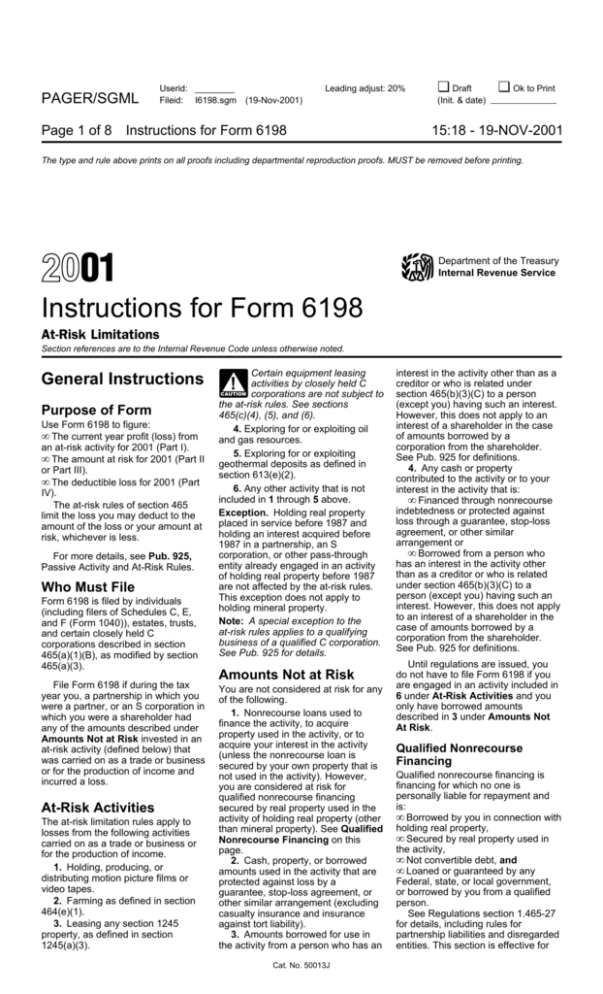

6198 Form Instructions

6198 Form Instructions - First, the adjusted tax basis of the partnership interest under sec. You can download or print current or. Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable fields, and rearrange or delete pages from your. We have no way of. Web the form 6198 instructions will help you in filling out the 21 lines with all the necessary data. Sign it in a few clicks draw your signature, type. Edit your 6198 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Second, the partner's amount at risk. Most investors go into business. Get ready for tax season deadlines by completing any required tax forms today.

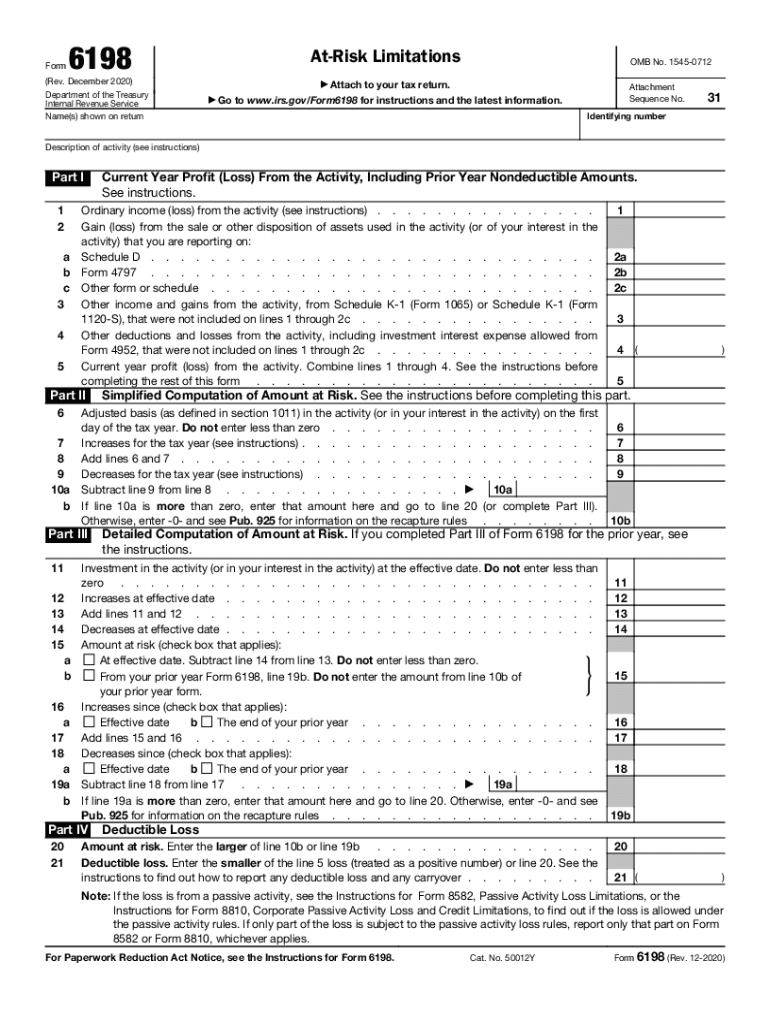

Get ready for tax season deadlines by completing any required tax forms today. There are 4 parts to irs form 6198, which we’ll go. The amount at risk for the current year (part ii. For paperwork reduction act notice,. Web 4.7 satisfied 102 votes quick guide on how to complete example of completed form 6198 forget about scanning and printing out forms. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Web these rules and the order in which they apply are: Fortunately, this tax form is only one page long, so it’s not terribly long. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Web how do i complete irs form 6198?

Form 6198 is used by individuals, estates,. If only part of the loss is subject to the passive activity loss rules, report only that part on form 8582 or form 8810, whichever applies. Form 6198 should be filed separately for each activity related to your. Web use form 6198 to figure: We have no way of. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. For paperwork reduction act notice,. Sign it in a few clicks draw your signature, type. The amount at risk for the current year (part ii. Using our service filling in form 6198 instructions will.

Cms Claim Form 1500 Instructions Form Resume Examples EZVggzRVJk

Web follow the simple instructions below: Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. The amount at risk for the current year (part ii. Web these rules and the order in which they apply are: Department of the treasury.

Instructions For Form 6198 AtRisk Limitations 1998 printable pdf

Web how do i complete irs form 6198? Get ready for tax season deadlines by completing any required tax forms today. Web follow the simple instructions below: If only part of the loss is subject to the passive activity loss rules, report only that part on form 8582 or form 8810, whichever applies. Fortunately, this tax form is only one.

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

First, the adjusted tax basis of the partnership interest under sec. Get ready for tax season deadlines by completing any required tax forms today. Web use form 6198 to figure: Second, the partner's amount at risk. (part i), the amount at risk for the current year (part ii or part iii), and.

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

Web how do i complete irs form 6198? Use our detailed instructions to fill out. Fortunately, this tax form is only one page long, so it’s not terribly long. Edit your 6198 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Get ready for tax season deadlines by completing any required tax forms today.

LEGO 6198 Stingray Stormer Instructions, Aquazone

Sign it in a few clicks draw your signature, type. Web the form 6198 instructions will help you in filling out the 21 lines with all the necessary data. Web general instructions purpose of form use form 6198 to figure: Fortunately, this tax form is only one page long, so it’s not terribly long. Effortlessly add and underline text, insert.

IRS Instructions 1120S 2019 Fill out Tax Template Online US Legal Forms

(part i), the amount at risk for the current year (part ii or part iii), and. Experience all the benefits of submitting and completing documents online. Web 4.7 satisfied 102 votes quick guide on how to complete example of completed form 6198 forget about scanning and printing out forms. The amount at risk for the current year (part ii. Sign.

6198 At Risk Limitations Fill Out and Sign Printable PDF Template

Web how do i complete irs form 6198? Form 6198 should be filed separately for each activity related to your. Sign it in a few clicks draw your signature, type. For paperwork reduction act notice,. Web the form 6198 instructions will help you in filling out the 21 lines with all the necessary data.

Instructions for Form 6198

Web follow the simple instructions below: Form 6198 should be filed separately for each activity related to your. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Form 6198 is used by individuals, estates,. First, the adjusted tax basis of the partnership interest under sec.

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Experience all the benefits of submitting and completing documents online. Sign it in a few clicks draw your signature, type. Web these rules and the order in which they apply are: Using our service filling in form 6198 instructions will. You can download or print current or.

LEGO 6198 Stingray Stormer Set Parts Inventory and Instructions LEGO

You can download or print current or. First, the adjusted tax basis of the partnership interest under sec. If only part of the loss is subject to the passive activity loss rules, report only that part on form 8582 or form 8810, whichever applies. There are 4 parts to irs form 6198, which we’ll go. Web the instructions provided with.

(Part I), The Amount At Risk For The Current Year (Part Ii Or Part Iii), And.

Get ready for tax season deadlines by completing any required tax forms today. If only part of the loss is subject to the passive activity loss rules, report only that part on form 8582 or form 8810, whichever applies. Form 6198 is used by individuals, estates,. Fortunately, this tax form is only one page long, so it’s not terribly long.

Sign It In A Few Clicks Draw Your Signature, Type.

Web how do i complete irs form 6198? Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Web 4.7 satisfied 102 votes quick guide on how to complete example of completed form 6198 forget about scanning and printing out forms. Second, the partner's amount at risk.

Web Follow The Simple Instructions Below:

Web edit form 6198 instructions. Form 6198 should be filed separately for each activity related to your. Edit your 6198 instructions online type text, add images, blackout confidential details, add comments, highlights and more. There are 4 parts to irs form 6198, which we’ll go.

First, The Adjusted Tax Basis Of The Partnership Interest Under Sec.

You can download or print current or. Experience all the benefits of submitting and completing documents online. We have no way of. Most investors go into business.