Are Funeral Expenses Deductible On Form 1041

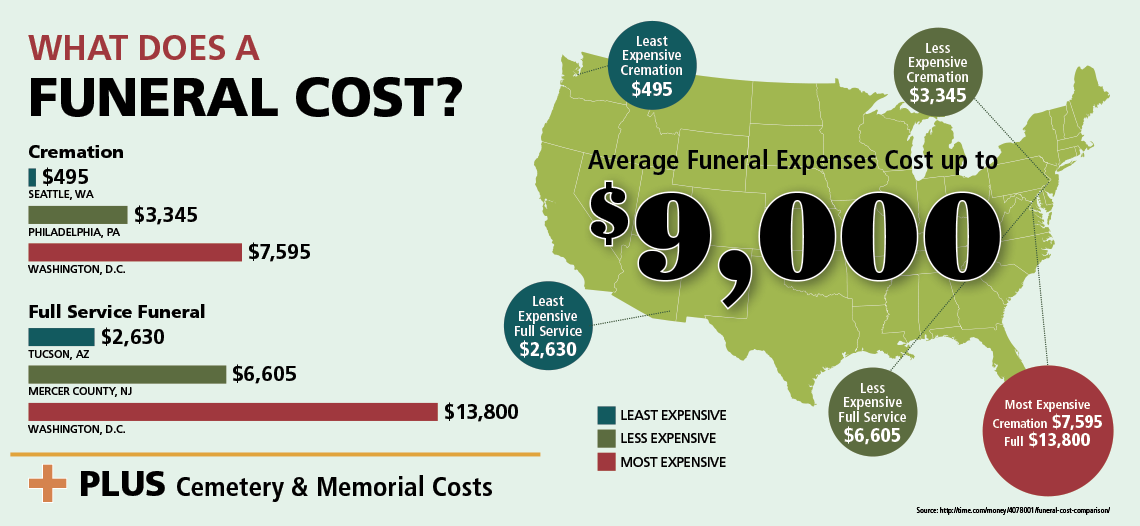

Are Funeral Expenses Deductible On Form 1041 - Web the costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and floral costs, are deductible. You can’t take the deductions. Web you may deduct the expense from the estate’s gross income as part of the estate’s income tax calculation on form 1041, u.s. Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets. Web what expenses are deductible? The cost of transporting the body. While the irs allows deductions for medical expenses, funeral costs are not included. What expenses are deductible on estate tax return? Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. The cost of a funeral and burial can be deducted on a form 1041, which is the final income tax return filed for a.

Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. Web home forms and instructions about form 1041, u.s. Medical expenses of the decedent paid by the estate may be deductible on the. Web ask an expert tax questions are funeral expenses deductible on form 1041? Web can i enter any of those in federal taxes/deductions/other deductions? It requests information about income distributed to. Web the costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and floral costs, are deductible. Web funeral expenses are never deductible for income tax purposes, whether they're paid by an individual or the estate, which might also have to file an income tax. Income tax return for estates and trusts the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files. Web you may deduct the expense from the estate’s gross income as part of the estate’s income tax calculation on form 1041, u.s.

However, funeral expenses are simply not deductible on form 1041 and. Income tax return for estates and. You can’t take the deductions. Thank you for your quick reply, but my question was. The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. The cost of transporting the body. The cost of a funeral and burial can be deducted on a form 1041, which is the final income tax return filed for a. According to the irs, funeral expenses are only deductible on form 706, a separate tax return used by. What expenses are deductible on estate tax return? Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets.

Can I Deduct Funeral Expenses On Form 1041 ELCTIO

The cost of transporting the body. According to the irs, funeral expenses are only deductible on form 706, a separate tax return used by. Funeral and burial expenses are only tax. Yes, except for medical and funeral expenses, which you do not deduct on form. What expenses are deductible on estate tax return?

Are Funeral Expenses Tax Deductible? Claims, WriteOffs, etc.

Web you may deduct the expense from the estate’s gross income as part of the estate’s income tax calculation on form 1041, u.s. Web the internal revenue service (irs) sets strict rules about what expenses can and cannot be deducted from your tax bill. What expenses are deductible on estate tax return? Web individual taxpayers cannot deduct funeral expenses on.

Funeral Advantage Final Expense Insurance Program Saves Burial Costs

Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. Yes, except for medical and funeral expenses, which you do not deduct on form. What expenses are deductible on estate tax return? The cost of transporting the body. Income tax return for estates and.

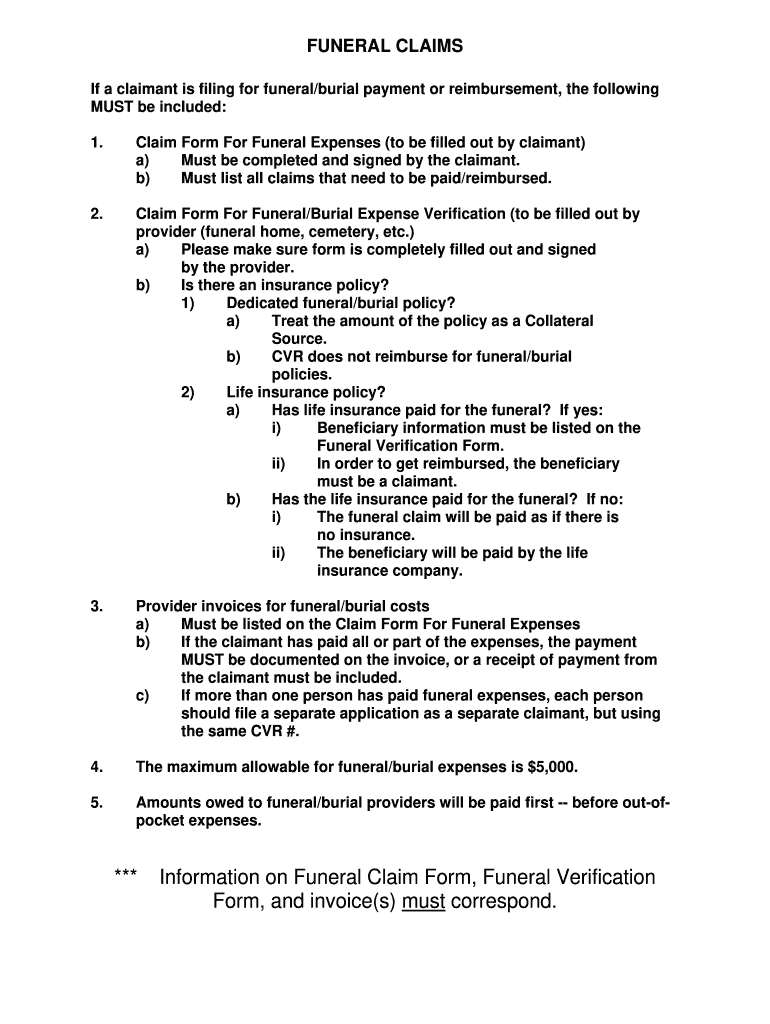

FREE 47+ Claim Forms in PDF

You can’t take the deductions. Income tax return for estates and. Funeral and burial expenses are only tax. Web unfortunately, you can not deduct medical or funeral expenses on form 1041. Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements.

Funeral Budget Spreadsheet For Funeral Bill Template Expenses Blank

According to the irs, funeral expenses are only deductible on form 706, a separate tax return used by. Web the costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and floral costs, are deductible. The cost of transporting the body. Income tax return for estates and. Web individual taxpayers cannot deduct funeral expenses on their tax return.

Funeral Expenses Spreadsheet Pertaining To Funeral Bill Template

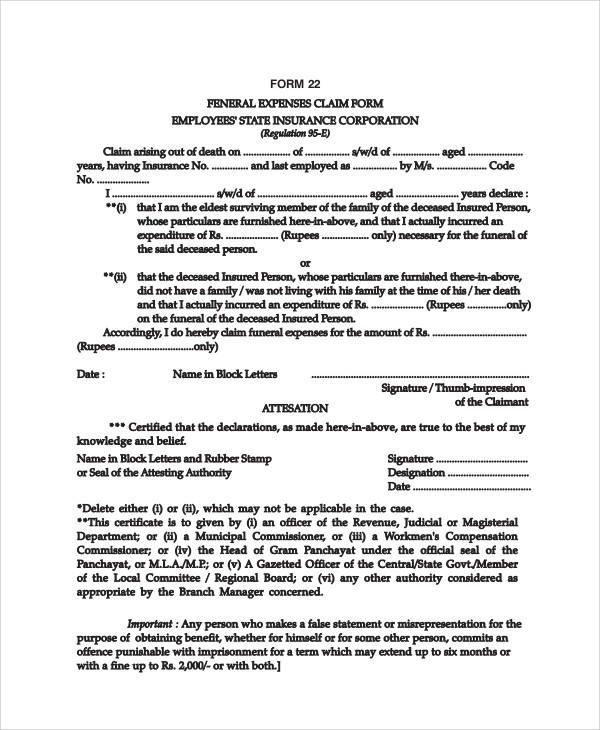

Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. Web no, you are not able to claim deductions for funeral expenses on form 1041. Web most individuals don’t qualify for tax deductions on the funeral expenses of a close relative, although some estates may.

Funeral Expenses Claim Form Fill Online, Printable, Fillable, Blank

Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets. Web funeral expenses are never deductible for income tax purposes, whether they're paid by an individual or the estate, which might also have to file an income tax. However, funeral expenses are simply not deductible on form 1041.

Burial Insurance For Parents A Comprehensive Guide

Funeral and burial expenses are only tax. However, funeral expenses are simply not deductible on form 1041 and. Medical expenses of the decedent paid by the estate may be deductible on the. Web unfortunately, you can not deduct medical or funeral expenses on form 1041. Web can i enter any of those in federal taxes/deductions/other deductions?

Can Funeral Expenses Be Deducted on a Federal Tax? Sapling

Web home forms and instructions about form 1041, u.s. Web ask an expert tax questions are funeral expenses deductible on form 1041? Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. Web most individuals don’t qualify for tax deductions on the funeral expenses of a close relative, although some estates may.

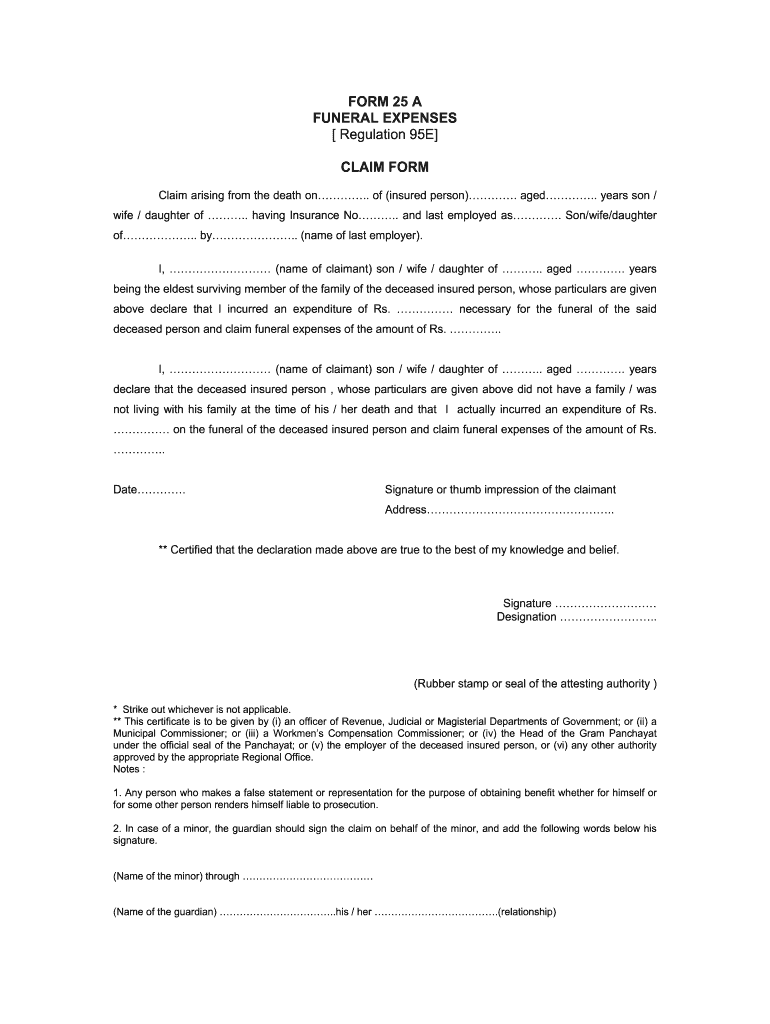

Funeral Expenses Claim Form 25a Fill Online, Printable, Fillable

Web can i enter any of those in federal taxes/deductions/other deductions? Web you may deduct the expense from the estate’s gross income as part of the estate’s income tax calculation on form 1041, u.s. Web funeral expenses are never deductible for income tax purposes, whether they're paid by an individual or the estate, which might also have to file an.

It Requests Information About Income Distributed To.

Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. Web ask an expert tax questions are funeral expenses deductible on form 1041? According to the irs, funeral expenses are only deductible on form 706, a separate tax return used by. Web home forms and instructions about form 1041, u.s.

Web Individual Taxpayers Cannot Deduct Funeral Expenses On Their Tax Return.

The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. Web unfortunately, you can not deduct medical or funeral expenses on form 1041. Yes, except for medical and funeral expenses, which you do not deduct on form. Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets.

The Cost Of A Funeral And Burial Can Be Deducted On A Form 1041, Which Is The Final Income Tax Return Filed For A.

Web are funeral expenses deductible on form 1041? Web most individuals don’t qualify for tax deductions on the funeral expenses of a close relative, although some estates may make them eligible. Web the costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and floral costs, are deductible. The cost of transporting the body.

Web Form 1041 Requires The Preparer To List The Trust Or Estate's Income, Available Credits And Deductible Expenses.

Web funeral expenses are never deductible for income tax purposes, whether they're paid by an individual or the estate, which might also have to file an income tax. Medical expenses of the decedent paid by the estate may be deductible on the. Income tax return for estates and. Web the internal revenue service (irs) sets strict rules about what expenses can and cannot be deducted from your tax bill.