941 Form 2023 Schedule B

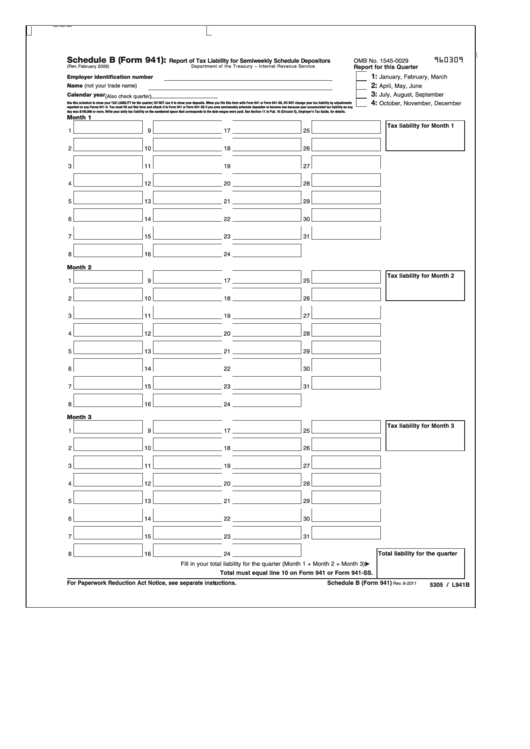

941 Form 2023 Schedule B - Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Schedule b (form 941) pdf instructions for schedule b. It includes the filing requirements and tips on reconciling and balancing the two forms. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. (check one.) employer identification number (ein) — 1: It discusses what is new for this version as well as the requirements for completing each form line by line. This means that the majority of. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Report of tax liability for semiweekly schedule depositors (rev.

Qualified small business payroll tax credit for increasing research activities. (check one.) employer identification number (ein) — 1: Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. Web schedule b (form 941): Web the irs has released: Web file schedule b (form 941) if you are a semiweekly schedule depositor. Schedule b (form 941) pdf instructions for schedule b. It discusses what is new for this version as well as the requirements for completing each form line by line. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes.

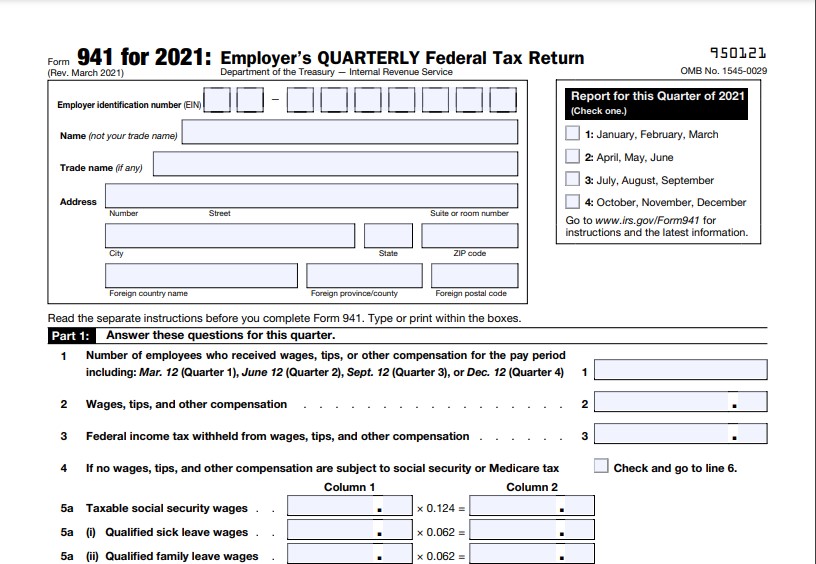

Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability for semiweekly schedule depositors schedule r, allocation schedule for aggregate form 941 filers, and its instructions the form 941 for 2023 contains no major changes. Schedule b (form 941) pdf instructions for schedule b. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Reported more than $50,000 of employment taxes in the lookback period. Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. (check one.) employer identification number (ein) — 1: Web the irs has released: Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Qualified small business payroll tax credit for increasing research activities.

Form 941 Schedule B YouTube

You are a semiweekly depositor if you: Reported more than $50,000 of employment taxes in the lookback period. Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end.

IRS Form 941 Schedule B 2023

Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Web street suite or room.

941 schedule b 2021 Fill out & sign online DocHub

The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability for semiweekly schedule depositors schedule r, allocation schedule for aggregate form 941 filers, and its instructions the form 941 for 2023 contains no major changes. January 2017) department of the treasury — internal revenue service 960311 omb no. You.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Web the irs has released: January 2017) department of the treasury — internal revenue service 960311 omb no. The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability.

Download Instructions for IRS Form 941 Schedule B Report of Tax

Reported more than $50,000 of employment taxes in the lookback period. The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability for semiweekly schedule depositors schedule r, allocation schedule for aggregate form 941 filers, and its instructions the form 941 for 2023 contains no major changes. Schedule b (form.

IRS Form 941X Complete & Print 941X for 2021

Report of tax liability for semiweekly schedule depositors (rev. This means that the majority of. Web schedule b (form 941): The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability for semiweekly schedule depositors schedule r, allocation schedule for aggregate form 941 filers, and its instructions the form 941.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

Web the irs has released: January 2017) department of the treasury — internal revenue service 960311 omb no. It includes the filing requirements and tips on reconciling and balancing the two forms. (check one.) employer identification number (ein) — 1: Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

Form 941 Printable & Fillable Per Diem Rates 2021

January 2017) department of the treasury — internal revenue service 960311 omb no. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Report of tax liability for semiweekly schedule depositors (rev. The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report.

How to File Schedule B for Form 941

Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end of the first quarter of the 2023 tax year. You are a semiweekly depositor if you: Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Report of tax liability for semiweekly schedule depositors (rev. Schedule b (form 941) pdf instructions for schedule b. Qualified small business payroll tax credit for increasing research activities. (check one.) employer identification number (ein) — 1: You are a semiweekly depositor if you:

Web The Irs Form 941 Schedule B For 2023 Is Used By Semiweekly Schedule Depositors That Report More Than $50,000 In Employment Taxes.

Adjusting tax liability for nonrefundable credits claimed on form 941, lines 11a, 11b, and 11d. January 2017) department of the treasury — internal revenue service 960311 omb no. Report of tax liability for semiweekly schedule depositors (rev. (check one.) employer identification number (ein) — 1:

Reported More Than $50,000 Of Employment Taxes In The Lookback Period.

It discusses what is new for this version as well as the requirements for completing each form line by line. You are a semiweekly depositor if you: The 2023 form 941, employer’s quarterly federal tax return, and its instructions the instructions for schedule b, report of tax liability for semiweekly schedule depositors schedule r, allocation schedule for aggregate form 941 filers, and its instructions the form 941 for 2023 contains no major changes. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023.

Web Street Suite Or Room Number City State Zip Code Foreign Country Name Foreign Province/County Foreign Postal Code 950122 Omb No.

This means that the majority of. Web the irs has released: Schedule b (form 941) pdf instructions for schedule b. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

It Includes The Filing Requirements And Tips On Reconciling And Balancing The Two Forms.

Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this schedule. Web schedule b (form 941): Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. Web file schedule b (form 941) if you are a semiweekly schedule depositor.