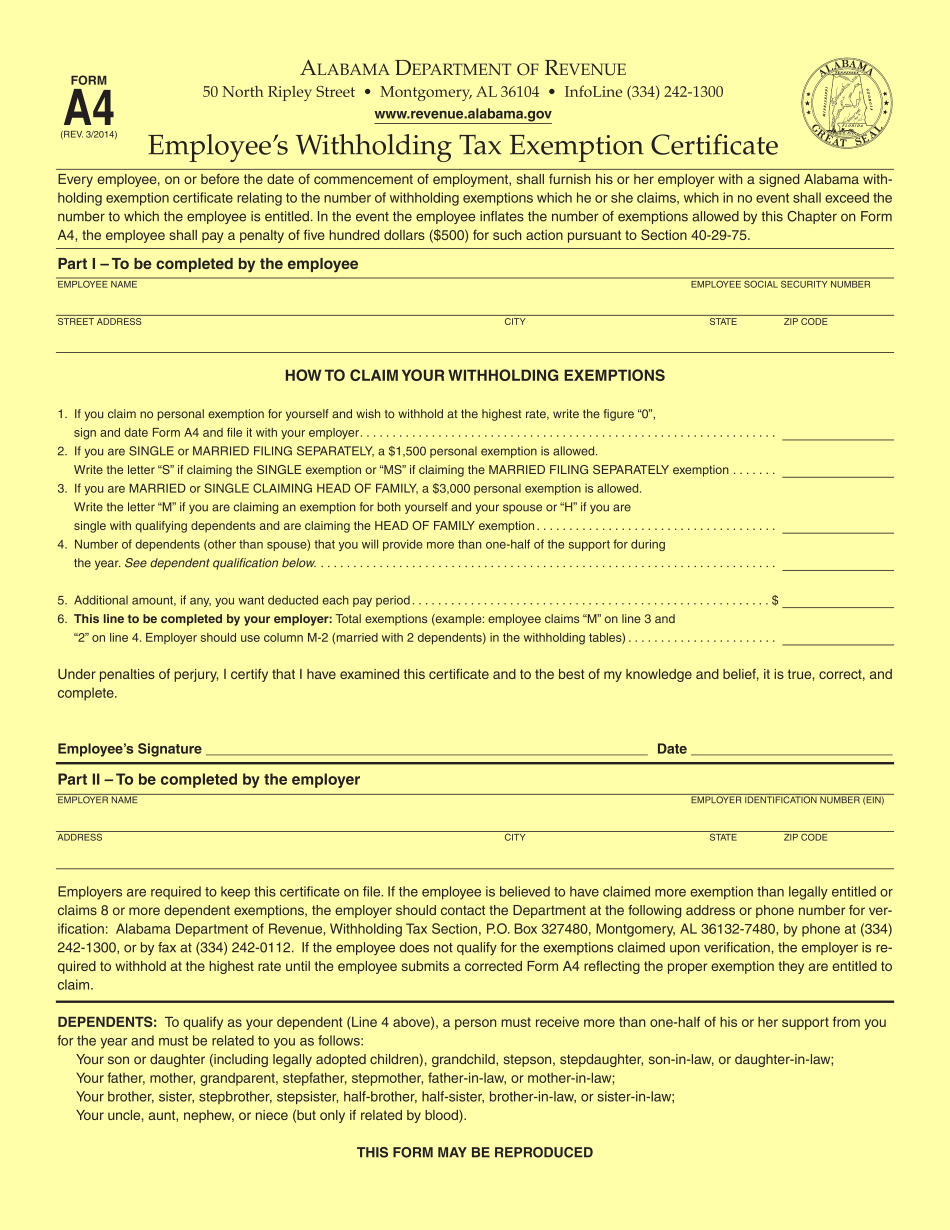

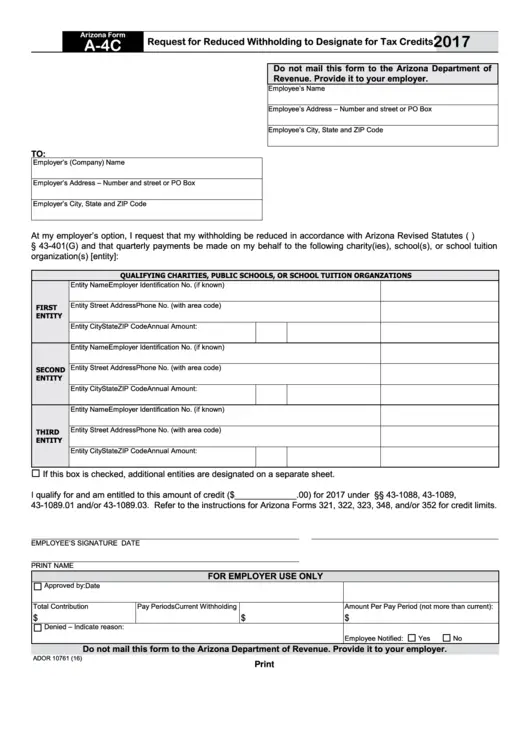

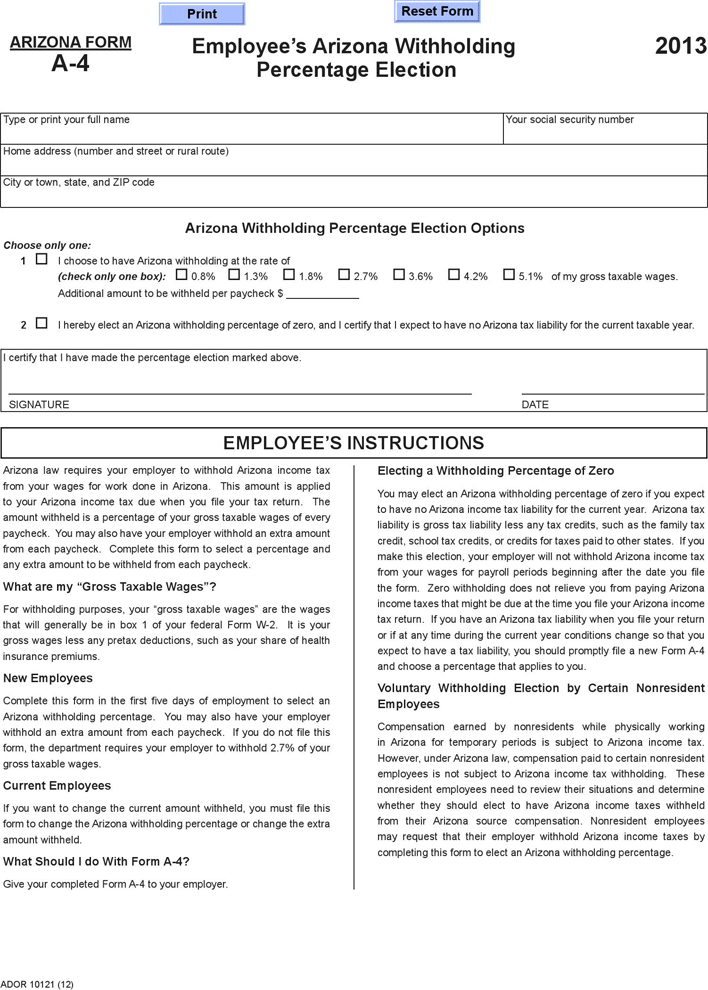

Arizona State Withholding Form

Arizona State Withholding Form - Web complete this form within the first five days of your employment to select an arizona withholding percentage. It works similarly to a. Web arizona s corporation income tax return. Web you may use this form to request arizona income tax withholding if you receive regularly scheduled payments from pensions or annuities that are included in your arizona gross. Web arizona updates employee withholding form. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Web december 7, 2022. You can use your results.

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web december 7, 2022. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Web you may use this form to request arizona income tax withholding if you receive regularly scheduled payments from pensions or annuities that are included in your arizona gross. You may also have your employer withhold an extra amount. The income tax withholding formula for the state of arizona, includes the following changes: Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Ad register and subscribe now to work on petition to stop income & more fillable forms. You may also have your employer withhold an extra. Submitted by anonymous (not verified) on fri,.

Form to elect arizona income tax withholding. Web december 7, 2022. Web arizona s corporation income tax return. The withholding rates have changed. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. It works similarly to a. Ad register and subscribe now to work on petition to stop income & more fillable forms. The income tax withholding formula for the state of arizona, includes the following changes: All new employees subject to arizona income tax withholding must complete arizona form a. Web complete this form within the first five days of your employment to select an arizona withholding percentage.

How to Report Backup Withholding on Form 945

You can use your results. Web arizona updates employee withholding form. Web complete this form within the first five days of your employment to select an arizona withholding percentage. You may also have your employer withhold an extra amount. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and.

Arizona State Tax withholding form 2018 Fresh 3 21 111 Chapter Three

Resident shareholder's information schedule form with instructions. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Web you may use this form to request arizona income tax withholding if you receive.

2022 Arizona State Withholding Form

Web december 7, 2022. Web arizona updates employee withholding form. It works similarly to a. You can use your results. Web city or town state zip code choose either box 1 or box 2:

How Do I Pay My Arizona State Taxes

The income tax withholding formula for the state of arizona, includes the following changes: I certify that i have made the election marked above. You may also have your employer withhold an extra amount. Web arizona updates employee withholding form. Form to elect arizona income tax withholding.

State Tax Withholding Forms Template Free Download Speedy Template

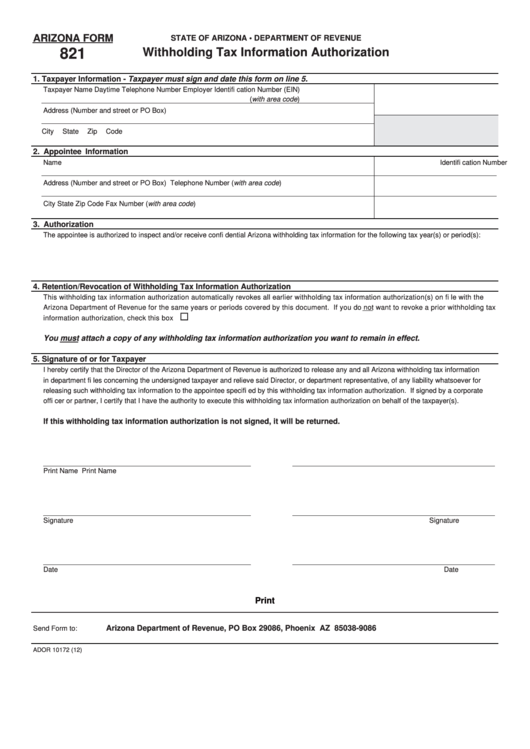

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web december 7, 2022. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web you may use this form to request arizona income tax.

What Is IRS Form W 9 and How Should You Fill It Out

Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. You can use your results. Web arizona s corporation income tax return. Complete, edit or print tax forms instantly. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more.

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

All new employees subject to arizona income tax withholding must complete arizona form a. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. Web arizona updates employee withholding form. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all.

Arizona State Withholding Form A4 2022

Ad register and subscribe now to work on petition to stop income & more fillable forms. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web you may use this form to request arizona income tax withholding if you receive regularly scheduled payments from pensions or annuities that are included in your.

Fillable Arizona Form 821 Withholding Tax Information Authorization

The withholding rates have changed. Resident shareholder's information schedule form with instructions. It works similarly to a. Web you may use this form to request arizona income tax withholding if you receive regularly scheduled payments from pensions or annuities that are included in your arizona gross. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,.

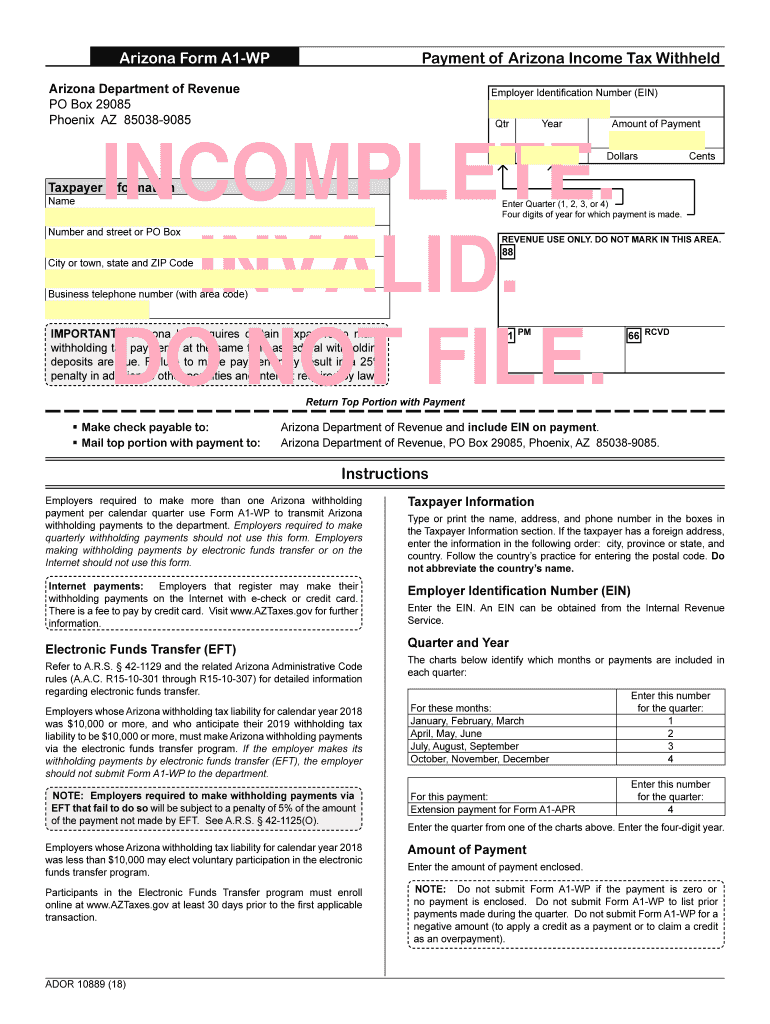

20182020 Form AZ ADOR A1WP Fill Online, Printable, Fillable, Blank

Web city or town state zip code choose either box 1 or box 2: Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. All.

Complete, Edit Or Print Tax Forms Instantly.

You can use your results. Web arizona s corporation income tax return. You may also have your employer withhold an extra amount. Form to elect arizona income tax withholding.

Web Complete This Form Within The First Five Days Of Your Employment To Select An Arizona Withholding Percentage.

The income tax withholding formula for the state of arizona, includes the following changes: Web city or town state zip code choose either box 1 or box 2: I certify that i have made the election marked above. Ad register and subscribe now to work on petition to stop income & more fillable forms.

Web Arizona Updates Employee Withholding Form.

Web december 7, 2022. All new employees subject to arizona income tax withholding must complete arizona form a. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and.

Resident Shareholder's Information Schedule Form With Instructions.

It works similarly to a. The withholding rates have changed. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more.