Alabama State Tax Withholding Form

Alabama State Tax Withholding Form - Details on how to only prepare and print an alabama. Taxformfinder provides printable pdf copies. Web any correspondence concerning this form should be sent to the al dept of revenue, withholding tax section, po box 327480, montgomery, al 361327480 or by fax to. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. Web alabama state tax withholding forms; Taxformfinder provides printable pdf copies. Persons claiming single or zero exemption: The idiot and the odysseyarticle and.

Web any correspondence concerning this form should be sent to the al dept of revenue, withholding tax section, po box 327480, montgomery, al 361327480 or by fax to. The idiot and the odysseyarticle and. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web this is a component of individual income tax. Web popular forms & instructions; Persons claiming single or zero exemption: Web up to $40 cash back state tax withholding forms. Web ( ) i wish to have $___________withheld from each monthly benefit check, if that amountis greater than would have been withheld on the basis of exemptions claimed on. Taxformfinder provides printable pdf copies. Download alabama state tax withholding forms for free formtemplate offers you hundreds of resume templates that you can.

Web up to $40 cash back state tax withholding forms. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Details on how to only prepare and print an alabama. Taxformfinder provides printable pdf copies. Web ( ) i wish to have $___________withheld from each monthly benefit check, if that amountis greater than would have been withheld on the basis of exemptions claimed on. Web popular forms & instructions; The zero (0) or single,. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. State tax withholding forms alabama. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all.

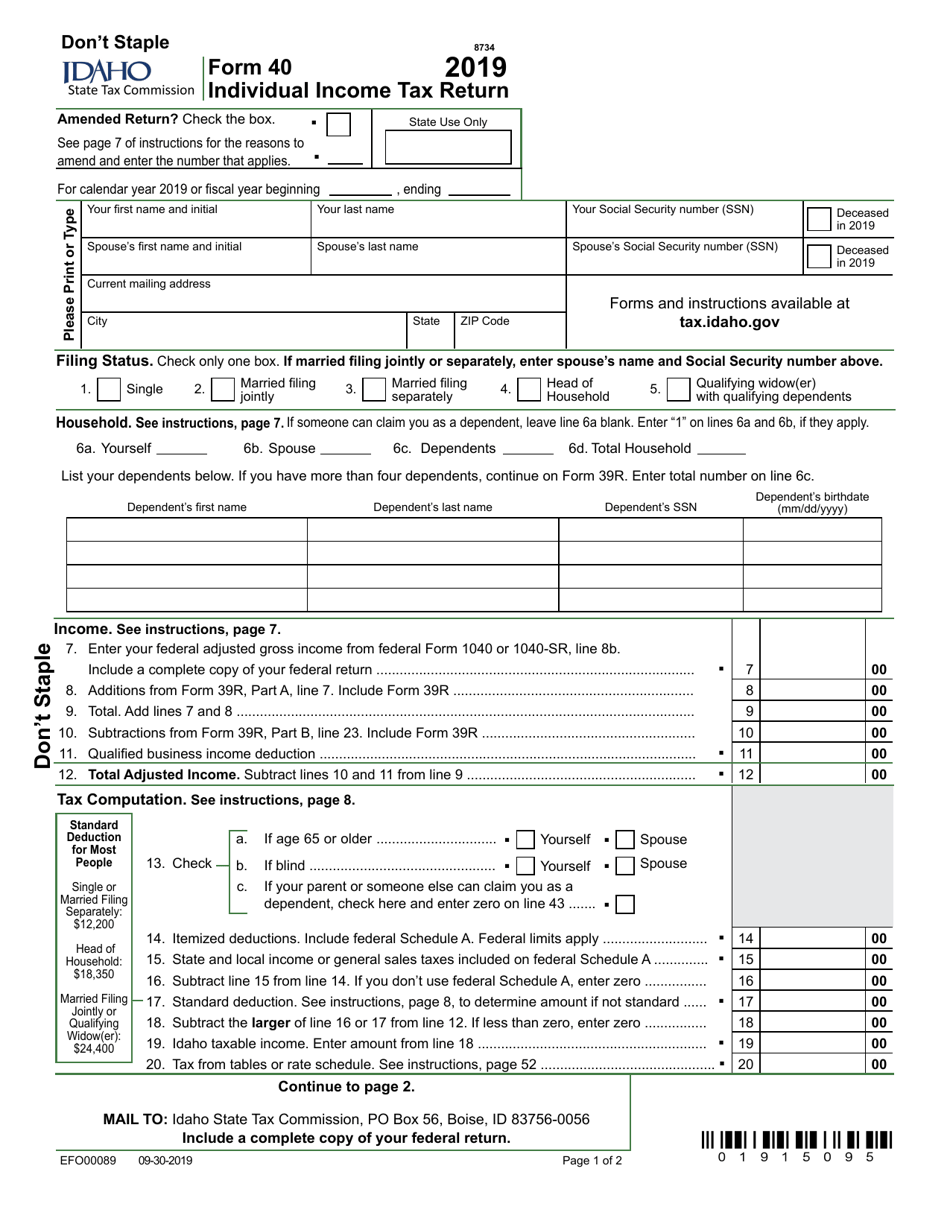

Form 40 Download Fillable PDF or Fill Online Individual Tax

Web any correspondence concerning this form should be sent to the al dept of revenue, withholding tax section, po box 327480, montgomery, al 361327480 or by fax to. Taxformfinder provides printable pdf copies. Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. The zero (0) or.

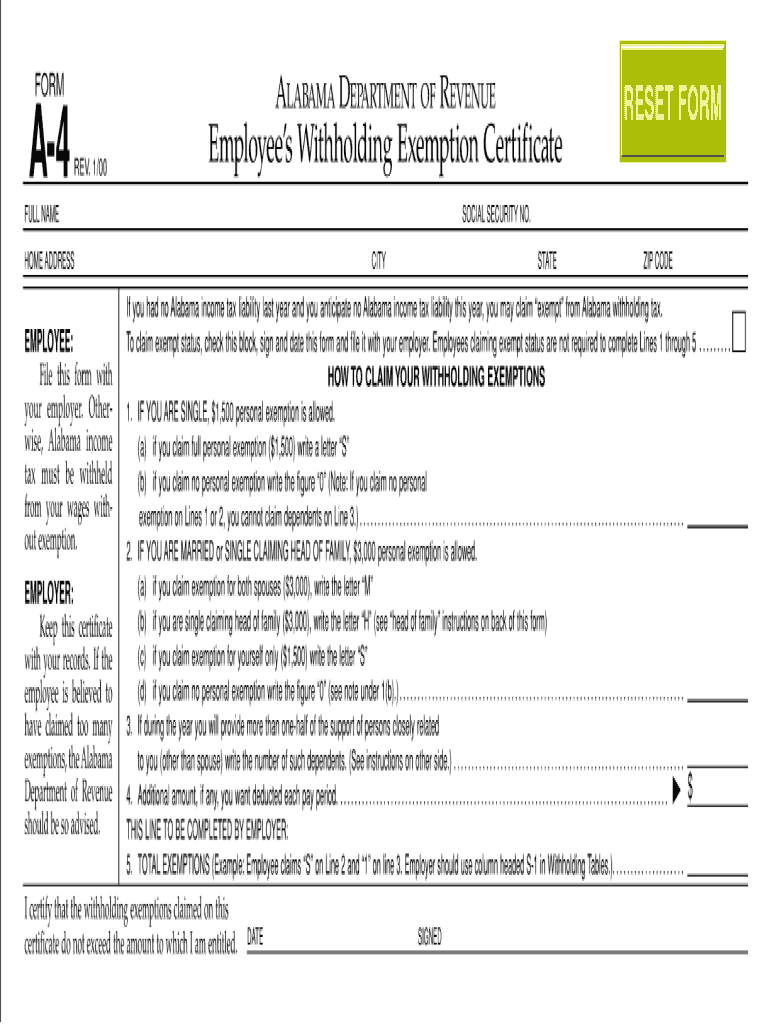

Alabama Withholding Form 2021 2022 W4 Form

The zero (0) or single,. Web ( ) i wish to have $___________withheld from each monthly benefit check, if that amountis greater than would have been withheld on the basis of exemptions claimed on. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Download alabama state tax withholding forms for.

Alabama Tax Forms 2021 Printable 2022 W4 Form

Web up to $40 cash back state tax withholding forms. Web ( ) i wish to have $___________withheld from each monthly benefit check, if that amountis greater than would have been withheld on the basis of exemptions claimed on. State tax withholding forms alabama. Web alabama state tax withholding forms; Details on how to only prepare and print an alabama.

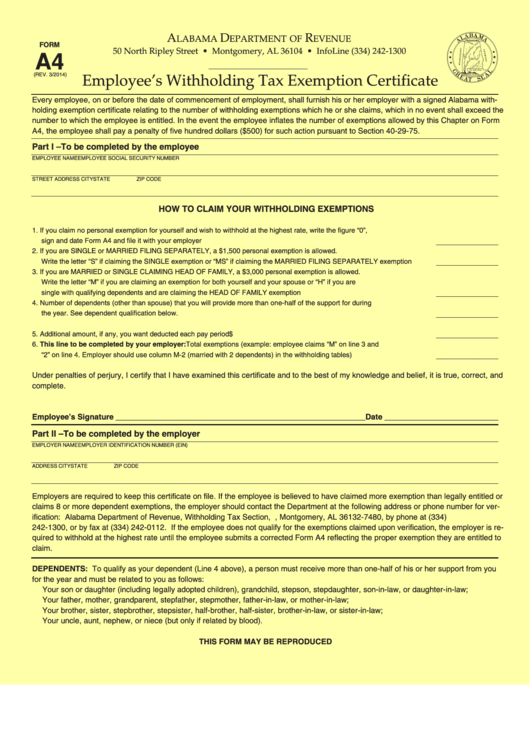

Fillable Form A4 Alabama Employee'S Withholding Tax Exemption

Taxformfinder provides printable pdf copies. Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Web popular forms & instructions; Web any correspondence concerning this form should be sent to the al dept of revenue, withholding tax section, po box 327480, montgomery, al 361327480 or by fax.

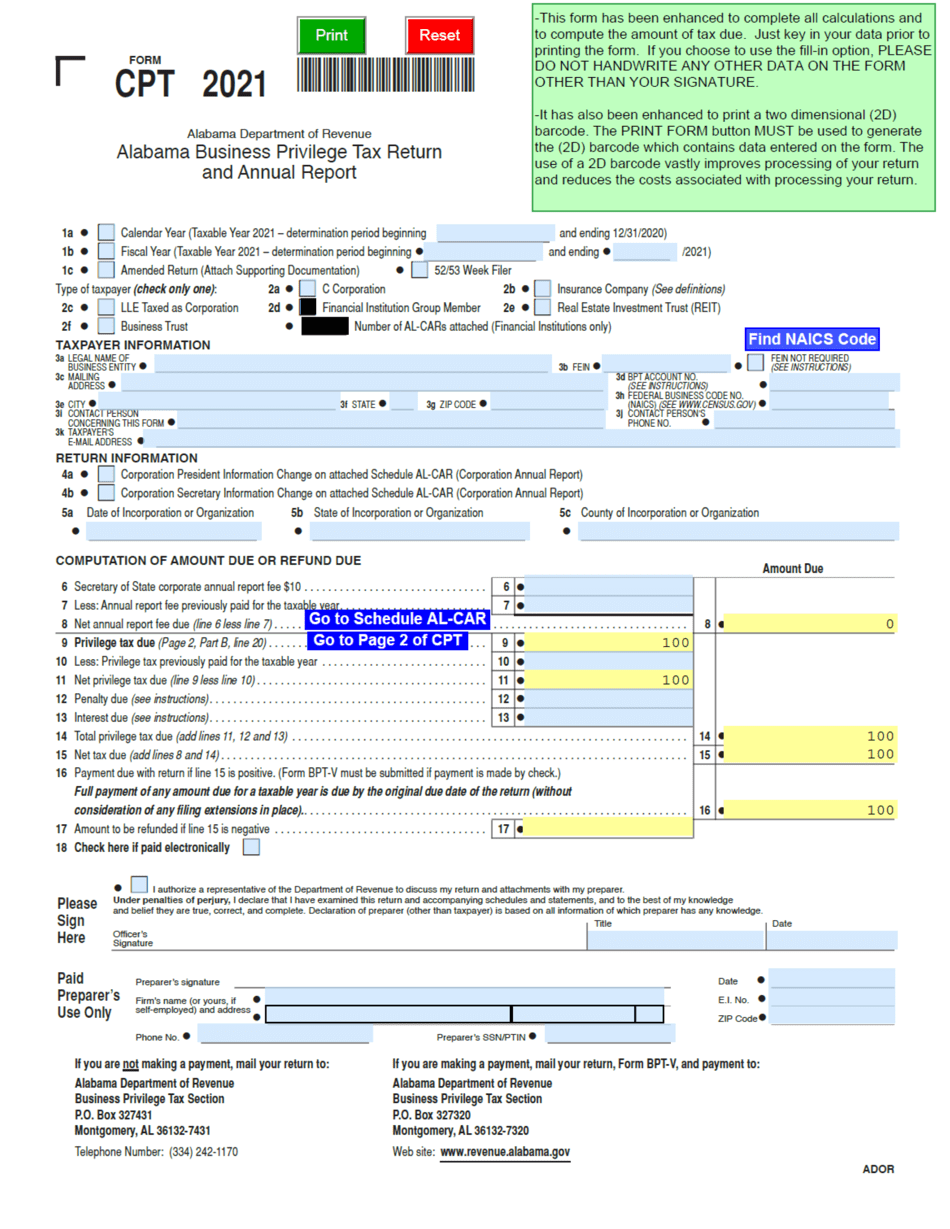

Form CPT Download Fillable PDF or Fill Online Alabama Business

The idiot and the odysseyarticle and. Web any correspondence concerning this form should be sent to the al dept of revenue, withholding tax section, po box 327480, montgomery, al 361327480 or by fax to. Web alabama has a state income tax that ranges between 2% and 5%. The zero (0) or single,. Web popular forms & instructions;

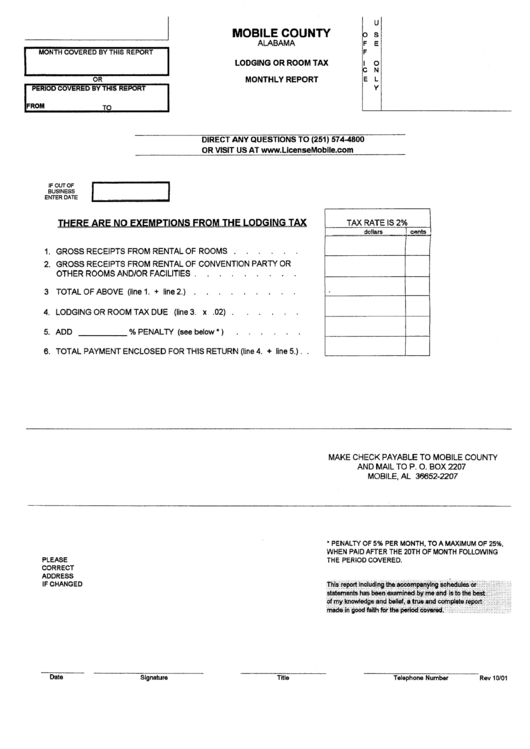

Lodging Or Room Tax Form State Of Alabama printable pdf download

Web popular forms & instructions; Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Web alabama has a state income tax that ranges between 2% and 5%.

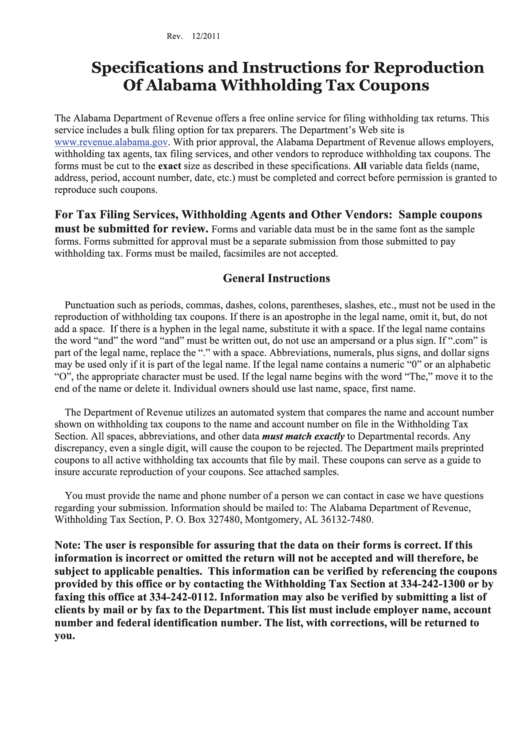

Specifications And Instructions For Reproduction Of Alabama Withholding

Web up to $40 cash back state tax withholding forms. The idiot and the odysseyarticle and. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all. Persons claiming single or zero exemption: State tax withholding forms alabama.

Happy tax day Forbes says Alabama is the 10th best state for taxes

2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all. State tax withholding forms alabama. Details on how to only prepare and print an alabama. Web alabama state tax withholding forms; Taxformfinder provides printable pdf copies.

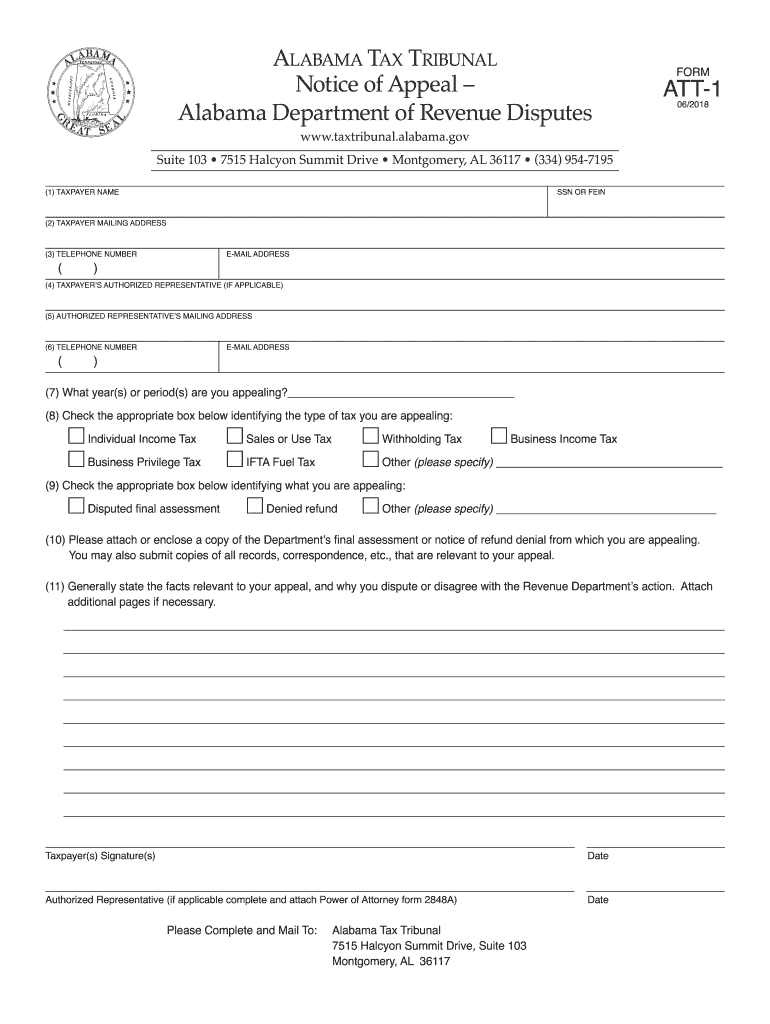

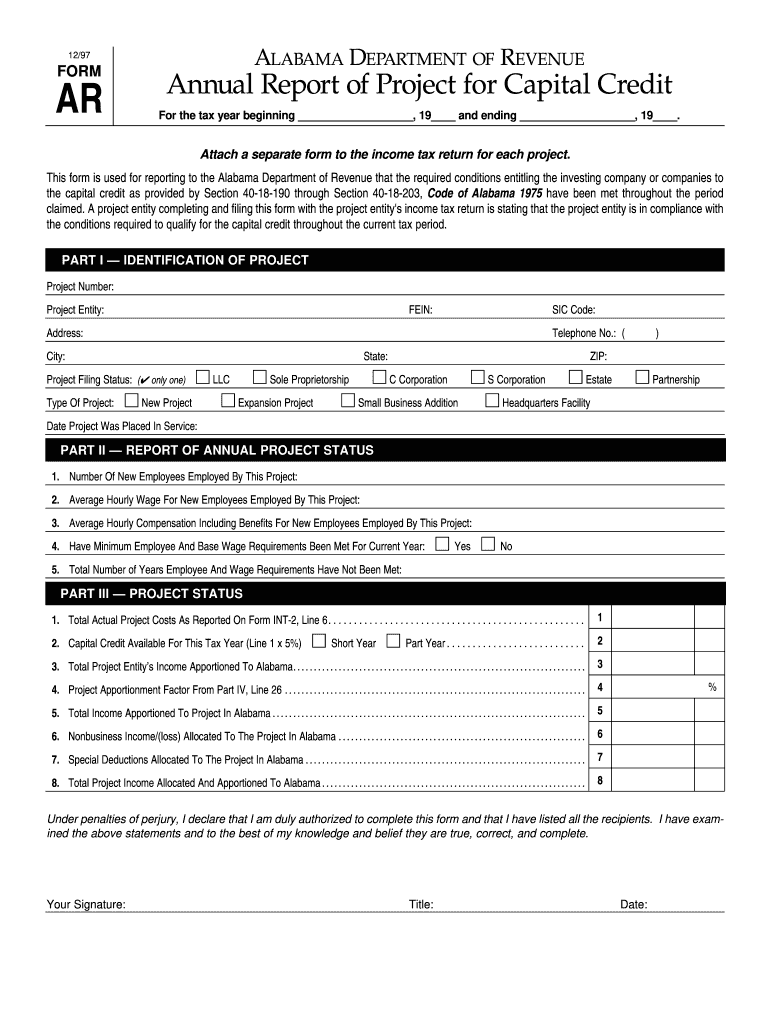

Alabama Department Capital Fill Out and Sign Printable PDF Template

Web alabama state tax withholding forms; Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. The idiot and the odysseyarticle and. Taxformfinder.

How To Fill Out Alabama State Tax Withholding Form

Persons claiming single or zero exemption: Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Web ( ) i wish to have $___________withheld from each monthly benefit check, if that amountis greater than would have been withheld on the basis of exemptions claimed on. Download alabama.

Web ( ) I Wish To Have $___________Withheld From Each Monthly Benefit Check, If That Amountis Greater Than Would Have Been Withheld On The Basis Of Exemptions Claimed On.

Web alabama state tax withholding forms; Web up to $40 cash back state tax withholding forms. Web any correspondence concerning this form should be sent to the al dept of revenue, withholding tax section, po box 327480, montgomery, al 361327480 or by fax to. Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue.

Taxformfinder Provides Printable Pdf Copies.

State tax withholding forms alabama. Taxformfinder provides printable pdf copies. Details on how to only prepare and print an alabama. Web popular forms & instructions;

Persons Claiming Single Or Zero Exemption:

Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Download alabama state tax withholding forms for free formtemplate offers you hundreds of resume templates that you can. The zero (0) or single,. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below.

Web Alabama Has A State Income Tax That Ranges Between 2% And 5%.

2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all. Web alabama has a state income tax that ranges between 2% and 5% , which is administered by the alabama department of revenue. Web this is a component of individual income tax. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o.