529 Withdrawal Tax Form

529 Withdrawal Tax Form - Web updated for tax year 2022 • december 1, 2022 09:04 am overview a 529 plan can help you save money for college and grow those savings faster—plus it offers. You can inadvertently trigger a tax penalty unless you make sure there’s. This form is specifically for 529 plan spending and ensures your taxes are. You can transfer money between fidelity accounts and your linked bank account. Determine when to withdraw the funds. Web your 529 plan withdrawals that aren’t used for qualified education expenses can be subject to tax and a 10% penalty. Web assume the 529 withdrawal includes $8,000 of earnings. In addition, he will be socked. Web getting tax forms, instructions, and publications. Learn more about how a 529 plan can help you save for your child's future today.

Web updated for tax year 2022 • december 1, 2022 09:04 am overview a 529 plan can help you save money for college and grow those savings faster—plus it offers. Web consumer reports explains how to withdraw money from a 529 college savings plan. You can transfer money between fidelity accounts and your linked bank account. Ad most 529 plans give you the ability to effectively save for your child's education. Here’s how to avoid that penalty. Follow the 529 withdrawal rules scrupulously. You can inadvertently trigger a tax penalty unless you make sure there’s. Dave must report the $8,000 as miscellaneous income on his form 1040. Calculate how much you are spending on qualified education expenses. These moves can save you money and avoid costly penalties.

Web there may also be state or local income tax, as well as interest or dividends tax. Ad most 529 plans give you the ability to effectively save for your child's education. Dave must report the $8,000 as miscellaneous income on his form 1040. Calculate how much you are spending on qualified education expenses. You can transfer money between fidelity accounts and your linked bank account. Web be aware that 529 plan withdrawal rules are numerous and can be confusing. Here’s how to avoid that penalty. This form is specifically for 529 plan spending and ensures your taxes are. In addition, he will be socked. Web assume the 529 withdrawal includes $8,000 of earnings.

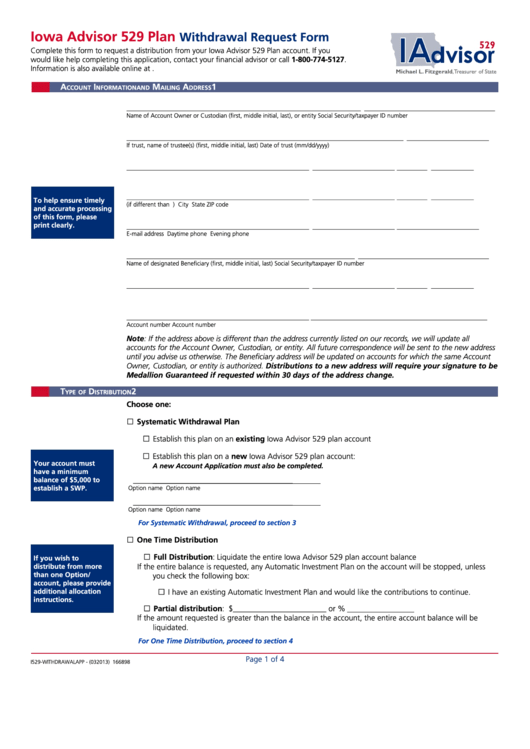

Fillable Iowa Advisor 529 Plan Withdrawal Request Form printable pdf

Web assume the 529 withdrawal includes $8,000 of earnings. Dave must report the $8,000 as miscellaneous income on his form 1040. Determine when to withdraw the funds. Web be aware that 529 plan withdrawal rules are numerous and can be confusing. Ad most 529 plans give you the ability to effectively save for your child's education.

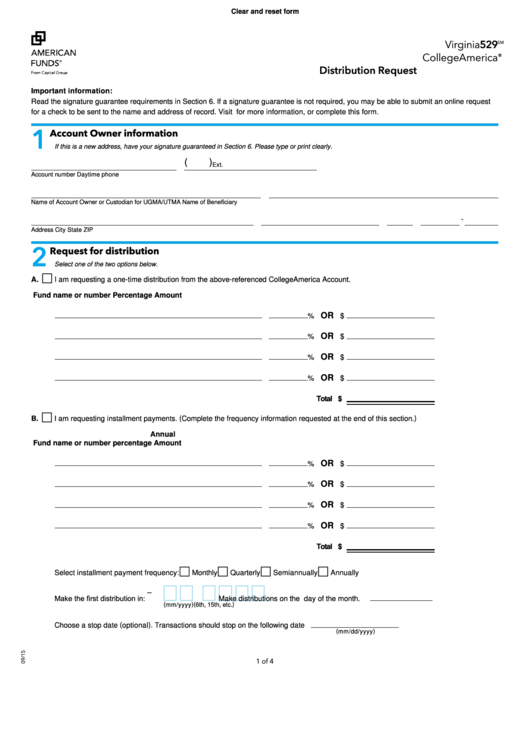

Fillable American Funds 529 Withdrawal Form Distribution Request

Web 6 tips for making qualified withdrawals from your 529. Web getting tax forms, instructions, and publications. In addition, he will be socked. Dave must report the $8,000 as miscellaneous income on his form 1040. You can transfer money between fidelity accounts and your linked bank account.

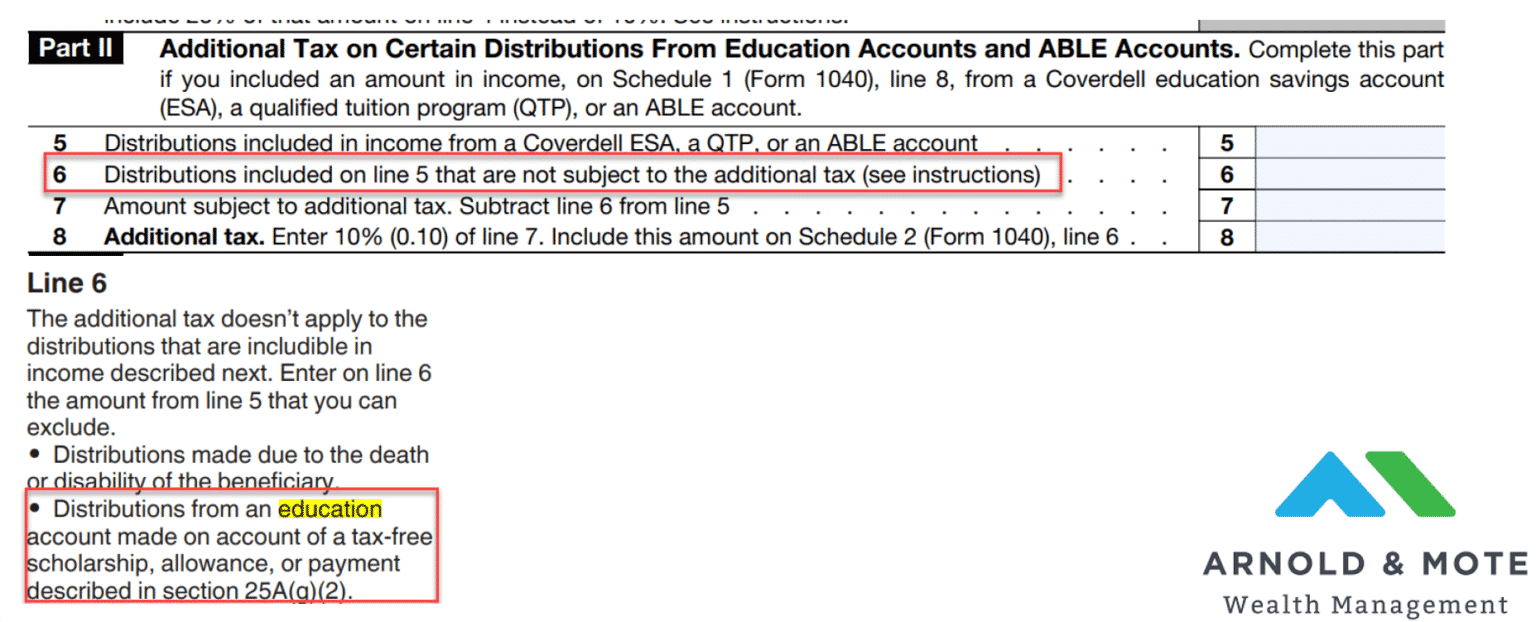

What happens to a 529 if my child gets a college scholarship or grant?

Web 6 tips for making qualified withdrawals from your 529. Web be aware that 529 plan withdrawal rules are numerous and can be confusing. Web updated for tax year 2022 • december 1, 2022 09:04 am overview a 529 plan can help you save money for college and grow those savings faster—plus it offers. Web consumer reports explains how to.

Blackrock College Advantage 529 Forms Fill Online, Printable

Here’s how to avoid that penalty. Web be aware that 529 plan withdrawal rules are numerous and can be confusing. Web assume the 529 withdrawal includes $8,000 of earnings. You can inadvertently trigger a tax penalty unless you make sure there’s. Web there may also be state or local income tax, as well as interest or dividends tax.

united states What is a good strategy for an overfunded 529 account

Calculate how much you are spending on qualified education expenses. Ad most 529 plans give you the ability to effectively save for your child's education. This form is specifically for 529 plan spending and ensures your taxes are. Determine when to withdraw the funds. Follow the 529 withdrawal rules scrupulously.

Stanley 529 Withdrawal Form 20202022 Fill and Sign Printable

You can inadvertently trigger a tax penalty unless you make sure there’s. These moves can save you money and avoid costly penalties. Web updated for tax year 2022 • december 1, 2022 09:04 am overview a 529 plan can help you save money for college and grow those savings faster—plus it offers. Learn more about how a 529 plan can.

Irs Printable 1099 Form Printable Form 2022

Dave must report the $8,000 as miscellaneous income on his form 1040. Ad most 529 plans give you the ability to effectively save for your child's education. Here’s how to avoid that penalty. Web consumer reports explains how to withdraw money from a 529 college savings plan. In addition, he will be socked.

How to Avoid Taxes, Penalties if Changing 529s WSJ

These moves can save you money and avoid costly penalties. This form is specifically for 529 plan spending and ensures your taxes are. The key to avoiding costly penalties and additional taxes. Web getting tax forms, instructions, and publications. Learn more about how a 529 plan can help you save for your child's future today.

American Funds 529 Withdrawal Form American Choices

Web 6 tips for making qualified withdrawals from your 529. Learn more about how a 529 plan can help you save for your child's future today. Web getting tax forms, instructions, and publications. The key to avoiding costly penalties and additional taxes. Web consumer reports explains how to withdraw money from a 529 college savings plan.

how to report 529 distributions on tax return Fill Online, Printable

Dave must report the $8,000 as miscellaneous income on his form 1040. Web assume the 529 withdrawal includes $8,000 of earnings. This form is specifically for 529 plan spending and ensures your taxes are. Web updated for tax year 2022 • december 1, 2022 09:04 am overview a 529 plan can help you save money for college and grow those.

Web There May Also Be State Or Local Income Tax, As Well As Interest Or Dividends Tax.

Web updated for tax year 2022 • december 1, 2022 09:04 am overview a 529 plan can help you save money for college and grow those savings faster—plus it offers. Calculate how much you are spending on qualified education expenses. Web 6 tips for making qualified withdrawals from your 529. You can inadvertently trigger a tax penalty unless you make sure there’s.

In Addition, He Will Be Socked.

This form is specifically for 529 plan spending and ensures your taxes are. Follow the 529 withdrawal rules scrupulously. Here’s how to avoid that penalty. Web getting tax forms, instructions, and publications.

Ad Most 529 Plans Give You The Ability To Effectively Save For Your Child's Education.

Web your 529 plan withdrawals that aren’t used for qualified education expenses can be subject to tax and a 10% penalty. Web consumer reports explains how to withdraw money from a 529 college savings plan. Web assume the 529 withdrawal includes $8,000 of earnings. Web be aware that 529 plan withdrawal rules are numerous and can be confusing.

Determine When To Withdraw The Funds.

These moves can save you money and avoid costly penalties. Dave must report the $8,000 as miscellaneous income on his form 1040. Learn more about how a 529 plan can help you save for your child's future today. The key to avoiding costly penalties and additional taxes.