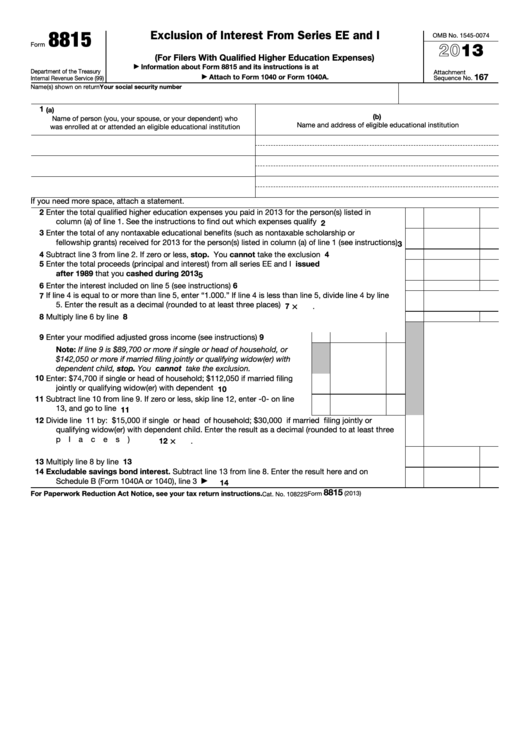

8815 Tax Form

8815 Tax Form - Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. I'd like to exclude some us savings bond interest from tax but can't enter coverdell contributions. Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Web we last updated the exclusion of interest from series ee and i u.s. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. You pay $1,000 for a $1,000 bond. You paid qualified higher education expenses to an eligible institution that same tax year. When buying a series i or electronic series ee bond, you pay the face value of the bond.

Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Web we last updated the exclusion of interest from series ee and i u.s. Use form 8815 to figure the amount of any interest you may exclude. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions to a coverdell education savings account (coverdell esa) or a qualified tuition program (qtp). You pay $1,000 for a $1,000 bond.

You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. I'd like to exclude some us savings bond interest from tax but can't enter coverdell contributions. It accrues interest until the bond matures. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: Web we last updated the exclusion of interest from series ee and i u.s. When buying a series i or electronic series ee bond, you pay the face value of the bond. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022.

IRS 8815 2015 Fill out Tax Template Online US Legal Forms

Then, when the bond matures, you get the bond amount plus the accrued interest. You paid qualified higher education expenses to an eligible institution that same tax year. Web we last updated the exclusion of interest from series ee and i u.s. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully.

Form 8815 Edit, Fill, Sign Online Handypdf

Then, when the bond matures, you get the bond amount plus the accrued interest. When buying a series i or electronic series ee bond, you pay the face value of the bond. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. You.

Maximize Form 8815 Unlock Educational Tax Benefits Fill

When buying a series i or electronic series ee bond, you pay the face value of the bond. You pay $1,000 for a $1,000 bond. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. It accrues interest until the bond matures. Web 1 best answer irenes intuit alumni you can.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Web we last updated the exclusion of interest from series ee and i u.s. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds..

Fillable Form 8815 Exclusion Of Interest From Series Ee And I U.s

Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. You paid qualified higher education expenses to an eligible institution that same tax year. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. If you find the.

Form 8815 Edit, Fill, Sign Online Handypdf

Use form 8815 to figure the amount of any interest you may exclude. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest.

Paying For College A Tax Dodge For College Students

You pay $1,000 for a $1,000 bond. Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions to a coverdell education savings account (coverdell esa) or a qualified tuition.

食卓を彩る甘みと旨みがギュっと詰まった御宿の伊勢えび ふるさと納税 [ふるさとチョイス]

If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Savings bonds this year that were issued after 1989, you may be able to exclude from your.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Web specific instructions line 1 column (a). Use form 8815 to figure the amount of any interest you.

GH 8815(B) TWINS DOLPHIN

When buying a series i or electronic series ee bond, you pay the face value of the bond. Web posted june 4, 2019 5:28 pm last updated june 04, 2019 5:28 pm is there a place or way to complete form 8815 in turbo tax premier? Web we last updated the exclusion of interest from series ee and i u.s..

Web We Last Updated The Exclusion Of Interest From Series Ee And I U.s.

I'd like to exclude some us savings bond interest from tax but can't enter coverdell contributions. Web if you cashed series ee or i u.s. When buying a series i or electronic series ee bond, you pay the face value of the bond. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022.

Savings Bonds This Year That Were Issued After 1989, You May Be Able To Exclude From Your Income Part Or All Of The Interest On Those Bonds.

Use form 8815 to figure the amount of any interest you may exclude. You pay $1,000 for a $1,000 bond. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Web specific instructions line 1 column (a).

Savings Bonds Issued After 1989 (For Filers With Qualified Higher Education Expenses) Go To Www.irs.gov/Form8815 For The Latest Information.

Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions to a coverdell education savings account (coverdell esa) or a qualified tuition program (qtp). Web posted june 4, 2019 5:28 pm last updated june 04, 2019 5:28 pm is there a place or way to complete form 8815 in turbo tax premier? You paid qualified higher education expenses to an eligible institution that same tax year.

It Accrues Interest Until The Bond Matures.

Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. Then, when the bond matures, you get the bond amount plus the accrued interest.

![食卓を彩る甘みと旨みがギュっと詰まった御宿の伊勢えび ふるさと納税 [ふるさとチョイス]](https://img.furusato-tax.jp/img/x/original/feature/form/details/20210608/gpfd_c3a4cc8815b475611cadcf6f134b28abfa6554db.jpg)