Are Churches Required To File Form 990

Are Churches Required To File Form 990 - This means you are not required. Web one difference is that churches are not required to file the annual 990 form. Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. Form 990 is a required filing that creates significant transparency for exempt organizations. Web churches are exempt from having to file form 990 with the irs. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web churches that have completed form 1023 are not required to complete form 990. While most nonprofits must file a form 990 with the irs, churches are exempt. Section 6033 of the internal revenue code requires every. We recommend that you do not submit form 990.

Web we have received conflicting opinions. Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. While most nonprofits must file a form 990 with the irs, churches are exempt. Section 6033 exempts several organizations from the form 990 reporting requirements,. For several evangelical organizations, that advantage—no 990 filing—has been a. Form 990 is a required filing that creates significant transparency for exempt organizations. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except: Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web requirements for nonprofit churches. Section 6033 of the internal revenue code requires every.

Web churches typically do not have to file 990 tax returns. Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. Section 6033 exempts several organizations from the form 990 reporting requirements,. In 1971, it was harder to get your hands on a. The due date for form 990. Web in the past, we have not filed 990’s as we are a small congregation. Your church is not required to file a form 990 with the federal government. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except: Form 990 is a required filing that creates significant transparency for exempt organizations. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual.

Efile Form 990 2021 IRS Form 990 Online Filing

Section 6033 exempts several organizations from the form 990 reporting requirements,. Churches or religious organizations that are an integral part of churches that are exempt from filing irs form 990 under provisions of 26 usc §6033; Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Your church is not required.

2003 Form 990 for Indonesian Christian Fellowship Church Cause IQ

In 1971, it was harder to get your hands on a. Web we have received conflicting opinions. While most nonprofits must file a form 990 with the irs, churches are exempt. Web churches were found to receive between $6 billion and $10 billion from the ppp. Web churches are exempt from having to file form 990 with the irs.

What is Form 990PF?

Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except: Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a.

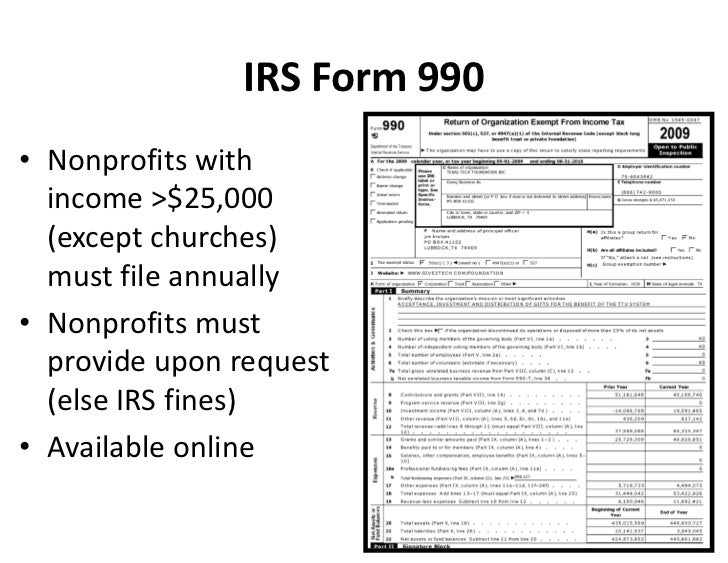

IRS Form 990 • Nonprofits with >25,000 (except churches)

This means you are not required. Nonprofit churches have 2 options to request a retail sales and use tax exemption: The due date for form 990. Web churches were found to receive between $6 billion and $10 billion from the ppp. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns.

IRS Form 990 • Nonprofits with >25,000 (except churches)

Web churches are exempt from having to file form 990 with the irs. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web churches typically do not have to file 990 tax returns. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution.

Do Churches File Form 990? YouTube

We recommend that you do not submit form 990. For several evangelical organizations, that advantage—no 990 filing—has been a. Web one difference is that churches are not required to file the annual 990 form. Web churches were found to receive between $6 billion and $10 billion from the ppp. Web we have received conflicting opinions.

Form 990N ePostcard

We recommend that you do not submit form 990. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Web churches are exempt from having to file form 990 with the irs. While most nonprofits must file a form 990 with the irs, churches are exempt. Churches are required to file.

2019 Form 990 for The Church of God Restoration Ministerial Body Cause IQ

Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. Web one difference is that churches are not required to file the annual 990 form. While most nonprofits must file a form 990 with the irs, churches are exempt. Web bona fide duly.

7 Things You Need to Know About Churches and Form 990

We recommend that you do not submit form 990. Web in the past, we have not filed 990’s as we are a small congregation. Web churches that have completed form 1023 are not required to complete form 990. Web churches typically do not have to file 990 tax returns. Web bona fide duly constituted religious institutions and such separate groups.

Instructions to file your Form 990PF A Complete Guide

Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web in the past, we have not filed 990’s as we are a small congregation. Section 6033 exempts several organizations from the form 990 reporting requirements,. Web we have received conflicting opinions. While most nonprofits must file a form 990 with the irs, churches are exempt.

Web Churches Are Exempt From Having To File Form 990 With The Irs.

We recommend that you do not submit form 990. Web requirements for nonprofit churches. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web churches that have completed form 1023 are not required to complete form 990.

Churches Or Religious Organizations That Are An Integral Part Of Churches That Are Exempt From Filing Irs Form 990 Under Provisions Of 26 Usc §6033;

Web churches typically do not have to file 990 tax returns. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except: Form 990 is a required filing that creates significant transparency for exempt organizations. This means you are not required.

Your Church Is Not Required To File A Form 990 With The Federal Government.

Section 6033 of the internal revenue code requires every. Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to file a form 990. Web churches were found to receive between $6 billion and $10 billion from the ppp. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual.

While Most Nonprofits Must File A Form 990 With The Irs, Churches Are Exempt.

Churches are required to file form 990 (return of organization exempt from income tax) only if its annual gross receipts exceed $50,000. Web in the past, we have not filed 990’s as we are a small congregation. In 1971, it was harder to get your hands on a. Web one difference is that churches are not required to file the annual 990 form.