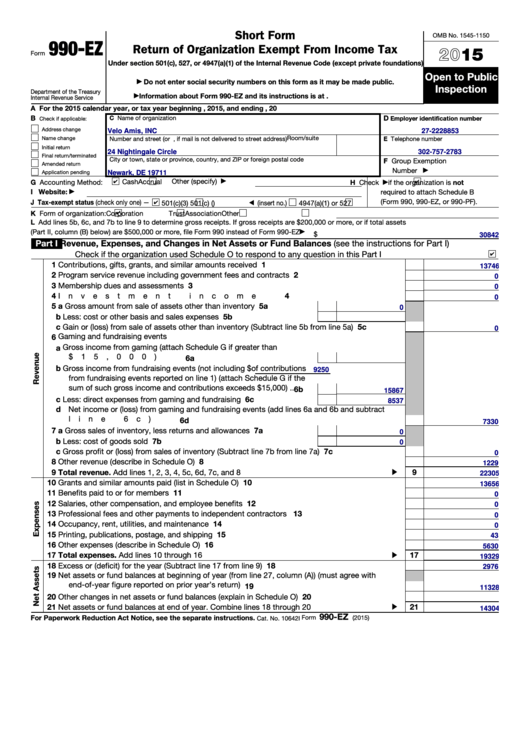

990 Ez Printable Form

990 Ez Printable Form - We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. The download files are organized by month. On this page you may download the 990 series filings on record for 2021. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Address change name change initial return This form is for income earned in tax year 2022, with tax returns due in april 2023. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Enter amount of tax on line 40c reimbursed by. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable:

Some months may have more than one entry due to the size of the download. On this page you may download the 990 series filings on record for 2021. The download files are organized by month. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Enter amount of tax on line 40c reimbursed by. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Address change name change initial return A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.

Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. This form is for income earned in tax year 2022, with tax returns due in april 2023. Some months may have more than one entry due to the size of the download. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: On this page you may download the 990 series filings on record for 2021. Enter amount of tax on line 40c reimbursed by. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The download files are organized by month.

Fillable Form 990 Ez Short Form Return Of Organization Exempt From

Some months may have more than one entry due to the size of the download. Address change name change initial return Enter amount of tax on line 40c reimbursed by. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: The information provided will enable you to file a more.

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Address change name change initial return We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Enter amount of tax on line 40c reimbursed by. The download files are organized by month. On this page you may download the 990 series filings on record for.

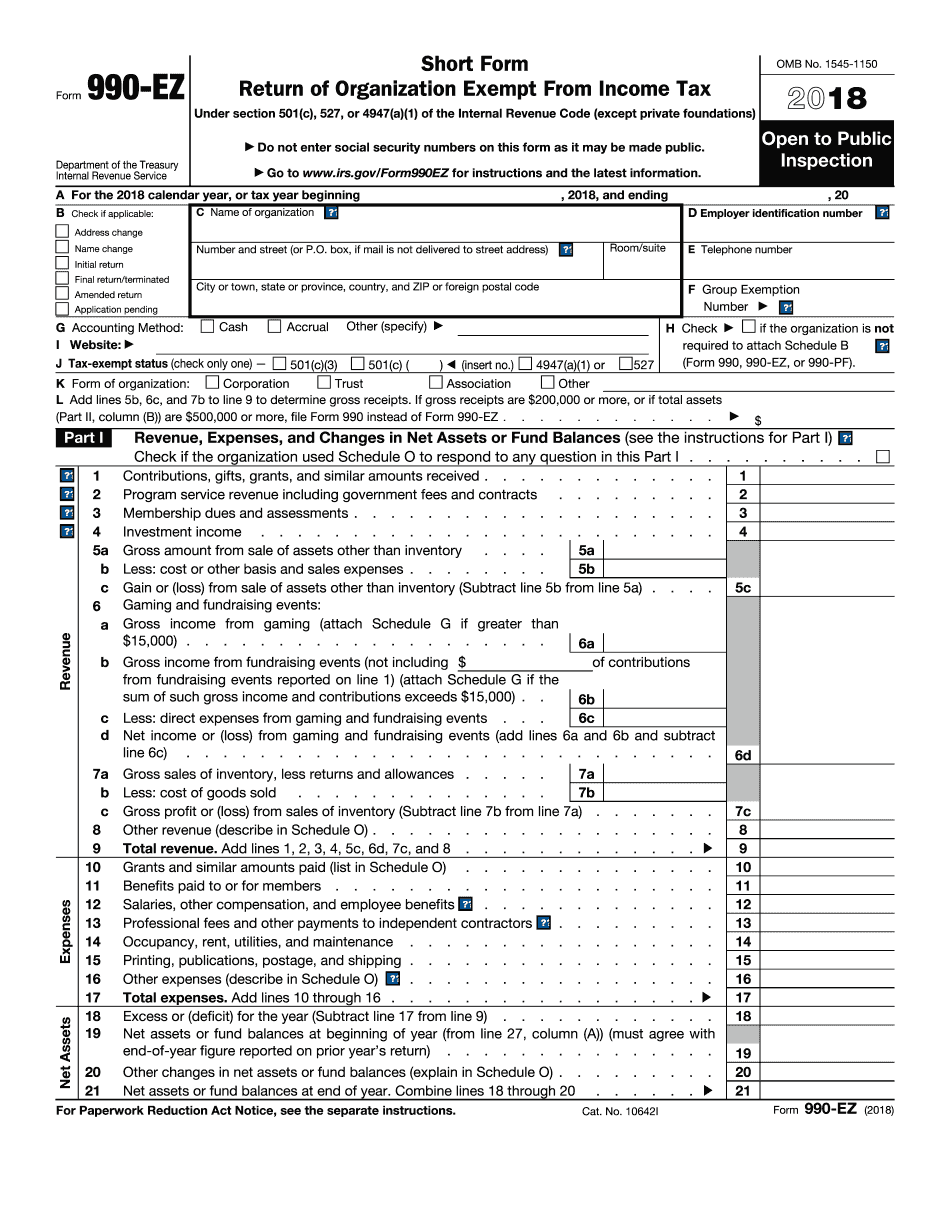

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

The download files are organized by month. Enter amount of tax on line 40c reimbursed by. This form is for income earned in tax year 2022, with tax returns due in april 2023. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: We will update this page with a.

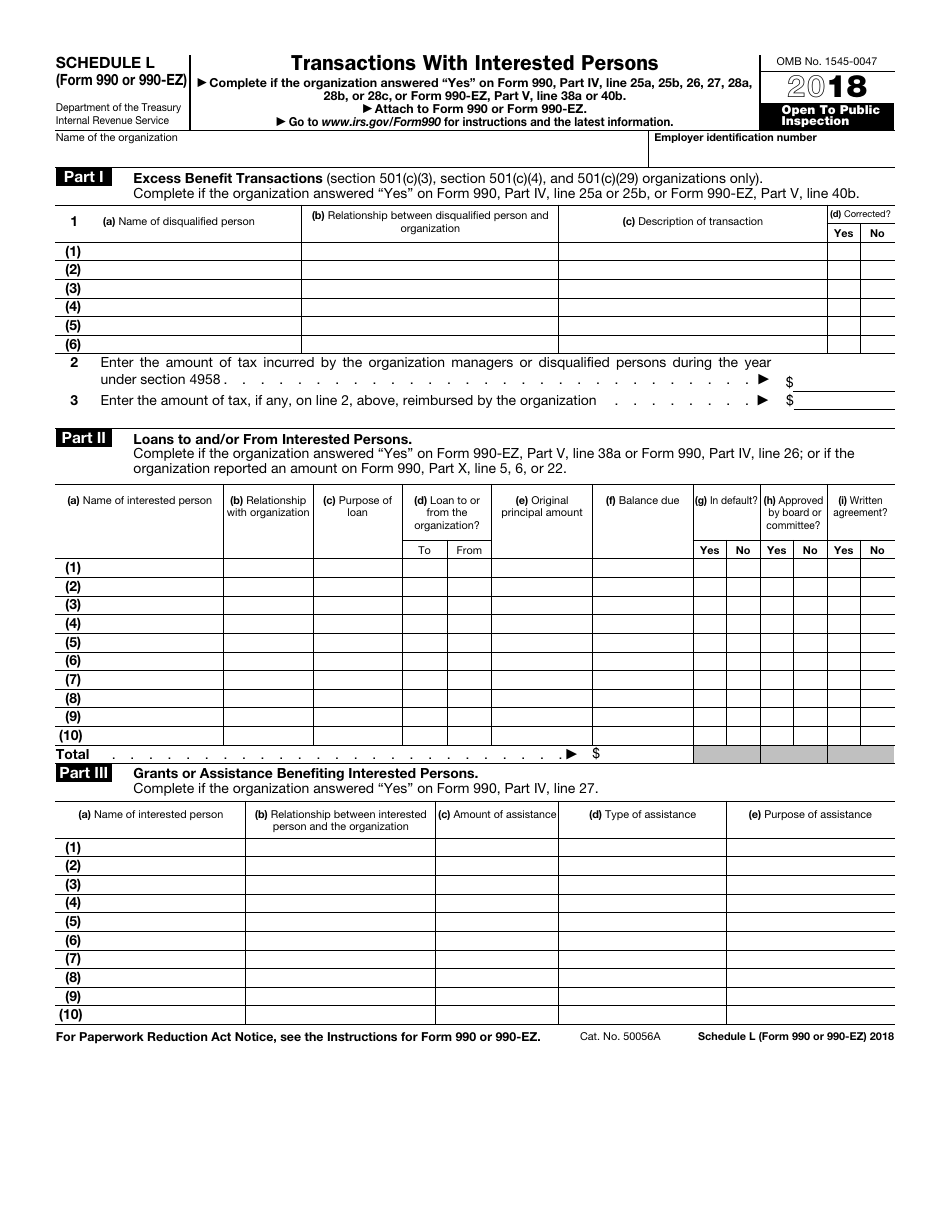

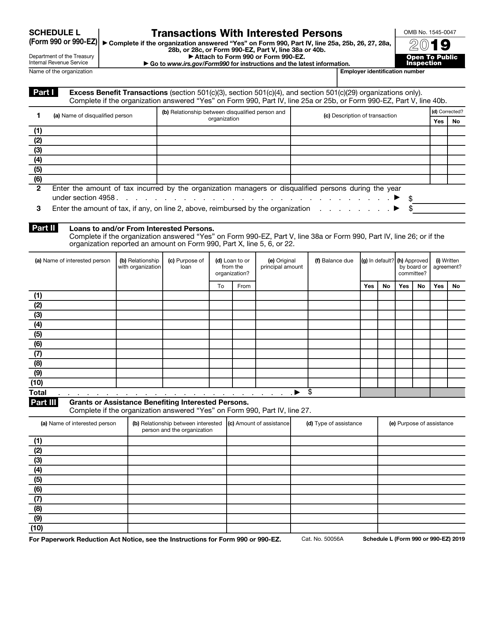

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Enter amount of tax on line 40c reimbursed by. On this page you may download the 990 series filings on record for 2021. Address change name change initial return This form is for.

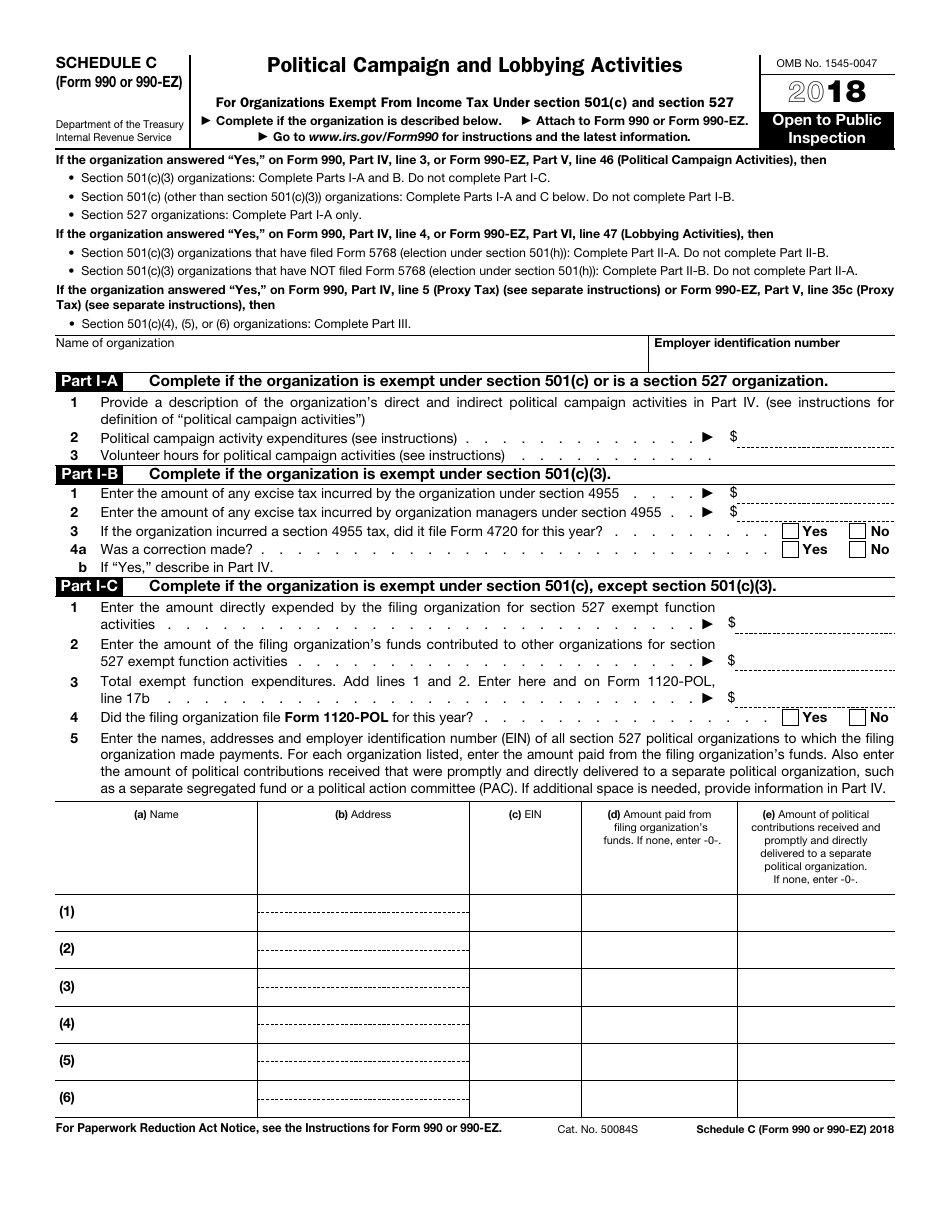

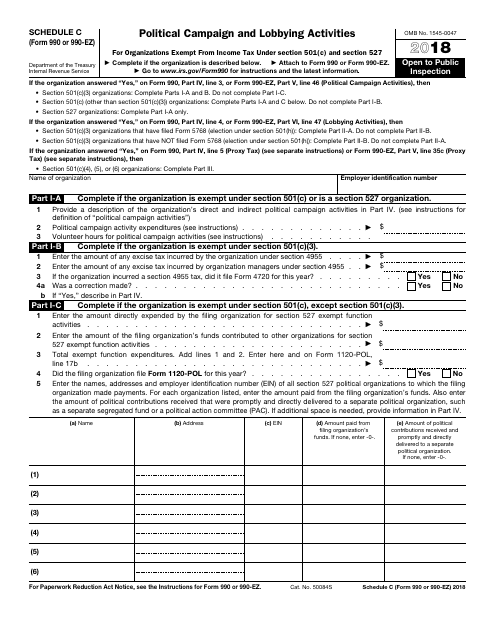

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. On this page you may download the 990 series filings.

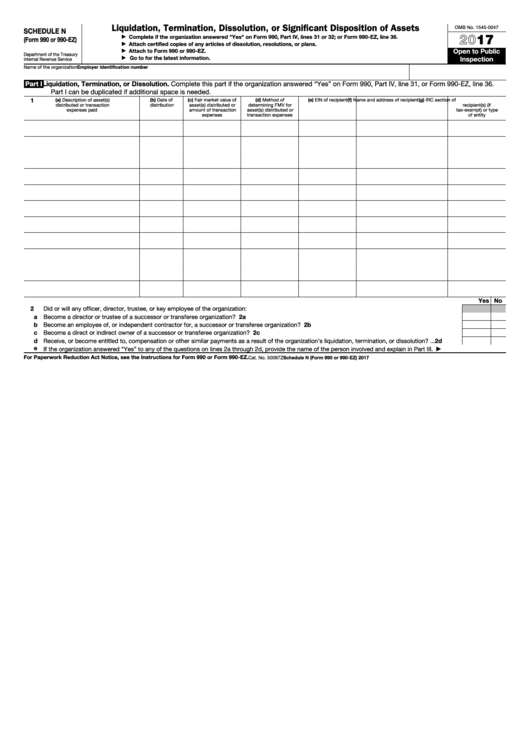

Fillable Schedule N (Form 990 Or 990Ez) Liquidation, Termination

Address change name change initial return Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Some months may have more than one entry due to the size of the download. Web enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955,.

How To Fill Out Form 990 Ez 2020 Blank Sample to Fill out Online in PDF

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Address change name change initial return Web enter amount of tax imposed on organization managers or disqualified.

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. This form is for income earned in tax year 2022, with tax returns due in april 2023. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you..

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Enter amount of tax on line 40c reimbursed by. The information provided will enable you.

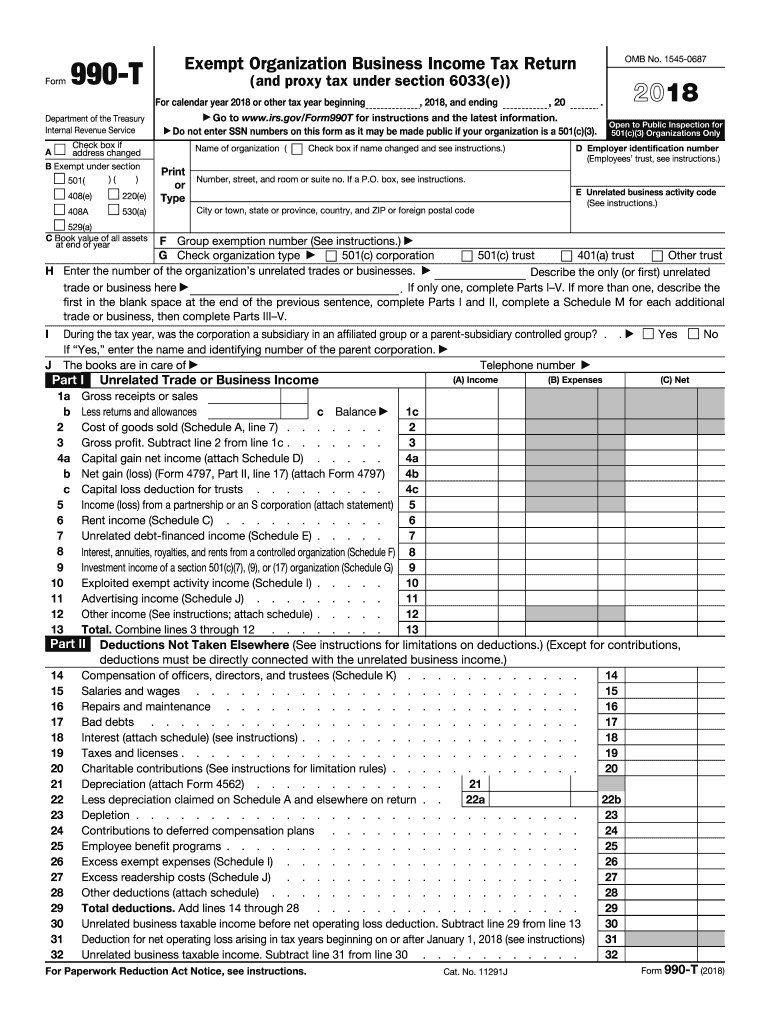

990 t Fill Out and Sign Printable PDF Template signNow

The download files are organized by month. Enter amount of tax on line 40c reimbursed by. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable: The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Its.

On This Page You May Download The 990 Series Filings On Record For 2021.

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. The download files are organized by month. Enter amount of tax on line 40c reimbursed by. A for the 2022 calendar year, or tax year beginning , 2022, and ending , 20 b check if applicable:

Web Enter Amount Of Tax Imposed On Organization Managers Or Disqualified Persons During The Year Under Sections 4912, 4955, And 4958 Section 501(C)(3), 501(C)(4), And 501(C)(29) Organizations.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Some months may have more than one entry due to the size of the download. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Address change name change initial return