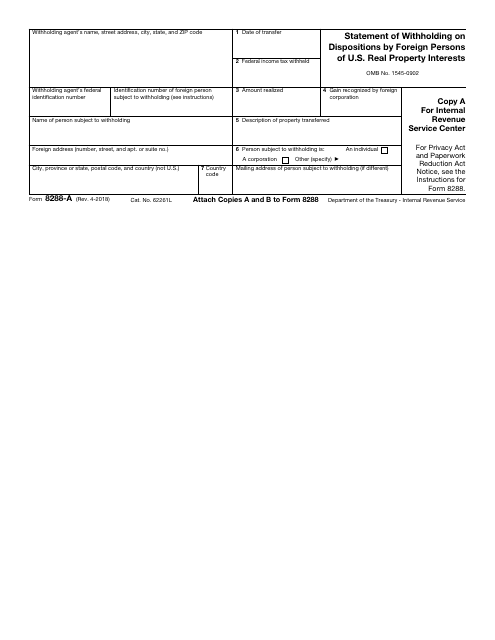

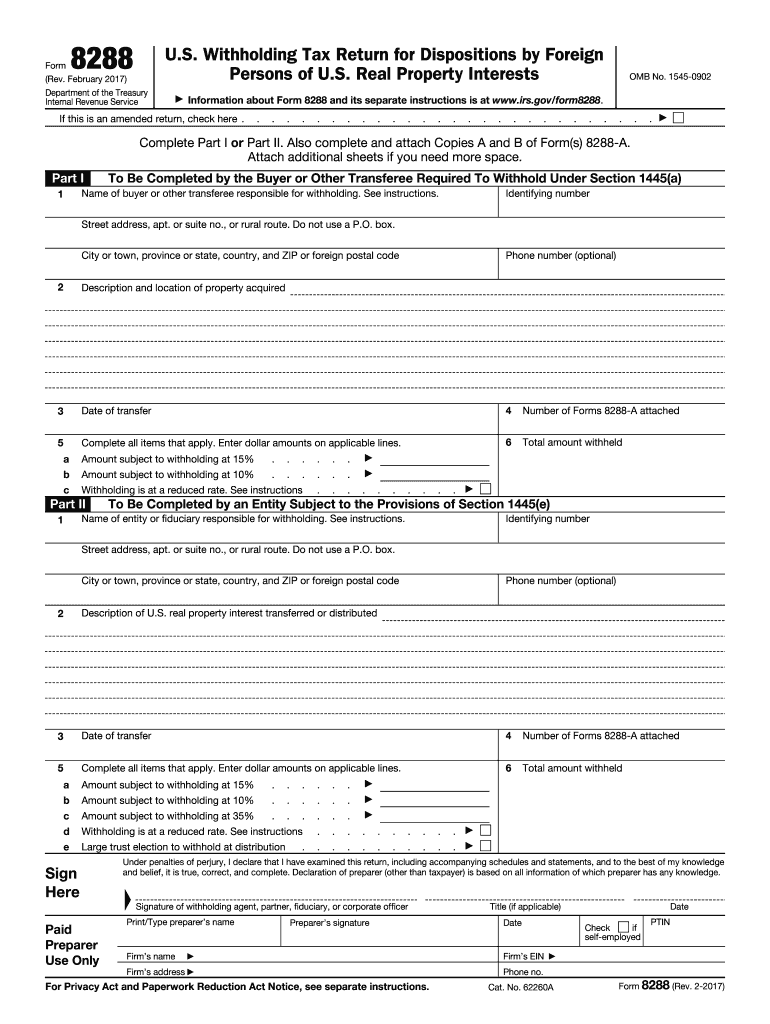

8288 A Form

8288 A Form - Real property interests | internal revenue service To report withholding on the amount realized. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Real property interests) for each person subject to withholding. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. If this is a corrected return, check here. Copy c is for your records. Real property interests by foreign persons to the irs: The foreign owner can be a single person, a group of investors, or a corporation. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s.

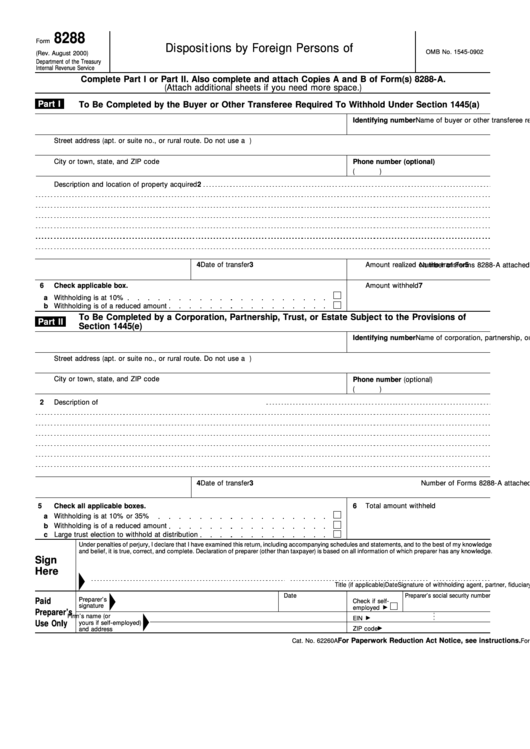

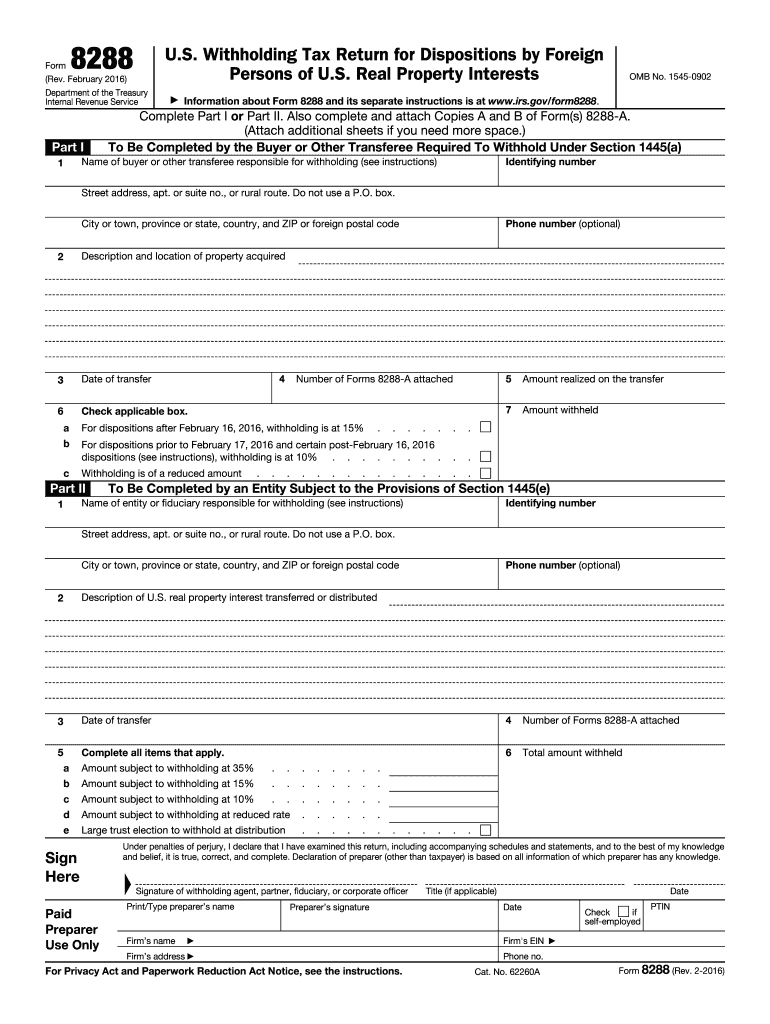

Withholding tax return for dispositions by foreign persons of. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. The foreign owner can be a single person, a group of investors, or a corporation. You must file a u.s. If this is a corrected return, check here. Real property interests | internal revenue service Copy c is for your records. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations.

If this is a corrected return, check here. Withholding tax return for dispositions by foreign persons of. To report withholding on the amount realized. Copy c is for your records. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. The foreign owner can be a single person, a group of investors, or a corporation. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. Copy c is for your records.

IRS Form 8288 Withholding Taxes on Purchase of U.S. Real Estate from

Real property interests) for each person subject to withholding. Withholding tax return for dispositions by foreign persons of. Real property interests | internal revenue service Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Copy c is for your records.

Form 8288B FIRPTA and reduced withholding

Real property interests) for each person subject to withholding. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Withholding tax return for dispositions by foreign persons of. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s..

Form 8288 U.s. Withholding Tax Return For Dispositions By Foreign

Copy c is for your records. If this is a corrected return, check here. The foreign owner can be a single person, a group of investors, or a corporation. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Some common tax credits apply to many taxpayers, while others.

Irs Form 8288 Fill Out and Sign Printable PDF Template signNow

If this is a corrected return, check here. Copy c is for your records. Real property interests by foreign persons to the irs: Real property interests | internal revenue service To report withholding on the amount realized.

IRS Form 8288A Download Fillable PDF or Fill Online Statement of

Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Real property interests by foreign persons to the irs: Copy c is for your records. Applying for an early refund. You must file a u.s.

2017 Form IRS 8288 Fill Online, Printable, Fillable, Blank pdfFiller

You must file a u.s. Real property interests | internal revenue service Copy c is for your records. Applying for an early refund. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s.

3.21.261 Foreign Investment in Real Property Tax Act (FIRPTA

Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Applying for an early refund. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Copy c is for your records. The foreign owner.

Form 8288B Application for Withholding Certificate for Dispositions

Real property interests by foreign persons to the irs: Real property interests | internal revenue service Applying for an early refund. The foreign owner can be a single person, a group of investors, or a corporation. To report withholding on the amount realized.

Fill Free fillable Form 8288 U.S. Withholding Tax Return PDF form

Real property interests) for each person subject to withholding. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Real property interests by foreign persons to the irs: Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes.

Form 8288B Edit, Fill, Sign Online Handypdf

Real property interests by foreign persons to the irs: Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house.

If This Is A Corrected Return, Check Here.

Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Applying for an early refund. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Withholding tax return for dispositions by foreign persons of.

Real Property Interests By Foreign Persons To The Irs:

To report withholding on the amount realized. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. You must file a u.s. Real property interests | internal revenue service

Copy C Is For Your Records.

Real property interests) for each person subject to withholding. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. Buyers and transferees use this form with form 8288 for each foreign person that disposes of real property located in the u.

The Foreign Owner Can Be A Single Person, A Group Of Investors, Or A Corporation.

Copy c is for your records.