Applicable Checkbox On Form 8949

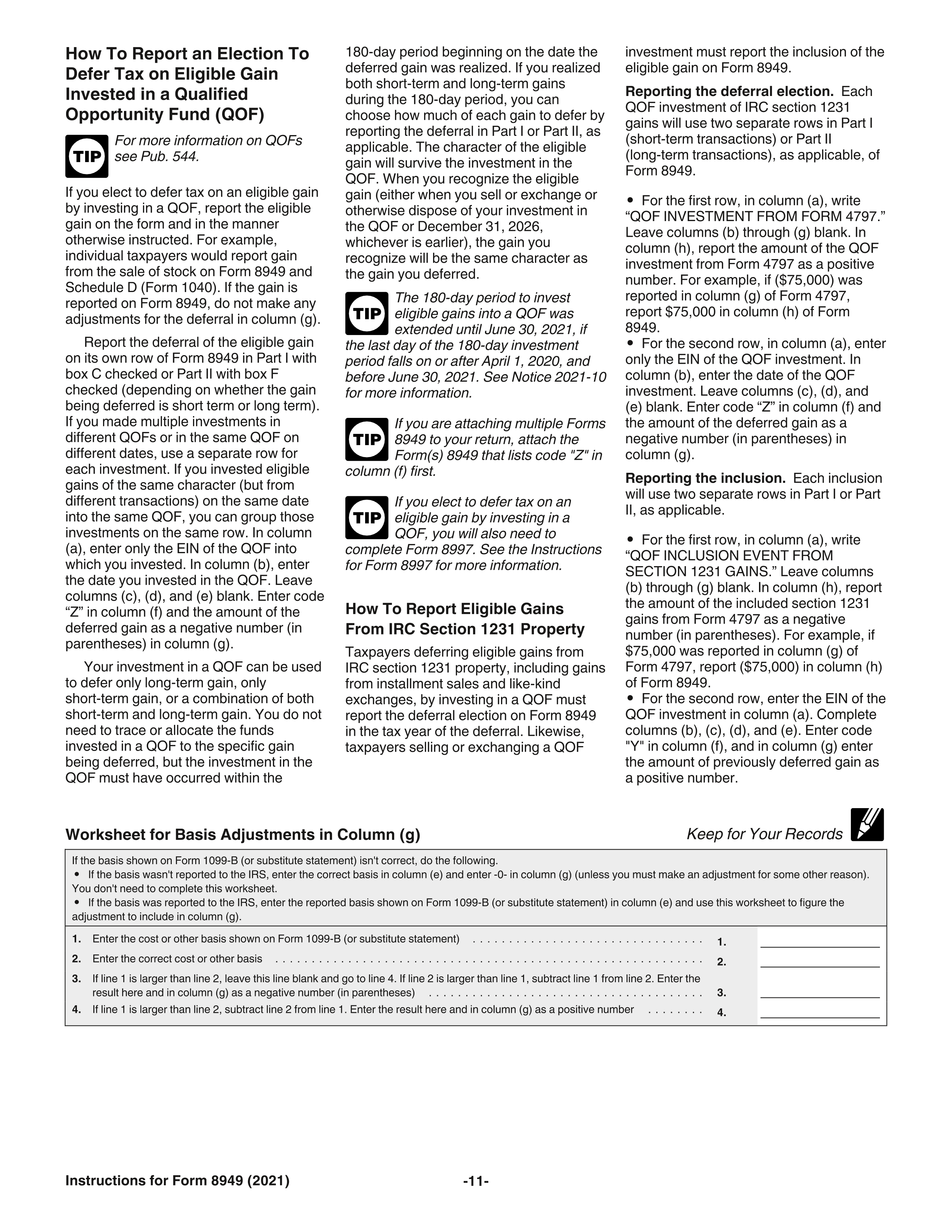

Applicable Checkbox On Form 8949 - Web use form 8949 to report sales and exchanges of capital assets. You must check box d, e, or f below. Here is more information on how tax form 8949 is used from the irs: Web on part i of form 8949. Check box a, b, or. Web schedule d, line 1a; Web what is the purpose of this checkbox? Check box a, b, or. Web applicable check box on form 8949. Web applicable checkbox on form 8949.

Tax withholding (backup withholding, if applicable) cost basis. Check box a, b, or. Stock or other symbol removed:. Web on part i of form 8949. Web schedule d, line 1a; You aren’t required to report these transactions on form 8949 (see instructions). Applicable check box on form 8949 added: Check box a, b, or. Wash sale loss disallowed removed: If more than one box applies for.

Stock or other symbol removed:. The applicable check box is typically listed in the fine print just below the. Web schedule d, line 1a; Web applicable check box on form 8949. You aren’t required to report these transactions on form 8949 (see instructions). Web applicable checkbox on form 8949 (sales and other dispositions of capital assets) quantity. Here is more information on how tax form 8949 is used from the irs: You aren’t required to report these transactions on form 8949 (see instructions). Web applicable checkbox on form 8949 each section indicates — where to report this transaction on form 8949 and schedule d (form 1040), and which checkbox is. If more than one box applies for.

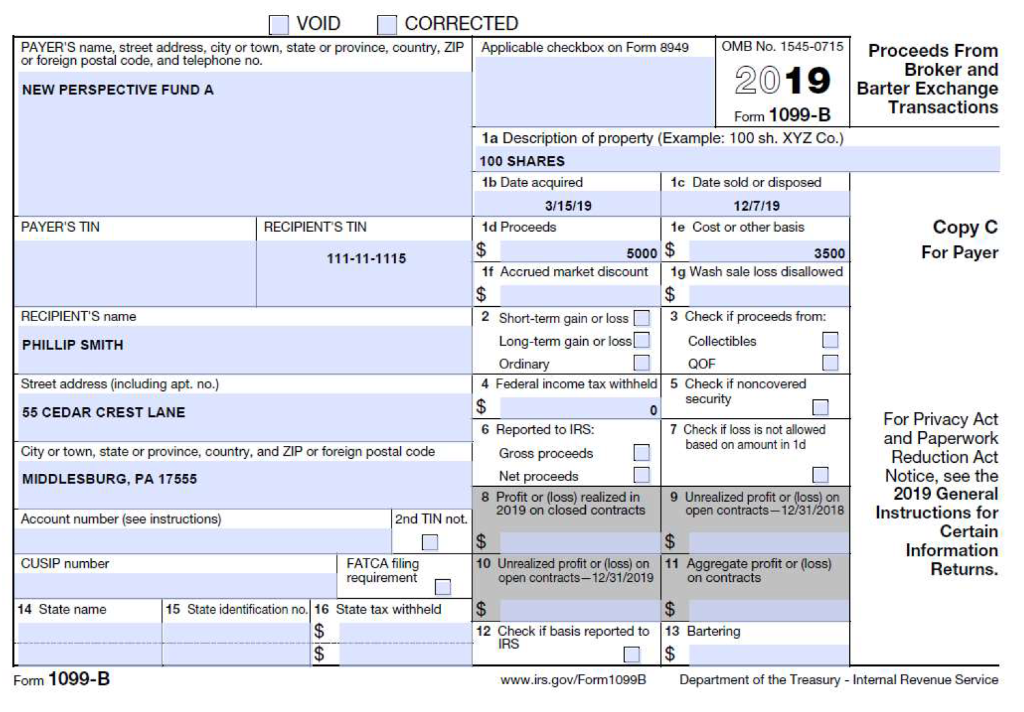

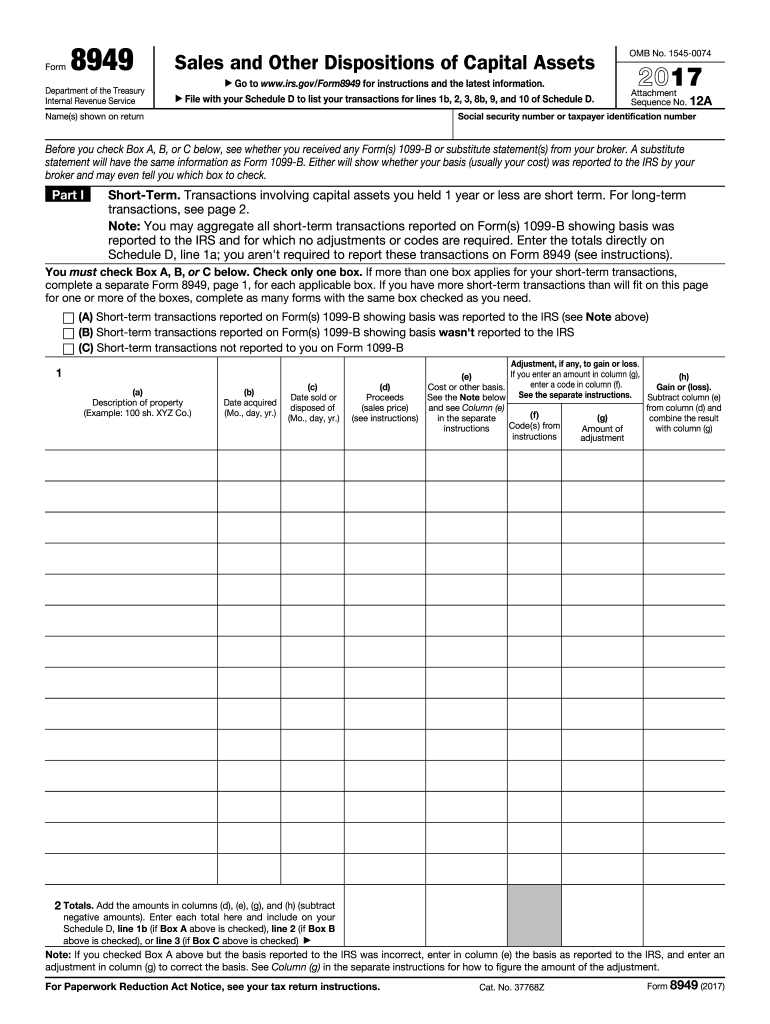

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

If more than one box applies for. You must check box d, e, or f below. The applicable check box is typically listed in the fine print just below the. Wash sale loss disallowed removed: Check box a, b, or.

How To Add Checkbox In Contact Form 7 Without Code?

Web you will report the totals of form 8949 on schedule d of form 1040. Here is more information on how tax form 8949 is used from the irs: Web applicable checkbox on form 8949. Web schedule d, line 1a; Web however, if box 2 of form 1099 is left blank and code x is in the “applicable checkbox on.

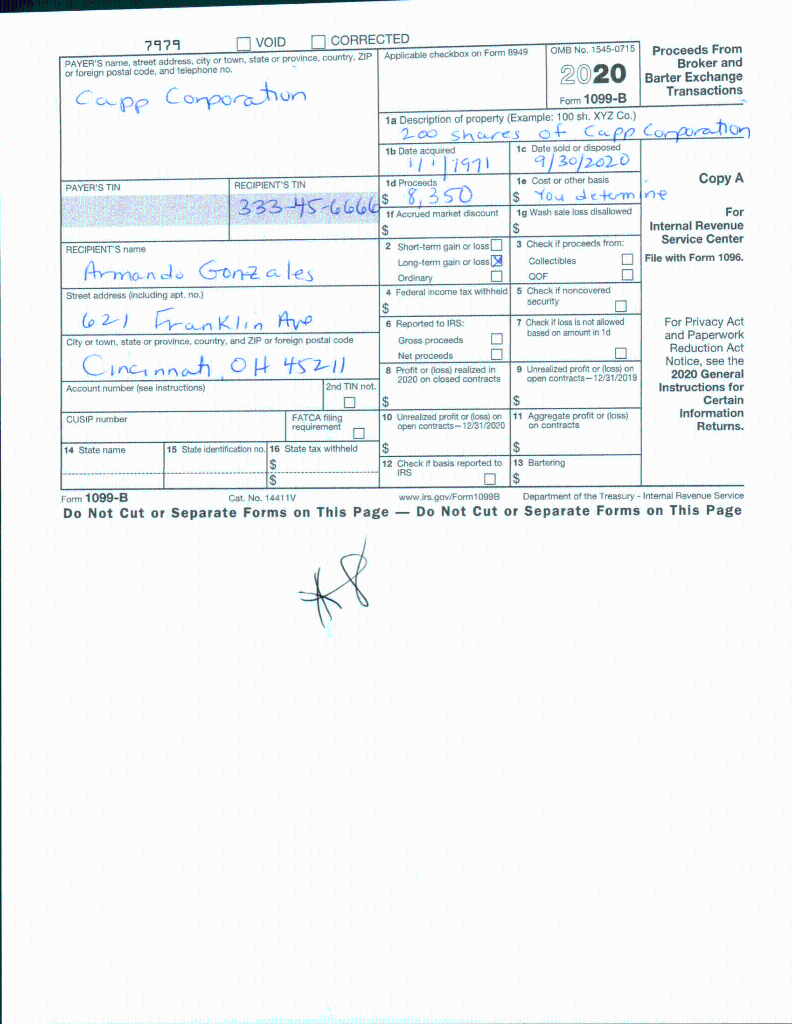

This Assignment Has Two Parts. PREPARE THE FORMS L...

Web applicable checkbox on form 8949 each section indicates — where to report this transaction on form 8949 and schedule d (form 1040), and which checkbox is. The applicable check box is typically listed in the fine print just below the. Actions > enter transactions > check > distributions tab: You aren’t required to report these transactions on form 8949.

IRS Form 8949 Instructions

You aren’t required to report these transactions on form 8949 (see instructions). Check box a, b, or. Web schedule d, line 1a; Here is more information on how tax form 8949 is used from the irs: Web applicable checkbox on form 8949 (sales and other dispositions of capital assets) quantity.

IRS Form 8949 instructions.

The applicable check box is typically listed in the fine print just below the. Tax withholding (backup withholding, if applicable) cost basis. Actions > enter transactions > check > distributions tab: Web on part i of form 8949. Web applicable check box on form 8949.

Individual Tax Return Problem 5 Required Use the

Web applicable checkbox on form 8949 (sales and other dispositions of capital assets) quantity. You must check box d, e, or f below. You aren’t required to report these transactions on form 8949 (see instructions). If more than one box applies for. Check box a, b, or.

In the following Form 8949 example,the highlighted section below shows

Web applicable checkbox on form 8949. Applicable check box on form 8949 added: Check box a, b, or. You aren’t required to report these transactions on form 8949 (see instructions). Actions > enter transactions > check > distributions tab:

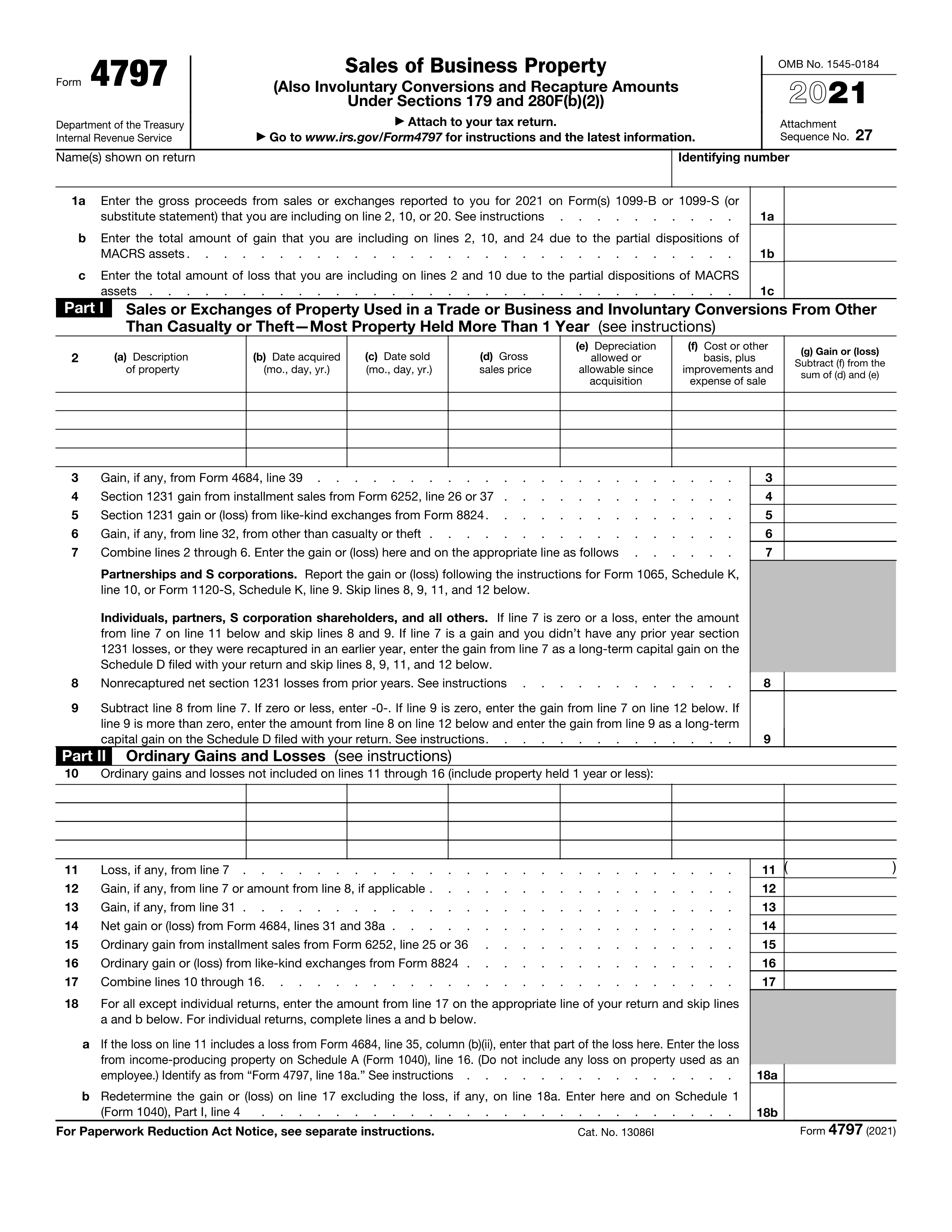

IRS Form 4797

You aren’t required to report these transactions on form 8949 (see instructions). Web applicable checkbox on form 8949 each section indicates — where to report this transaction on form 8949 and schedule d (form 1040), and which checkbox is. If more than one box applies for. Web what is the purpose of this checkbox? Check box a, b, or.

Printable irs tax form 8949 2017 Fill out & sign online DocHub

Stock or other symbol removed:. Tax withholding (backup withholding, if applicable) cost basis. Web however, if box 2 of form 1099 is left blank and code x is in the “applicable checkbox on form 8949” box, then you will need to decide from your own records. Web use form 8949 to report sales and exchanges of capital assets. Indicates where.

Tax Withholding (Backup Withholding, If Applicable) Cost Basis.

Web however, if box 2 of form 1099 is left blank and code x is in the “applicable checkbox on form 8949” box, then you will need to decide from your own records. Check box a, b, or. Actions > enter transactions > check > distributions tab: Web you will report the totals of form 8949 on schedule d of form 1040.

Web Schedule D, Line 1A;

Click the ellipsis button next to the 1099 item you chose. Applicable check box on form 8949 added: Web applicable checkbox on form 8949. Check box a, b, or.

Web What Is The Purpose Of This Checkbox?

You aren’t required to report these transactions on form 8949 (see instructions). The applicable check box is typically listed in the fine print just below the. Web applicable checkbox on form 8949 each section indicates — where to report this transaction on form 8949 and schedule d (form 1040), and which checkbox is. Here is more information on how tax form 8949 is used from the irs:

Web On Part I Of Form 8949.

Web use form 8949 to report sales and exchanges of capital assets. Web applicable check box on form 8949. Indicates where to report this transaction on form 8949 and schedule d (form 1040), and which checkbox is applicable. Wash sale loss disallowed removed: