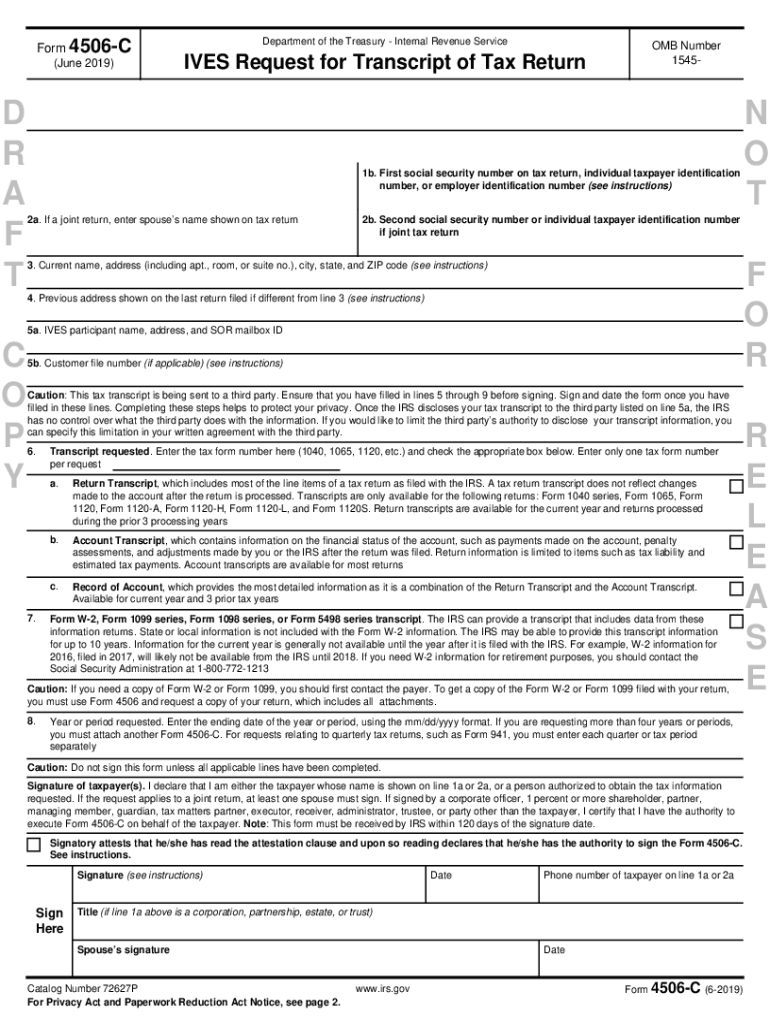

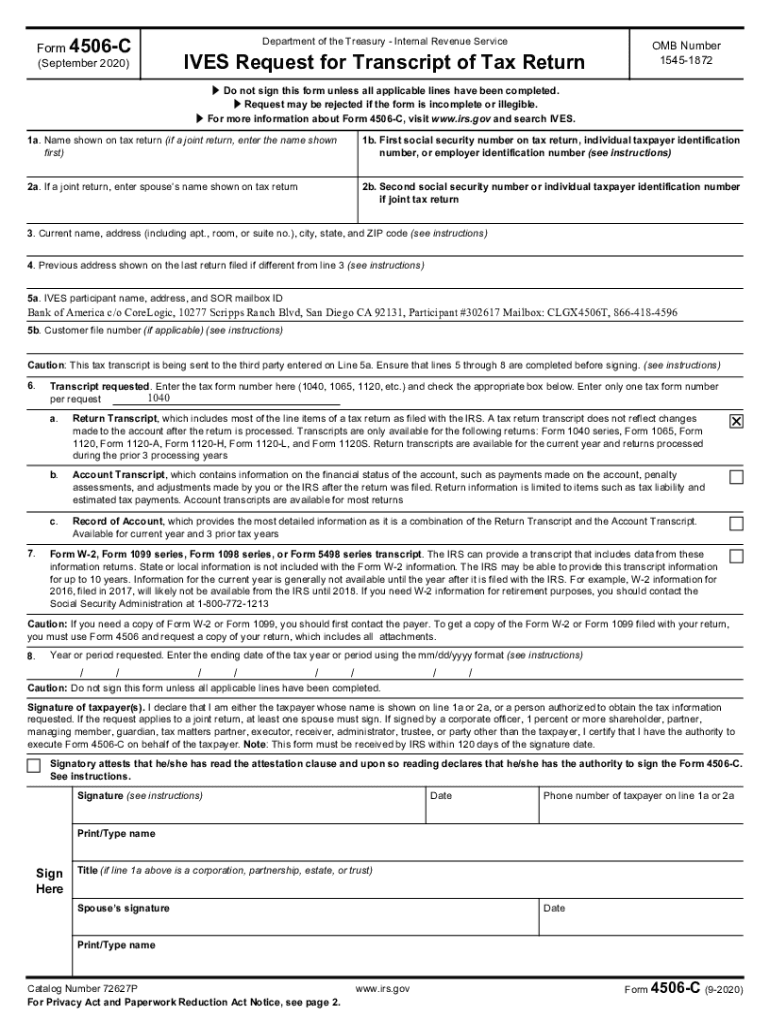

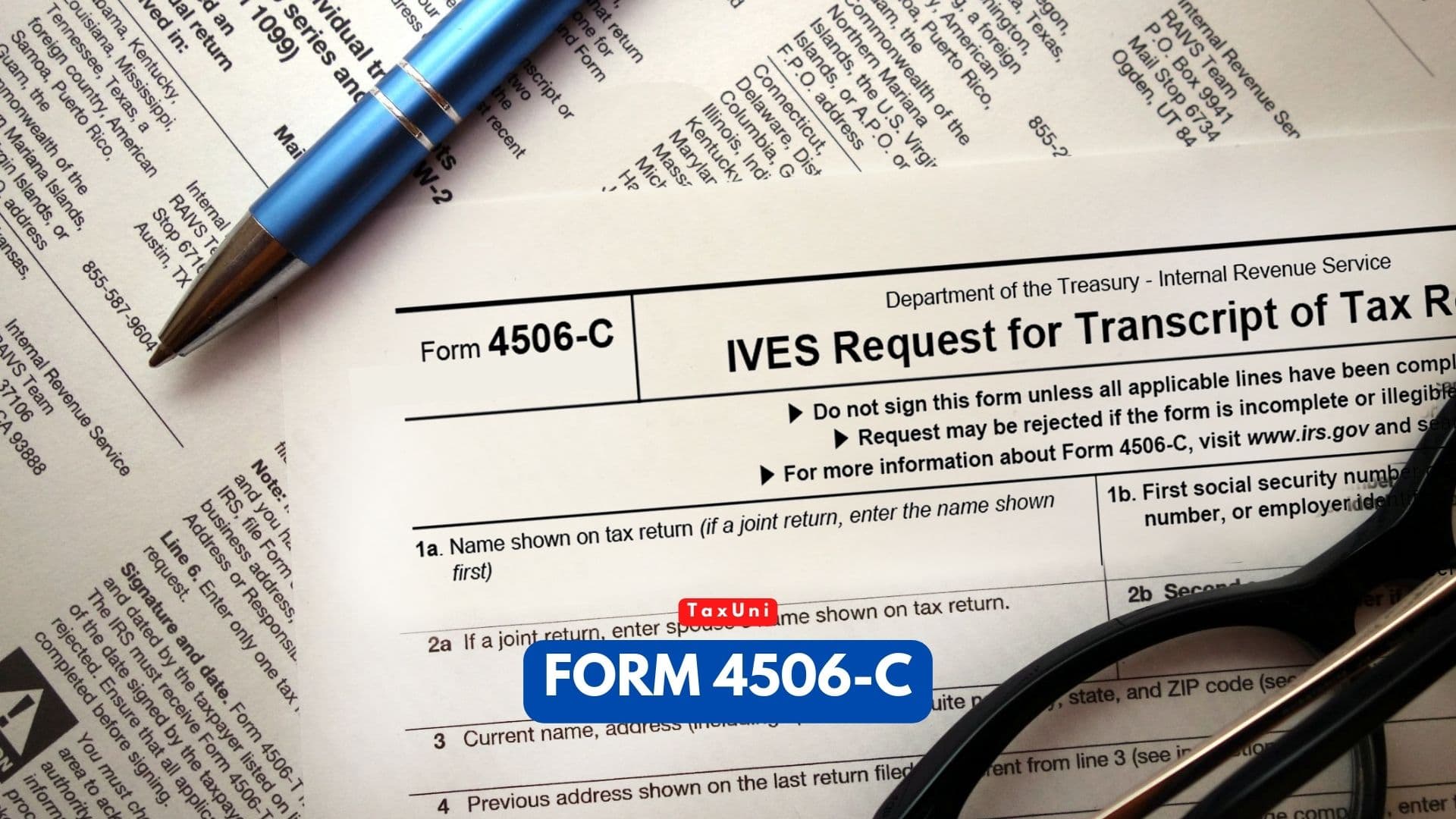

4506-C Form

4506-C Form - Follow example to complete form. Web please see attachments below to download corresponding forms. Do not sign this form unless all applicable lines have been completed. You can begin using this new form as soon as today. Do not sign this form unless all applicable lines have been completed. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. We encourage you to review the form in its. Download, print form and complete or complete version online and print. Download, print loan application and complete. If “signatory confirms document was electronically signed” box is checked on a form with a wet signature, will that be acceptable by the irs, or will it be rejected?

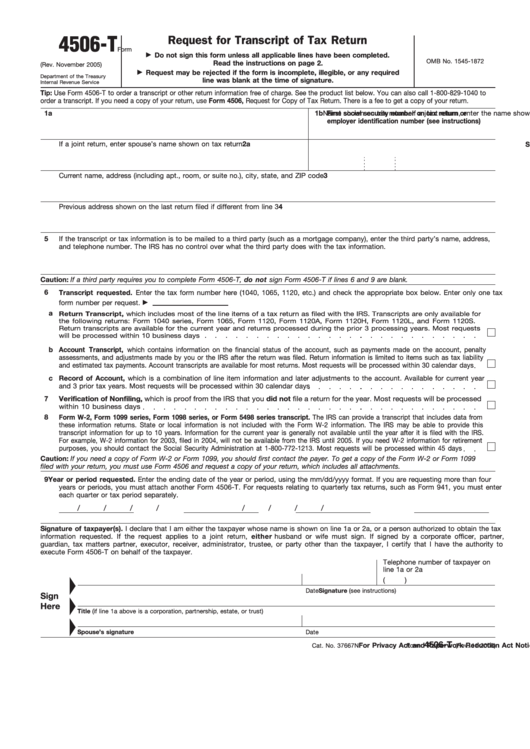

Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Do not sign this form unless all applicable lines have been completed. Request a copy of your tax return, or designate a third party to receive the tax return. Follow example to complete form. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. Department of the treasury internal revenue service for more information about form 4506, visit www.irs.gov/form4506. Do not sign this form unless all applicable lines have been completed. Web please see attachments below to download corresponding forms. Download, print loan application and complete. Internal revenue code, section 6103(c), limits disclosure

We encourage you to review the form in its. Internal revenue code, section 6103(c), limits disclosure Download, print form and complete or complete version online and print. You can begin using this new form as soon as today. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. Follow example to complete form. Do not sign this form unless all applicable lines have been completed. If “signatory confirms document was electronically signed” box is checked on a form with a wet signature, will that be acceptable by the irs, or will it be rejected? Ensure that all applicable lines, including lines 5a through 8,. Web please see attachments below to download corresponding forms.

4506 C Pdf Fill and Sign Printable Template Online US Legal Forms

Web please see attachments below to download corresponding forms. If “signatory confirms document was electronically signed” box is checked on a form with a wet signature, will that be acceptable by the irs, or will it be rejected? You can begin using this new form as soon as today. Follow example to complete form. Do not sign this form unless.

4506 C Fill Out and Sign Printable PDF Template signNow

Follow example to complete form. We encourage you to review the form in its. Request a copy of your tax return, or designate a third party to receive the tax return. If “signatory confirms document was electronically signed” box is checked on a form with a wet signature, will that be acceptable by the irs, or will it be rejected?.

Fill Free fillable Form 4506C IVES Request for Transcript of Tax

Follow example to complete form. Do not sign this form unless all applicable lines have been completed. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. You can begin using this new form as soon as today. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form.

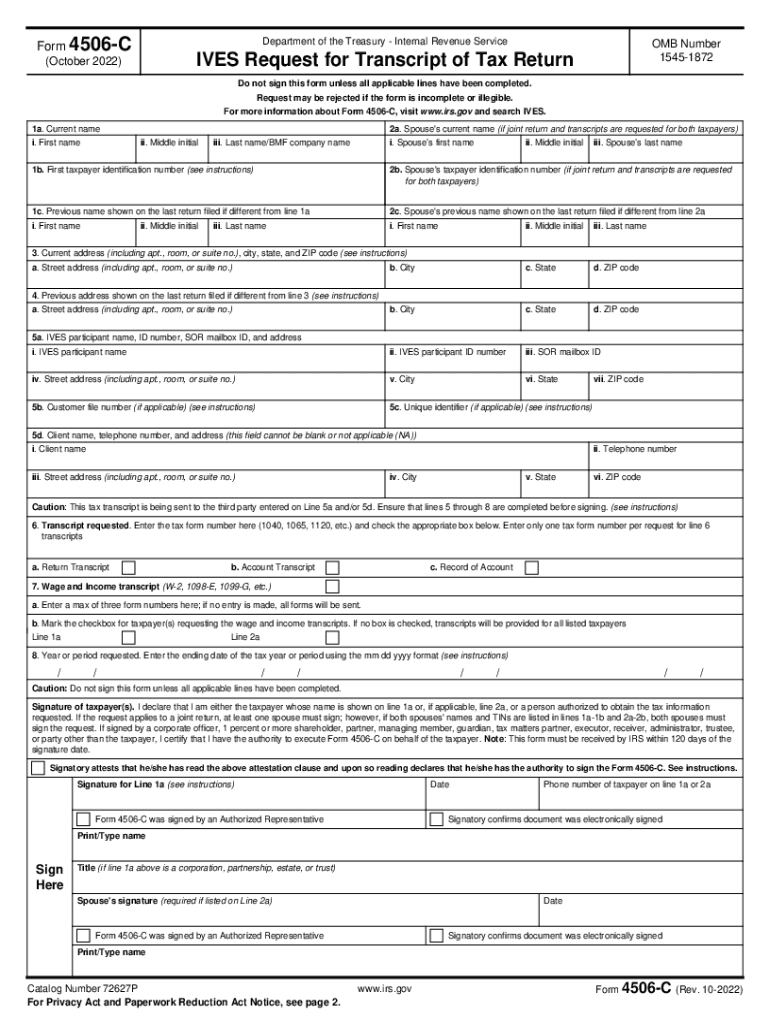

Ez Form 2018 Fill Out and Sign Printable PDF Template signNow

You can begin using this new form as soon as today. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. Department of the treasury internal revenue service for more information about form 4506, visit www.irs.gov/form4506. Web form 4506 is used by taxpayers to request copies of their.

DocMagic Blog Mortgage news to keep you compliant IRS

Request may be rejected if the form is incomplete or illegible. Do not sign this form unless all applicable lines have been completed. Do not sign this form unless all applicable lines have been completed. Ensure that all applicable lines, including lines 5a through 8,. If “signatory confirms document was electronically signed” box is checked on a form with a.

4506 C Fillable Form Fill and Sign Printable Template Online US

If “signatory confirms document was electronically signed” box is checked on a form with a wet signature, will that be acceptable by the irs, or will it be rejected? Do not sign this form unless all applicable lines have been completed. Internal revenue code, section 6103(c), limits disclosure Web 4506 request for copy of tax return (novmeber 2021) do not.

Fill Free fillable Form 4506C IVES Request for Transcript of Tax

Download, print loan application and complete. Internal revenue code, section 6103(c), limits disclosure Ensure that all applicable lines, including lines 5a through 8,. We encourage you to review the form in its. Download, print form and complete or complete version online and print.

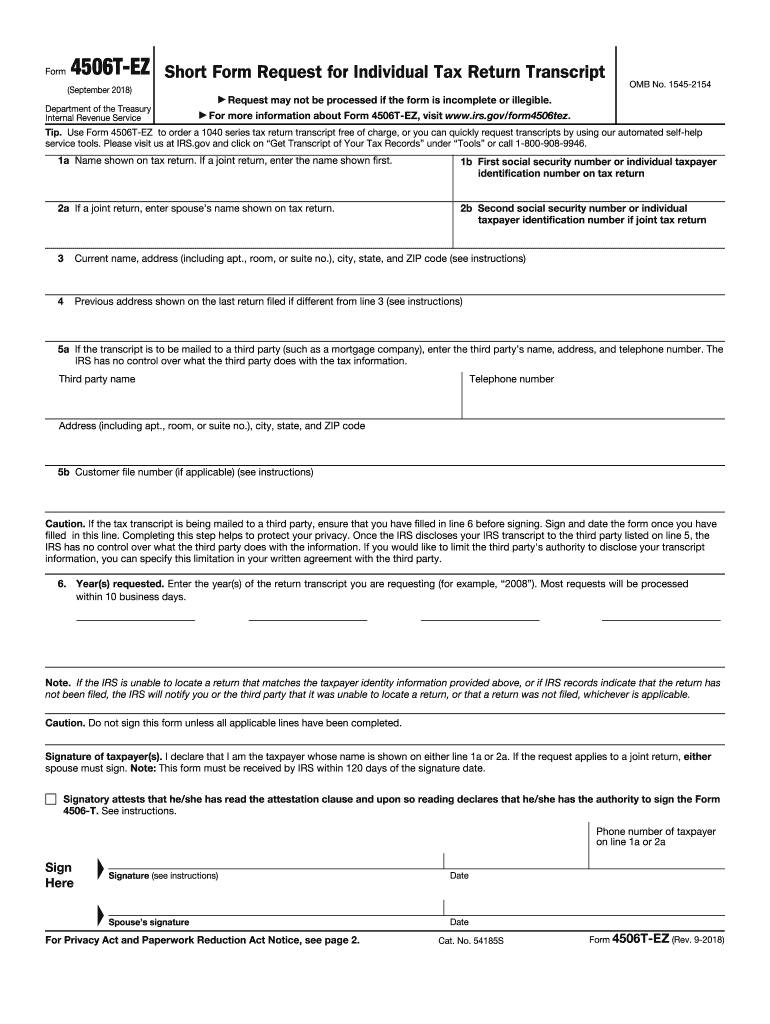

Form 4506 20092022 Fill and Sign Printable Template Online US

Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Ensure that all applicable lines, including lines 5a through 8,. Department of the treasury internal revenue service for more information about form 4506, visit www.irs.gov/form4506. Download, print form and complete or complete version online and print. Request a copy of your tax return,.

Form 4506C 2023

Do not sign this form unless all applicable lines have been completed. Internal revenue code, section 6103(c), limits disclosure Download, print form and complete or complete version online and print. Follow example to complete form. Request a copy of your tax return, or designate a third party to receive the tax return.

Fillable Form 4506T Request For Transcript Of Tax Return printable

Do not sign this form unless all applicable lines have been completed. Do not sign this form unless all applicable lines have been completed. Internal revenue code, section 6103(c), limits disclosure If “signatory confirms document was electronically signed” box is checked on a form with a wet signature, will that be acceptable by the irs, or will it be rejected?.

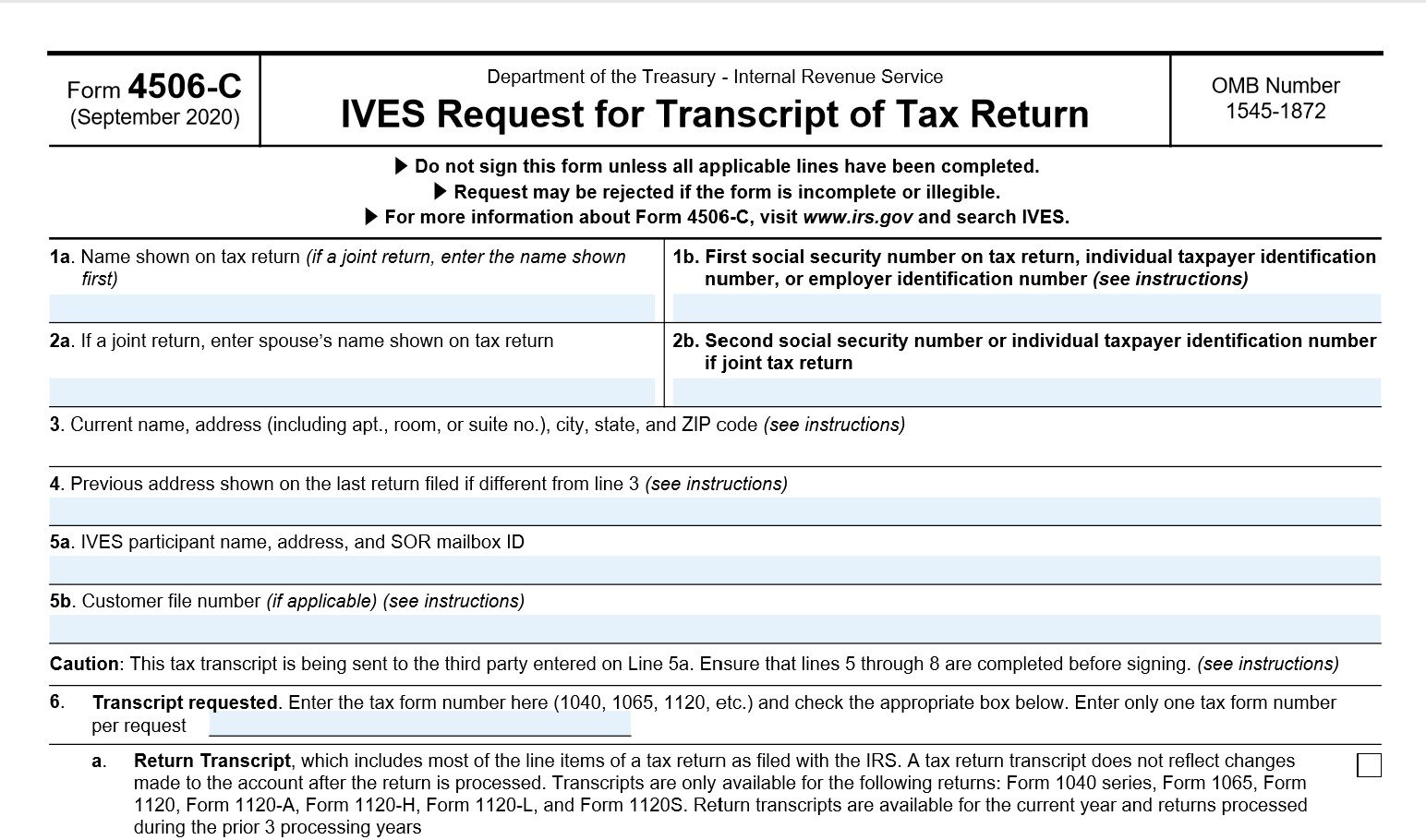

Download, Print Loan Application And Complete.

Ensure that all applicable lines, including lines 5a through 8,. Download, print form and complete or complete version online and print. If “signatory confirms document was electronically signed” box is checked on a form with a wet signature, will that be acceptable by the irs, or will it be rejected? We encourage you to review the form in its.

Do Not Sign This Form Unless All Applicable Lines Have Been Completed.

Do not sign this form unless all applicable lines have been completed. Web please see attachments below to download corresponding forms. Internal revenue code, section 6103(c), limits disclosure Web form 4506 is used by taxpayers to request copies of their tax returns for a fee.

You Can Begin Using This New Form As Soon As Today.

Department of the treasury internal revenue service for more information about form 4506, visit www.irs.gov/form4506. Request may be rejected if the form is incomplete or illegible. Web 4506 request for copy of tax return (novmeber 2021) do not sign this form unless all applicable lines have been completed. Request a copy of your tax return, or designate a third party to receive the tax return.