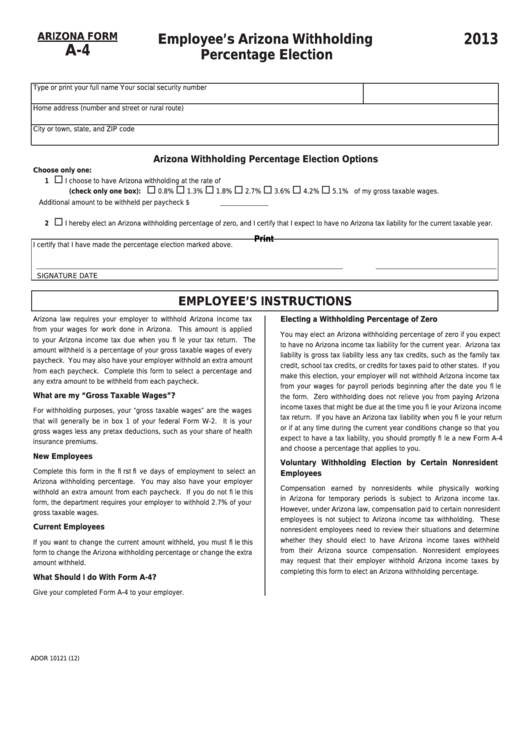

Arizona Tax Form A-4

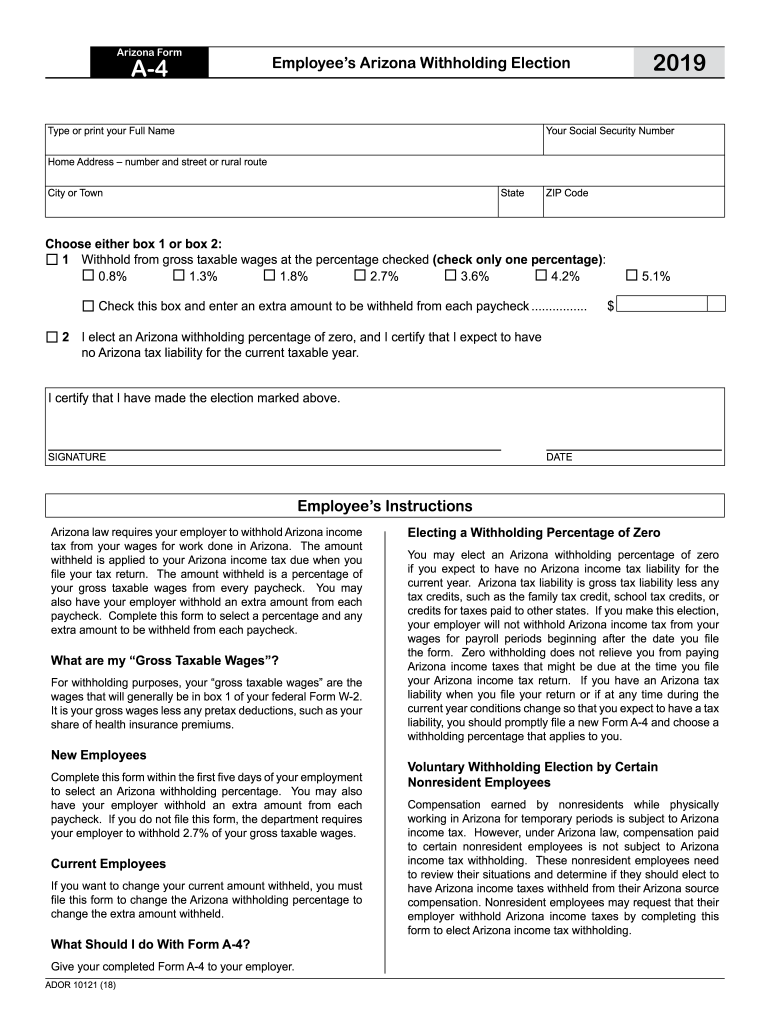

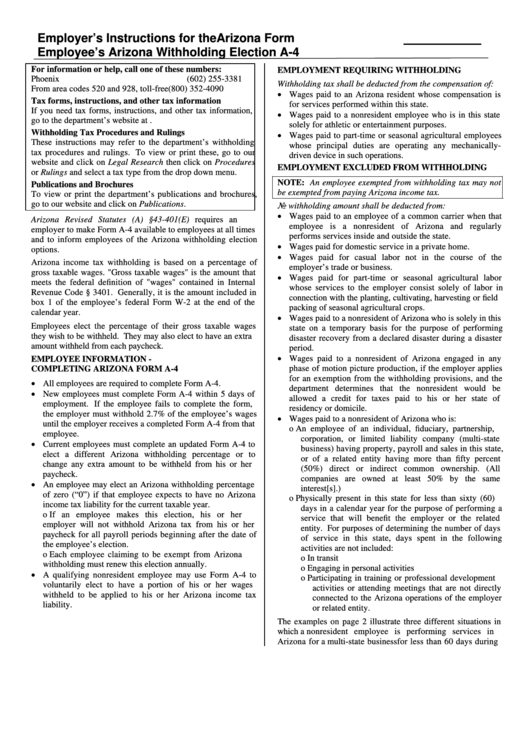

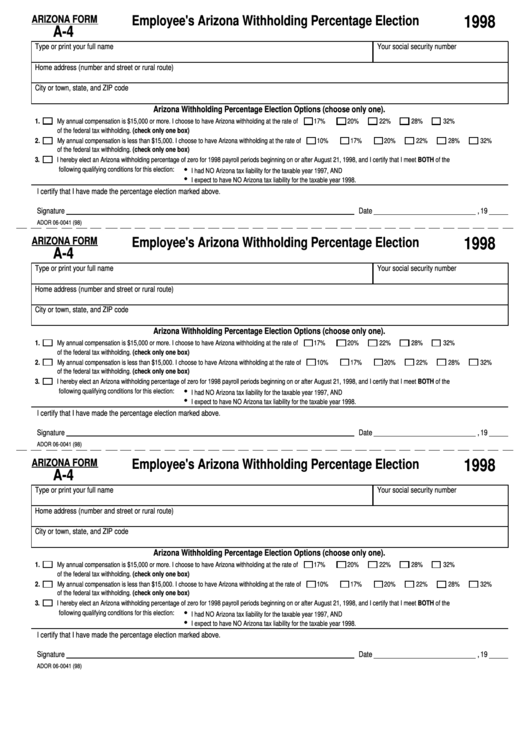

Arizona Tax Form A-4 - Request for reduced withholding to designate for tax credits. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income tax from your payments until you notify the payor to change or terminate arizona withholding. 9 by the state revenue department. Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. Web arizona withholding percentage: Annuitant's request for voluntary arizona income tax. The rates used on the form continue to range from 0.8% to 5.1%. Voluntary withholding request for arizona resident employed outside of arizona | arizona department of revenue

This form is for income earned in tax year 2022, with tax returns due in april 2023. Arizona tax liability is gross tax liability less any This form is submitted to the employer, not the department. Web what is the normal arizona withholding percentage? Zero withholding does not relieve you from paying arizona income taxes that might be due at the time you file your arizona income tax return. Web arizona corporate or partnership income tax payment voucher: Individual estimated tax payment form: Request for reduced withholding to designate for tax credits. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Arizona corporation income tax return (short form) corporate tax forms :

Zero withholding does not relieve you from paying arizona income taxes that might be due at the time you file your arizona income tax return. Web arizona corporate or partnership income tax payment voucher: Web july 26, 2023. For more information about this withholding law change, visit our website at www.azdor.gov. Request for reduced withholding to designate for tax credits. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income tax from your payments until you notify the payor to change or terminate arizona withholding. Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024. This form is submitted to the employer, not the department. Individual estimated tax payment form: Arizona corporation income tax return (short form) corporate tax forms :

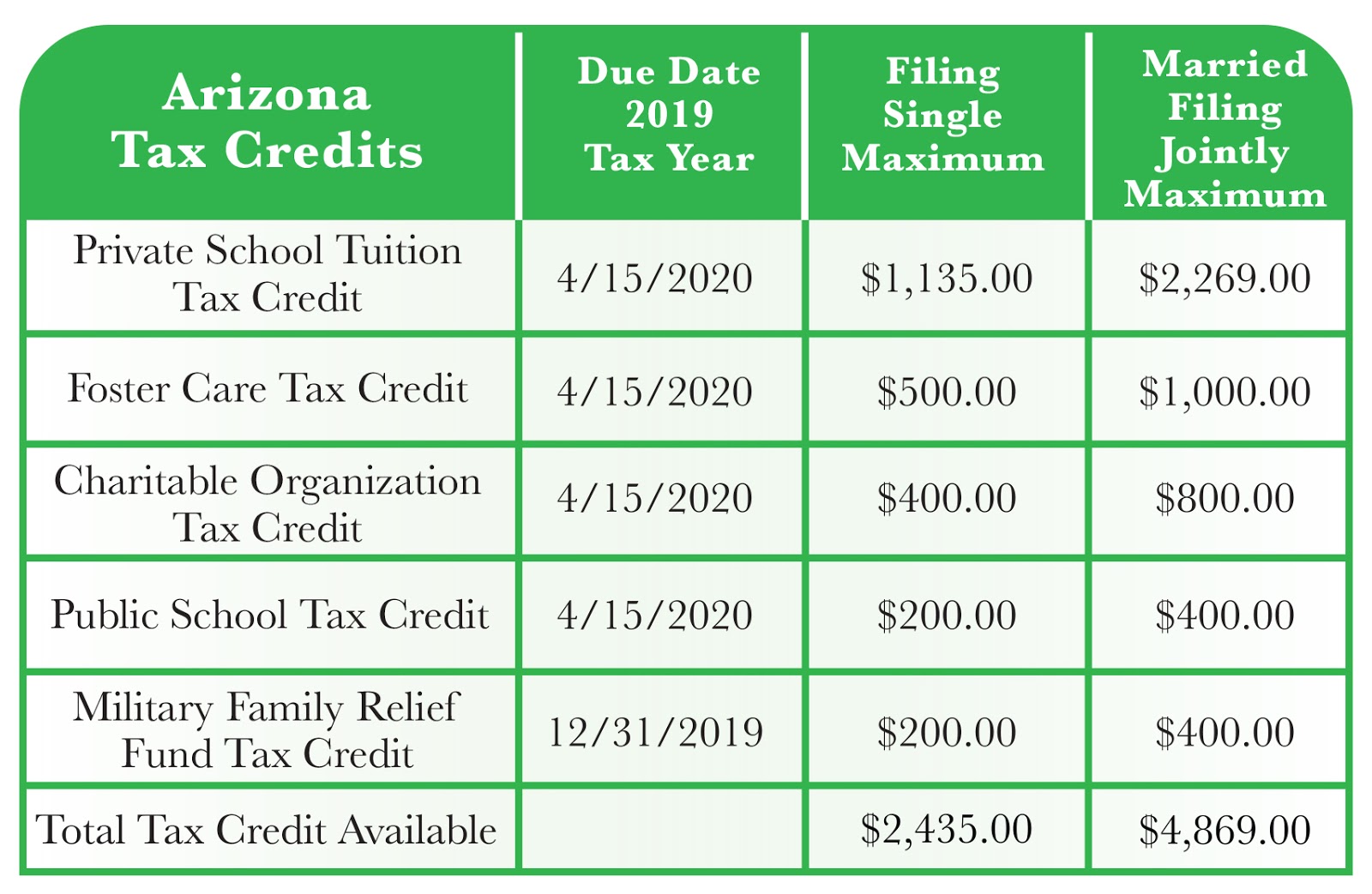

IBE Scholarships Arizona Offers Five Different Tax Credits

Tax credits forms, individual : You can use your results from the formula to help you complete the form and adjust your income tax withholding. Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Thursday, december 9th, 2021 if your.

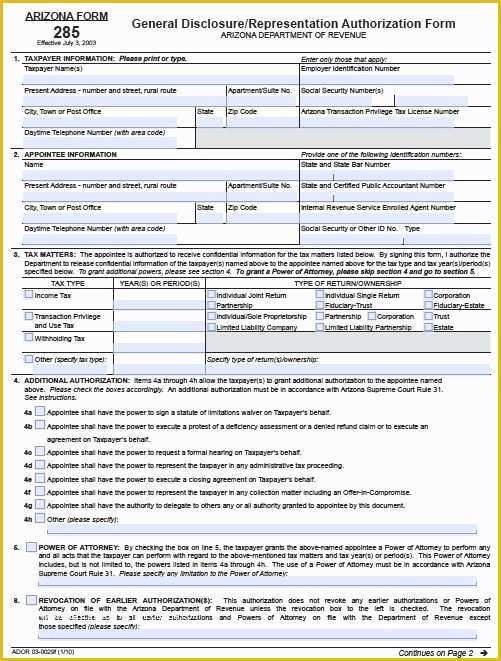

Free Will Template Arizona Of Free Tax Power Of attorney Arizona form

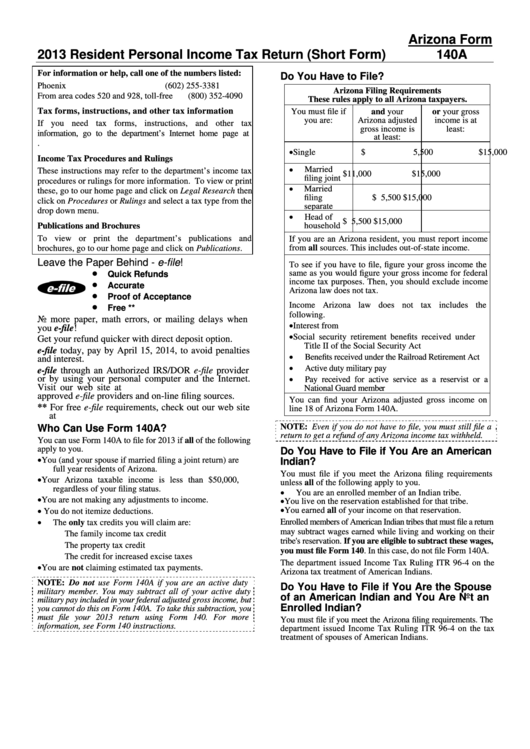

Request for reduced withholding to designate for tax credits. Individual estimated tax payment form: Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Web july 26, 2023. Arizona corporation income tax return (short form) corporate tax forms.

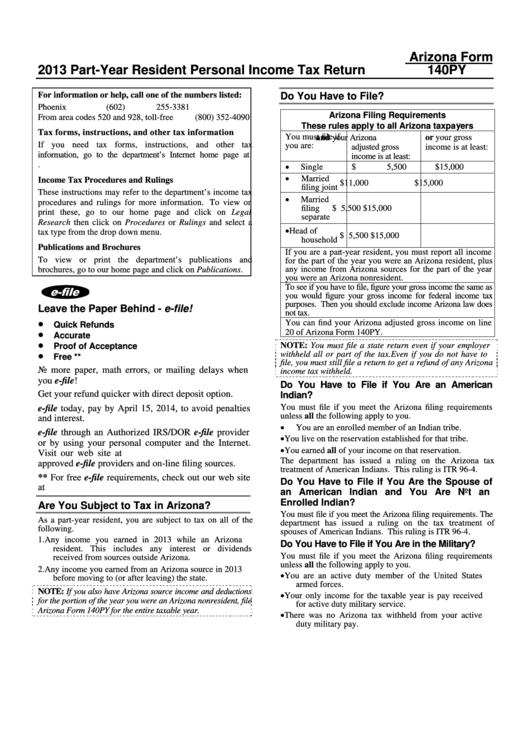

Arizona Form 140py PartYear Resident Personal Tax Return

Web arizona withholding percentage: Arizona s corporation income tax return: This form is submitted to the employer, not the department. Arizona corporation income tax return (short form) corporate tax forms : Arizona tax liability is gross tax liability less any

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Web arizona withholding percentage: Web when the federal government recently announced it had stopped 10,000 pounds of fentanyl from entering arizona and southern california from mexico, the special.

Download Arizona Form A4 (2013) for Free FormTemplate

Thursday, december 9th, 2021 if your small business staff includes hired employees, your financial responsibilities will include adjusting their paychecks for income tax withholding. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income tax from your payments until you notify the payor to change or terminate arizona withholding. This form is submitted.

2019 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

Web when the federal government recently announced it had stopped 10,000 pounds of fentanyl from entering arizona and southern california from mexico, the special name attached to the counternarcotics. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Arizona tax liability is gross tax liability less any Duration.

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Web arizona corporate or partnership income tax payment voucher: Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Tax credits forms, individual : If you have an arizona tax liability. Web arizona withholding percentage:

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income tax from your payments until you notify the payor to change or terminate arizona withholding. 9 by the state revenue department. Web what is the normal arizona withholding percentage? The rates used on the form continue to range from 0.8% to 5.1%. Zero.

Arizona to begin printing tax forms with revisions Legislature has yet

Web what is the normal arizona withholding percentage? Arizona s corporation income tax return: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web arizona withholding percentage: The rates used on the form continue to range from 0.8% to 5.1%.

Instructions For Arizona Form 140a Resident Personal Tax

Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income tax from your payments until you notify the payor to change or terminate arizona withholding. We will update this page with a new version of the form for 2024 as soon as it is made available by the arizona government. This form is.

Web When The Federal Government Recently Announced It Had Stopped 10,000 Pounds Of Fentanyl From Entering Arizona And Southern California From Mexico, The Special Name Attached To The Counternarcotics.

Arizona s corporation income tax return: Request for reduced withholding to designate for tax credits. For more information about this withholding law change, visit our website at www.azdor.gov. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year.

9 By The State Revenue Department.

I think rates are likely to remain relatively flat. Arizona tax liability is gross tax liability less any Electing a withholding percentage of zero you may elect an arizona withholding percentage of zero if you expect to have no arizona income tax liability for the current year. Individual estimated tax payment form:

If You Have An Arizona Tax Liability.

This form is submitted to the employer, not the department. Web arizona corporate or partnership income tax payment voucher: Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income tax from your payments until you notify the payor to change or terminate arizona withholding. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks.

Arizona Corporation Income Tax Return (Short Form) Corporate Tax Forms :

The date of the employee's election. The rates used on the form continue to range from 0.8% to 5.1%. Web july 26, 2023. Web arizona withholding percentage: