your. If you make $70,000 a year living in arkansas you will be taxed $11,683. Fiduciary and estate income tax forms.

Arkansas State Tax Form and Booklet Fill Out and Sign

Details on how to only prepare and print an arkansas tax. Web file this form with your employer. Every employer with one (1) or more employees must file form. Electronic filing and payment options; If you make $70,000 a year living in arkansas you will be taxed $11,683.

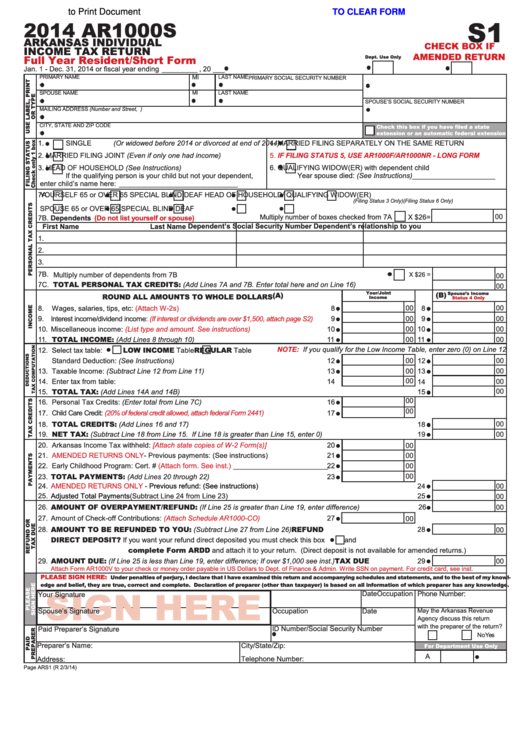

Fillable Form Ar1000s Arkansas Individual Tax Return 2014

Earned income credit (eitc) advance child tax credit; Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web 2021 tax year forms. Web file now with turbotax other arkansas individual income tax forms: Web for irs or federal back taxes, access the tax forms here.

Web File Now With Turbotax Other Arkansas Individual Income Tax Forms:

Ar1000es individual estimated tax vouchers for 2021. Claim additional amounts of withholding tax if desired. Filing and pay due date. Web our combined gross income from all sources will not exceed $17,200.

If You Make $70,000 A Year Living In Arkansas You Will Be Taxed $11,683.

Download or email ar1000f & more fillable forms, register and subscribe now! Below find links to other important arkansas income tax return information and other related features (e.g. [ ] i am married filing jointly with my spouse. Fill, sign, email ar1000f & more fillable forms, register and subscribe now!

Web File This Form With Your Employer.

Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Taxformfinder has an additional 39 arkansas income tax forms that you may need, plus all federal. Details on how to only prepare and print an arkansas tax. All other filing statuses must.

You Qualify For The Low Income Tax Rates If Your.

Earned income credit (eitc) advance child tax credit; Check the status of your refund get. Web for irs or federal back taxes, access the tax forms here. Estimated tax paid or credit brought forward from last year: