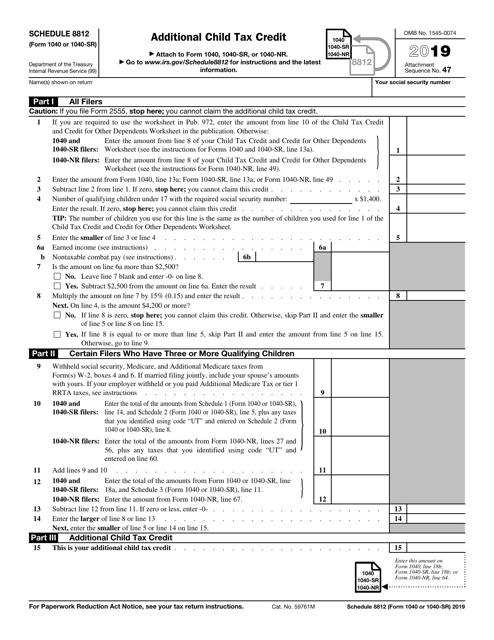

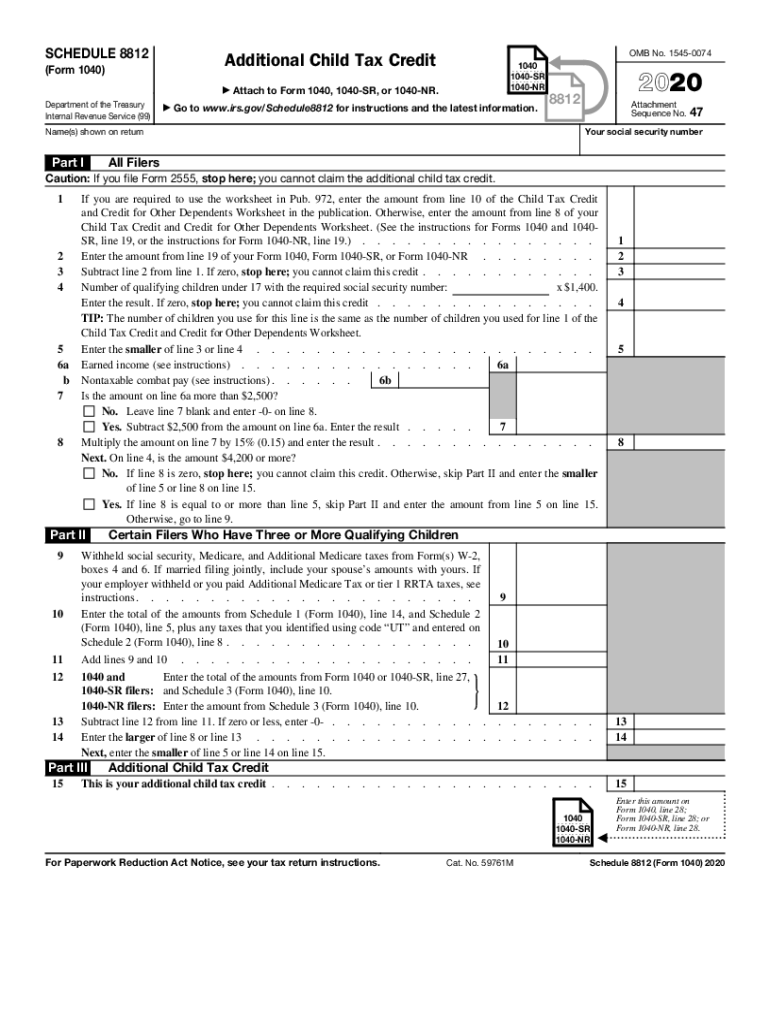

8812 Form 2020

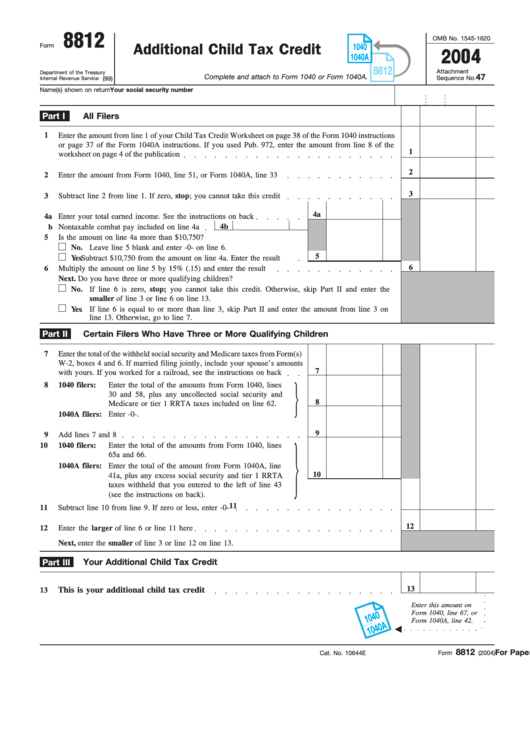

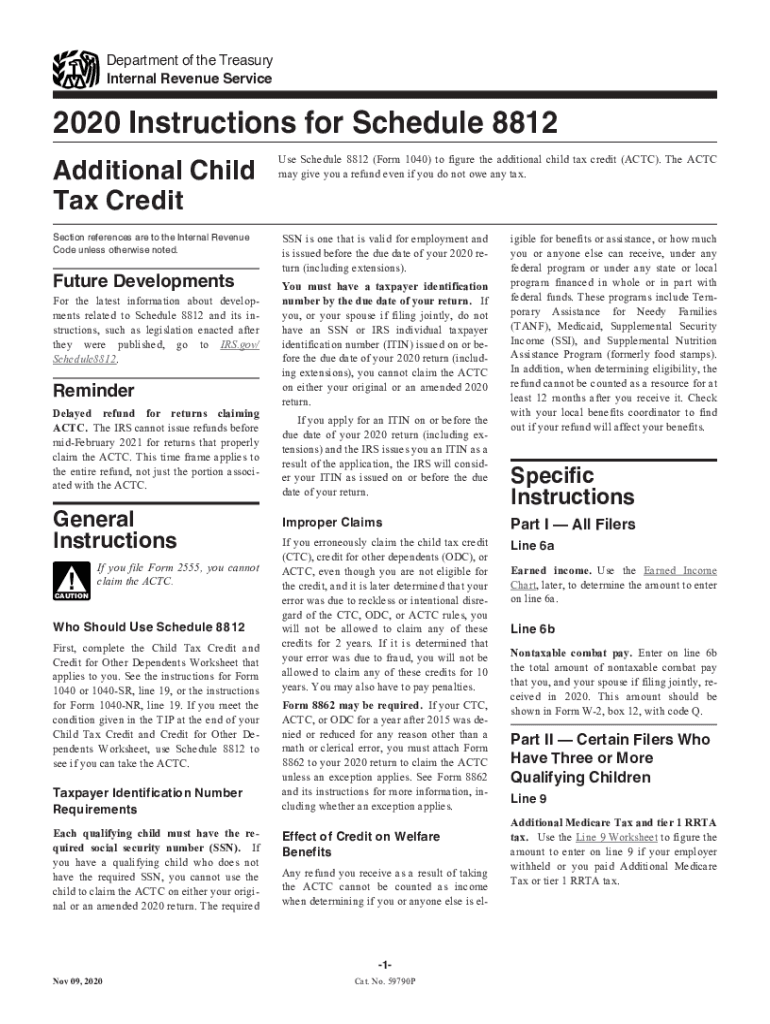

8812 Form 2020 - Web the increased age allowance for qualifying children ended. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. For tax years 2020 and prior: Complete, edit or print tax forms instantly. Web you'll use form 8812 to calculate your additional child tax credit. The child tax credit is a partially refundable credit offered. Web filling out schedule 8812. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. I discuss the 3,600 and 3,000 child tax credit amounts. For example, if the amount.

For example, if the amount. To preview your 1040 before filing: Web solved • by turbotax • 3264 • updated january 25, 2023. The child tax credit is a partially refundable credit offered. Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Should be completed by all filers to claim the basic. Web enter the information for the tax return. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040.

Review your form 1040 lines 24 thru 35. Should be completed by all filers to claim the basic. Get ready for tax season deadlines by completing any required tax forms today. For 2022, there are two parts to this form: Web filling out schedule 8812. Complete, edit or print tax forms instantly. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. For example, if the amount. I discuss the 3,600 and 3,000 child tax credit amounts. Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social.

Form 8812 Credit Limit Worksheet A

Web filling out schedule 8812. Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions..

What Is A 1040sr Worksheet

The ctc and odc are. Your refund is reported on form 1040 line 35a. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. So which of these forms was reactivated for 2021. A child must be under age 17 at the end of 2022 to be considered a qualifying child.

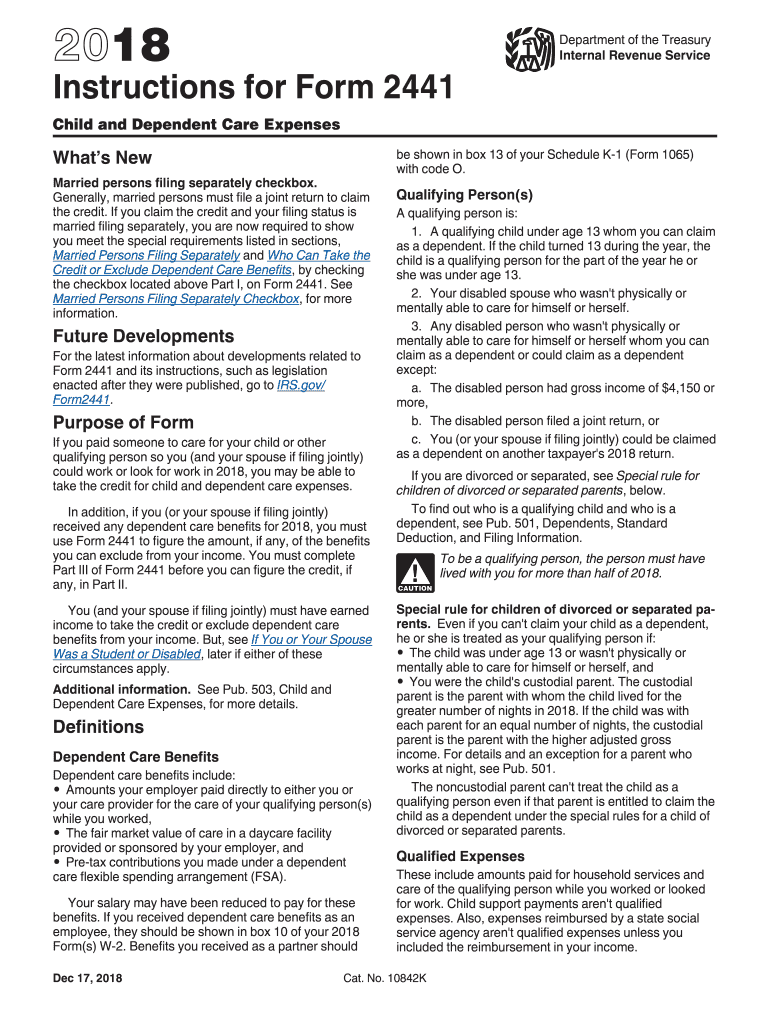

Form 2441 Instructions Fill Out and Sign Printable PDF Template signNow

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web the increased age allowance for qualifying children ended. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. I discuss the 3,600 and.

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. Web you'll use form 8812 to calculate your additional child tax credit. The ctc and odc are. I discuss the 3,600 and 3,000 child.

Irs Child Tax Credit Form 2020 Trending US

Web filling out schedule 8812. The ctc and odc are. To preview your 1040 before filing: Web you'll use form 8812 to calculate your additional child tax credit. Should be completed by all filers to claim the basic.

Fillable Form 8812 Additional Child Tax Credit printable pdf download

Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. For example, if the amount. Get ready for tax season deadlines by completing any required tax forms today. Web you'll use form 8812 to calculate your additional child tax credit. Web we overhauled the schedule 8812 of the form 1040 in 2021.

IRS 1040 Schedule 8812 Instructions 2020 Fill out Tax Template Online

Web you'll use form 8812 to calculate your additional child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web solved • by turbotax • 3264 • updated january 25, 2023. Complete, edit or print tax forms instantly. Get ready for tax season.

30++ Child Tax Credit Worksheet 2019

Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions. Your refund is reported on form 1040 line 35a. Get ready for tax season deadlines by completing any required tax forms today. To preview your 1040 before filing: Web you'll use form 8812 to calculate your additional child tax credit.

Check Economic Impact Payments and Advanced Child Tax Credit

Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web tax forms for irs and state income tax returns. For tax years 2020 and prior: The ctc and odc are. Complete, edit or print tax forms instantly.

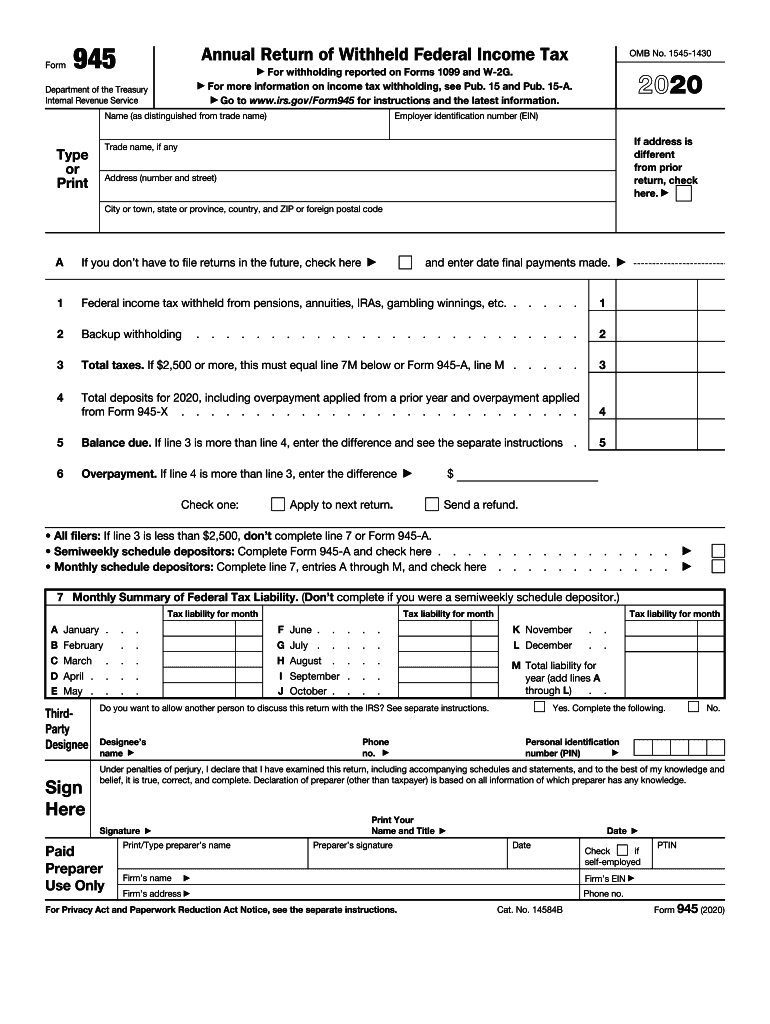

2020 Form IRS 945 Fill Online, Printable, Fillable, Blank pdfFiller

The ctc and odc are. For tax years 2020 and prior: For 2022, there are two parts to this form: I discuss the 3,600 and 3,000 child tax credit amounts. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”.

Web We Overhauled The Schedule 8812 Of The Form 1040 In 2021 To Implement These Changes Under The American Rescue Plan.

Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions. A child must be under age 17 at the end of 2022 to be considered a qualifying child. Review your form 1040 lines 24 thru 35. So which of these forms was reactivated for 2021.

For Example, If The Amount.

Web enter the information for the tax return. Should be completed by all filers to claim the basic. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents.

Resident The Taxpayer And Child Must Meet Other Eligibility Requirements To Qualify, Including Relationship, Joint Return, And Social.

Web you'll use form 8812 to calculate your additional child tax credit. For 2022, there are two parts to this form: To preview your 1040 before filing: Web filling out schedule 8812.

Web Use Schedule 8812 (Form 1040) To Figure Your Child Tax Credit (Ctc), Credit For Other Dependents (Odc), And Additional Child Tax Credit (Actc).

For tax years 2020 and prior: Complete, edit or print tax forms instantly. Web the increased age allowance for qualifying children ended. Web solved • by turbotax • 3264 • updated january 25, 2023.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)